Hello 60,

I do not agree with it. What do you see here that you agree with that is worth discussing? What specific debts do we see QVCGA board going after? How much debt can they buy back and still run the business, pay the firms, and fund social growth?

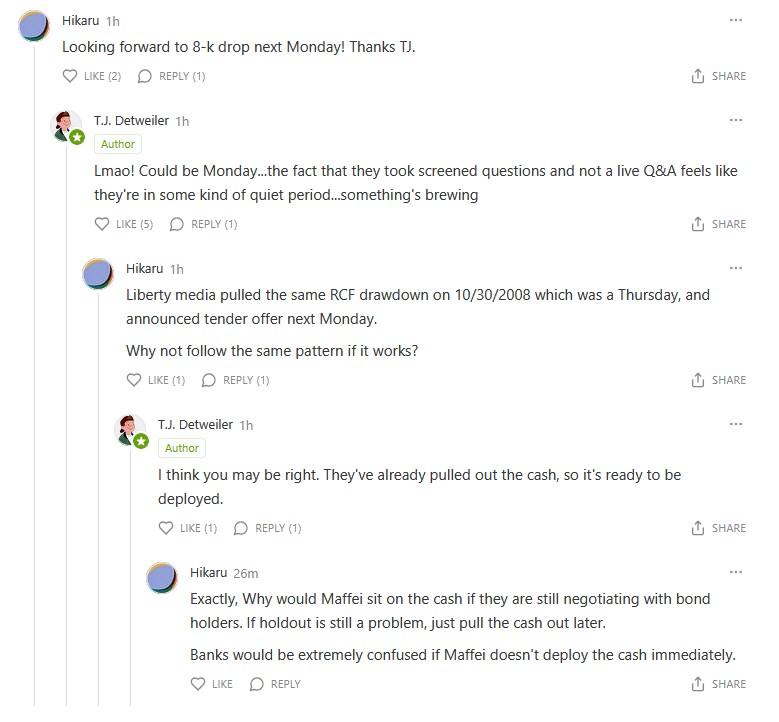

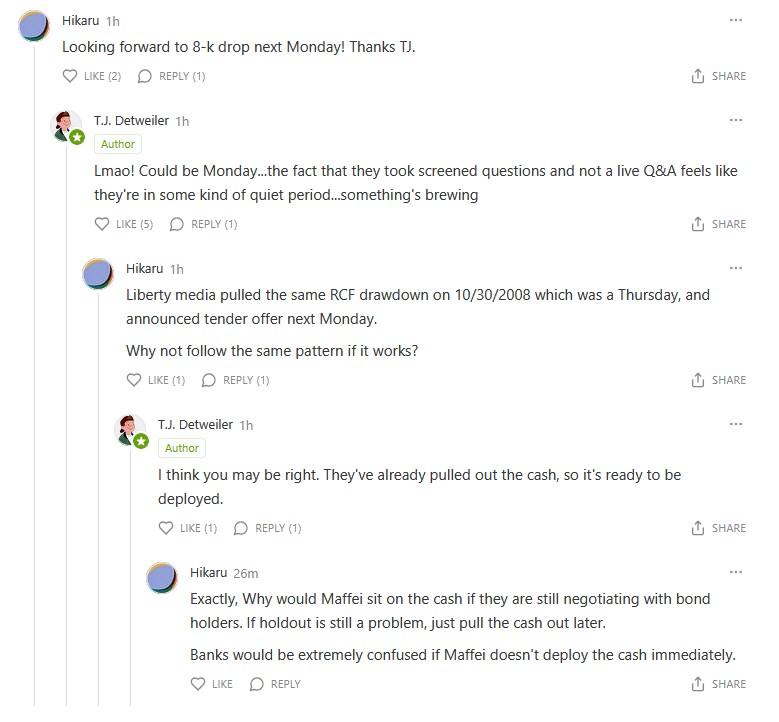

Management took screened questions and this poster takes this as a sign it's positive? Given management is paying for Kirkland & Evercore + $100K a month for Roger and Carol this is a normal legal advice especially in prepetition.

I am not sure what bank is going to take a company trending towards $800-900M EBITDA when they use to do $1.9B and will allow them to get close to maxing out their credit facility so they can buy back debt at a discount when that bank has no idea if they can even get their own money back. Absolute priority has facility in line first followed by rest of senior debt so it's uncommon to see longer duration debt bought back first in these situations. If business continued to decline and they are forced to file anyway then they open themselves up to clawbacks claims.

Cable is in secular decline, this is QVC Group not Liberty Media, so any comparison to 2008 is moot. Again, common for a company in prepetition to draw on a credit facility so in my opinion reading this as a LCT is a misread from him.

I again ask why would senior holders ever agree when they have direct claim on QVC, Inc equity? This poster never answers this. Why would they take haircuts when the seniority of their debt gives them equity? They can just hold out. If QVC is so valuable that this posters own QVCGA position wins why would bond holders give up and take cash haircuts and lose? Just doesn't logically make sense and violates why bond holders lend cash to begin with. Is the theory they drew on facility to then upstream cash and take care of HoldCo LITNA debenures and/or ParCo preferreds? LOL if so.

And as a reminder QVC Group hired Kirkland and Evercore and then bondholders hired PJT Partners & David Polk & Warwell and then LITNA holders hired Centerview & Akin Gump Strauss. QVC is of course paying for their two firms but normally they reimburse the bondholders here too so they're likely paying six firms. Throw in $100K for Carl and Roger and in six months that's $600K gone. They just burned ($156M) in six months running the business and even QVC, Inc. FCF was ($75M). So they're buying bonds the poster says but I again ask which? Can they get them all? Are all senior holders in agreement? Does this seem probable or speculative?

As it stands QVC Group has a 3.96x EV/EBITDA multiple (using FMV of debt) which is POOR. As I wrote typical distressed situations is 4-8x and QVC broke below. If we assume 2025 EBITDA decline to $1,000M (which is on high end) then at a say 4x multiple this puts equity deeply negative.

In my opinion this view from the poster is hope and not investment advice I would EVER follow.

Maybe I am wrong but we will see in days to weeks as I stand by my view they file. It would be a miracle that a company drawing a revolver to maxish levels, likely paying six legal firms, paying $100K a month on two restructuring board members, revenue/EBITDA declines, some how come away fine. Stranger things in this market.

Still makes me think of this "when you hear the sound of hooves, think horses, not zebras".

Happy investing,

-Sean |