Cascadia Minerals and Granite Creek Copper Announce Merger to Create a Leading Yukon Copper-Gold Exploration and Development Company

Concurrent Non-brokered Private Placement Equity Financing of up to $2.25 Million Supported by Strategic Investor Michael Gentile

newswire.ca

News provided by Cascadia Minerals Ltd. Jun 09, 2025, 07:30 ET

/NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES/

VANCOUVER, BC, June 9, 2025 /CNW/ - Granite Creek Copper Ltd. ("Granite Creek") (TSXV: GCX) and Cascadia Minerals Ltd. ("Cascadia") (TSXV: CAM) are pleased to announce that they have entered into a definitive arrangement agreement dated June 8, 2025 (the "Agreement") whereby Cascadia will acquire 100% of the issued and outstanding shares of Granite Creek for consideration payable in shares of Cascadia (the "Transaction"). The consideration will consist of 0.25 common shares in the capital of Cascadia for each one Granite Creek common share held. The Cascadia shares to be received by Granite Creek shareholders represent a value of $0.04 per Granite Creek share held based on Cascadia's closing price ending June 6, 2025.

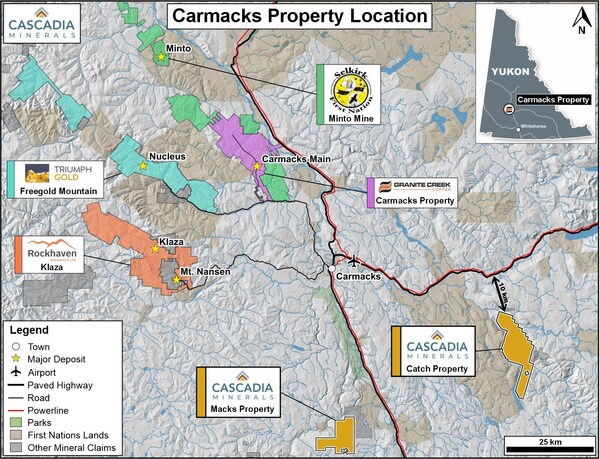

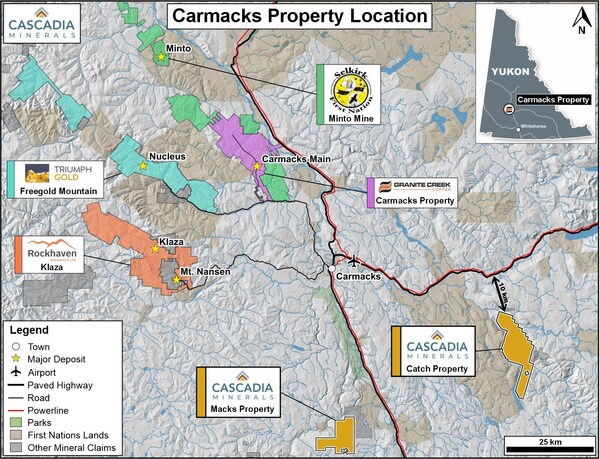

Carmacks Property Location (CNW Group/Cascadia Minerals Ltd.)

The Cascadia shares provide Granite Creek shareholders with a premium of 48% based on Granite Creek's 5-day volume-weighted average trading price of $0.027 as of June 6, 2025, the last trading day prior to announcement of the Agreement.

Granite Creek is primarily engaged in copper and gold exploration and development of the Carmacks Project, located 34 km northwest of Carmacks in central Yukon, and 40 km from the past-producing Minto mine.

All references to $ in this news release are to Canadian dollars unless otherwise indicated.

Transaction Highlights:

- Strong Resource Base. The road-accessible Carmacks Project hosts a high-grade Measured and Indicated Resource1 containing 651 Mlbs of copper and 302 koz of gold (36.3 million tonnes2 grading 0.81 % copper, 0.26 g/t gold, and 3.23 g/t silver and 0.01% molybdenum, or 1.07% copper equivalent3) with a 2023 PEA demonstrating positive economic potential ($230.5 M Post-Tax NPV(5%) and 29% Post-Tax IRR)4.

