Fitzroy Minerals Provides Corporate and Exploration Update

thenewswire.com

Vancouver, British Columbia – TheNewswire - July 16, 2025 – Fitzroy Minerals Inc. (“Fitzroy” or the “Company”) (TSXV: FTZ) is pleased to provide strategic and exploration updates after its recent financing (see Fitzroy news release July 9, 2025). Following excellent exploration results in H1 2025, at both the Buen Retiro Copper (“Buen Retiro”) and Caballos (“Caballos”) Copper-Molybdenum-Gold-Rhenium projects, the Company will focus primarily on advancing these two projects. Further, the Company will review divestment strategies for the Polimet Gold-Copper-Silver (Chile) (“Polimet”) and Taquetren Gold (Argentina) (“Taquetren”) projects, as well as the Cariboo Silver Project (Canada) (“Cariboo”).

Highlights:

- Recent C$12.54 million financing strengthens the Fitzroy balance sheet.

- Focus on two core copper projects in Chile streamlines the Company.

- Current work at Buen Retiro aims to define leachable copper mineralization and evaluate near-term production potential.

- Drilling is underway at Caballos to test scale and continuity of sulphide-dominated Cu-Mo-Au-Re system.

- Polimet, Taquetren, and Cariboo to be divested, leaving Fitzroy as a pure Copper play (with valuable by-products).

Merlin Marr-Johnson, President and CEO of Fitzroy commented, “With a strong treasury position and a clear focus, Fitzroy is well-positioned to deliver a growth and value creation plan with momentum. We will accelerate copper exploration at our core projects. Our goal at Buen Retiro is to define a high-return development scenario while continuing to establish a robust resource base. At Caballos, the scale potential is significant, and with drilling underway at Chincolco and pending at Mule Hill, we are optimistic about what the district can deliver. The Company is entering an exciting 12 months of potential value creation.

Separately, Phase 1 drilling at Polimet opened up approximately 3 km of prospective vein sets. With gold trading at over US$100 per gram, veins of around 5 grams per tonne gold can become economic propositions. Fitzroy will look to retain upside exposure to any exploration success at Polimet.”

Financing and Corporate Strategy

Fitzroy is now funded for planned exploration and development work on the Company’s core projects until 2027. Fitzroy has five mineral projects within its portfolio, and the best results to date have come from the Buen Retiro Copper project near Copiapó, Chile, and from the Caballos Cu-Mo-Au-Re project in the Valparaiso Region, Chile. The Company has decided that the best use of capital, to drive value on a per-share basis, is to concentrate on their Chilean Buen Retiro Copper and Caballos Cu-Mo-Au-Re projects.

At Buen Retiro, no resources have been defined nor technical studies completed as yet, and Fitzroy will continue to allocate some drill meterage to testing deep targets. Nonetheless, the combination of the dynamics of the copper market, the Buen Retiro project’s proximity to infrastructure, and positive near-surface drilling results to date, has encouraged a conscious shift of focus by the Company to investigate potential fast-track development scenarios. Fitzroy will shortly add a reverse circulation (“RC”) drill rig to the diamond drilling (“DD”) that is already underway at Buen Retiro.

At Caballos, the strength of the mineralizing system intersected in CAB_DDH001, combined with the scale of related structures, alteration anomalies, and Caballos project concession area are sufficiently attractive to warrant an equal investment to that planned for Buen Retiro. Fitzroy plans to add a second (and possibly a third) drill rig in October of this year to the diamond drilling that is already underway at Caballos.

To facilitate the corporate focus on Buen Retiro and Caballos, the Company will divest the Polimet Gold-Copper-Silver (Chile) and Taquetren Gold (Argentina) projects, as well as the Cariboo Silver Project (Canada). Fitzroy believes that the exploration results from the Polimet project (see below) warrant further exploration and that Polimet could be a core project in a new company. In any divestment plan, Fitzroy will seek to retain upside exposure to any exploration success at Polimet, Taquetren, or Cariboo.

Buen Retiro – Exploration Update

The 2025 program at Buen Retiro, including the broader Sierra Fritis area, will include between 12,000 and 14,000 metres of drilling. Two diamond drill rigs are currently active on a 7,500 m program, of which approximately 3,800 m have already been completed. This program is expected to conclude in November 2025.

The Company is finalizing plans for an RC drilling program of approximately 5,000 m to test regional targets and conduct in-fill drilling, as required under concession agreements. In addition, a short air-blast pilot program of 800 m is being conducted as a scoping tool in the North Area of the Buen Retiro Copper Project. Once the pilot program ends, shallow fence drilling in the North Area will be completed using RC drill rigs.

Initial results from the South West and South areas are highly encouraging, indicating the presence of near-surface copper mineralized material that is broadly continuous section to section, open to the south and at depth.

