Portrait of a Crack-Up Boom, in Four Charts

JOHN RUBINO

AUG 09, 2025

The Austrian school of economics (the only good school of economics) has a concept called the “crack-up boom” that perfectly explains today’s world. Here’s an AI-generated summary:

A crack-up boom is an economic crisis characterized by the collapse of a monetary system due to sustained, expansionary monetary policy leading to hyperinflation and a complete loss of trust in the currency. This phenomenon occurs when the public becomes convinced that the money supply will continue to increase indefinitely, causing the purchasing power of money to fall relentlessly. As a result, individuals rush to exchange their cash for tangible goods, known as a "flight into real goods" or "Katastrophenhausse" in German, to preserve value, drastically reducing the demand for money.

This shift creates a vicious cycle: as people abandon the currency, the demand for money collapses, accelerating price increases and further eroding the currency's value. The monetary system breaks down, with money failing to function as a medium of exchange, unit of account, store of value, or standard of deferred payment. This breakdown can lead to a return to barter or the adoption of alternative currencies. The process is a key component of the Austrian business cycle theory, where the central bank's attempt to sustain an artificial boom by continuously expanding credit ultimately triggers a fundamental economic collapse.

Why Now?

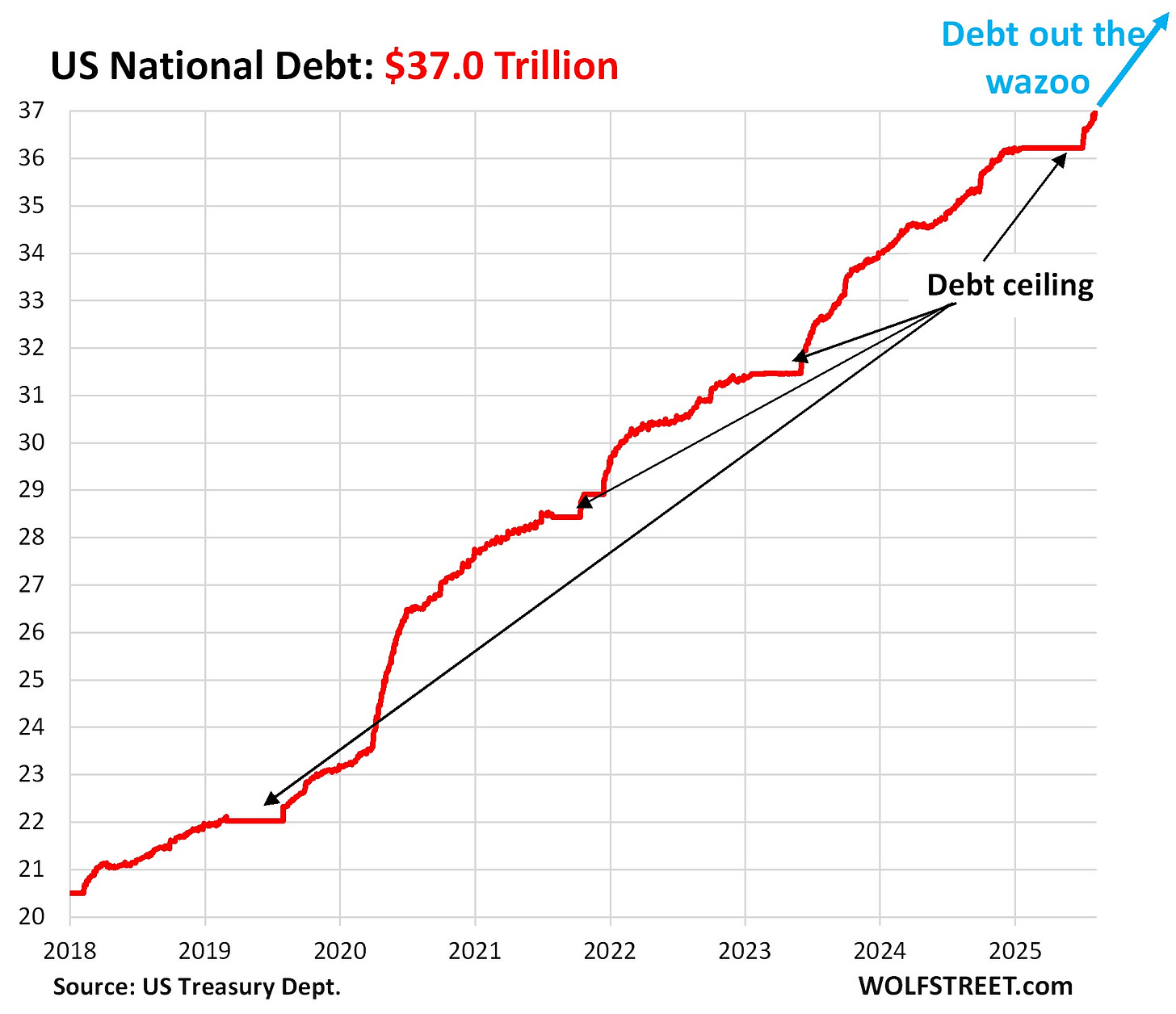

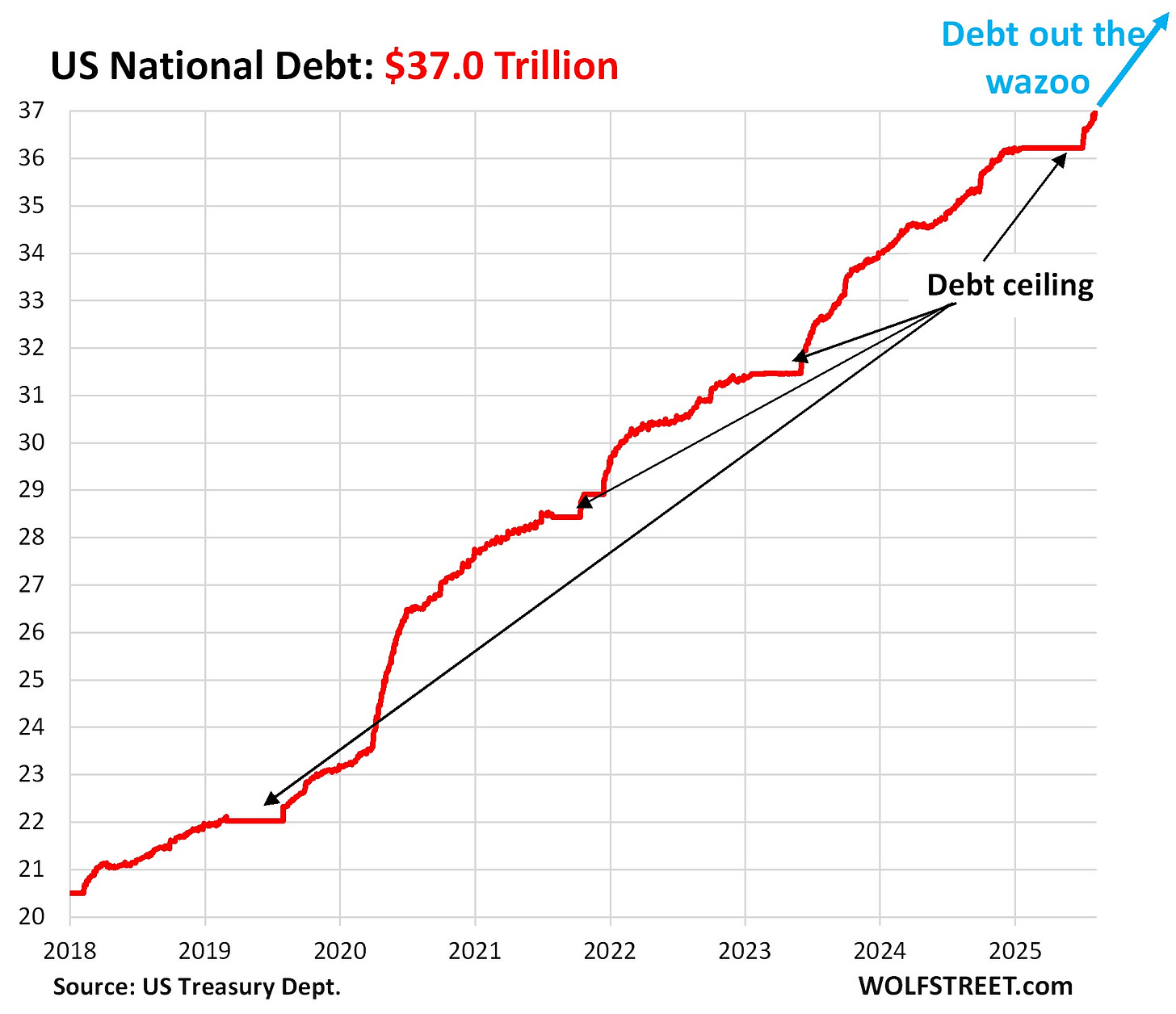

US government debt was $20 trillion in 2018. Today, it’s maybe two years away from $40 trillion. In other words, it took us 250 years to borrow the first $20 trillion, and only a decade to borrow the second $20 trillion.

