Article from Seeking Alpha this morning

seekingalpha.com

Universal Display's OLED Breakthrough Paints A More Profitable Future

May 20, 2025 7:42 AM ET

WideAlpha

Summary- Universal Display's blue OLED breakthrough is a game changer, unlocking new revenue streams and further energy savings for next-gen displays.

- The company boasts a dominant IP portfolio, high-margin royalty revenue, and a fortress balance sheet with nearly $1B in net cash.

- OLED adoption is accelerating across devices, and Universal Display's technology is poised to gain further market share as costs fall.

- While shares trade at premium multiples, strong growth prospects, high margins, and the blue OLED innovation justify a more optimistic valuation.

Pavel Muravev

Universal Display (NASDAQ: OLED) is one of the companies we've had on our radar for quite some time, but every time we took a look at shares appeared unreasonably expensive, and the technology was still far from the mass adoption inflection point. While many products have been using their OLED technology for high-quality displays for a few years now, competing low-cost LEDs have limited their adoption and pricing power.

However, we see a potential inflection point as the technology continues to improve while its production costs decline. We are particularly optimistic now that the company appears to have finally cracked the notoriously elusive "blue OLED".

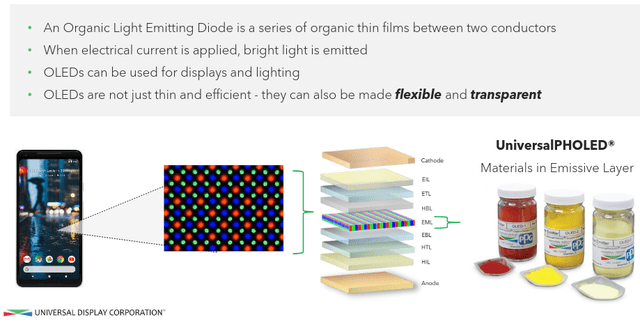

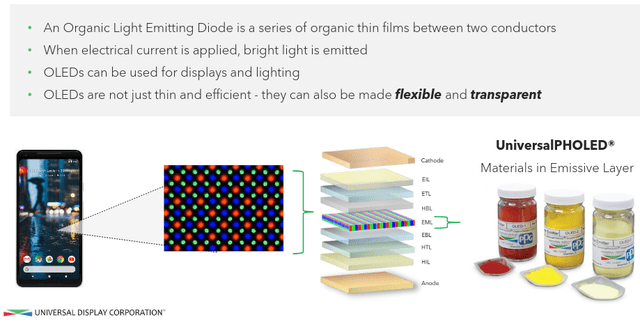

Company OverviewUniversal Display is a science-driven company that has built a formidable reputation as a tech innovator, dominating various segments of the OLED market. They boast over 6,500 issued and pending patents globally, securing leading intellectual property assets that make competing in the OLED space difficult for newcomers and competitors alike. The company makes money both by licensing its technology and selling specialty materials needed for the manufacturing of OLED displays.

Universal Display Investor Presentation Universal Display Investor Presentation

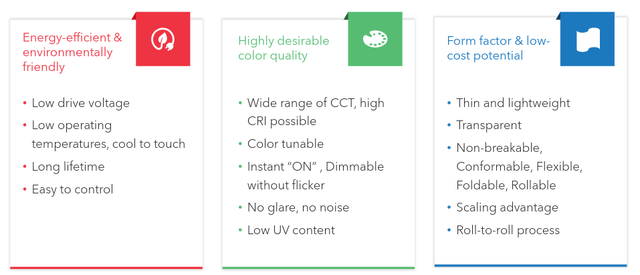

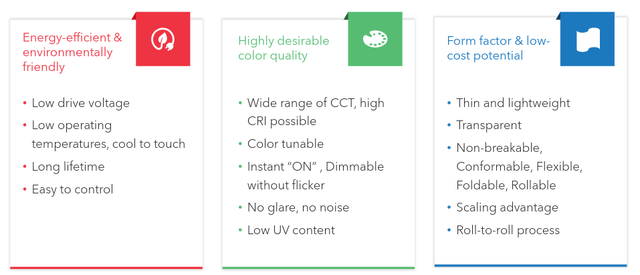

Cutting-edge TechnologyUniversal Display's phosphorescent OLED technology and materials offer a number of benefits compared to alternative display technologies. For example, they tend to use less power, improve image quality, allow for thin and light form factors for the devices where they are used, have a wide viewing angle and high contrast ratio (i.e. true black), have low ultraviolet (UV) emissions which are bad for eye health and interfere with sleep cycles, are flexible, require fewer manufacturing steps, and require a lower bill of materials (BOM) as things like a backlight with color filters are not needed, and enable non-glass substrates.

