| | | Seeking Alpha article from today:

Universal Display Corporation: Calculating Tariff Impacts, Maintaining 'Buy'

Apr. 08, 2025 11:54 AM ET

Wolf Report

Investing Group

Summary- Universal Display Corporation remains attractive due to its technological edge, despite recent market downturns and tariff impacts, with a promising future in OLED technology.

- The company's 2024 results were solid, with adjusted EPS growth of nearly 10% and a 12.5% dividend increase, showcasing its resilience.

- OLED stock's valuation is now more attractive, with a forward P/E of 23.9x and a potential annualized upside of 18-22%, making it a "Buy."

- Risks include competition and revenue concentration, but the company's market-leading position and technological advancements justify a $150 price target.

- Looking for more investing ideas like this one? Get them exclusively at iREIT®+HOYA Capital. Learn More »

Luis Alvarez/DigitalVision via Getty Images

Dear readers/followers,

Sometimes, you become the victim of your own strategic approach and concerns. My usual concern is that I don't want to overpay for assets, and that valuation guides my every investment step as well as my analysis and my stating various ratings, such as “Buy” and “Hold”. Now, while the entire market has taken a nosedive in response to tariffs, my stance and rating on Universal Display Corporation (NASDAQ: OLED) has done much worse than my overall portfolio and somewhat worse than the market, depending on what index you're comparing it to.

Here is the rate of return for the company since my last article, which you can find here.

What I will do in this article is look at the potential impact of tariffs, at the situation of the company going forward, and how this should impact the valuation. We can recall here that OLED is a business that typically trades on the relatively high side. However, also as I am writing this article on the morning of Tuesday the 8th of April, the premarket trading for the NASDAQ shows OLED bouncing back up about 5.57%, much more than it fell on Monday. Therefore, I say, OLED might, alongside other stocks, see a recovery.

Let's include the full-year results, which were not yet out at the time of my last article, and see where this leaves us with the company.

OLED-The company's appeal in an unstable worldIn January, I introduced you to a company that I believed, despite the high multiple in valuation, could be considered attractive due to its technological and market-related edge. That has not changed. Remember that the latest weeks have not changed the fundamental nature, the customer base or the business of the businesses that we look at, including OLED.

I have an investment in the business. Including FX, that investment is now down over 20% in a very short period of time. But the company remains attractive. Its proprietary technology of OLED, which is being used across the world, even with tariff and trade barriers, remains high. Current estimates for the company on a forward basis also do not show any material earnings weakness for 2025E, and neither do the company's forecasts.

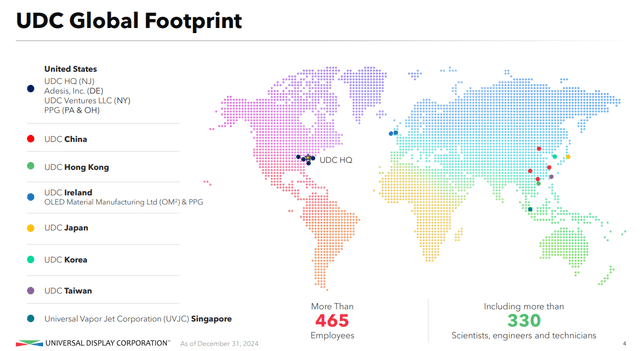

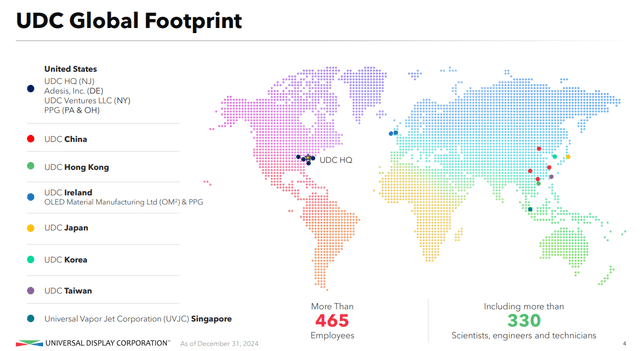

2024 came in at an adjusted EPS growth of nearly 10%. The fact that the company has production and a footprint that goes well beyond just Asia should secure much of the company's appeal in the context of tariff and trade. It already researches and sells as well as sells, and has headquarters in the U.S.

OLED investor presentation FY 2024 IR (OLED investor presentation FY 2024 IR)

The company's business model is tailor-made to handle most any situation that can arise. The company combines innovation and invention, research, with licensing of attractive OLED tech, including patents, PHOLED emitters and hosts.

That means that its revenues, and in turn its earnings and cash flows, are coming from things like licensing revenue and material sales-that's it.

