Sorry, I am not a member either, but it did load for me:

ImmunityBio: Lymphopenia Opportunity Could Provoke Short Squeeze

Jun. 12, 2025 9:09 AM ET ImmunityBio, Inc. (IBRX) Stock JNJ, JNJ:CA, IBRX 16 Comments

Atticus Analysis

140 Followers

Summary- ImmunityBio, Inc.’s Anktiva shows promise for bladder cancer, but faces FDA setbacks and a rocky approval path.

- Peak sales for Anktiva’s indications could reach $900 million by 2028, implying a 73% upside, but this is far from guaranteed.

- The company's lymphopenia treatment would face zero competition and would provide a larger addressable market.

- As investor awareness of the lymphopenia opportunity market grows, IBRX shorts could be forced to cover.

koto_feja

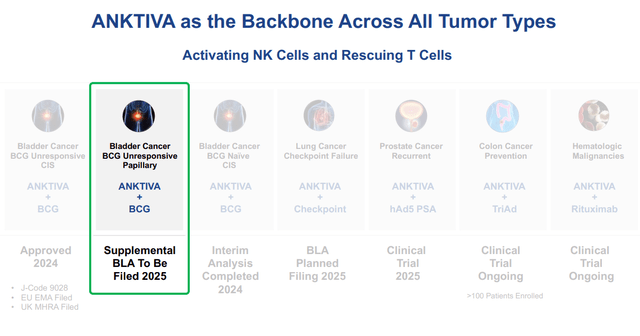

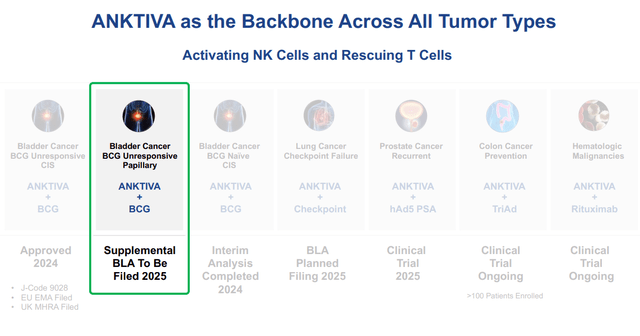

Introduction ImmunityBio, Inc. (NASDAQ: IBRX) is a biotech company focused on a cancer drug, Anktiva, which functions by training the body's T-cells to destroy the cancer. The FDA has approved Anktiva for certain indications with bladder cancer, and it is currently in trials for a variety of other indications, including lymphopenia, referenced under hematologic in the chart below:

Company Presentation Company Presentation

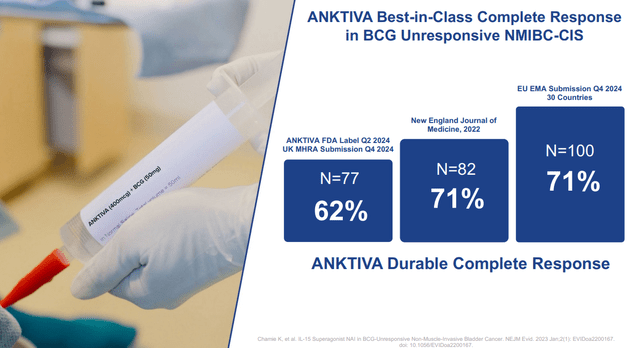

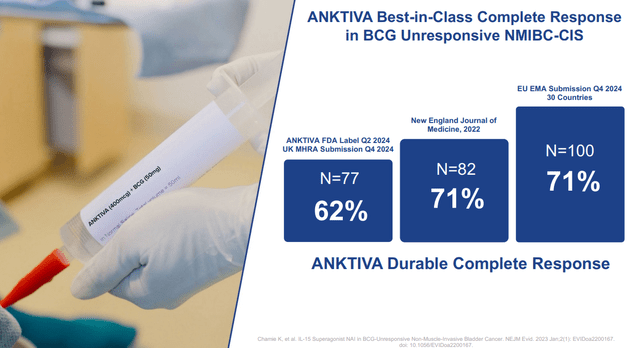

So far, the evidence for this indication as a second or third line cancer therapy has been quite strong:

Company Presentation Company Presentation

However, the road to approval for these conditions has been very rocky. The stock is down more than 90% from its peaks in 2021, and recently, the FDA refused to file their submission for expanding Anktiva's indications.