One of the most important recent news is that their phosphorescent blue OLED materials are now commercially viable, marking a historic breakthrough. Blue proved challenging due to stability and longevity concerns. But success at last places Universal Display firmly on a path to potential new revenue streams, as focus shifts towards wide-scale adoption in smartphones, laptops, tablets, foldable devices, and TVs. This breakthrough is so important that CEO Steve Abramson even called it a “game changer” during the most recent earnings call.

Regarding blue, the journey has been challenging as all trailblazing breakthroughs are, and our teams continue to work tirelessly. We are excited about the strides we are making and are pleased by the news release this morning from LG Display announcing that they have successfully verified the commercialization level performance of blue phosphorescent OLED panels. We believe that our phosphorescent blue will be a game changer for our customers, the industry, consumers, and for us.

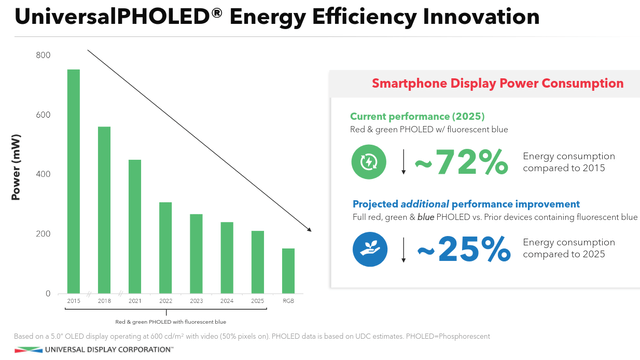

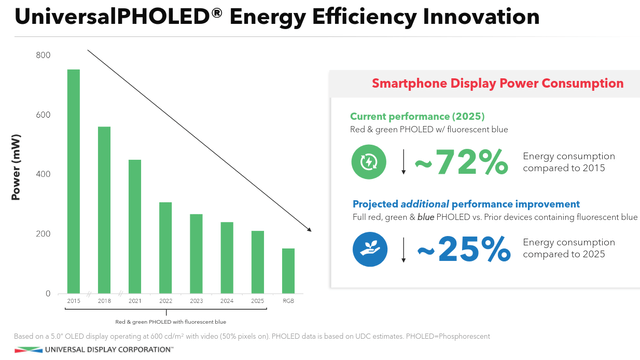

This breakthrough is expected to unlock an additional ~25% improvement in energy consumption reduction, which is a particularly strong selling point when it comes to battery-powered devices. For many of us, this might mean our next smartphone's battery will last noticeably longer. Blue PHOLEDs are also expected to enhance color accuracy and sharpness in high-resolution displays.

