>> THE F*CKING F*CKS

China, as far as I know, does not sell gold, certainly not into the international market, and yet am told otherwise per below, according to usual suspect

I shall buy gold / paper gold on Friday, and crypto gold on Sunday, then wait for Tuesday to sell, in order to pay for the Apple Mac Studio M3 Ultra and accessories and furniture I ordered earlier this day all intended to improve my together with my Jack’s understanding of the world by way of AI / LLM or otherwise enhance my memory

With any luck perhaps also pay for my Apple Mac Studio M4 Max with dual-screens meant for everyday work as opposed to AI / LLM duties

zerohedge.com

Gold Breaks Down As China Hits The Sell Button And CTAs Line Up To Follow

BY THE MARKET EAR

THURSDAY, MAY 01, 2025 - 21:04

All good things come to an end

Gold remains under pressure, continuing its downward momentum. As of writing, it is testing the 21-day moving average. A close below this level—and the key $3,200 support zone—could open the door for a move toward the trend line established since January, which aligns with the 50-day moving average near $3,100.

Source: Refinitiv

Could get more oversold

RSI in gold remains far from oversold...

Source: Refinitiv

Check in with Xi

That 'somebody' who stopped selling Treasury futures / buying gold — as we pointed out a few days ago — continues to stay out of the market. Xi is definitely taking a break on May 1...

Source: Refinitiv

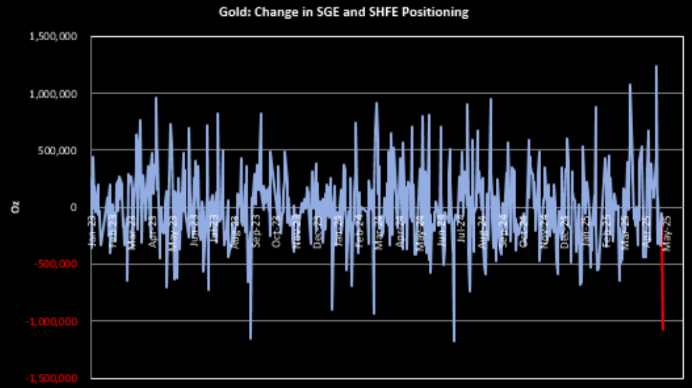

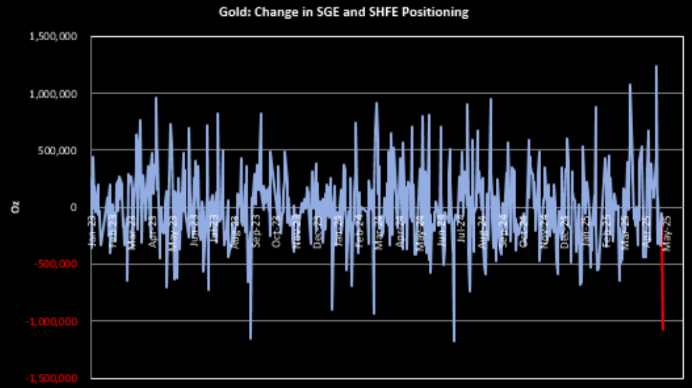

Massive "sell order"

Goldman's Gillard points out: "Today China liquidated ~1mn oz across SHFE and SGE". China basically sold what they bought last week.

Source: GS

Gold selling

The weighted average entry price of ETF buying flows so far this year has been $3,010/t oz, with $4.7 billion of recent purchases established between $3,175–3,450/t oz. Additional ETF outflows would weigh on gold prices in the short term, and potentially put some recently established ETF positions at risk. This would align with several large CTA selling levels at $3,300/t oz and $3,175/t oz, further exacerbating short-term price pressure. (Energy Aspects)

Source: Energy Aspects

The dollar is a driver

Gold has grown accustomed to loving the weak dollar. Watch any bids in the dollar carefully, as it is spilling over to gold weakness quickly. Chart shows gold vs DXY (inverted).

Source: Refinitiv

CTAs need to sell some gold

It is not momentum related, but more volatility related, writes GS.

