Money Multiplies in Trees (MMT) Central banks have kept long-term interest rates artificially low for a long time writes professor Robin Brooks.

When I asked what was this magic that only developed countries could do?

The answer was: The debt is in their own currencies. But it will have to be repaid! Principal and Interest.

There is always that time when the bill arrives.

The Level of Debt and Interest Rates

Central banks have kept long-term interest rates artificially low for a long time

Robin J Brooks Robin J Brooks

May 22, 2025

My posts this week have focused on the sharp rise in long-term government bond yields. Yesterday’s post made the point that rising yields are a delayed reckoning for many years of irresponsible fiscal policy, which in turn reflect the mistaken belief that “deficits don’t matter,” the slogan of Modern Monetary Theory (MMT).

In the decade after the global financial crisis, inflation was doggedly low, allowing central banks to keep policy rates near zero for much longer than during previous recoveries. This held down long-term interest rates as well, because the stability of inflation at low levels kept markets from pricing meaningful risk premia at the long end of the yield curve. It turns out that all this was an illusion. Inflation soared as the global economy recovered from COVID, forcing central banks to hike much more aggressively than anyone could have dared imagine.

The kind of expansionary fiscal policy that had previously seemed like a good idea now began to look problematic. But just how problematic is not something you will glean from looking at actual government bond yields. That’s because central banks around the world have embraced quantitative easing, whereby they buy longer-term government debt with the express purpose of flatting the yield curve when policy rates hit the zero lower bound. Even though those quantitative easing programs have ended, the mere fact that these programs existed and could be reactivated keeps long-term yields in many places artificially low.

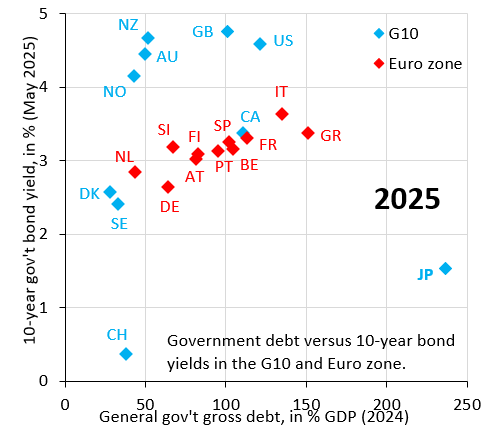

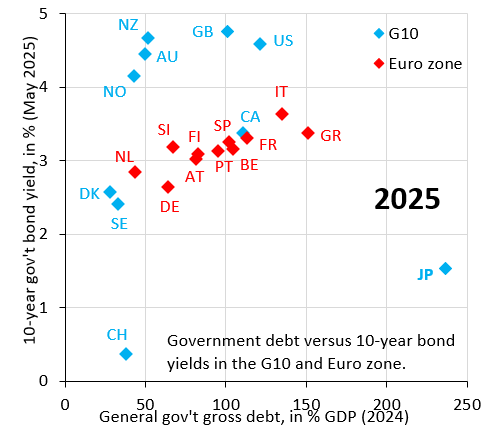

The best way to see this is to look at 10-year government bond yields across advanced countries (what’s often called the G10). Given that Japan’s gross government debt is 240 percent of GDP (horizontal axis), its 10-year yield of 1.5 percent (vertical axis) is a big outlier. This outlier status is entirely due to the central bank buying all net new debt issuance until very recently, keeping long-term interest rates artificially low.

Japan is an extreme case, but this same dynamic is playing out - to a lesser extent - across many other countries. In the Euro zone, for example, there’s almost no upward-sloping relationship anymore between the level of debt and 10-year yield. The ECB isn’t running QE at the moment, but the fact that it did in the past - especially when yields spiked - keeps long-term interest rates artificially low now (the ECB “put”).

All this raises two big questions. First, how high would long-term yields be without all the interference from central banks? Second, if rates continue to rise, will central banks come under political pressure to intervene and cap yields. The answers to these questions determine how high long-term yields can go (or will be allowed to go). I’ll discuss these two questions tomorrow

robinjbrooks.substack.com |