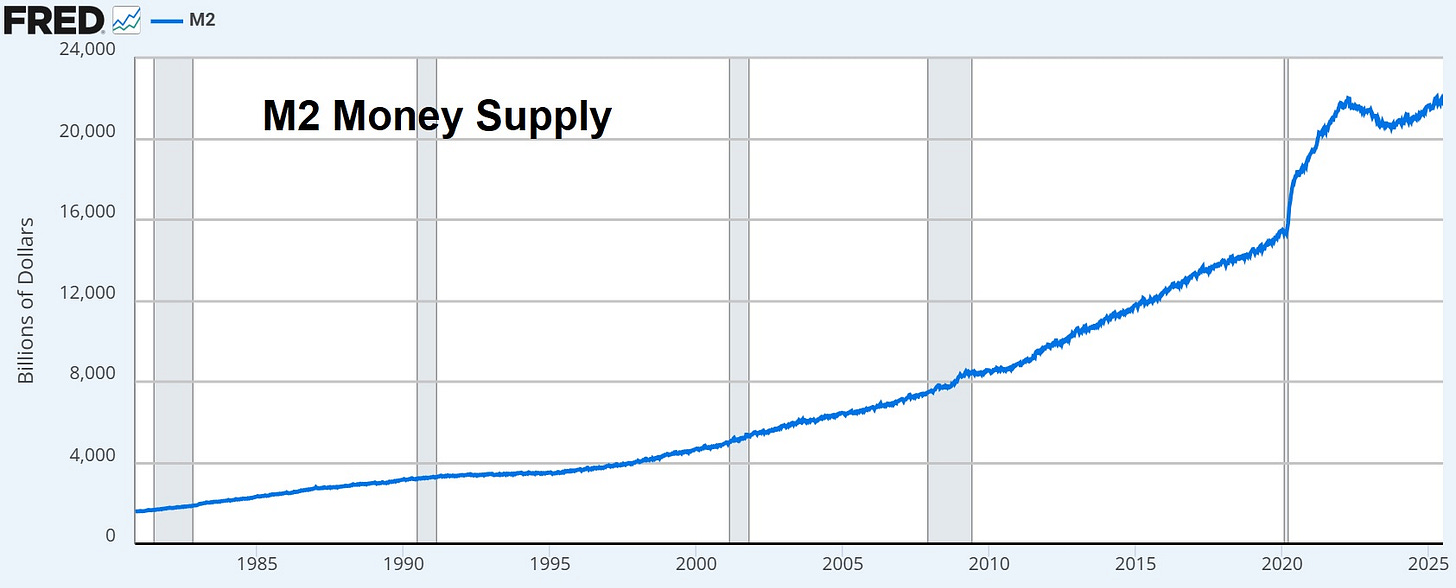

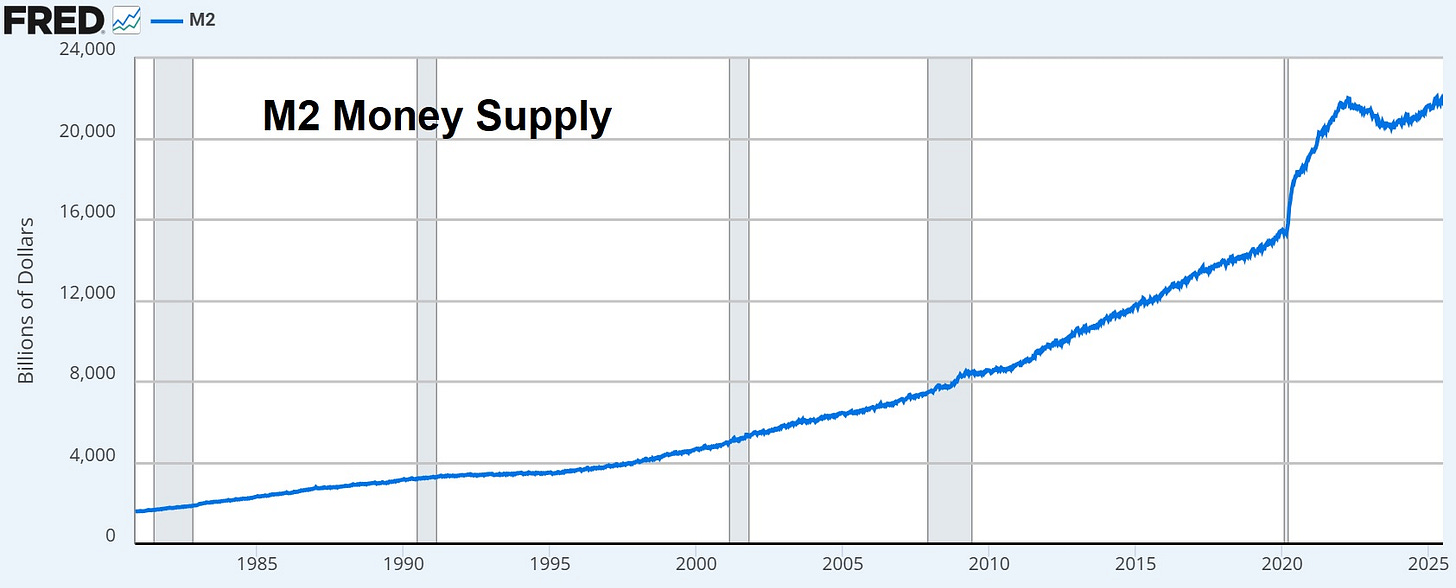

Soaring government debt requires commensurately aggressive currency creation. The widely followed M2 money supply, after a brief post-pandemic pause, is now back on its long-term trajectory. It hit an all-time high this year.

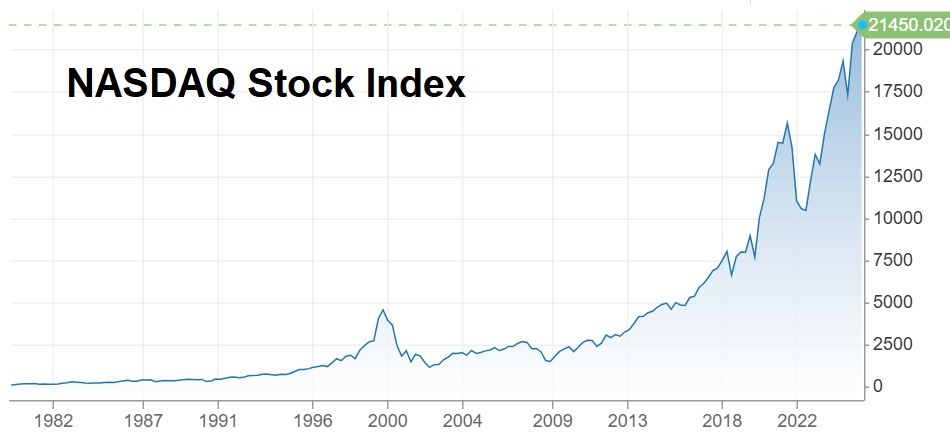

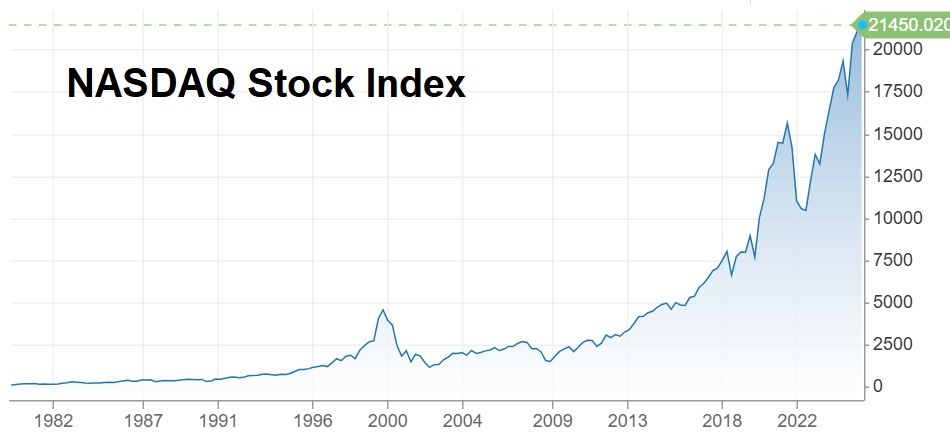

All this cash has to go somewhere, and a big part of it has flowed into tech stocks. Compare today’s NASDAQ index with its bubble peak in 1999. The dot-coms were apparently just a warm-up.

Gold, another popular destination for excess cash, is up by $1,000/oz in just the past year.

Now here’s where the “crack-up” part of the theory morphs from “inferred” to “guaranteed”: The US is preparing to shift its borrowing from longer-dated notes and bonds to short-dated bills.

The plan: Load up on short-term paper, and then lower short-term interest rates to zero or below. This will cut (and potentially eliminate) the government’s interest expense, which in turn will lower the deficit going forward.

But the cost will be a tsunami of currency creation, which will turbo-charge the stampede of capital out of financial assets and into tech stocks, gold, and other traditional inflation hedges. Hence, the crack-up boom. Keep stacking. |