While no site-specific metallurgical test-work has been completed to date, petrographic studies have identified a mineral paragenesis that is common in this part of Chile. The mineralized zones are expected to be largely defined by year-end with at least one hole on every section line. The North Area, while expected to return lower grades than in the South and South-West Areas, has the potential to host large volumes of near-surface mineralized material. In the North Area, Fitzroy is aiming to extend the known strike-length of previously identified mineralization in the hanging wall of a shear zone. The shear zone has a related magnetic anomaly that continues to the northeast for several kilometres, and Fitzroy will step out along trend following copper mineralization.

In 2025, the Company also intends to test deeper magnetic structures and pursue sulphide targets beneath the historical Manto Negro open pit, including follow-up on Phase 1 high-grade intercepts (e.g., 30 m @ 3.5% Cu - see Fitzroy news release October 30, 2024).

Planning for 2026 includes submission of large volume samples for metallurgical testwork and the submission of a Declaración de Impacto Ambiental (DIA), a high-level environmental impact study, to secure permits for more drill pads to allow in-fill drilling.

Caballos – Exploration Update

Exploration at Caballos is advancing, with one diamond drill rig currently completing a 500 m vertical hole (CAB_DDH002) from the same central collar location as CAB_DDH001. In addition, path construction is ongoing to facilitate future drilling north and south of the current drill pad.

Upon return to site (September/October), after the seasonal winter pause, Fitzroy plans to mobilize a second drill rig and complete at least a further four holes along the 1.2 km-long Chincolco Target. The drill holes are planned to be 200 m and 400 m north, and 200 m and 400 m south of the first two drill holes.

The Company is also investigating options for a heli-supported drilling program of approximately 1,000 m at Mule Hill and for a geophysical program, to run in parallel. Recent mapping at the Chincolco Target has identified younger, unaltered, unconformably overlying volcanic rocks that mask the hanging wall geology of the main anomaly. These younger unmineralized units are visible in recent road cuts to the east of the Pocuro Fault Zone (“PFZ”). Fitzroy is in the process of evaluating which geophysical methods are best to use. The primary exploration thesis is that eastern extensions of mineralization at Chincolco may be concealed beneath unmineralized younger volcanic rocks and geophysics is expected to aid in identifying structures and mineralizing features beneath cover.

By the end of 2025, the Company anticipates having a greatly improved understanding of grade and continuity at the Chincolco Target, and preliminary insights into the potential of Mule Hill. Drilling across the broader Caballos district will continue through 2026, targeting expansion of the mineralized footprint.