- Expansion Potential. Cascadia is well positioned to grow the Carmacks Project resource, with a resource expansion drill program planned for fall 2025 to test numerous targets, including near 2021 diamond drill hole CRM21-0115,6 which returned 105.52 m of 0.96% copper with 0.18 g/t gold and 4.06 g/t silver (1.18% copper equivalent3) and has not seen follow-up.

- Exploration Synergies. The combined company will be a leading Yukon copper-gold explorer and developer, combining Granite Creek's advanced Carmacks Project with Cascadia's portfolio of copper-gold exploration projects across Yukon's Stikine Terrane, providing shareholders a robust pipeline of projects from greenfield discoveries to brownfield expansion and development.

- Benefits to Shareholders. Granite Creek shareholders will receive exposure to Cascadia's discovery-stage Catch Property, where drilling is underway to test a new high-grade epithermal gold discovery (1,065 g/t gold in outcrop7) and extensive copper-gold porphyry mineralization.

- Well Financed. Upon completion of the Transaction Cascadia will have a total cash balance of approximately $2.5 million, which will be used to fund ongoing work on the combined property portfolio.

- Experienced Team. The Cascadia team brings extensive and proven Yukon exploration experience, including comprehensive geology, engineering, metallurgy, finance, capital markets, community engagement, governance and sustainability backgrounds.

- Streamlined Overhead. The Transaction will provide efficiencies and remove duplicative costs by optimizing resources of the combined company and providing for more efficient advancement of the assets as a single portfolio with a focus on delivering maximum value for shareholders.

Graham Downs, President and CEO of Cascadia, commented: "This transaction is a great opportunity for both Cascadia and Granite Creek shareholders. The Carmacks Project provides a strong foundation of road-accessible resources in a safe jurisdiction. Our team is confident in the exploration potential around the main deposits and throughout the property. We look forward to building on the systematic work Granite Creek has conducted in recent years by growing near-deposit resources and exploring along trend toward the nearby Minto deposit to the north. Planning is already underway for a fall drill program at Carmacks, while work advances in parallel at our Catch Property and other discovery-stage Yukon Stikine projects. The Cascadia team has a demonstrated track record of advancing district-scale projects and making meaningful discoveries, and we look forward to bringing this experience to the Carmacks Project as well."

Tim Johnston, President and CEO of Granite Creek, commented: "With Cascadia's board and management's long history of discovery and development of mineral projects in the Yukon, I have confidence that they are the right team to advance the Carmacks Project and create long term shareholder value. This merger is a logical next step for both companies and will result in a combined entity with a robust portfolio of projects that will be positioned for success in these strong copper and gold markets. I look forward to remaining involved with Cascadia and moving the Carmacks Project forward towards development."

Carmacks Project Overview

The 177 km2 Carmacks Project is located 34 km northwest of the town of Carmacks, within the Traditional Territory of the Little Salmon Carmacks First Nation and the Selkirk First Nation. It is 35 km southeast of the past producing Minto Copper-Gold Mine, which is currently being acquired by the Selkirk First Nation8. It is road-accessible, with grid power located within 12 km of the property.

Figure 1 – Property Location

The Carmacks Project is located within the Minto Copper Belt, a 180 km x 60 km belt of intrusion-related copper-gold-silver deposits. This belt is within the Stikine Terrane, which extends into Yukon from British Columbia, and is characterized by Late Triassic to early Jurassic volcanic-plutonic arc complexes that are well-endowed with copper-gold-molybdenum porphyries including the Red Chris, Schaft Creek, Kemess, KSM and Galore Creek deposits and mines.

Figure 2 – Geological Setting

The Carmacks Project has seen significant historical work, including over 40,000 m of drilling, primarily focused on the Carmacks Main deposit. Highlights of drilling completed in 2020 and 2021 by Granite Creek are provided in Table 1.