Universal Display Investor Presentation Universal Display Investor Presentation

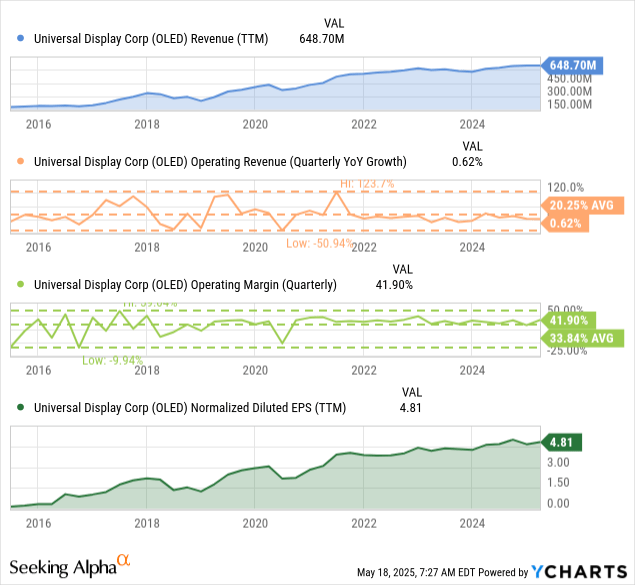

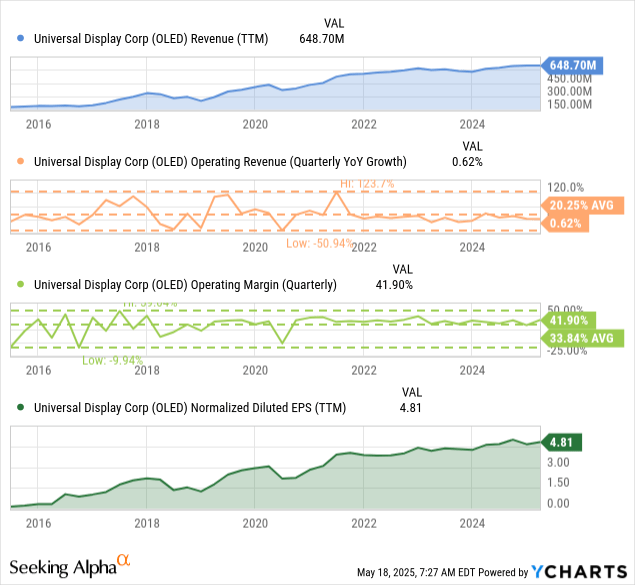

FinancialsUniversal Display’s revenue model is mostly based on collecting royalties and licensing fees from major panel producers, who lean heavily on the company's proprietary technology. This results in elevated operating margins ordinarily reserved for companies benefiting from a strong competitive moat.

In the first quarter of FY2025, Universal Display reported revenues of $166 million, essentially flat compared to the previous year. Material sales softened a bit to $86 million, from $93 million last year, with green emitter sales dropping slightly. Still, while materials paused momentarily, high-margin licensing and royalty fees showed a very meaningful improvement, rising from $68 million to $74 million. This helped the operating margin reach 41.9%, significantly above the ten-year average. Earnings per share have been trending higher over the past decade, even if it has been achieved with some cyclicality.

Data by YCharts Data by YCharts

Balance SheetAnother strong point for Universal Display is its balance sheet, with basically no long-term debt and significant cash and short-term investments. In fact, net cash was ~$918 million at the end of the most recent quarter, roughly $19 per share, or more than ten percent of its market capitalization.

This strong financial position, coupled with a more reasonable valuation and the technical progress achieved, is likely what motivated the company to launch a $100 million share buyback program and to increase its dividend by more than 12%.

Future OutlookOLED adoption continues to gain momentum, with smartphones, tablets, laptops, and particularly the automotive segment experiencing strong growth. According to market research, the OLED market is expected to grow at a compounded annual growth rate of approximately 13% between 2024 and 2032.

Universal Display is working toward making the switch to OLED technology an easier choice for device manufacturers. Many companies like LG Display ( LPL), Apple ( AAPL), and Samsung Electronics ( OTCPK:SSNLF) already have devices using OLED technology. Given the constant improvement in technology, it is likely that it will continue to gain share. The slide below summarizes some of the key advantages OLED technology has over alternatives like LED screens. Importantly, Universal Display has hundreds of scientists working on further improving the technology, with the blue color breakthrough adding benefits like a further 25% reduction in energy consumption.