Polimet – Exploration Update and Drilling Program Summary

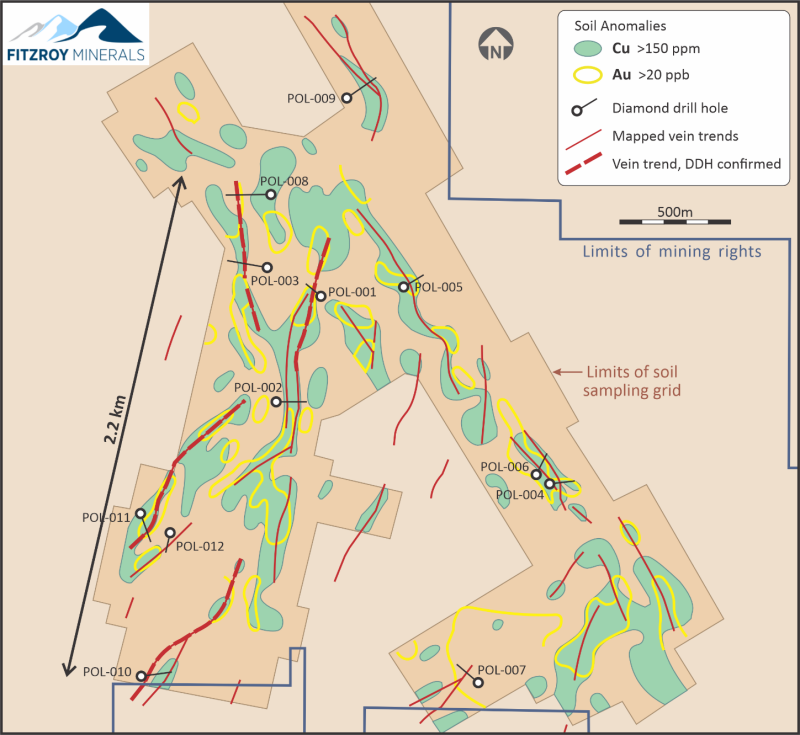

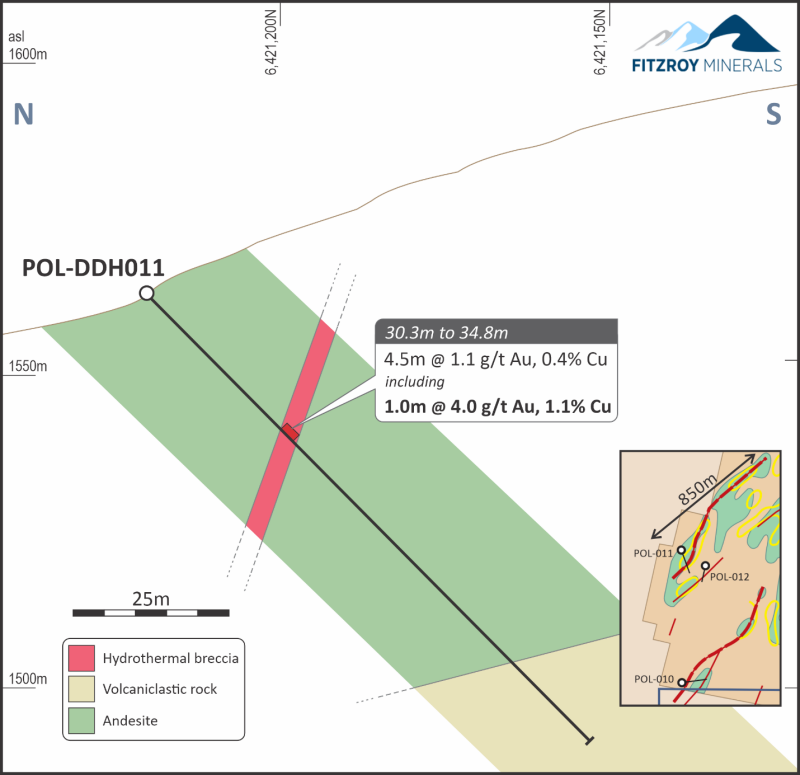

Phase I diamond drilling at the Polimet Project totalled 2,486.4 metres across 12 drill holes, targeting copper and gold anomalies identified through geochemical soil surveys and coincident geophysical anomalies. The drill holes intersected multiple mineralized structures along interpreted structural trends within a low-sulfidation epithermal system. Copper and gold grades were markedly better on north-south and northeast-southwest trending structures than on the northwest-southeast trending veins. This observation is compatible with Polimet being part of a large, dextral strike-slip structural corridor, which can be targeted in future exploration and drilling programs.