Drillhole

| From (m)

| To (m)

| Length (m)

| Cu (%)

| Mo (%)

| Au (g/t)

| Ag (g/t)

| CuEq3 (%)

| CRM20-0019

| 102.85

| 230.12

| 127.27

| 0.61

| 0.028

| 0.13

| 2.14

| 0.79

| incl

| 104.85

| 133.50

| 28.65

| 1.03

| 0.014

| 0.20

| 3.09

| 1.23

| CRM21-01110

| 223.98

| 329.50

| 105.52

| 0.96

| 0.013

| 0.18

| 4.06

| 1.15

| incl

| 223.98

| 245.20

| 21.22

| 2.17

| 0.010

| 0.36

| 9.13

| 2.51

| CRM21-01911

| 277.95

| 345.30

| 67.35

| 0.93

| 0.011

| 0.31

| 4.23

| 1.20

| incl

| 322.00

| 345.30

| 23.30

| 1.70

| 0.016

| 0.57

| 7.51

| 2.18

| CRM21-02512

| 88.65

| 209.30

| 120.65

| 0.76

| 0.016

| 0.14

| 2.53

| 0.92

| incl

| 106.00

| 155.40

| 49.40

| 1.08

| 0.015

| 0.20

| 3.41

| 1.28

| Table 1: Carmacks Project Highlight Drill Results 6

Granite Creek completed an updated Mineral Resource Estimate in 2022 on the Carmacks Main deposit, which is summarized in Table 2. These mineralized zones remain open along strike and at depth, with much of the historical drilling focused on near-surface oxide mineralization, overlooking the significant potential for more sulfide mineralization throughout the system.

Category

| Cut-off2

| Tonnes

| Copper

| Silver

| Gold

| Molybdenum

| Copper Equiv.3

|

| (Cu %)

