SAP Reports Mixed Results. The AI Stock Is Falling.

You said:

Summarize the key points of this article at this link: marketwatch.com

ChatGPT said:

Here’s a breakdown of the main findings from the MarketWatch article:

?? 1. Knowledge Gap: The Main Barrier - Lack of understanding is the top reason most Americans haven’t entered crypto: 90% of non-owners say they don’t know enough about using or trading it, with 49% admitting they simply don’t understand how it works MarketWatch+8MarketWatch+8MarketWatch+8.

? 2. Confusion Over Decentralization and Backing - Around 41% of respondents are unsure what decentralization even means. Many don’t know what “backs” cryptocurrencies, making them reluctant to trust or invest MarketWatch.

?? 3. High-Profile Failures & Volatility ?? 4. Trust & Emotional Hurdles - Many find crypto trading overwhelming—survey respondents note research is “overwhelming,” and only 14% have spoken about it with friends or family MarketWatch.

- Distrust also stems from intangible concepts and lack of clarity on what crypto represents MarketWatch+6MarketWatch+6MarketWatch+6.

?? 5. Education as the Solution - NCA President Stu Alderoty likens crypto’s current state to the early internet (circa 1996). Clearer education and conversation could unlock wider adoption—and in turn, improve crypto valuations MarketWatch+1MarketWatch+1.

?? TL;DR

BarrierImpact|

| Knowledge deficit | 90% cite ignorance as the issue | | Technical confusion | 41% unclear on decentralization | | Market shakeups & volatility | High-profile failures reduce trust | | Emotional resistance | Few talk about it, find it daunting | | Education | Key to unlocking broader adoption |

Bottom line: It's not fear of innovation or greed stopping Americans from entering crypto—it's simply not knowing enough. Increasing awareness and understanding appears to be the first step toward wider acceptance and participation.

Related crypto adoption news??

MarketWatch

Here's what's preventing the majority of Americans from getting into crypto

Today

Sources

You said:

Summarize the key points of this article: marketwatch.com

ChatGPT said:

Here are the key takeaways from the MarketWatch article “Why Is Texas Instruments Stock Sliding After Earnings? Analysts Boil It Down to One Word”:

?? 1. Flat-Out Q2 Beat, But Q3 Tone Dims Outlook ??? 2. That One Word: “Tone” - Analysts said it came down to “tone”—recently upbeat management comments were replaced by a more “moody”, cautious stance focused on geopolitical tensions and tariffs MarketWatch.

- Oppenheimer described the call as “moody,” Cantor Fitzgerald said it was “definitively more cautious,” and Bernstein labeled it “tone deaf” MarketWatch.

?? 3. Underlying Concerns: Tariffs & Pull-Forward Effects - Management highlighted concerns about tariff impact, noting that prior Q2 demand might have been front-loaded—customers ordering ahead of potential tariff hikes Barron's+4MarketWatch+4Reuters+4.

- The auto sector remains weak, and rising geopolitical uncertainties are weighing on customer sentiment Reuters Barron's.

?? 4. Stock Reaction: Worst Drop in Years - TI shares plunged approximately 12% after hours, marking what could be the worst single-day fall since 2008 Reuters+2MarketWatch+2Finviz+2.

- Broader coverage cites drops of 8–11% after hours, reflecting investor shock at tone ambiguity despite solid numbers Reuters Barron's Investors.

??? 5. Still Investing in Capacity - TI continues to invest aggressively in manufacturing, spending over $60?billion on U.S. capacity and modern 300?mm wafer plants Investopedia+2Reuters+2Reuters+2.

- Though long-term outlook remains positive, flat factory utilization and margin pressure due to cautious demand may weigh on profitability Reuters.

?? TL;DR

FactorTakeaway|

| Earnings beat | Q2 results exceeded expectations | | Guidance tone | Management’s cautious tone spooked investors | | Risks highlighted | Tariffs, front-loaded orders, soft auto sector | | Stock reaction | ~12% after-hours decline | | Long-term view | Continues capital investment, but margins may suffer |

Bottom line:

Texas?Instruments delivered a solid quarterly beat and met guidance—but investor focus shifted sharply to the tone of cautious commentary around macroeconomic and tariff uncertainties. That tonal shift, more than the numbers, triggered a major stock sell-off.

Relevant news on TI’s earnings drop

MarketWatch

Why is Texas Instruments' stock sliding after earnings? Analysts boil it down to one word.

Today

Reuters

Texas Instruments slumps as tariff uncertainty weighs on demand

Today

Reuters

Texas Instruments third-quarter profit forecast disappoints; shares fall

Today

Sources

You said:

Summarize key points of this article: marketwatch.com

ChatGPT said:

Here are the key insights from the article on the approaching “golden cross” in the small-cap benchmark index:

?? 1. Technical Breakout — Golden Cross Nearing ?? 2. Historical Signal of Gains ?? 3. Bulls Cautious — Rally Might Be Fleeting ?? 4. Economic Headwinds - Small-caps are more sensitive to factors like inflation, tariffs, and economic slowdowns — pressures firmly in play.

