In my daily news readings this morning I came across the new Substack poster writing a new piece that he released yesterday. Some interesting topics in there that create some thoughts.

Link to the post for those interested: Bondholders and P Holders Beware: QVC’s Next Move Might Be Coercive

I will of course provide my view as I do not agree with the ideas presented as I see them as distorting things to fit the common shares and I do not believe this to be a probable outcome to the company and shareholders currently. Being a contrarian and having a strong narrative is fine but we don't get paid on narrative alone - there should be qualitative and quantitative components to support the contrarian analysis.

Now I myself am open to the idea this poster could be correct as his points are valid to some degree, but what is the most probable outcomes? Where and when do we as investors get paid?

Revolver:

He states the only reason the revolver could be drawn would be because of the limited condition transaction that is outlined in section 1.10 of the credit agreement. I stand by my challenge that we're looking for a zebra in Delaware. The banking syndicate is incentivized to work with QVC if they can see value at the OpCo level as it protects the prior $1.925B drawn on their dime (now $2.9B). If they agreed in prepetition to extend with the agreement it will be converted to a DIP in postpetition then this is also possible. If this were to happen it protects the banks by moving them up in priority to super priority and above even senior secured holders and gives them further breathing room.

In my view, to write off prepackaged bankruptcy as a higher probability is bound to lose someone their hard-earned money. We can't say it fits the math or not because we don't have insight into what deals the company is cutting but we do have historical precedent in these cases to analyze. Therefore we can't write the outcome off to fit the outcome we need. "Many investors familiar with distressed situations do not see QVC’s situation the way I do, because most of the time distressed companies don’t do what I’m about to suggest". Again, we're looking for a zebra in Delaware.

In the end it's your money and we must all manage it as such, but once it's gone it's gone.

I believe the banks benefit more in protecting their capital by working for a DIP and getting super priority than risking further EBITDA/cash volatility and they can't get paid. The business is still in decline after all so this move is not risk-free for the banking syndicate.

Consent solicitations:

This goes into the next argument that the company will do what WBD did to get bond holders to agree. I do not see this the same. For starters WBD was done because the company was splitting into two new legal entities and the debt needed to support the new capital structures and in the end both new entities should thrive and continue to generate positive FCF. QVC is in secular decline with EBITDA going from $1.9B in 2019 at QVC, Inc to projected $800-900M in 2025-2026 and they're losing on a FCF basis currently too. As I wrote before, the FITCH/rating guidance is usually not done in a vacuum and often has management support as it impacts their credit ratings and thus their cost and access to credit.

Keep in mind the prior FITCH guidance was north of $300M FCF in 2024 and the company did under. Now it's $150M a year and so far in two quarters they burned $156M at QVCG and $77M at QVC, Inc.

Situations are not the same and thus comparing them is likely to lead to underwhelming outcomes.