| Mt

| %

| Mlbs

| g/t

| Ounces

| g/t

| Ounces

| %

| Mlbs

| %

| Mlbs

| In-Pit Oxide

| Measured

| 0.30

| 11.36

| 0.96

| 239

| 4.11

| 1,501,000

| 0.40

| 145,000

| 0.006

| 1.5

| 1.28

| 319

| Indicated

| 0.30

| 4.33

| 0.91

| 87

| 3.37

| 469,000

| 0.28

| 39,000

| 0.007

| 0.6

| 1.14

| 190

| M&I

| 0.30

| 15.69

| 0.94

| 326

| 3.91

| 1,971,000

| 0.36

| 184,000

| 0.006

| 2.1

| 1.23

| 424

| Inferred

| 0.30

| 0.22

| 0.52

| 2.5

| 2.44

| 17,000

| 0.09

| 1,000

| 0.006

| 0.03

| 0.62

| 3

| In-Pit Sulphide

| Measured

| 0.30

| 5.71

| 0.68

| 86

| 2.54

| 467,000

| 0.16

| 28,000

| 0.016

| 2.0

| 0.85

| 107

| Indicated

| 0.30

| 13.49

| 0.72

| 214

| 2.83

| 1,226,000

| 0.19

| 82,000

| 0.013

| 4.0

| 0.90

| 269

| M&I

| 0.30

| 19.19

| 0.71

| 300

| 2.74

| 1,693,000

| 0.18

| 110,000

| 0.014

| 6.0

| 0.89

| 377

| Inferred

| 0.30

| 1.68

| 0.51

| 19

| 2.24

| 120,895

| 0.13

| 7,000

| 0.020

| 0.7

| 0.67

| 25

| Below Pit Sulphide

| Measured

| 0.60

| 0.03

| 0.71

| 0.41

| 2.54

| 2,000

| 0.16

| 132

| 0.010

| 0.0

| 0.86

| 0.5

| Indicated

| 0.60

| 1.34

| 0.82

| 24

| 2.88

| 124,000

| 0.19

| 8,000

| 0.012

| 0.4

| 1.00

| 30

| M&I

| 0.60

| 1.37

| 0.82

| 25

| 2.88

| 126,000

| 0.19

| 8,000

| 0.012

| 0.4

| 1.00

| 30

| Inferred

| 0.60

| 0.97

| 0.77

| 16

| 2.48

| 77,000

| 0.17

| 5,000

| 0.012

| 0.3

| 0.94

| 20

| Combined Total

| M&I

| Various

| 36.25

| 0.81

| 651

| 3.25

| 3,790,000

| 0.26

| 302,000

| 0.010

| 9

| 1.04

| 831

| Inferred

| Various

| 2.86

| 0.60

| 38

| 2.34

| 214,895

| 0.14

| 13,000

| 0.016

| 1

| 0.76

| 48

| Table 2: Carmacks Project Mineral Resource Estimate 1

A preliminary economic assessment was completed in 2023 on the Carmacks Main deposit, envisioning a 7,000 tpd open pit mine with conventional flotation to produce a copper concentrate. This study included processing of both oxide and sulfide material, and yielded the results shown in Table 3.

| Base Case

| Case 1

| Copper Price (US$/lb)

| 3.75

| 4.25

| Gold Price (US$/oz)

| 1,800

| 2,000

| Silver Prince (US$/oz)

| 22

| 25

| Exchange Rate ($:US$)

| 0.75

| 0.75

| Pre-Tax NPV @5%

| $324.1M

| $475.0M

| Pre-Tax IRR

| 36 %

| 48 %

| Pre-Tax Net Cash Flow

| $505.9M

| $714.5M

| After Tax NPV @5%

| $230.5M

| $330.1M

| After Tax IRR @5%

| 29 %

| 38 %

| After Tax Net Cash Flow

| $371.2M

| $507.4M

| Table 3: Carmacks Project PEA Economics 4

Transaction Terms

Pursuant to the Arrangement Agreement, Cascadia will acquire all the issued and outstanding common shares of Granite Creek in exchange for common shares of Cascadia by way of a plan of arrangement under the Business Corporations Act (British Columbia). Each Granite Creek share will be exchanged for 0.25 of a Cascadia share (the "Exchange Ratio"). Upon completion of the Transaction, existing Cascadia and Granite Creek shareholders will own approximately 59% and 41% of the issued and outstanding shares of the combined company, respectively (excluding any securities issued in the Placement, as defined below).

Outstanding stock options of Granite Creek will be exchanged for options of Cascadia and all warrants of Granite Creek will become exercisable to acquire common shares of Cascadia, in amounts and at exercise prices adjusted in accordance with the Exchange Ratio.

Granite Creek will hold a special meeting of Granite Creek securityholders in connection with the Transaction (the "Meeting"). Granite Creek expects to hold the Meeting in July 2025, and the Transaction is expected to close shortly thereafter, subject to customary closing conditions and approvals. In addition to securityholder approvals, the Transaction is also subject to, among other things, obtaining customary regulatory approvals including applicable TSX Venture Exchange ("TSX-V") approvals. The Transaction is arm's length for the purposes of the TSX-V's policies.

The Agreement contains customary reciprocal deal-protection provisions. Under certain circumstances, Cascadia or Granite Creek may be entitled to a reciprocal termination fee of $500,000. Further details regarding the terms and conditions of the Transaction are set out in the Agreement, which has been filed by Cascadia and Granite Creek under their respective SEDAR+ profiles.

Further information respecting the Agreement and the Transaction will be provided in the Granite Creek information circular which will be sent to Granite Creek's securityholders in connection with the Meeting.

Principle Conditions to Completion

The Transaction will be effected by way of a plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of at least: (i) 66?% of the votes cast by Granite Creek shareholders and optionholders (voting as a single class) (the "Granite Creek Securityholders"); and (ii) a simple majority of the votes cast by Granite Creek shareholders, excluding the votes cast by certain persons in accordance with Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). No finders' fees are being paid in connection with the Transaction.

The completion of the Transaction is subject to a number of terms and conditions, including, without limitation, the following: (i) acceptance by the TSX-V; (ii) approval of the British Columbia Supreme Court; (iii) there being no material adverse changes in respect of Granite Creek or Cascadia; and (iv) other standard conditions of closing for a transaction of this nature. There can be no assurance that the necessary terms or conditions will be met or that the Transaction will be completed as proposed or at all.