- A front-loaded impact from previous tariffs hit small businesses hard MarketWatch+7MarketWatch+7MarketWatch+7.

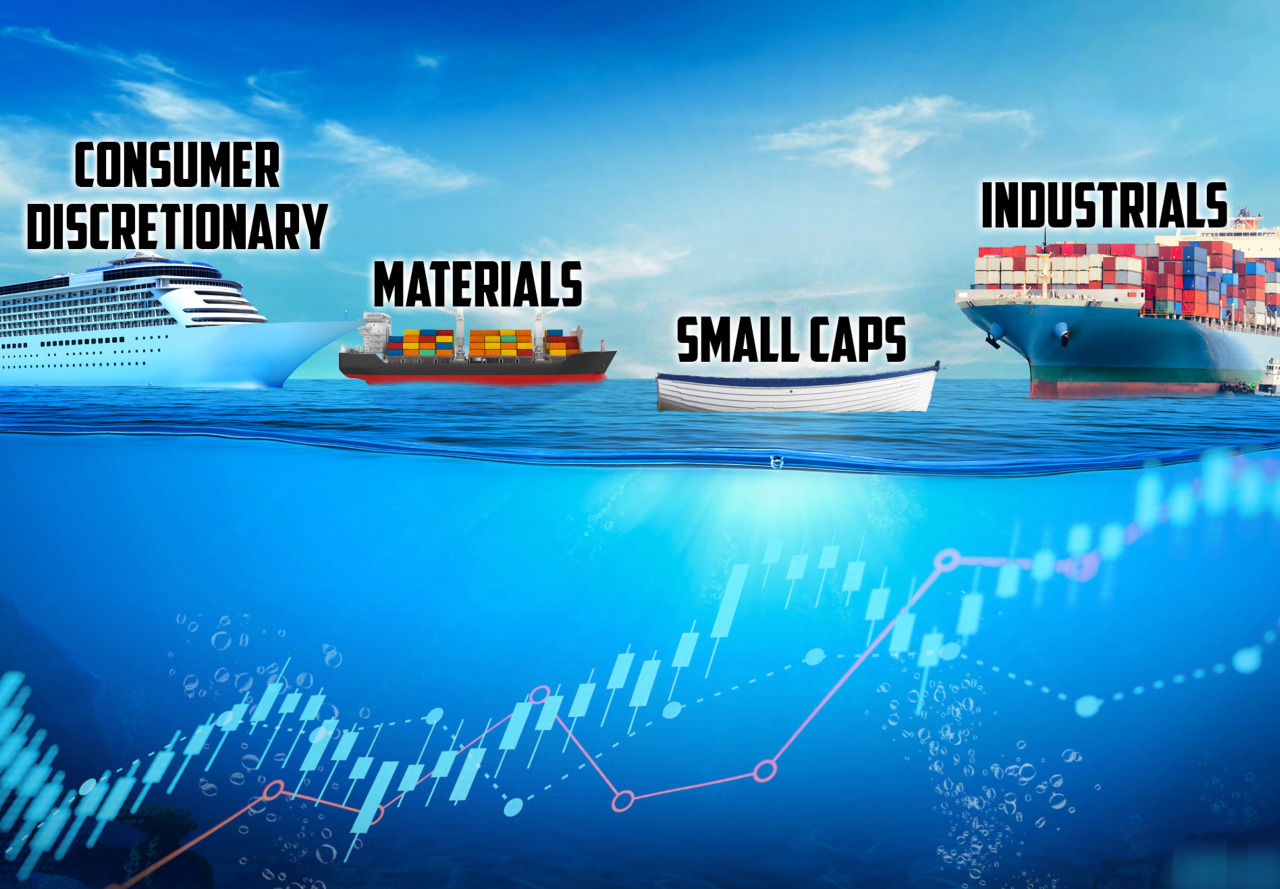

?? 5. Rotation from Tech to Cyclicals - Investors are rotating from expensive megacap tech into more cyclical sectors—materials (+3.9%), consumer discretionary (+3.7%), and industrials (+2.3%) in July MarketWatch.

?? 6. Fed Policy Is Key - The sustainability of the small-cap rally hinges on Federal Reserve rate cuts.

- Markets price in only about two 25-basis-point cuts by year-end, likely keeping rates relatively high MarketWatch.

?? TL;DR Summary

ThemeInsight|

| Technical Setup | Golden cross approaching — bullish signal | | Past Performance | Historically leads to modest mid-term gains | | Skeptical View | Rally seen as fragile, with macro risks looming | | Sector Shift | Money moving into cyclical vs. tech | | Future Outlook | Dependent on Fed easing; limited cuts expected |

Bottom line:

Small-caps are flashing a bullish technical signal and benefiting from a market rotation into more economically sensitive stocks. But persistent inflation, tariffs, and only modest Fed easing cast doubt on whether this rally has lasting momentum.