For 2024, the company's results were very solid. The company not only raised its quarterly dividend by 12.5%, but the company also beat its revenue estimate by almost $10M.

As I see it, very little has changed in the fundamental or the thesis for OLED. The company is U.S.-founded, which means that tariff impacts because of its production and domicile are likely to be far less than producers and manufacturers out of Asia and Europe. What might happen is that the geopolitical trends ensure that the company's trends and the way that the U.S. administration is currently handling trade is that peers outside of the U.S. start looking much more appealing for customers in some segments where OLED competes directly with others. This includes LG Display, one of the largest manufacturers of panels globally. However, peers like Coherent and Applied Materials ( AMAT) are likely to see the impact, and these are key suppliers to OLED technologies, even PHOLED, which Universal Display Corporation is spearheading. So, this needs to be kept in mind.

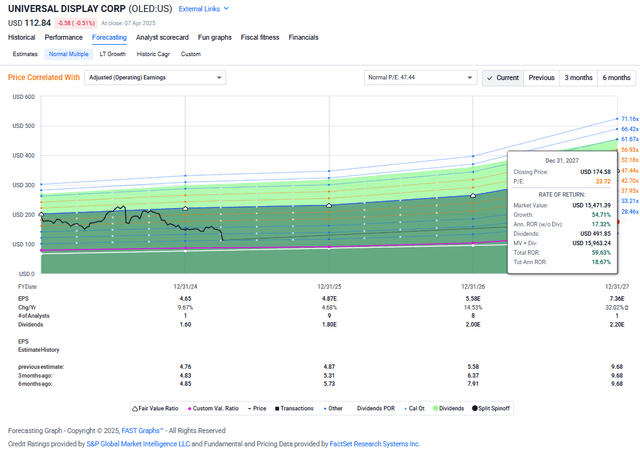

2024 saw the company generate adjusted earnings in excess of $4.6/share-and current analyst estimates call for the company to reach almost $4.9/share in 2025 and for 2027 to breach over $7.3/share. While these forecasts come at a relatively low likelihood of being accurate, given the poor accuracy ratings for these forecasts and estimates.

That being said, we need to take into account the company's very poor performance in the last 5 years. My own rate of return, even inclusive of these tariffs, has been superb the last 5 years-this company has lost 16.26% including the latest few days of chaos. So, obviously, you want to buy the company cheap. I thought that I did, and if we hadn't seen “worse” tariff impacts than expected, then I don't think we'd have seen this crash for OLED.

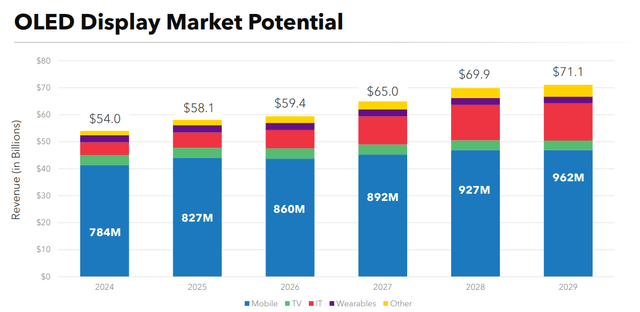

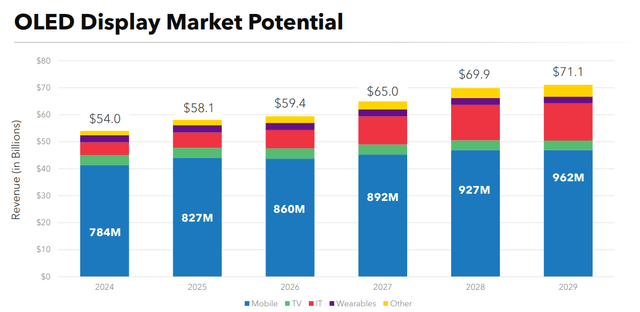

What I want to continue pointing to is the potential for the market for the company-which is rising quickly over time.

OLED investor presentation FY 2024 IR (OLED investor presentation FY 2024 IR)

I do not think anything has happened to make this “untrue”, and I don't think anything that's happened will impact panel demand, which is one of the company's core indicators for how well it will do. The drivers underlying these trends also will not change. The low-power usage of OLED and PHOLED is crucial, as is the fact that by using PHOLED, companies can get low-UV, minimal-bezel, flexible screens that are great for 3D, near-true black, and with better image quality. Not only that, but they are also more cost-effective than any other comparable technology with the same sort of fundamental quality upsides.