Recommendation by the Boards of Directors and Fairness Opinion

The board of directors of Granite Creek received a fairness opinion from Evans & Evans Inc. stating that, as of June 8, 2025 of such opinion and subject to the assumptions, limitations and qualifications contained in its opinion, the consideration to be received by Granite Creek Securityholders pursuant to the Transaction is fair, from a financial point of view, to the Granite Creek Securityholders. The board of directors of Granite Creek, as well as the independent directors voting as a group, unanimously approved entering into the Agreement and unanimously recommended that Granite Creek Securityholders vote in favour of the Transaction.

The Agreement has been unanimously approved by the board of directors of Cascadia.

Board of Directors and Management of Resulting Issuer

Upon closing of the Transaction, Timothy Johnston, Granite Creek's current President and CEO, is expected to join the board of directors of Cascadia.

Voting Support Agreements

The officers and directors of Granite Creek, collectively holding approximately 6% of Granite Creek's shares issued and outstanding, have entered into voting support agreements pursuant to which they have agreed, among other things, to vote their Granite Creek shares in favour of the Transaction.

Transaction Timeline

Pursuant to the Agreement and subject to satisfying all necessary conditions and receipt of all required approvals, the parties anticipate completion of the Transaction on or about July 2025. In connection with completion of the Transaction, Granite Creek shares will be de-listed from the TSX-V and following closing, Granite Creek will make an application to cease to be a reporting issuer under Canadian securities laws.

Concurrent Private Placement and Consolidation

In connection with the Transaction, Cascadia is undertaking a concurrent non-brokered private placement (the "Placement") to raise gross proceeds up to C$2,250,000 by the sale of: (a) up to 14,285,714 subscription receipts ("Subscription Receipts") at a price of $0.14 per Subscription Receipt for gross proceeds of up to C$2,000,000; and (b) up to 1,785,714 units ("Cascadia Units") at a price of C$0.14 per Cascadia Unit for gross proceeds of up to C$250,000. Each Subscription Receipt will entitle the holder to receive at the effective time of the Transaction one unit of Cascadia consisting of one Cascadia share and one common share purchase warrant (a "Warrant"). Each Warrant will entitle the holder thereof to purchase an additional Cascadia share at a price of $0.24 per share for a period of two years following the date of issuance of the Warrant. The Cascadia Units also consist of one Cascadia share and one common share purchase warrant having the same terms as the Warrants forming part of the units underlying the Subscription Receipts. Certain directors, officers and insiders of Cascadia may participate in the Placement.

The proceeds from the sale of the Subscription Receipts will be held in escrow pending the closing of the Transaction. If the closing of the Transaction has not completed by August 29, 2025, the Subscription Receipts will be cancelled and the escrowed proceeds returned to the subscribers. The proceeds from the sale of the Cascadia Units will not be escrowed, but will be available to Cascadia for its immediate use, unconditional on the closing of the Transaction. Cascadia may pay customary finders' fees in connection with the Placement. The Placement is subject to the approval of the TSX-V.

Cascadia will use the proceeds of the Placement to pay expenses associated with the Transaction and to conduct exploration on the Carmacks Project.

Following the closing of the Transaction and Placement, Cascadia will consider undertaking a consolidation of its issued and outstanding common shares at a ratio and on a timeline to be determined.

Bridge Loan

Cascadia will provide a non-interest-bearing bridge loan to Granite Creek in the amount of $375,000 to cover certain transaction costs (the "Bridge Loan"), subject to TSX-V approval. If the Agreement is terminated for any reason, the Bridge Loan will be repayable on demand by Cascadia in cash or, at Cascadia's option, may be converted to up to 12,500,000 common shares of Granite Creek at a price of $0.03 per share.

