From behind the curtain …

zerohedge.com

10 Reasons Why Goldman's Trading Desk Is Quietly Buying Gold

BY TYLER DURDEN

FRIDAY, MAY 16, 2025 - 11:29 AM

Six weeks after Liberation Day, Gold briefly dropped as low as $3150/oz - down 10% from record highs just a few weeks earlier - in a world where headline risk remains ubiquitous, correlations are broken, and Asia is still in the driving seat.

And while the recent de-escalation in US-China tensions and major geopolitical conflicts has likely removed the right tail of macro risk, Gold is anything but dead. As Goldman analyst Gerald Tan writes in an overnight note (full pdf available to pro subs), despite 50 bps of rate cuts priced out in ten days, S&P500 up 20% since April lows, and the West not being in the trade, Gold is still up 20% YTD.

No surprise then that Tan believes this retracement is healthy as "fundamental drivers of de-dollarisation and diversification remain firmly intact."

And while Western investors have been largely absent of this year’s rally, Goldman expects re-engagement as the market consolidates, though another leg of positioning flush may be needed before the long trade regains traction.

Finally, Tan shares ten charts laying out the case for gold:

1. Gold is back to pre-Liberation Day levels after trading in a $550 range in the span of 6 weeks.For context, Gold traded in a $500 range between 2014 and 2019.

[url=] [/url] [/url]

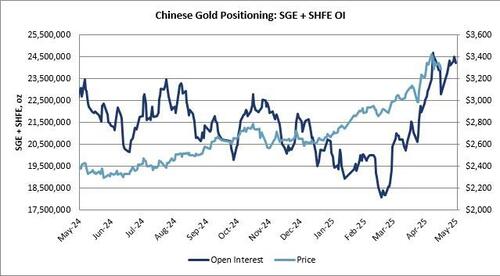

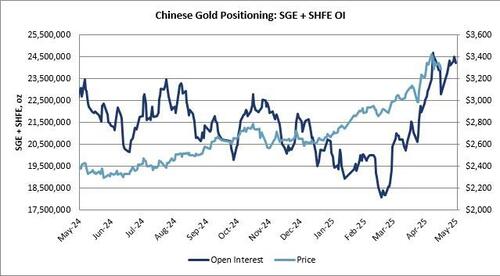

2. Chinese Positioning remains in the driving seat with close to 9mm ounces OI increase on SGE + SHFE since March 2025.

[url=] [/url] [/url]

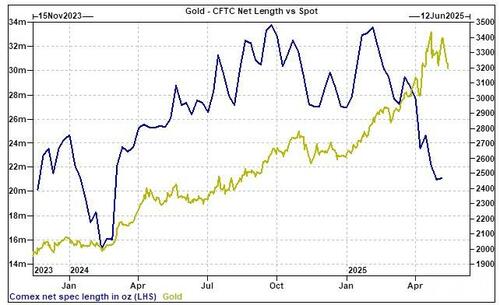

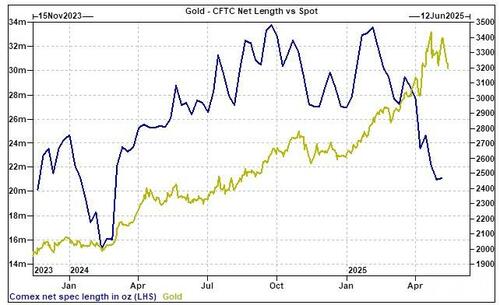

3. In the meantime the West is still not in the trade with CFTC Net length at Q1-2024 levels, when Gold was $1000/oz cheaper.