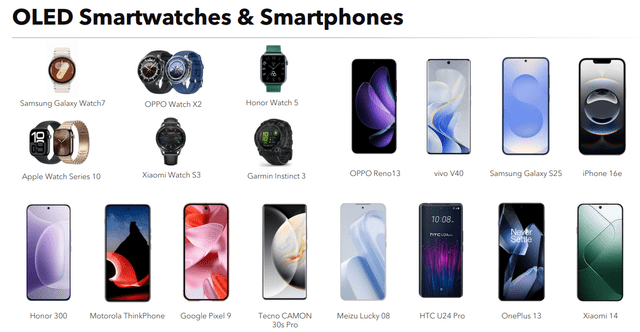

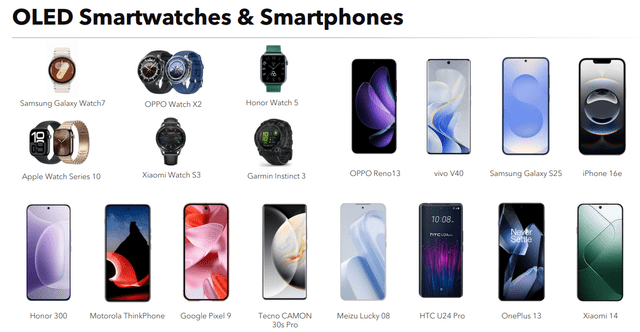

So, again-a lot to like here-and the products being used confirm the appeal.

OLED investor presentation FY 2024 IR (OLED investor presentation FY 2024 IR)

And this doesn't even include things like automotive OLED/Lights TVs, AR/VR, and other IT products, like screens. I myself bought an OLED gaming monitor not long ago, and I could not be happier. I consider it “game changing” for me.

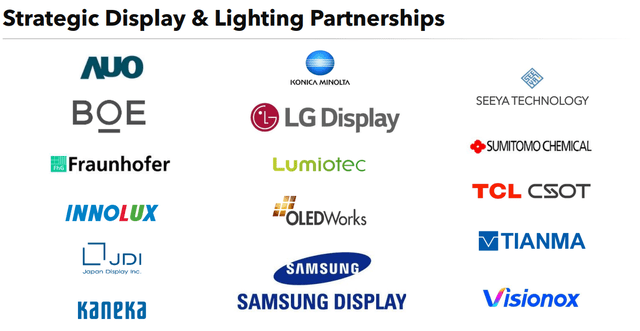

The tariffs and market trends also cannot take away from Universal Display Corp already working with all major manufacturers on the planet.

OLED investor presentation FY 2024 IR (OLED investor presentation FY 2024 IR)

Seeking Alpha currently rates the company a “SELL” in its Quant Rating. I disagree. And while I might not put the company at my first spot to “Buy more”, I will say that I like the company at this valuation, despite that valuation being premium. I believe the price and multiple are defended by the fact that it holds a major market-leading position in OLED technology. The company essentially “owning” blue PHOLED is a major advantage because it increases battery life by a significant margin (up to 30%) and enhances lifespan and general efficiency. The fact that a double-digit growth rate is estimated here means that the company, in my view, continues to deserve a premium valuation and not just your basic 13-20x P/E. I'm comfortable forecasting it higher.

Risks, aside from tariffs, do continue to exist. Competition in the space is heavy, and there are technological alternatives to PHOLED, such as QD-OLED and MicroLED—but I currently believe that the tariff situation will not change this competitive situation.

Perhaps the biggest risk I see is the concentration of revenue, but this is not a tariff issue. Over 75% of the company's revenues come from Samsung, LG, and BoE. Thankfully, the two biggest are Korean, not Chinese, and I don't think the company's issues will be as big as they might be with Chinese companies. But again, it's a bit too early to estimate exactly and in detail what the tariff impacts might be in certain scenarios.

That's why I'm going to do a broad adjustment to account for the tariff situation-and I believe that to be the best way to go about it at this time, unless we have a company that has specific, crucial production in China needed for products made in the USA-such as we have with Apple ( AAPL).

I believe 2024 was a good year, as shown by good earnings and revenue. I believe the future of the company is promising because of its technological leadership, its patents and its business model.

The main danger is valuation-and that's what I'll show you here.