Shares for Debt Transaction

In connection with the Transaction, Granite Creek intends to settle an aggregate of up to approximately $521,000 of indebtedness owing to TruePoint Exploration Inc. ("TruePoint") and a Carmacks North royalty holder in exchange for Granite Creek shares (the "Shares for Debt Transaction"). Pursuant to the Shares for Debt Transaction, Granite Creek shares will be issued at a price per share equal to the closing price of the Granite Creek shares on June 9, 2025, subject to the polices of the TSX-V. The shares will be exchanged for Cascadia shares pursuant to the Transaction.

TruePoint is a privately held exploration service company that provides exploration and administrative services to Granite Creek. TruePoint is more than 50% owned by directors and senior officers of Granite Creek, being Mr. Timothy Johnson, Mr. Michael Rowley and Ms. Susan Henderson. Granite Creek's indebtedness to TruePoint relates primarily to certain long-term loans owing to TruePoint for past services rendered.

Following the Shares for Debt Transaction, and based on the closing price of Granite Creek shares on June 6, 2025, TruePoint will hold 15,354,273 Granite Creek shares, representing approximately 7.7% of the outstanding Granite Creek shares at the time of issuance.

The Shares for Debt Transaction is subject to TSX-V approval, including any disinterested shareholder approval required pursuant to the policies of the TSX-V.

The Shares for Debt Transaction with TruePoint is considered a "related party transaction" for purposes of MI 61-101. The issuance of these Granite Creek shares will be completed in reliance on exemptions available under MI 61-101 from the formal valuation and minority approval requirements of MI 61-101. Specifically, these Shares for Debt Transactions will be exempt from the formal valuation requirement in Section 5.4 of MI 61-101 in reliance on Section 5.5(b) of MI 61-101 as Granite Creek is not listed on a specified market within the meaning of MI 61-101. Additionally, the issuance is exempt from the formal valuation and minority approval requirement in Section 5.6 of MI 61-101 in reliance on Section 5.7(1)(a) of MI 61-101 as neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the shares exceeds 25% of Granite Creek's market capitalization. Granite Creek's board of directors and independent directors (as such term is defined in MI 61-101) have, acting in good faith, determined that the Shares for Debt Transaction is in the best interest of Granite Creek.

Advisers and Counsel

Cascadia has engaged Stikeman Elliott LLP as its legal adviser in connection with the Transaction. Sangra Moller LLP is acting as legal adviser to Granite Creek and Evans & Evans Inc. provided a fairness opinion to the Granite Creek board of directors.

About Cascadia

Cascadia is a Canadian junior mining company focused on making new copper and gold discoveries the Yukon and British Columbia. Cascadia's flagship Catch Property in the Yukon hosts a brand-new copper-gold porphyry discovery where inaugural drill results returned broad intervals of mineralization, including 116.60 m of 0.31% copper with 0.30 g/t gold13. Catch exhibits extensive high-grade copper and gold mineralization across a 5 km long trend, with rock samples returning peak values of 3.88% copper13, 1,065 g/t gold7, and 267 g/t silver7.

In addition to Catch, Cascadia is conducting exploration work at its Macks and Milner properties – recently staked Catch analogues within Yukon's Stikine Terrane which have additional copper porphyry targets. Cascadia has approximately 70 million shares outstanding and its largest shareholders are Hecla Mining Company, Michael Gentile and Barrick Gold.

About Granite Creek

Granite Creek is a growth stage exploration company, focused on the acquisition and development of exploration properties that host, or have the potential to host, precious base or battery metals. GCX's flagship asset is the Carmacks Project in the high-grade Minto copper district in Yukon Territory, Canada. The project is located south of and within 35km of the Minto mine.

Qualified Person

The technical information in this news release has been approved by Andrew Carne, M.Eng., P.Eng., VP Corporate Development for Cascadia and a qualified person for the purposes of National Instrument 43-101.

Disclosure Notes

- The Mineral Resources disclosed here are referenced from the 2023 Technical Report on the Carmacks Project Preliminary Economic Assessment, authored by SGS Canada Inc. for Granite Creek Copper, and have not been independently reviewed by Cascadia.

- Mineral Resources are reported based on a 0.30% copper cut-off for mineralization classified as in-pit, and a 0.60% copper cut-off for mineralization classified as below-pit.