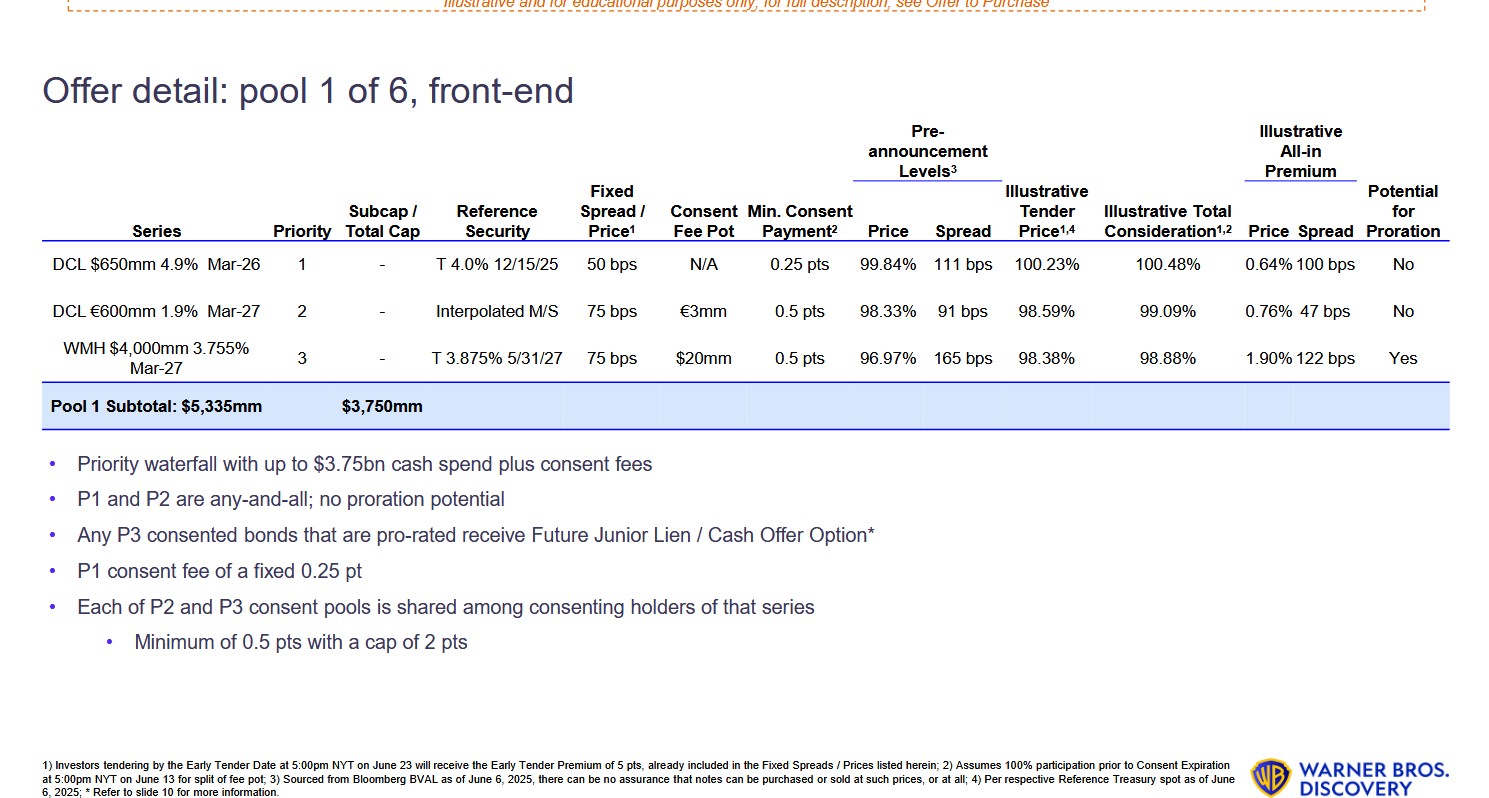

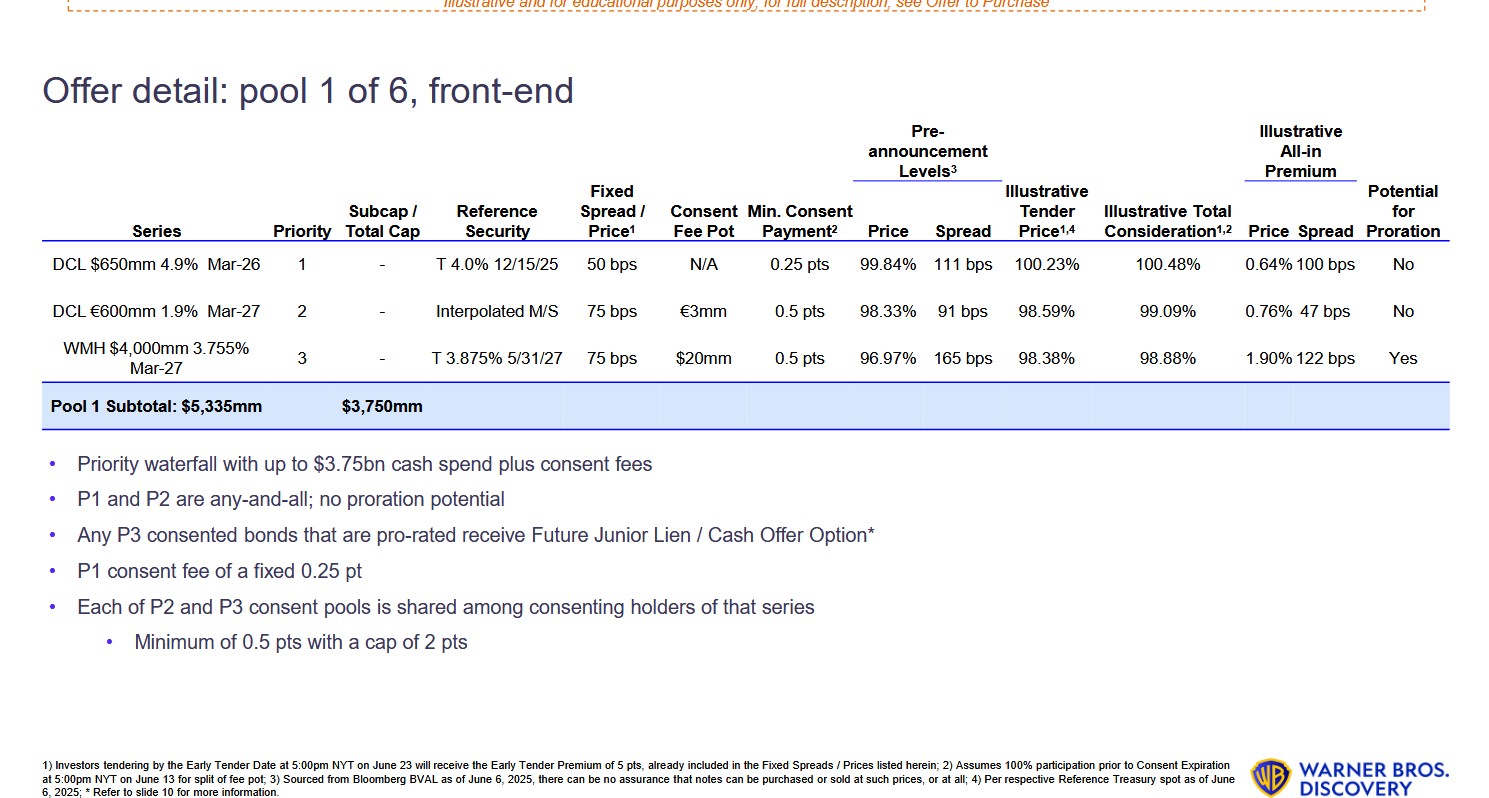

First let's look at what was offered for WBD from their June 2025 investor deck:

The offer(s) from WBD were pretty attractive and the reason they worked is because they were attractive. Bondholders were offered a big carrot to accept and strip their covenants so the company could execute the split needed.

Now where does this fall apart for QVC in my opinion? For starters WBD was splitting to lean into strength and QVC would be tackling this from a position of corporate weakness and bond holders won in a few ways from this offer. At $800-900M EBITDA this is not strength and reality is there's no floor set either. If company could underachieve on FCF estimates then they can underachieve on EBITDA estimates while cable is in secular decline. Social is only 10% of QVC revenue according to Q2 earnings leaving cable still as a major driver.