[url=] [/url] [/url]

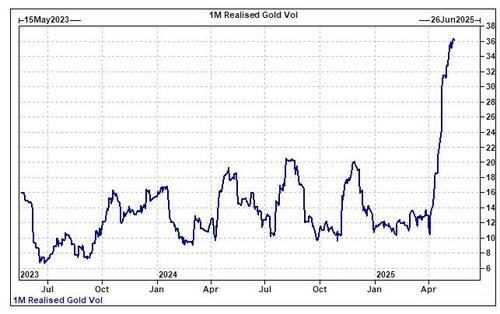

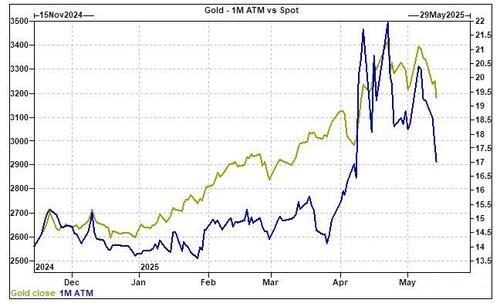

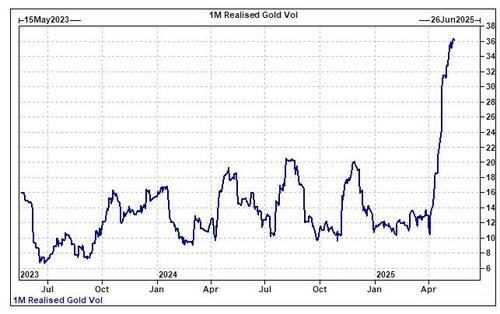

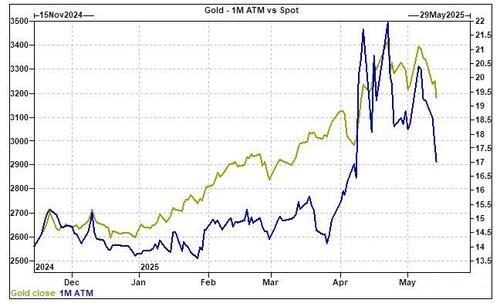

4. Long Gamma was the best trade with 1M realized above 36v when 1M ATM was trading 16v before Liberation day, 25v at the highs in April, and 18v this morning

[url=] [/url] [/url]

5. Long riskies was the other winning trade with 3m ATM trading in a 6v range over the past month and vols greatly outperforming the implied spot/vol moves.

[url=] [/url] [/url]

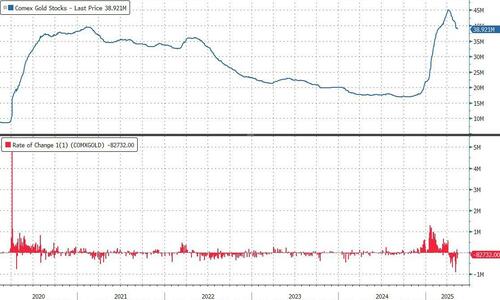

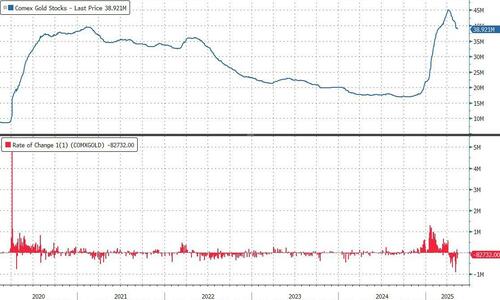

6. The EFP volatility and subsequent physical moves are now a distant memory, with London Gold trading above COMEX over the first three months of the curve. COMEX inventories have started to decline as more metal is being shipped back to London.

[url=] [/url] [/url]

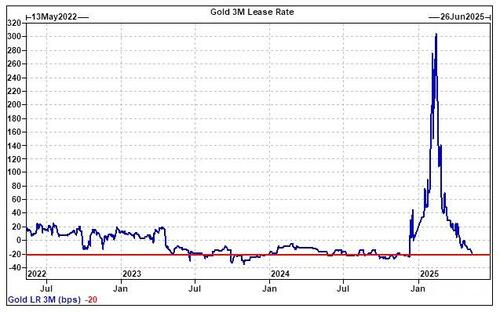

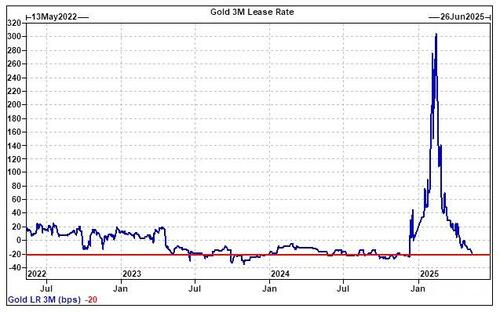

7. London forwards are back to pre-Trump elections, with the 3M Gold forward trading 20 bps above SOFR after having traded as low as 300 bps below SOFR three months ago.