Source: GS

Gold is not risk on

Gold vs SPX (inverted) needs little commenting.

Source: Refinitiv

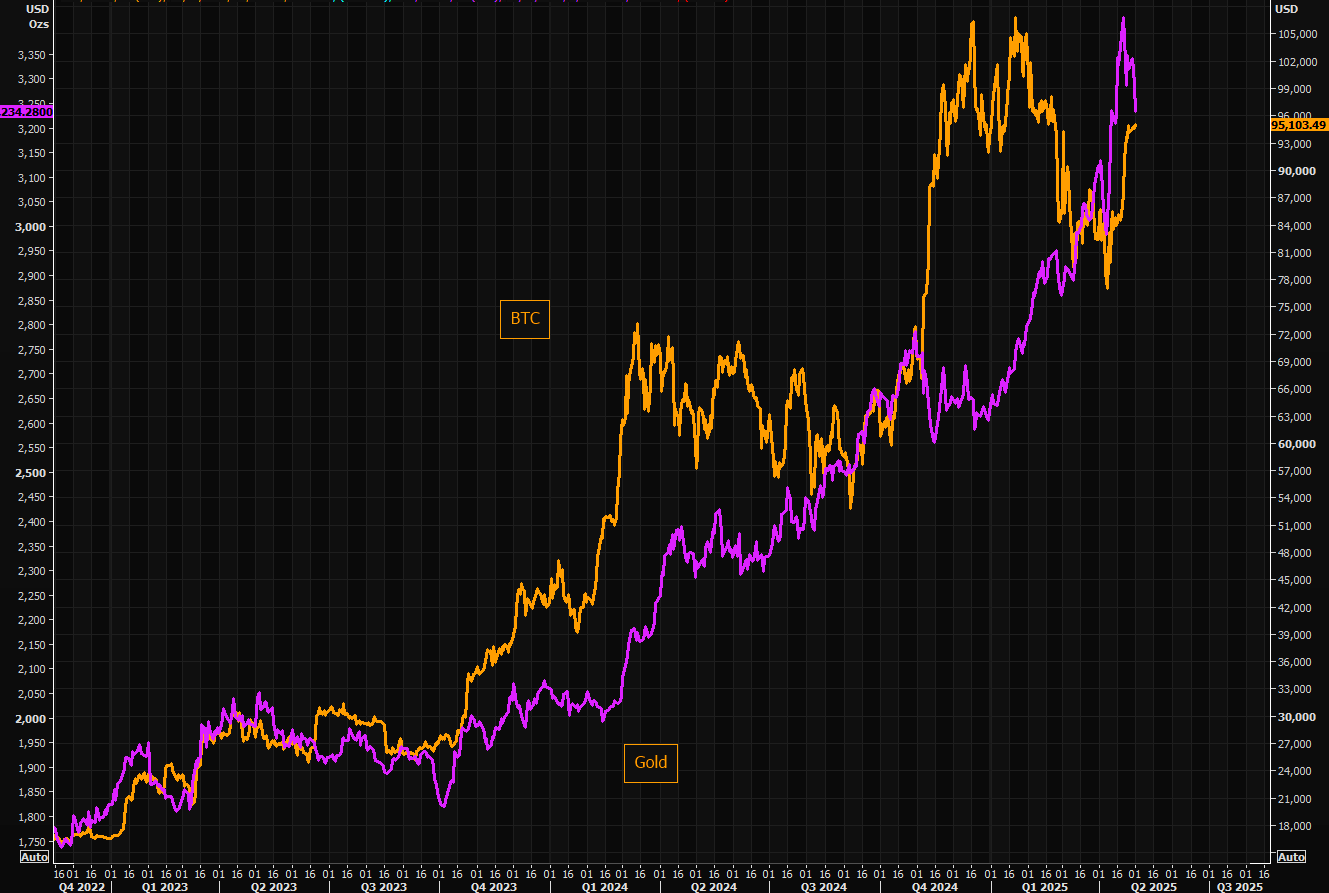