We also need to weigh the risk on rumors of Tiktok discontinuing their US app in 2026 meaning QVC would be left to rebuild on a new platform with a new algo. Do they get the same preference as before? Is the audience the same? No confirmation on this yet but it is rumored and thus creates investment risk on revenue.

QVC would also need seven different groups of bondholders to vote and get majority to do this. This isn't one bondholder but several. Different maturities, different coupons, different end games. One thing they all have in common is they are senior secured with the equity of QVC, Inc pledged as collateral. Assuming 50.1% of each series is willing to play ball is where this falls apart and in distressed debt the game is played different. Maybe some of them feel taking equity stake is the better outcome? This would leave Liberty Interactive with diluted ownership and then by proxy QVCGA owners with less ownership of the jewel. This is a real possibility and is often very common in distressed debt.

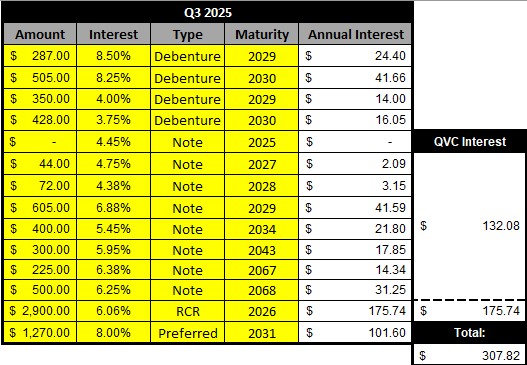

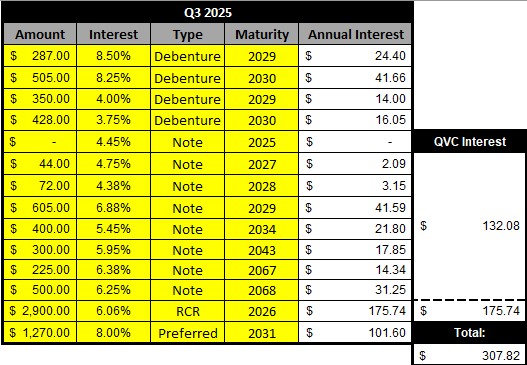

The QVC court that is being played on as of Q2-Q3:

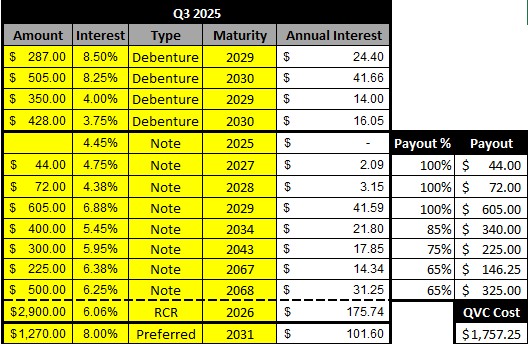

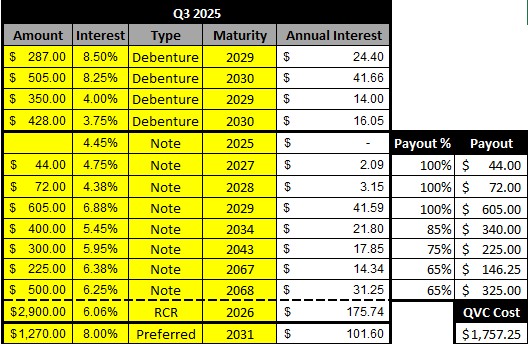

QVC would need to offer a decent carrot to get several players (2027-2068) to vote 50.1% on each and agree. It comes down to what would QVC be able to offer to get this deal done? Below I attempt to assume what would be attractive enough for this to work at such scale:

I/we can only speculate what would entice each group to accept but I think getting over 50% value is what may work. In total this would cost QVC $1,757.25M leaving them with only $114.75M in cash left. Now this should also give them an estimated ~$388.75 on gain on extinguishment of debt for their books and would be taxable. The cash left though is far too low as they need to again support working capital and fund growth into social as cable continues to decline thus they may need to go lower on what they offer to leave a cash pile left to fund the business and I struggle to see who takes more loss of these seven players. There is also consent fees, transactions costs, and whatever else I am forgetting that may increase this.

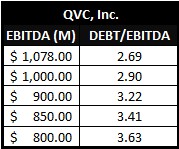

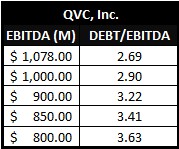

Let's say they magically make this work it still goes back to what I wrote before. The company now has less cash, EBITDA is still in decline, FCF is still trending lower, the revolver will have $2.9B drawn and at $800M EBITDA this keeps leverage ratio at 3.63x meaning they're still restricted. This scenario is unlikely to have FITCH, Moodys, or S&P upgrade them anytime soon and credit syndicate will still likely push for a higher rate on facility refinance and if this goes 8.5%-9% as I wrote before it's only a savings of $45.22-61.32M in annual interest expense.

If leverage ratio is still tighter or at risk and annual cash savings isn't that steep what's the value gain?

Here's a table of EBITDA and using only the $2.9B drawn on facility to show where leverage ratio may still sit:

Preferred:

All I will add here is the fact that the company had the chance to vote the way the poster writes and they did not. They halted the dividend to shore up short-term cash but did not do away with them. Why not rid them right when they voted to halt? As it stands the preferred still exist and if they do file then stand as a priority above the common equity so we cannot dismiss them and must treat them as a threat to value of QVCGA because they are until management actually does something.

Reality is I would not buy QVCGP because regardless they can be impacted as the poster states but they're trapped in same situation as QVCGA which is there's not enough value to upstream to recover anyway.

LITNA exchangables:

The poster is correct that the bonds are worthless. The reality is most holders are not retail investors but funds. The exchangable bonds themselves have likely been marked to zero in many cases on these books too and while tax implications are real, under §475 it's offset a bit so not as bad. In reality these are distressed plays now to fight for some recovery in equity or something else. Regardless, these don't impact QVC, Inc or the leverage ratios so it's not where the ball is going to matter.

There would need to be enough value to be created at QVC, Inc to upstream to these for them to matter in anyway. Recovery is far too low and pennies on the dollar offers from QVCG for a marked-to-market exchangable bond may not matter nor entice someone to jump. QVC, Inc would still need to upstream cash to parent(s) and whatever that parent does with the cash is the parents problem, but it doesn't solve what's happening to the crown jewel.

Final thoughts:

Felt it was worth adding my take as I see more talking about loading up on QVCGA shares. Not my concern on what one does with their money, but I see it as risky bets and felt some counter analysis could be helpful to those reviewing this security. Always, always, do your own diligence and research.

I find the situation to be heading towards bankruptcy as I have written prior. Nothing is certain, but we make money on probabilities and I see too low a probability to defend QVCGA as I once did. There are ways to make money here as I stated my case currently, but even that is not risk free. Given the above it's likely best to steer clear until stability shows.

Happy investing,

Sean |