Universal Display Investor Presentation Universal Display Investor Presentation

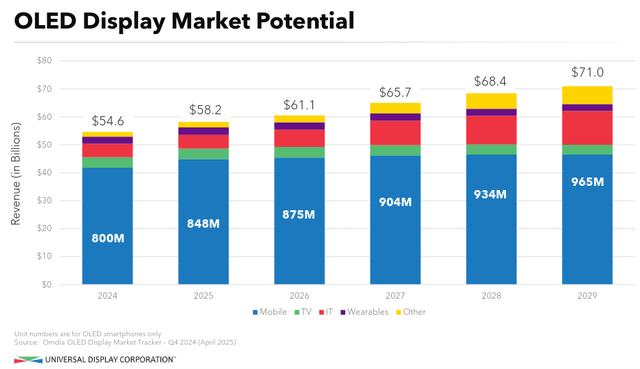

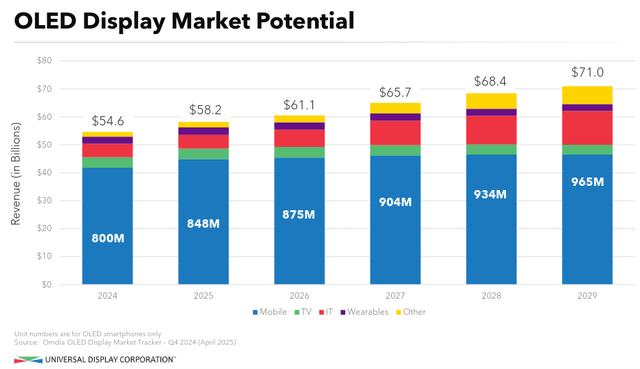

Universal Display's addressable market projections are more conservative, with the company expecting a roughly 30% increase by 2029 compared to 2024. This would represent a compounded annual growth rate of approximately 5.3%. If the blue phosphorescent OLED breakthrough really turns out to be a "game changer", their current projections could turn out to be conservative.

Universal Display Investor Presentation Universal Display Investor Presentation

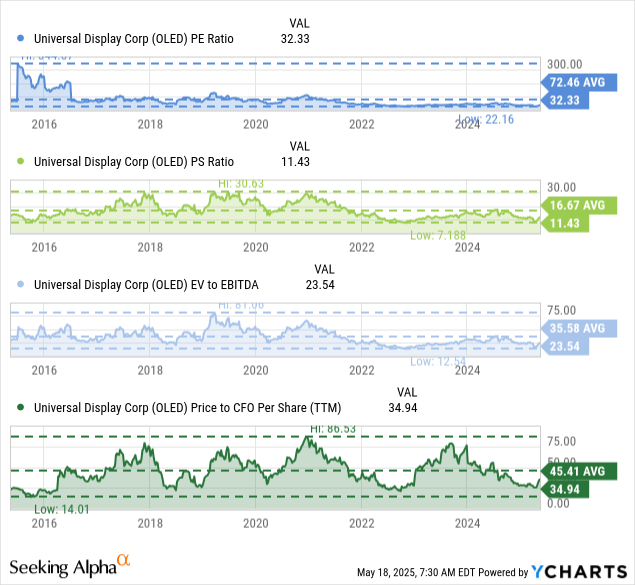

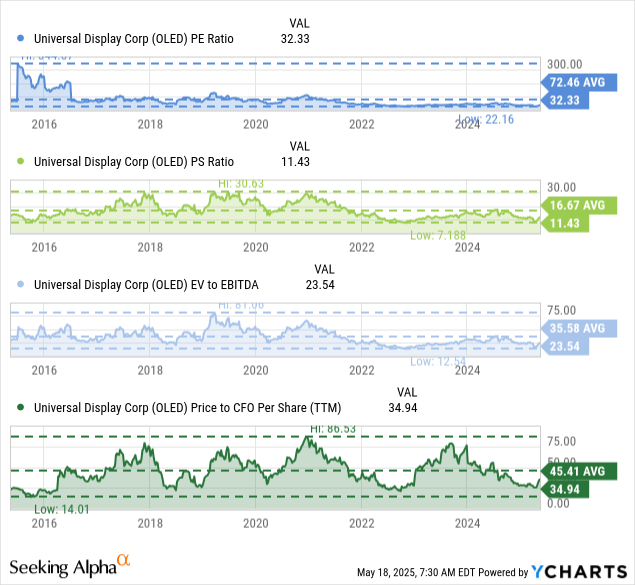

ValuationWhile the valuation multiples are not exactly cheap, companies that tend to have a significant percentage of their revenue come from royalties tend to have relatively high Price/Earnings ratios.