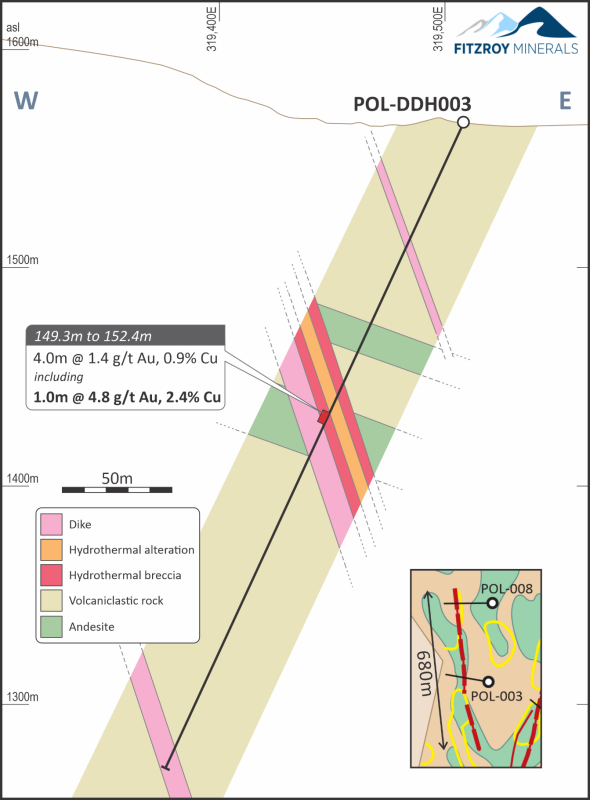

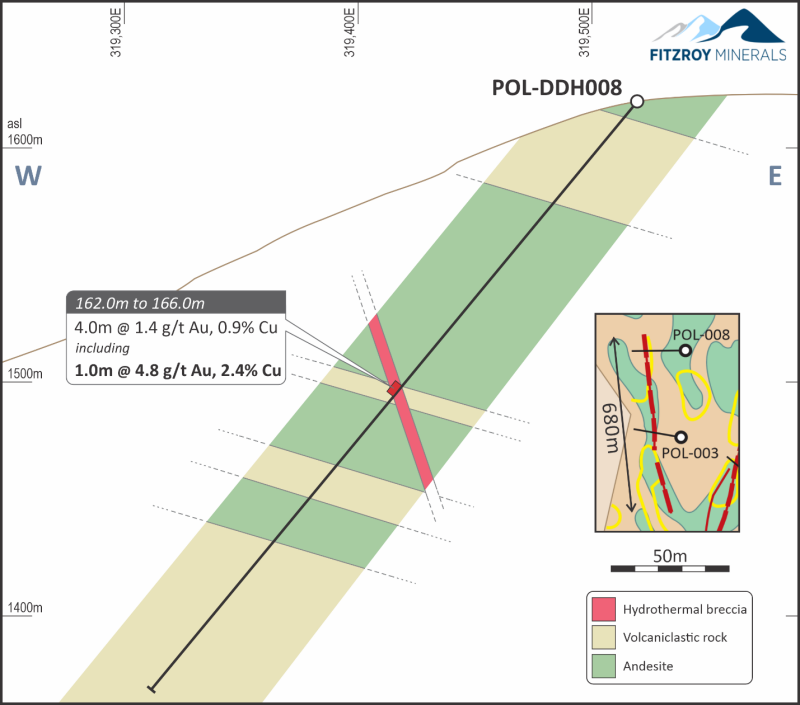

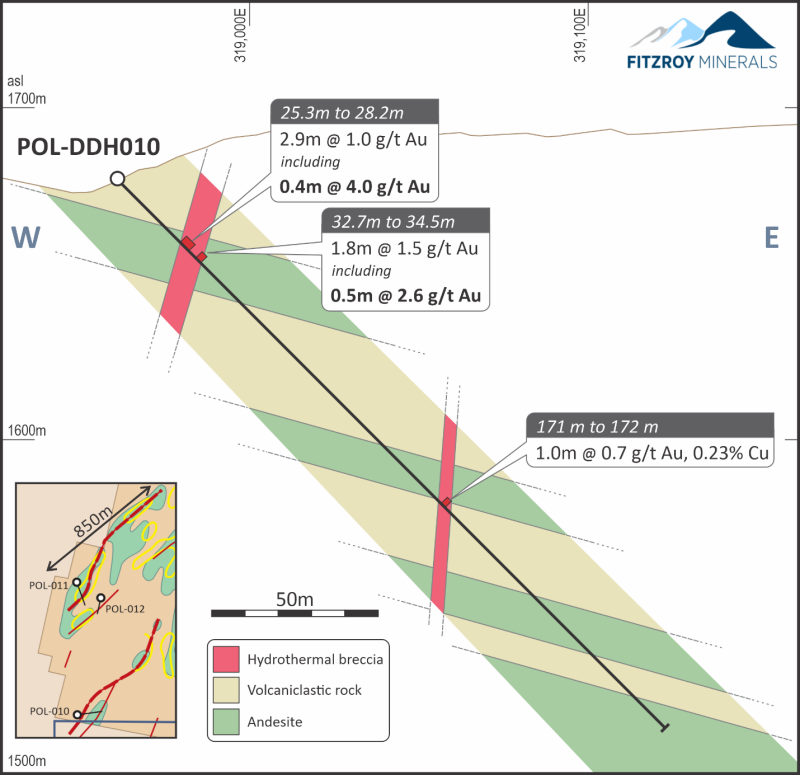

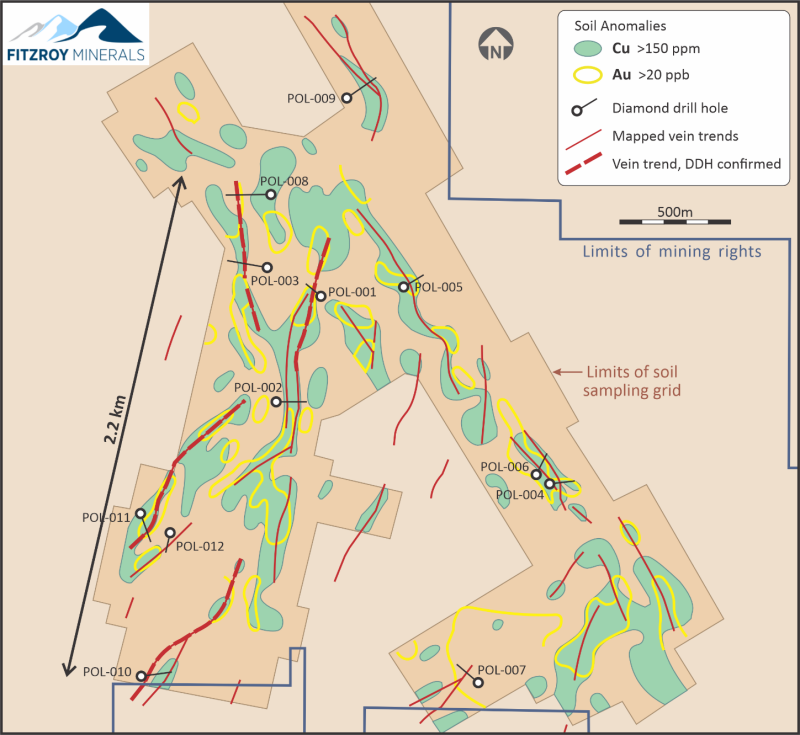

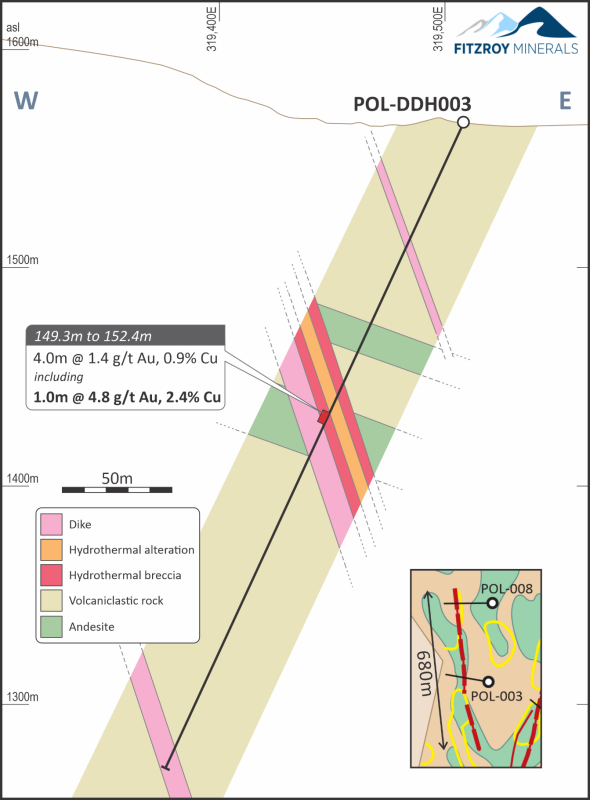

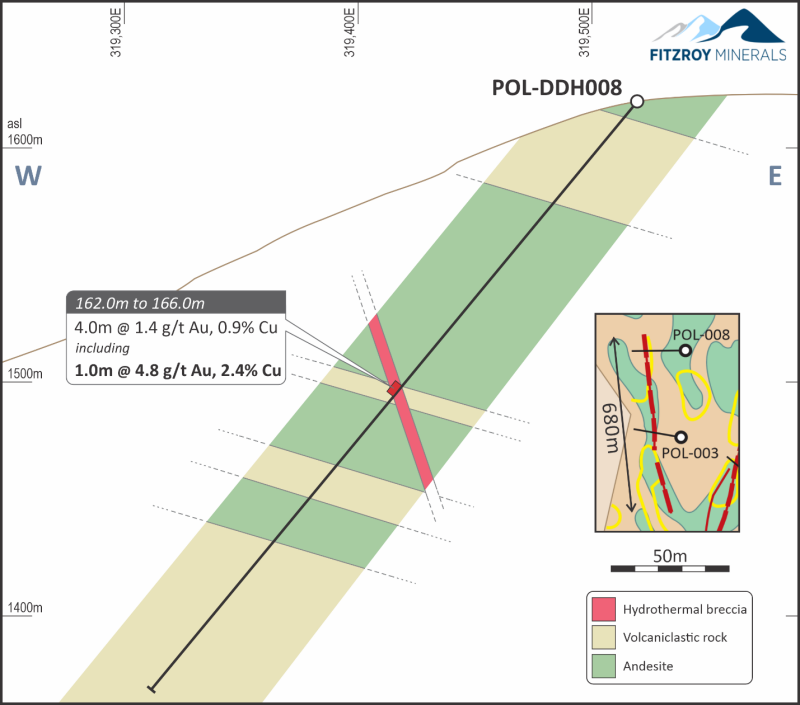

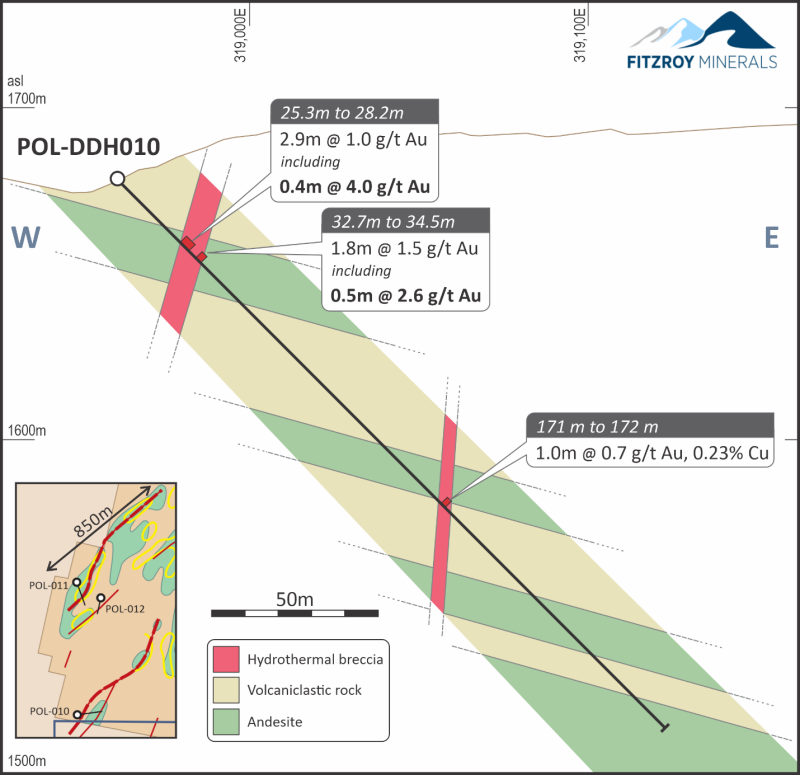

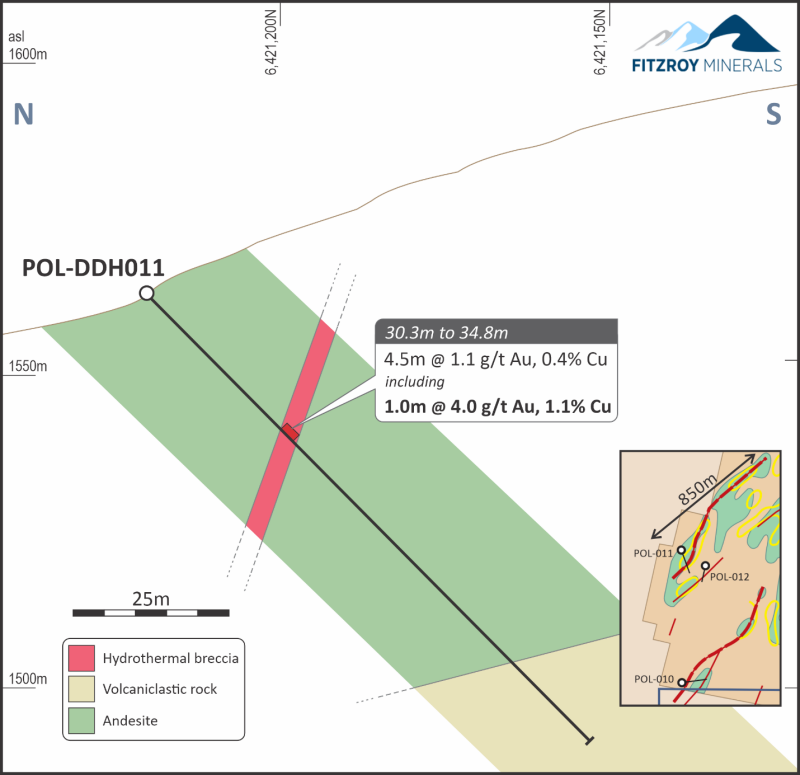

Figure 1 shows the locations of the drill holes and a map of the mineralizing trend at Polimet. Table 1 contains highlights of the drilling. Cross-sections for drill holes POL-DDH003, POL-DDH008, POL-DDH010, and POL-DDH011 are shown in the Appendix and here.