- Copper equivalent value assumes metal prices of $3.75/lb copper, $2,000/oz gold, $25/lb silver, $12/lb molybdenum, and recoveries of 82% for copper, 70% for gold, 69% for silver, and 70% for molybdenum, and has been re-calculated for consistency of presentation.

- Pricing for the base case economic analysis was US $3.75/lb copper, US $1,800/oz gold, and US $22/oz silver at an exchange rate of $1:US$0.75. For more details on the economic analysis, refer to the 2023 Technical Report on the Carmacks Project Preliminary Economic Assessment, authored by SGS Canada Inc. for Granite Creek Copper. The results of the Carmacks preliminary economic assessment are preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized.

- Please refer to Granite Creek's August 24, 2021, News Release for more information on CRM21-011.

- Reported lengths are drilled widths. Estimated true widths vary but are expected to be typically 60-70% of the intersected widths.

- Please refer to Cascadia's July 25, 2024, News Release for more information on Amp Zone results.

- For more information, see CBC News article dated September 7, 2024, entitled "Selkirk First Nation clears 1st hurdle to buy Yukon's abandoned Minto mine", available here: cbc.ca

- Please refer to Granite Creek's February 11, 2021, News Release for more information on CRM20-001.

- Please refer to Granite Creek's August 24, 2011, News Release for more information on CRM21-011.

- Please refer to Granite Creek's October 28, 2021, News Release for more information on CRM21-019.

- Please refer to Granite Creek's March 10, 2022, News Release for more information on CRM21-025.

- Please refer to Cascadia's July 19, 2023, News Release for more information.

Results referenced in this release represent highlights only. Below detection values for gold, copper, silver and molybdenum have been encountered in drilling, soil and rock samples in these target areas.

Disclosure regarding the Carmacks Project is reliant on previous disclosure made by Granite Creek. Results from this project have not been independently verified by Cascadia.

On behalf of Cascadia Minerals Ltd.

Graham Downs, President and CEO

On behalf of Granite Creek Copper Ltd.

Timothy Johnson, President and CEO

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Cautionary note regarding forward-looking statements:

This press release may contain "forward-looking information" within the meaning of applicable securities laws. Readers are cautioned to not place undue reliance on forward-looking information. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this press release. Cascadia and Granite Creek undertake no obligation to update forward-looking information, except as required by securities laws.

SOURCE Cascadia Minerals Ltd.

For further information, please contact: Andrew Carne, M.Eng., P.Eng., VP Corporate Development, Cascadia Minerals Ltd., T: 604-688-0111 ext. 106, acarne@cascadiaminerals.com; Timothy Johnson, President & CEO, Granite Creek Copper Ltd., Telephone: 1 (604) 235-1982, Toll Free: 1 (888) 361-3494, E-mail: info@gcxcopper.com For further information, please contact: Andrew Carne, M.Eng., P.Eng., VP Corporate Development, Cascadia Minerals Ltd., T: 604-688-0111 ext. 106, acarne@cascadiaminerals.com; Timothy Johnson, President & CEO, Granite Creek Copper Ltd., Telephone: 1 (604) 235-1982, Toll Free: 1 (888) 361-3494, E-mail: info@gcxcopper.com

|

For further information, please contact: Andrew Carne, M.Eng., P.Eng., VP Corporate Development, Cascadia Minerals Ltd., T: 604-688-0111 ext. 106, acarne@cascadiaminerals.com; Timothy Johnson, President & CEO, Granite Creek Copper Ltd., Telephone: 1 (604) 235-1982, Toll Free: 1 (888) 361-3494, E-mail: info@gcxcopper.com

For further information, please contact: Andrew Carne, M.Eng., P.Eng., VP Corporate Development, Cascadia Minerals Ltd., T: 604-688-0111 ext. 106, acarne@cascadiaminerals.com; Timothy Johnson, President & CEO, Granite Creek Copper Ltd., Telephone: 1 (604) 235-1982, Toll Free: 1 (888) 361-3494, E-mail: info@gcxcopper.com