For example, Dolby Laboratories ( DLB) is currently trading at roughly 29 times earnings. Universal Display is currently trading at ~32x times earnings, but if we adjust for net cash, the Price/Earnings would decline more than 10%. Other valuation metrics, such as Price/Sales, Price to Cash flow from Operations (CFO), and EV/EBITDA, are high in absolute terms, but significantly below their ten-year averages.

Data by YCharts Data by YCharts

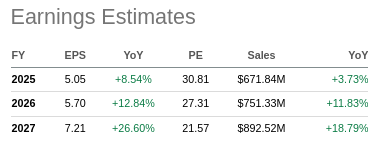

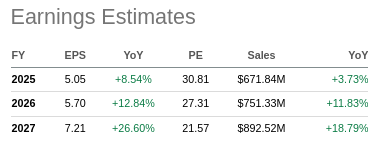

Based on average analyst estimates, the valuation appears significantly more reasonable when looking at the expected earnings in a couple of years. For instance, the forward FY2027 Price/Earnings multiple is only about 22x.

Seeking Alpha Seeking Alpha

RisksThere are a few key risks we see with Universal Display, including high customer concentration, with Samsung and LG Display dominating its revenue stream. Some of the end-markets using OLED displays can be sensitive to economic conditions and the health of the consumer. Examples include TVs, cars, and smartphones, all of which tend to be considered discretionary purchases.

Recent tariffs and complex geopolitics bring additional risks and have weighed on consumer sentiment, which is currently close to multi-decade lows. The materials side of the business has a weaker competitive moat and faces competition from the likes of Germany's Merck KGaA and Nippon Steel's ( OTCPK:NISTF) chemical division.

Perhaps the biggest risk is that of an alternative technology replacing advanced OLED displays. One such contender is the MicroLED technology being explored by companies such as Sony ( SONY), Samsung Electronics, and Apple. For the time being, it appears that most of these technologies remain confined to the lab for the most part, but a major breakthrough could make them a serious threat to Universal Display's OLED IP.

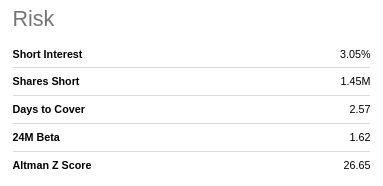

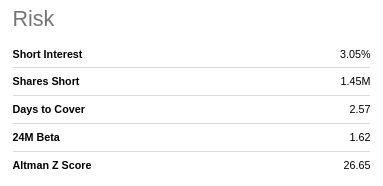

Risks are mitigated by the very solid balance sheet, elevated profit margins, and strong patent portfolio. In fact, we have rarely seen an Altman Z-score as high as Universal Display's, which is almost ten times as high as the 3.0 critical threshold.

Seeking Alpha Seeking Alpha

It is worth pointing out as well that, while the blue PHOLED breakthrough is very positive news for the company, it remains to be seen how widely adopted it will be. There could be issues that have to be ironed out when ramping up high-volume production. In fact, Steve Abramson appeared to slightly temper expectations during the Q&A session of the earnings call when an analyst asked about the commercialization timeline.

[...] on blue, we were certainly pleased to see the report today from LG Display highlighting the success that they’ve had utilizing our phosphorescent blue. We previously commented that having a customer indicate success with our material would be a positive step forward. So we’re pleased by the announcement.

Any specific plans and timeline of introducing into a product, or really for our customers and their customers, the OEMs to speak to. And on pricing, we’re in constant dialogue with our customers on various commercial matters, including blue pricing.

ConclusionUniversal Display is widely considered the OLED technology leader, generating significant revenue from licenses and royalties based on its patents and intellectual property. The OLED display technology is expected to continue growing at a rapid pace and continue taking market share from other display technologies. This is in large part because of their advantages, including low-energy consumption, vibrant picture quality, and flexibility that enables sleek designs.

Its recent blue phosphorescent breakthrough increases its competitive advantage, helping justify Universal Display's premium valuation multiples. While at first look shares appear expensive due to the elevated valuation multiples at which they trade, they appear significantly more reasonably valued when considering expected earnings in a few years, high profit margins, and adjusting for the large net cash position.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

WideAlpha

5.79K Followers

Follow |

Data by

Data by

Data by

Data by  Seeking Alpha

Seeking Alpha Seeking Alpha

Seeking Alpha