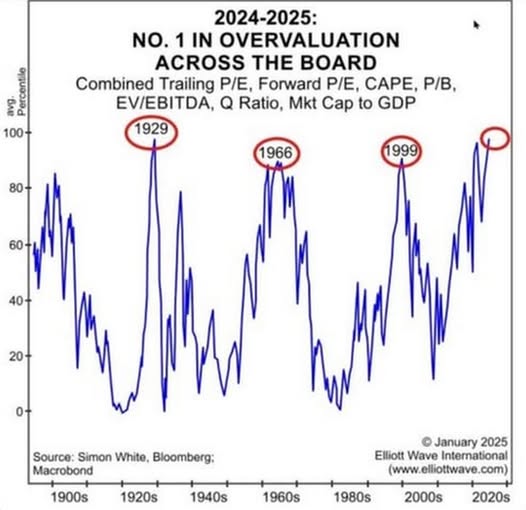

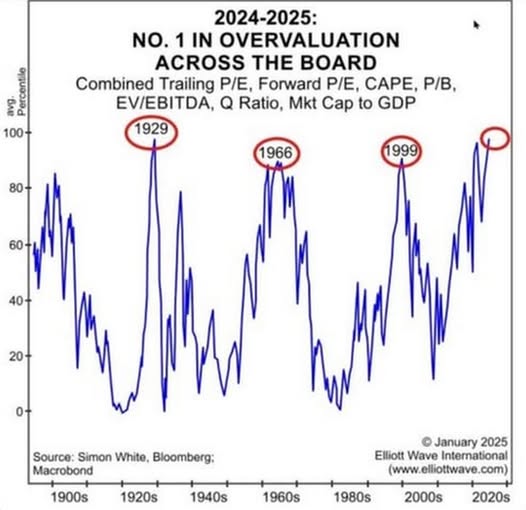

The US market is woefully over-valued based upon a host of metrics. NOT included in the illustration is the Price to Sales ratio (my favorite) and Earnings Yield. The latter is the reciprocal of the PE, the 3rd lowest in 145 years and useful in comparing with alternatives. The earnings yield presently is 100 basis points below the yield on a near risk-free 10 year T-Bond. Itself recently started RISING after declining since Trump assumed the office. The bond market, particularly Treasuries, dwarfs the stock market.

In other words, the stock market is expensive and personally expecting an 18 month bear market. IF this proves to be the case, it has bearing on distribution of stocks. So, I've given more attention to foreign stocks. I'm sharing the charts on three as well as demonstrating a stock, Sea Limited, a Singapore

company and has broke trend. NO longer a "Teddy:.

IPI, Intrepid Postash, is an Argentine fertilizer company. Argentina has a new goverment and their product is an alternative to now tariffed Canadian potash.

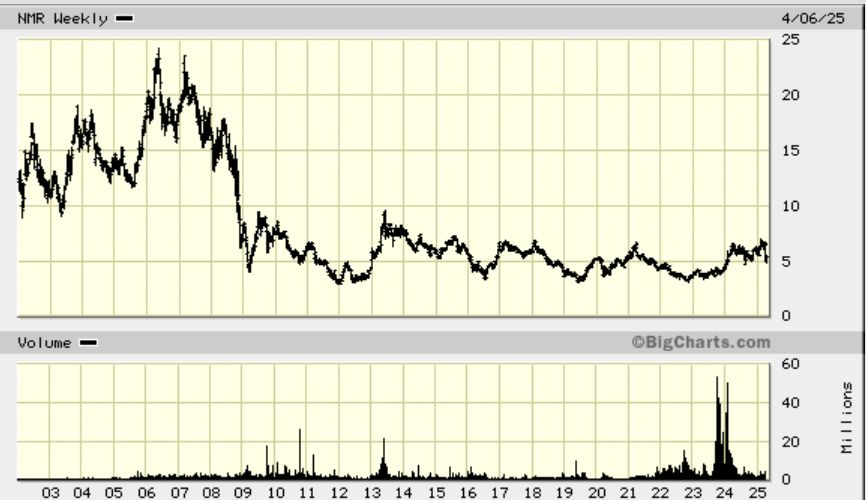

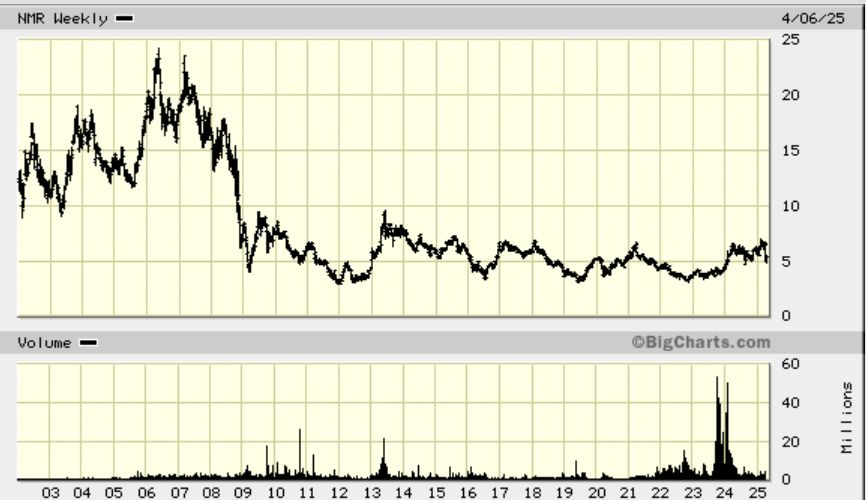

NMR. Nomura, is a Japanese wiire house. Japan has no resources other than perhaps oysters, and an aging population. The yen is still actively traded and there are a host of Japanese manufacturers with publice stocks.

DBVT DBV Technologies is a French biotech working on perfecting the remedy for peanut allergies.

SE Sea Limited. To reiterate, it has broke trend. It's done.

MNDO is an Isreali company mentioned elsewhere here.     |