I have tried to curb my natural bearishness as I have clearly been wrong...or early (but still wrong regardless). I have been long but conservative. Market is in just a rather frothy state that I can't help but question where it goes. Shiller P/E is sitting at 38.37 which is the highest November 2021 when it hit 38.51. S&P P/S 3.22 which is just highest since well at least 2000.

Bitcoin for your 401K! What a time. Throw in an NFT for the kids college.

I am fully invested at the moment holding things like OXY, GNK, GOOGL, DECK, QVCD, VET, AEO, and GTN (I am a degenerate and bought some recently after exiting last year). That said I am looking at what's next and I just am feeling off about where things are.

The news today that really got me was the new UFC deal. $7.7B for Paramount to stream UFC events. In 2018 UFC and ESPN reached a deal for $1.5B and now Parmount got the US rights for $7.7B. Looking at Yahoo! the market cap for PSKY is $6.41B so...............................this UFC deal is greater than the MC of the company or 40% of the enterprise value. Does Paramount get $2 back for every $1 of this deal? $10:$1? Or is it ($2):$1 or ($10):$1? Who cares, pop the corks! 12.67% of the float short though so keep an eye for some up/down action.

AI is going to take our jobs, but then the recent LLM progress seems to be stalling.

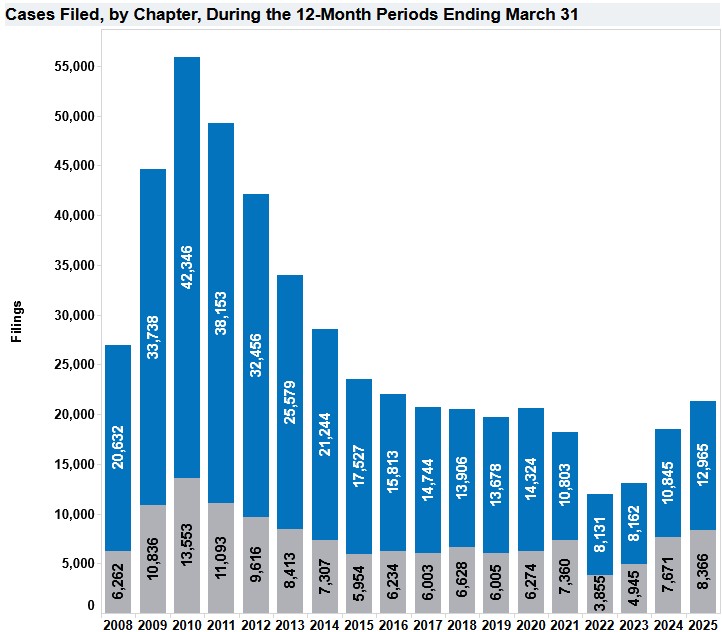

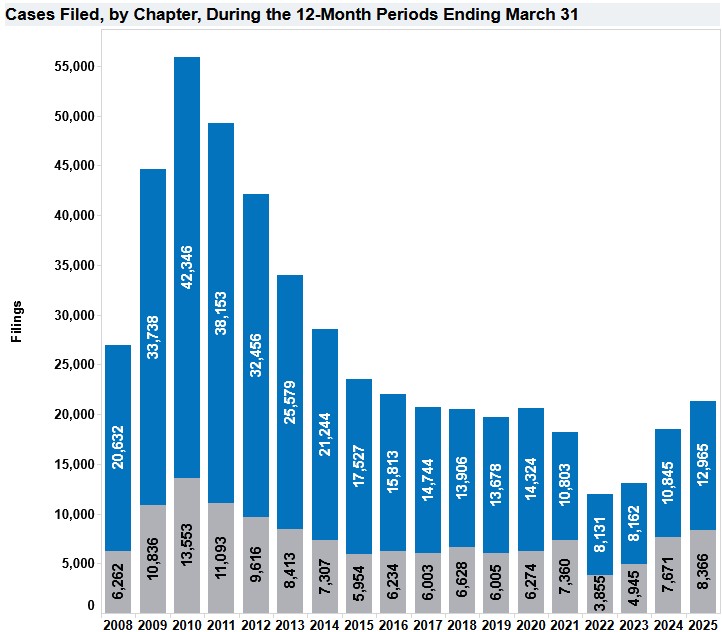

Anyone have any "bearish" strategies they're looking at right now? I do think there is some distressed debt opportunity forming (why my QVCD hold). Corporate bankruptcies are on the rise with chapter 11 (grey) highest since 2013 and chapter 7 (blue) highest since 2020. This is missing all the LME's that are taking place too which are on the rise.

Happy investing,

Sean |