Figure 1. Polimet mapped veins, soil geochemistry and drill hole locations.

|

Click Image To View Full Size

|

POL-DDH001 intersected two copper-bearing zones along a 1.5 km-long geochemical trend, including 0.9 m @ 1.72% Cu in a previously unrecognized hydrothermal breccia at shallow depth, and 2.7 m @ 1.3% Cu and 0.2 g/t Au, including 1.2 m @ 2.29% Cu and 0.18 g/t Au.

Two holes, POL-DDH003 and POL-DDH008, targeted the San Pedro Trend. Drill hole POL-DDH003 intersected 1.0 m @ 4.8 g/t Au and 0.6% Cu within a breccia zone. POL-DDH008, located 330 m to the north and guided by geophysics, returned 4.0 m @ 1.4 g/t Au and 0.9% Cu, including 1.0 m @ 4.8 g/t Au and 2.4% Cu, extending the San Pedro Trend to 850 m in strike length.

Drill hole POL-DDH010 tested an 820 m-long breccia trend in the south and intersected 2.9 m @ 1.01 g/t Au and 0.5 m @ 2.59 g/t Au in a deeper intersection. Drill hole POL-DDH011, drilled on an 860 m-long gold-copper anomaly, intercepted 4.5 m @ 1.11 g/t Au and 0.40% Cu, including 1.0 m @ 4.0 g/t Au and 1.06% Cu.