Valuation and Competitive Landscape for Bladder Cancer Treatments It's been estimated that all of the bladder cancer indications, including the indications that ImmunityBio has had trouble getting approved, have a peak sales of $900 million per year and would be reached in 2028. The average biotech P/S ratio is around 5.5, so that would imply a long-term market cap of $5.5 billion, about 73% higher than today's valuation.

A 73% return over three years is certainly very good, though not spectacular. However, there are reasons to doubt this figure. For one, as mentioned earlier, the company has some issues with the FDA, both recently as well as in 2023. So we can't automatically assume smooth sailing from here.

Second, the competitive landscape for Anktiva is shifting. Johnson & Johnson ( JNJ) is currently conducting phase 3 trials for Tar-200, which would compete directly with Anktiva. What's more, Tar-200 has shown superior trial readouts, with response rates in the 80s, vs the 60-70s response rates for Anktiva as shown above. Additionally, side effects for Tar-200 are also generally milder than Anktiva. With an annual cost of treatment at $429k, this makes Anktiva ripe for disruption.

Finally, it should also be noted that ImmunityBio is currently not profitable, and that the analyst consensus is that it will not reach profitability until at least 2027. The company has $60 million in cash and had a net loss of over $400 million over the last 12 months. This means that more dilutive financing will likely be required before profitability is reached, further reducing the expected return.

The risks of further FDA headaches, potential disruption, and dilutive financing all weigh down the potential valuation. It's not possible to put an exact value on the potential disruption from Tar-200, but in my view, that threat alone is enough to render the risk/reward unattractive.

The Lymphopenia Opportunity Given the above information on Antkiva as a bladder cancer drug, I do not believe future trial readouts or FDA approvals in other bladder cancer indications will ultimately matter much in terms of long-term value creation. For ImmunityBio shares to make sense at these levels, another opportunity is needed. Fortunately, the company recently received such a lifeline: the FDA gave them a compassionate use authorisation for lymphopenia.

This isn't full approval, but it is a positive step from the FDA, which, as mentioned, has been skeptical of ImmunityBio in the past. There are no currently approved treatments for lymphopenia, and as far as I could tell, the only other company developing a treatment is Genexine, whose treatment is in phase 1 trials and has not disclosed topline efficacy numbers. This is a much more favorable competitive landscape than the bladder cancer indications.

What's more, the total addressable market, or TAM, for lymphopenia is estimated at $3.4 billion, far higher than the bladder cancer indications Anktiva is aiming for. The disease affects 2.4 million Americans, and given the cost of Anktiva, the total market could be revised upwards. Still, to be conservative, I'll stick with the $3.4 billion dollar figure.

ImmunityBio is currently in phase 3 trials for their lymphopenia treatment. Normally, a company starting phase 3 trials has roughly a 50% chance of being approved. I'll lower this to a 38% chance for Anktiva, to reflect both the lower average for a biologic-category treatment and the company's long-standing issues with the FDA. This gives us a risk-adjusted market opportunity of $1.3 billion, 44% larger than the $900 million estimated peak sales for the kidney cancer indications. With the same 5.5 price-to-peak sales valuation mentioned earlier, this would provide a risk-adjusted valuation of the lymphopenia opportunity at 2.5 times ImmunityBio's current market cap.

A Potential Short Squeeze ImmunityBio has the single highest short float of any biotech stock, with nearly 80% of shares currently held short. This may be because of the company's high-profile troubles with the FDA, or the thorny competitive landscape for kidney cancer. It may also be because of the high-profile executive chairman of the company, the controversial LA Times owner Dr. Patrick Soon-Shiong. Whatever the reason, the stock is primed for a large move upwards if shorts have to cover.

The lymphopenia opportunity was until recently under-emphasized by ImmunityBio. For example, in their general corporate presentation from January of this year, the word "lymphopenia" was not mentioned a single time. However, by April, a new Investor Day presentation mentions it 21 times. If ImmunityBio begins to trade on the value of this indication, it could re-rate the stock and cause shorts to be squeezed.

Other triggers for the short squeeze could include the failure of Tar-200 in clinical trials, as well as progress on the other areas of cancer that ImmunityBio is targeting, such as lung, prostate, or colon cancer.

The Verdict

The lymphopenia opportunity provides an attractive valuation, even when risk-adjusted. The FDA's recent compassionate use authorisation could draw more attention to this area of treatment, which could spark a short squeeze, given the incredibly high short float. This gives investors two chances to make a profit - either in the long run, or selling during a potential squeeze. Given the company's troubled history, this is probably best only for very speculative investors, but the risk-reward feels attractive to me, so I rate ImmunityBio a very tentative Buy. |