Relevant news on small-cap rally & golden cross

MarketWatch

Benchmark small-cap index is approaching its first 'golden cross' in 18 months. Here's what history shows will come next.

Today

Sources

You said:

Summarize this article: barrons.com

ChatGPT said:

Here’s a polished summary of the key takeaways from the Barron’s live coverage and related recent reporting on Tesla’s Q2 2025 earnings:

?? 1. Q2 Earnings Preview: A Wild One Analysts expect Tesla’s Q2 earnings (due July 23) to be around $0.39–$0.40 EPS on $22.1–$22.2?billion in revenue, down substantially from last year’s $0.52 EPS and $25.5?billion in sales—reflecting a ~13.5% drop in vehicle deliveries (around 384,000 units) Indiatimes+2Barron's+2Barron's+2.

?? 2. Mixed Analyst Sentiment ?? 3. Focus on AI & Robo-Tech Investors are eyeing updates on Tesla’s AI ventures—including robo-taxis (an Austin pilot is underway) and sleek humanoid robots expected in 2026 Barron's+5Barron's+5Indiatimes+5.

???? 4. Musk’s Political Image & Leadership Elon Musk is once again sleeping at Tesla HQ, a move meant to restore investor confidence as he balances Tesla and political ambitions—including crafting a new party and clashing with Trump Omni Ekonomi+5Barron's+5Indiatimes+5. His political profile remains a flashpoint for brand and stock sentiment.

? 5. Tax Credits & Tariff Pressures ? 6. Crypto Buffers Tesla’s Bitcoin holdings (˜11,500?BTC) rebounded during Q2, potentially adding around $300 million to its balance sheet—though mostly excluded from non-GAAP profits SvD.se+2Barron's+2Indiatimes+2.

?? 7. Stock Volatility Expectations Options markets point to an expected ~7% swing in TSLA shares after earnings—mirroring the ~11% average moves seen over the past four quarters Barron's.

?? 8. Strategic Outlook Tesla continues to rely on EV margin support, but many now see it pivoting to future tech—robotaxis and humanoid robots—as the next growth engine The Times+1Investors+1.

?? TL;DR

FactorSummary|

| Earnings drop | EPS and sales down sharply YoY | | Tax & tariff risk | EV credit loss & storage tariffs weigh | | AI lines | Key updates on robo-taxis, humanoids | | Musk’s role | Political distractions vs. renewed HQ presence | | Crypto boost | Bitcoin gains may mildly offset earnings decline | | Stock reaction | Expect ~±7% earnings volatility |

Bottom line:

Tesla’s Q2 results will be defined less by core EV metrics and more by commentary around AI, tax credits, tariffs, Musk’s presence, and crypto gains. The earnings call could deliver a volatile outcome depending on whether these narratives assuage or alarm investors.

Tesla earnings and outlook coverage

MarketWatch

Tesla earnings are coming. Investors fret things could get worse.

Today

Indiatimes

Tesla Q2 earnings: Elon Musk sleeps at office again as Wall Street awaits his big reveal on Robotaxis, AI & sales recovery

Yesterday

Barron's

With Tesla Earnings, Don't Forget About Bitcoin

Today

The Times

Analysts are downbeat on Tesla but investors are still buying

Jun 19, 2025

Sources

You said:

Summarize this article: barrons.com

ChatGPT said:

Here are the key takeaways from the Barron’s preview of SAP’s Q2 earnings and related reporting:

?? 1. Mixed Q2 Results ?? 2. Cloud Segment Underwhelms - Cloud revenue grew 24% to €5.13?billion, slightly below analyst forecasts around €5.18?billion Reuters+4Barron's+4Investopedia+4.

- Current Cloud Backlog (CCB) rose ~28% to around €18–18.1?billion, giving visibility into future revenue Investors.

?? 3. AI Integration & Future Strategy ?? 4. Profitability & Cash Flow - Operating profit rose ~33% to €2.57?billion, with free cash flow skyrocketing 83% to €2.36?billion—far above expectations Reuters.

?? 5. Currency & Geopolitical Pressures ?? 6. Market Reaction - ADRs dropped ~4% after hours following mixed top-line/investor concerns Investopedia+3Barron's+3Barron's+3.

- U.S. share price softened ~1.6% in extended trading as investors digested the cautious tone despite strong cash flow Reuters.

?? TL;DR

CategoryHighlight|

| Earnings | EPS beat; revenue in line | | Cloud growth | Solid backlog but growth slightly lags | | AI focus | Joule enhancements, new AI tools pipeline | | Financial health | Profit and cash flow surge | | Risks | Tough currency headwinds, global uncertainty | | Stock movement | Shares dip on cautious outlook |

Bottom line:

SAP delivered a strong cash and profit beat, but a cautious tone around cloud momentum, foreign exchange pressures, and macro risks tempered investor enthusiasm. The company remains on track with its cloud- and AI-led transformation, though market reaction reflects concerns about near-term execution. |