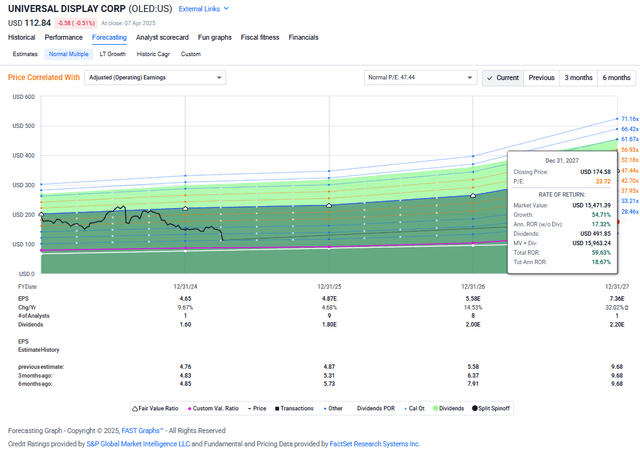

Valuation for OLED is now significantly more attractiveWhen I last wrote about the company, we were still above 26x P/E, and I still believed that to be attractive. Even forecasting at 25x P/E, the growth due to EPS saw annualized returns of 13%+.

Today, the situation is even more different.

The company now yields 1.6% on a forward basis, with a normalized P/E valuation of close to 23.9x, which is as cheap as the company has been for some time. In fact, the company hasn't been this cheap for almost 3 years, if we look at relative P/E multiples, and it's in a much better position than it was during COVID-19.

The bottom line is this. If you believe that OLED, and specifically PHOLED will be one of the major display technologies of the next decade, then this company is absolutely something to look at.

Why?

Because the current estimated earnings growth shows us a direction, I believe to be accurate. I believe earnings growth for OLED, regardless of the outcome of tariffs, will be a positive one. That means the only question is future multiples and future estimates. Current forecasts go up to 17-18% per year for the next few years. I'm willing to cut that to around 15-16%, discounting both for margin impacts from tariffs and current geopolitical risks, weighted against the upside from volumes and new customers and products.

The company has a 5-year average of 47x P/E and a 20-year average of around 60x P/E. If you follow my work, you know me well enough that I don't forecast at that multiple.

I go for 23-25x P/E.

F.A.S.T graphs OLED Upside (F.A.S.T graphs OLED Upside)

That is what you see below. The lowest annualized upside based on a P/E close to 23x that I would consider valid for this company-and it's still over 18% per year, inclusive of dividends. I will reiterate-this is not my first choice in this market. It's not even my second one. But this company, unlike others, is not a speculative play. Based on earnings estimates and historicals, I say that there is a significant upside to the company here, and one that you shouldn't underestimate. My price target, or PT, which cuts the estimate and fair value by around 12% based on tariff and geopolitical impacts as well as margin pressure, comes to $150/share, or around a 22-23x 2027E PT based on the current estimate of $7.2/share.

Based on company peers, which include Coherent, AMAT and LG Display ( LPL), I say that the company is somewhat overvalued in terms of multiples like sales and revenue-but we must also consider that peer companies don't have a yield, in the case of LG are at negative EPS, or in the case of Coherent are BB-rated. AMAT is definitely a contender here, both with a yield comparable to OLED, but also with an A rating in credit and a lower multiple in valuation. However, OLED has more than doubled the growth of AMAT forecasted. That being said, I also consider Applied Materials to be an attractive “Buy” here, so if you want to weigh the two against one another, I would say that AMAT's fundamentals and multiples are safer-but I would give OLED a higher upside.

That's the earnings forecast and peer upside or case I'm making.

I believe that based on this, the company is likely to continue to grow earnings, and that these earnings will support a 23-25x P/E going forward.

My thesis updated for the FY24 results is therefore now as follows.

Thesis- Universal Display Corporation is a market leader in a recession and future-resistant segment in display technology. Typically overvalued, the company has dropped 55%+ in less than a year, and I would no longer view it as overvalued in April 2025.

- At a 1.6% yield and a current earnings-based upside of 18-22% annualized, it's fair to say at this point that OLED is no longer overvalued after dropping from above $200/share when I sold half of my position. It's now down, according to some, at fair value and, according to me, at a more than decent potential upside, updated from January.

- The upside is based more on growth than on reversal here-but based on the company's fundamentals and market-leading position in its segment.

- I view OLED as a “Buy” here and may establish an initial position in the company. I give the company a current price target of around $150. This new PT takes into account tariffs and geopolitical uncertainty, but as you can see, still comes with an upside of over 20% as of this time.

- I would consider OLED cheap below $105/share.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 3 out of 3 quality indicators and 1 out of 2 valuation indicators. Based on this and a valuation target of $150/share, where I see a risk/reward-adjusted upside that's attractive enough for me, I give the company a “Buy” rating as of April 2025.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Wolf Report

34.11K Followers

Follow

Wolf Report is a senior analyst and private portfolio manager with over 10 years of generating value ideas in European and North American markets. |

|