[url=] [/url] [/url]

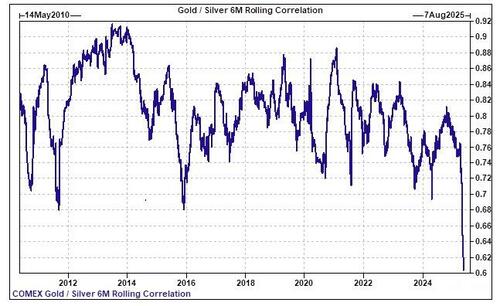

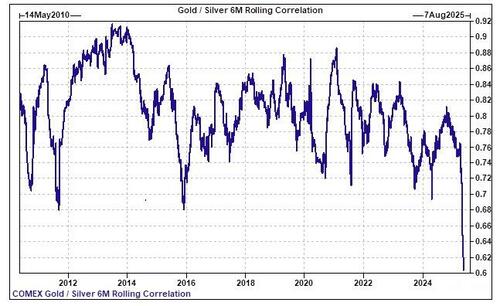

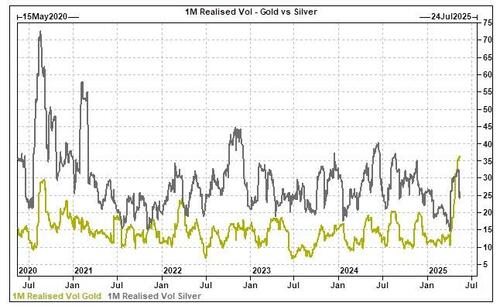

8. Silver has been the sideshow for the past month, trading in a tight $1.5 range, with the 6mth realized correlation between Gold & Silver trading at 15y lows.

[url=] [/url] [/url]

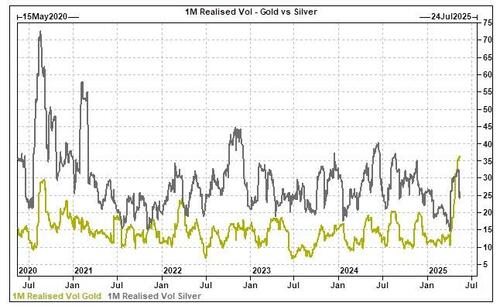

9. While Realized Silver vol is now trading below Gold for the first time since 2020.

[url=] [/url] [/url]

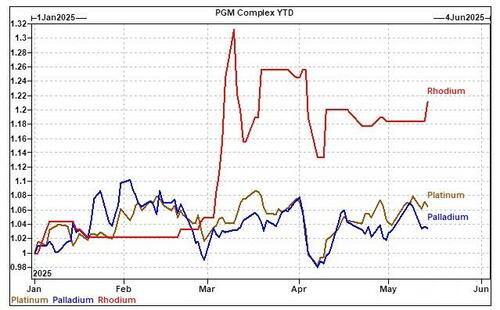

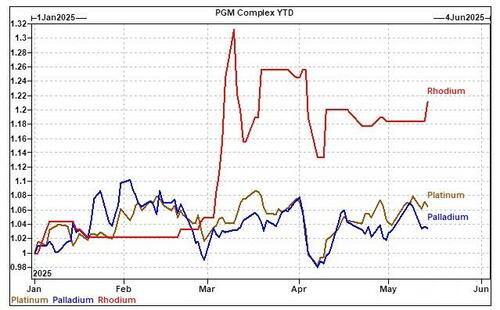

10. Rhodium is the one outlier of the PGM complex, up 20% YTD with the curve firmly in backwardation. Platinum and Palladium are trading uncorrelated to the rest of the precious complex with lower implied vols and even lower realised, hoping to find some revival with Platinum week starting off this Monday.

[url=] [/url] [/url] |

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]