IMO, there are always two aspects to consider when interrogating a company for purchase of its shares.

(1) Firstly, what is its current FINANCIAL state of affairs.

(2) Secondly, are there aspects that may influence or affect its future business performance.

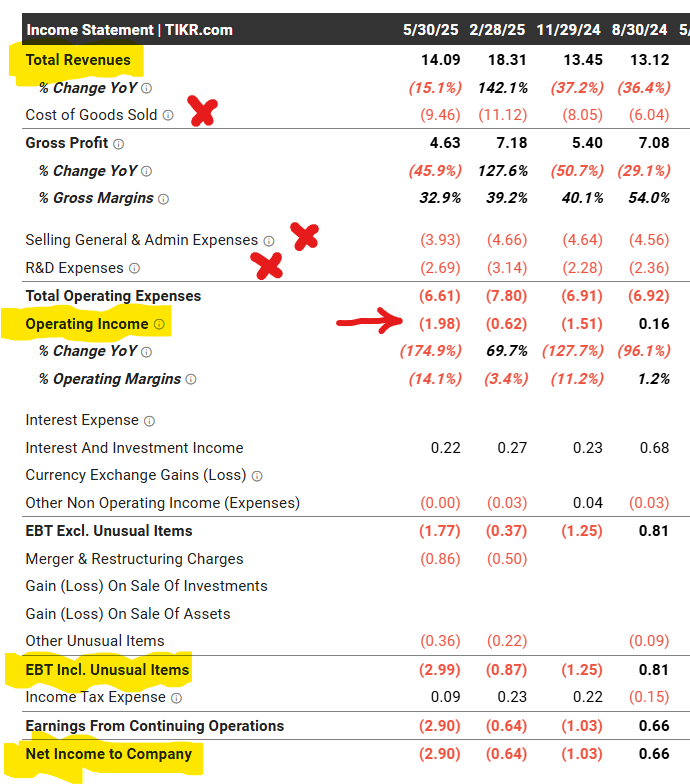

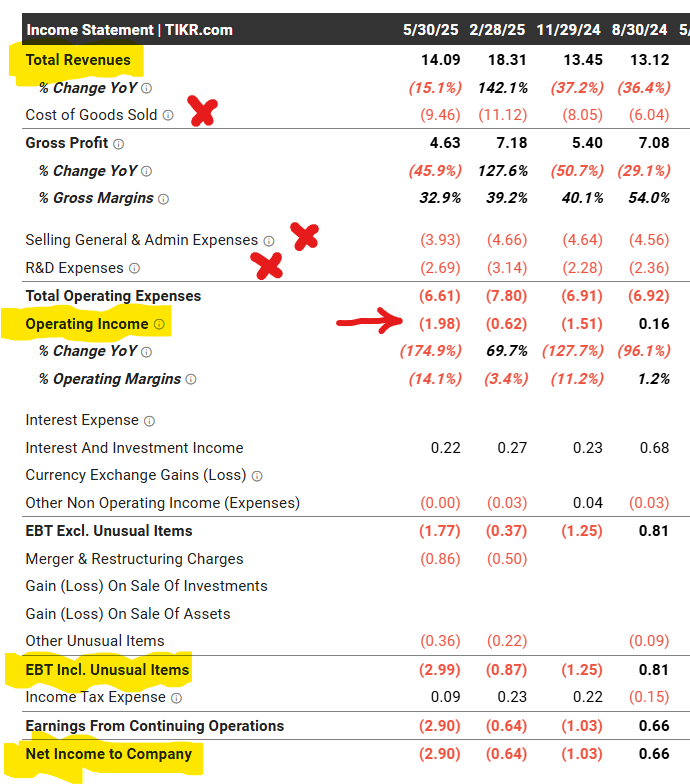

With regard to (1), its CURRENT Financials are Poor, to say the least. Here is its Income Statement ---->

I've highlighted in yellow the 4 components and their "trends" that I initially look at.

The first obvious problem for a company, with a business model that AEHR has, is that after deducting the 3 "COMPULSORY EXPENSES", marked with "X's", that it will always have, namely COGS, SG&A and R&D, it's already LOSING Money at its "Operating Income" level. That will, more than likely, result in it Losing Money at its Bottom Line ...... not something that is likely to attract Buyers of its shares.

In other words, the one thing we can be sure about with regard to AEHR is what ARE its CURRENT Financial State of Affairs, because that is "Cast in Stone" within its Financial Statements.

Now we then come to Item (2) :-

You make reference to an article which attempts to look into AEHR's future prospects.

Now those predictions, assumptions, opinions, conclusions may, or may not, come about.

For AEHR's future benefit one hopes that they do come about.

And if they do come about, how will we know for sure what their affect will be on the company ?

I would say that will become apparent in AEHR's future Financial Results, where the earliest indications will be in AEHR's QUARTERLIES.

And if the first one or two Quarterlies show improved Financial criteria, such as the Target Financial Ratios that I look at, and AEHR's Price Chart's trend supports those improved Financials, then one could consider buying its shares.

Of course, if one started only buying at that stage, one may have lost some of that initial Price improvement, BUT at least one should have more certainty/confidence in the Uptrend of AEHR's share price because it would be supported by the likely Uptrend in its Bottom Line which tends to attract Buyers on an ongoing basis. |