The mineralized breccia zones intercepted in this drilling program exhibit similar grades to those historically mined by artisanal workers at Polimet. Historical sales to Chile’s state entity ENAMI averaged 4.7 g/t Au and 1.0% Cu, suggesting the potential for continuous high-grade zones and discrete high-grade ore shoots along the known structural trends.

Next Steps at Polimet

The initial drilling program at Polimet has significantly improved the Company’s understanding of the structural controls on mineralization. At least 3 km of strike-length of veins are shown to be prospective through Phase 1 drilling. In addition, a further 1.2 km of veins with similar orientation and characteristics have not yet been drilled but are prospective. The San Pedro Trend and other key target zones will be prioritized in future drilling to delineate high-grade shoots and potentially contribute towards a maiden resource.

Table 1. Polimet Phase 1 Drilling Program Highlights (WS84 Zone 19S).

| Drill Hole

| UTMX

(mE)

| UTMY

(mN)

| Azimuth

(collar)

| Dip

(collar)

| From

(m)

| To

(m)

| Length

(m)*

| Au

(g/t)

| Cu

(%)

| POL-DDH001

| 319,754

| 6,422,198

| 311

| -45

| 20.7

| 21.6

| 0.9

| 0.03

| 1.72

| And

| | | | | 82.1

| 85.7

| 3.6

| 0.13

| 1.03

| Including

| | | | | 83.0

| 84.2

| 1.2

| 0.18

| 2.29

| POL-DDH003

| 319,508

| 6,422,325

| 280

| -65

| 149.3

| 153.7

| 4.4

| 1.10

| 0.20

| Including

| | | | | 149.3

| 150.3

| 1.0

| 4.79

| 0.56

| POL-DDH008

| 319,520

| 6,422,650

| 270

| -51

| 162.0

| 166.0

| 4.0

| 1.43

| 0.90

| Including

| | | | | 164.0

| 165.0

| 1.0

| 4.77

| 2.4

| POL-DDH010

| 318,961

| 6,420,493

| 78

| -45

| 25.3

| 28.2

| 2.9

| 1.01

| 0.05

| Including

| | | | | 26.3

| 26.7

| 0.4

| 4.04

| 0.05

| And

| | | | | 32.7

| 34.5

| 1.8

| 0.84

| 0.04

| Including

| | | | | 34.0

| 34.5

| 0.5

| 2.59

| 0.04

| POL-DDH011

| 318,951

| 6,421,221

| 156

| -45

| 30.3

| 34.8

| 4.5

| 1.11

| 0.4

| Including

| | | | | 30.3

| 31.3

| 1.0

| 4.00

| 1.06

| *Widths are downhole lengths, not true widths.

|

Sampling Procedures, Laboratory and QA/QC

Drill core was picked up and transported by Company personnel from the drill rig to the core logging and processing facility in Petorca, Valparaiso Region.

Using a core cutting diamond blade saw, primary half core samples are collected from the NQ-sized drill holes (63.5 mm diameter) with the remaining half-core stored in the original wooden core trays at the rented core storage warehouse in Petorca. The half core samples were bagged and tagged and transported by Fitzroy to Andes Analytical Assays (AAA) laboratory in Quilicura, near Santiago, an ISO IEC 17025:2017 accredited lab. The laboratory is independent of Fitzroy and the project qualified persons.

For the purposes of blind QA/QC, the sample identifications are changed and coded by the Company. The QA/QC samples prepared by the Company represent about 10% of the total primary core samples. Blanks were inserted every 20 m and sent to laboratory and post-results QA/QC is ongoing. The Company has selected approximately 5% of low, medium and high grade pulps, and a matching quantity of standards of the same grade range, and sent them for check assay. No secondary laboratory (referee lab) samples were completed in this round of drilling.

The pulps and rejects of crushed samples have been collected from the Andes Analytical Assays laboratory. The rejects are stocked in closed drums, identified with the corresponding batches and sample ranges, while the pulps are stocked in boxes and in shelves inside a container separated for this purpose. Both are located in the same warehouse facilities in Petorca.

A visual review of the QA/QC results from the laboratory’s internal QA/QC information was completed by the Company and no significant issues were identified.