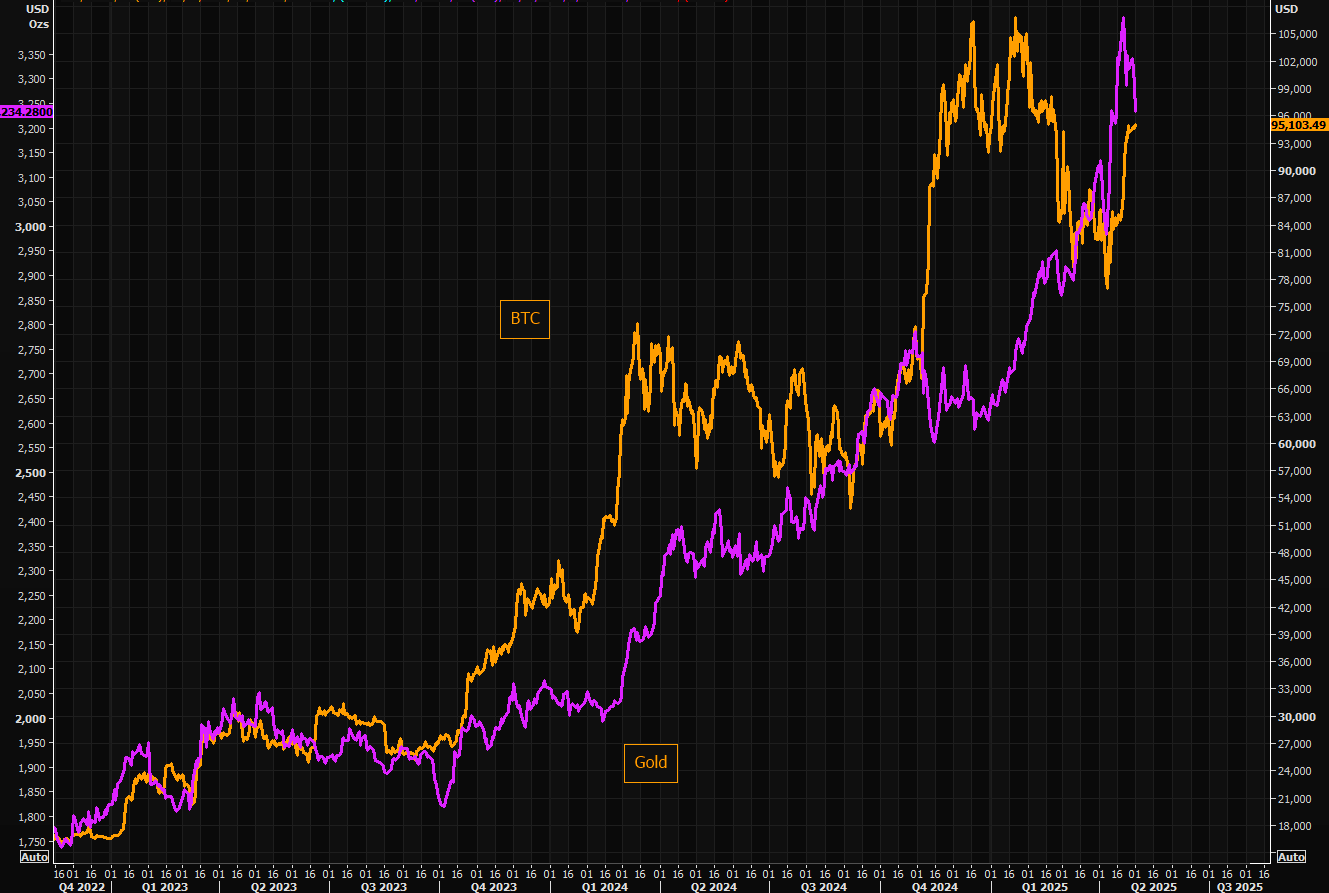

New sheriff in town

The gold vs BTC gap is now basically closed.

Source: Refinitiv |