this is from here: Message 34808481

Stunning.... No wonder Germany is having problems. Trump doesn't have a clue what he has stepped into and is exacerbating.

Volkswagen has ‘one year’ to adapt as European sales collapse

Matthew Field

Wed, Sep 4, 2024, 6:48 PM GMT

Volkswagen workers have promised to mount 'fierce resistance' to the company's planned cutbacks -

Moritz Frankenberg/Pool via Reuters

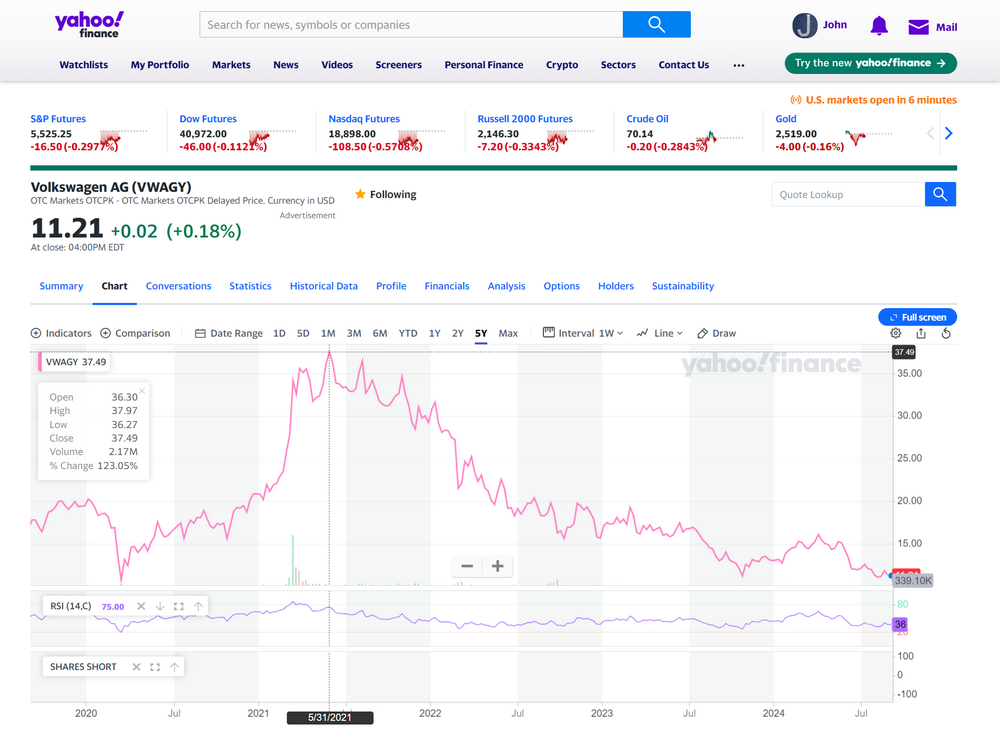

Volkswagen has as little as a year to adapt to plunging sales in Germany, its finance boss has said, as it considers closing a factory in its home market for the first time in 87 years.

Arno Antlitz, Volkswagen’s chief financial officer, told staff at the company’s Wolfsburg headquarters they had “a year, maybe two” to transform the business.

Daniela Cavallo, the chief of the company’s works council, which represents staff, said the closure threats amounted to a “declaration of bankruptcy”.

Volkswagen now expects to sell around 500,000 fewer cars in Europe per year, “the equivalent of around two [car] plants”, Mr Antlitz said, addressing a staff general meeting.

“We still have a year, maybe two years, to turn things around,” he added. “But we have to make use of this time.”

Workers carrying banners whistled and heckled executives, Reuters reported, as they delivered prepared statements. Around 16,000 staff gathered for the meeting, with some chanting “Auf Wiedersehen” as Mr Antlitz spoke.

VW's bosses including chief executive Oliver Blume, brand chief Thomas Schaefer and finance chief Arno Antlitz were heckled as they laid out the company's position -

Moritz Frankenberg/Pool/AFP via Getty Images

It comes as Volkswagen, which is Europe’s biggest carmaker, faces plunging demand for its vehicles in Germany and China, its most profitable market.

At the same time, sales of new electric models have stalled in the bloc as their relatively high price compared to petrol equivalents remains a barrier to uptake.

Executives at the carmaker warned earlier this week it could be forced to consider closing factories in Germany, where it employs more than 300,000 people, for the first time in its history.

Unions called the announcement a “black day” for the company as its powerful works council threatened “fierce resistance” to the plans.

Bosses are also planning to end a job security programme, originally scheduled to run until 2029, which would have protected roles in Germany.

Oliver Blume, the Volkswagen chief executive, said this week: “The economic environment has become even tougher and new players are pushing into Europe. Germany as a business location is falling further behind in terms of competitiveness.”

The carmaker is looking to save €10bn (£7.6bn) as it haemorrhages market share in China. In Europe, meanwhile, it is facing an influx of new rivals such as China’s BYD, as well as Elon Musk’s Tesla.

Thorsten Groeger, of the IG Metall Union, warned Volkswagen’s planned cubacks were “short-sighted” and “highly dangerous”, adding it “risks destroying the heart of Volkswagen”.

Workers' representatives Thorsten Groeger and Daniela Cavallo criticised the company's planned cutbacks - Moritz Frankenberg/Pool via Reuters

The carmaker has also been caught in the middle of a trade dispute between the European Union and China, as Brussels accuses Beijing of undercutting domestic car brands with hefty subsidies.

On Monday, a Volkswagen executive warned that EU tariffs on China threatened to “wipe out” one of its brands.

The company manufactures electric cars for its Cupra brand in China, meaning they will be hit by planned import tariffs being imposed by the EU. If those imports fall through, it would also put the company at risk of fines for failing to meet European electric vehicle sales targets.

“It puts the whole financial future of the company at risk,” said Wayne Griffiths, who leads Volkswagen’s Cupra brand.

finance.yahoo.com

|