Additional Disclosure Regarding Private Placement

Further to the Company’s news release dated July 9, 2025, in connection with the closing of the Company’s non-brokered private placement (“Private Placement”), the Company paid aggregate cash finder’s fees of $940,000.02 and issued 3,133,330 finder’s warrants to arm’s length finders as follows: (i) Arlington Group Asset Management Limited was paid $362,268.98 and issued 1,207,562 finder’s warrants; (ii) Tribeca Capital Pte Ltd. was paid $363,379.07 and issued 1,211,262 finder’s warrants; (iii) Haywood Securities Inc. was paid $67,392.01 and issued 224,640 finder’s warrants; (iv) Bonaventure Explorations Limited was paid $83,280 and issued 277,600 finder’s warrants; (v) Mr. Rhoderic Whyte was paid $12,399.98 and issued 41,333 finder’s warrants; (vi) GloRes Securities Inc. was paid $9,600 and issued 32,000 finder’s warrants; (vii) African Resource Consulting PTY Ltd. was paid $8,880 and issued 29,600 finder’s warrants; and (viii) Canaccord Genuity Corp. was paid $32,799.98 and issued 109,333 finder’s warrants. Each finder’s warrant is exercisable to acquire one common share in the capital of the Company at a price of $0.50 per share for a period of two years following the completion of the applicable tranche of the Private Placement. All finder’s fees paid in connection with the Private Placement remain subject to the approval of the TSXV.

Qualified Person

Dr. Scott Jobin-Bevans (P.Geo., Ph.D., PMP), a Qualified Person as defined by National Instrument 43-101 and independent geological consultant to the Company, has reviewed and verified the technical information provided in this news release, including the sampling, analytical and test data underlying the technical information contained in this news release. Specifically, the QP verified laboratory assay certificates against the reported drill core intervals as well as drill core logs against the geology, as supplied by the Company.

About Fitzroy Minerals Inc.

Fitzroy is focused on exploring and developing mineral assets with substantial upside potential in the Americas. The Company’s current property portfolio includes the Buen Retiro Copper Project located near Copiapó, Chile, the Caballos Copper and Polimet Gold-Copper-Silver projects located in Valparaiso, Chile, the Taquetren Gold Project located in Rio Negro, Argentina, and the Cariboo Project in British Columbia, Canada. Fitzroy’s shares are listed on the TSX Venture Exchange under the symbol FTZ and on the OTCQB under the symbol FTZFF.

On behalf of Fitzroy Minerals Inc.

Merlin Marr-Johnson

President and CEO

For further information, please contact:

Merlin Marr-Johnson

mmj@fitzroyminerals.com

+447803712280

For more information on Fitzroy, please visit the Company's website: www.fitzroyminerals.com

Neither Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain statements and information that constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts are forward-looking statements. Such forward-looking statements and forward-looking information specifically include, but are not limited to, statements that relate to the potential mineralization on the Company’s mineral properties, future exploration plans on the Company’s mineral properties, future corporate plans of the Company including future divestment plans for certain of the Company’s mineral properties, and the timing and results of future exploration.

Statements contained in this release that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of the Company. Such statements can generally, but not always, be identified by words such as "expects", "plans", "anticipates", "intends", "estimates", "forecasts", "schedules", "prepares", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. All statements that describe the Company's plans relating to operations and potential strategic opportunities are forward-looking statements under applicable securities laws. These statements address future events and conditions and are reliant on assumptions made by the Company's management, and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators, including without limitation, the dangers inherent in exploration, development and mining activities; actual exploration or development plans and costs differing materially from the Company’s estimates; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining activities; environmental regulations or hazards and compliance with complex regulations associated with mining activities; climate change and climate change regulations; fluctuations in exchange rates; the availability of financing; operations in foreign and developing countries and the compliance with foreign laws, remote operations and the availability of adequate infrastructure; fluctuations in price and availability of energy and other inputs necessary for mining operations; shortages or cost increases in necessary equipment, supplies and labour; regulatory, political and country risks, including local instability or acts of terrorism and the effects thereof; the reliance upon contractors, third parties and joint venture partners; challenges to title or surface rights; the dependence on key personnel and the ability to attract and retain skilled personnel; the risk of an uninsurable or uninsured loss; adverse climate and weather conditions; litigation risk; and competition with other mining companies. As a result of these risks and uncertainties, and the assumptions underlying the forward-looking information, actual results could materially differ from those currently projected, and there is no representation by the Company that the actual results realized in the future will be the same in whole or in part as those presented herein. the Company disclaims any intent or obligation to update forward-looking statements or information except as required by law. Readers are referred to the additional information regarding the Company's business contained in the Company's reports filed with the securities regulatory authorities in Canada. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that could cause actions, events or results not to be as anticipated, estimated or intended. For more information on the Company and the risks and challenges of its business, investors should review the Company's filings that are available at www.sedarplus.ca.

The Company provides no assurance that forward-looking statements and information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company does not undertake to update any forward-looking statements, other than as required by law.

Appendix Figures: Polimet Phase 1 Drilling Cross-Sections

|

Click Image To View Full Size

|

Click Image To View Full Size

|

Click Image To View Full Size

|

Click Image To View Full Size

|

|