re <<With over 3,000 horsepower, this Chinese electric supercar is set to become the world’s most powerful

BYD to unveil an extreme Yangwang U9 variant with 3,018 hp, set to become the most powerful production car ever; here’s what we know so far>>

bloomberg.com

Bessent Dismisses China Investing in US as Part of a Trade Deal

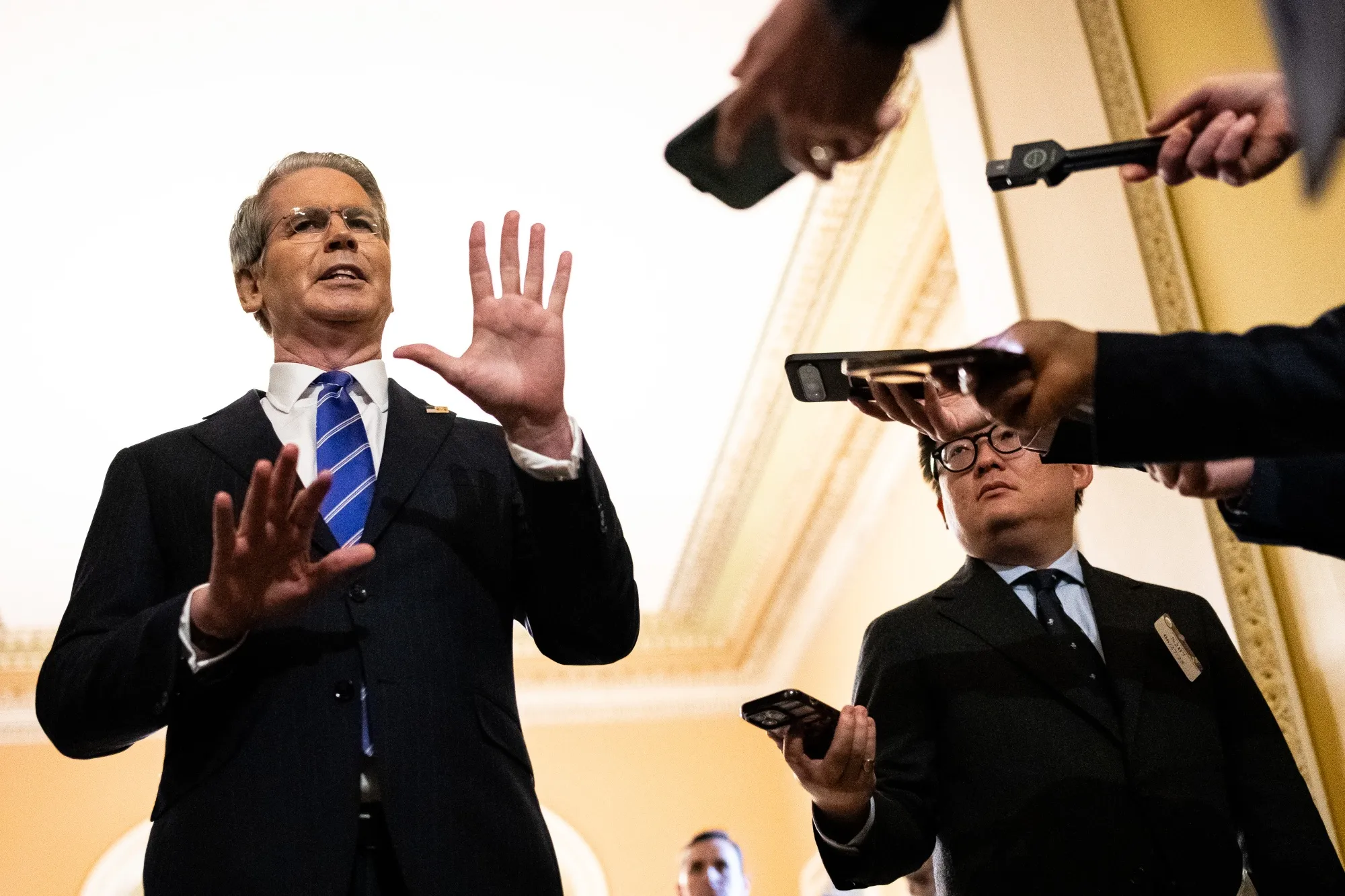

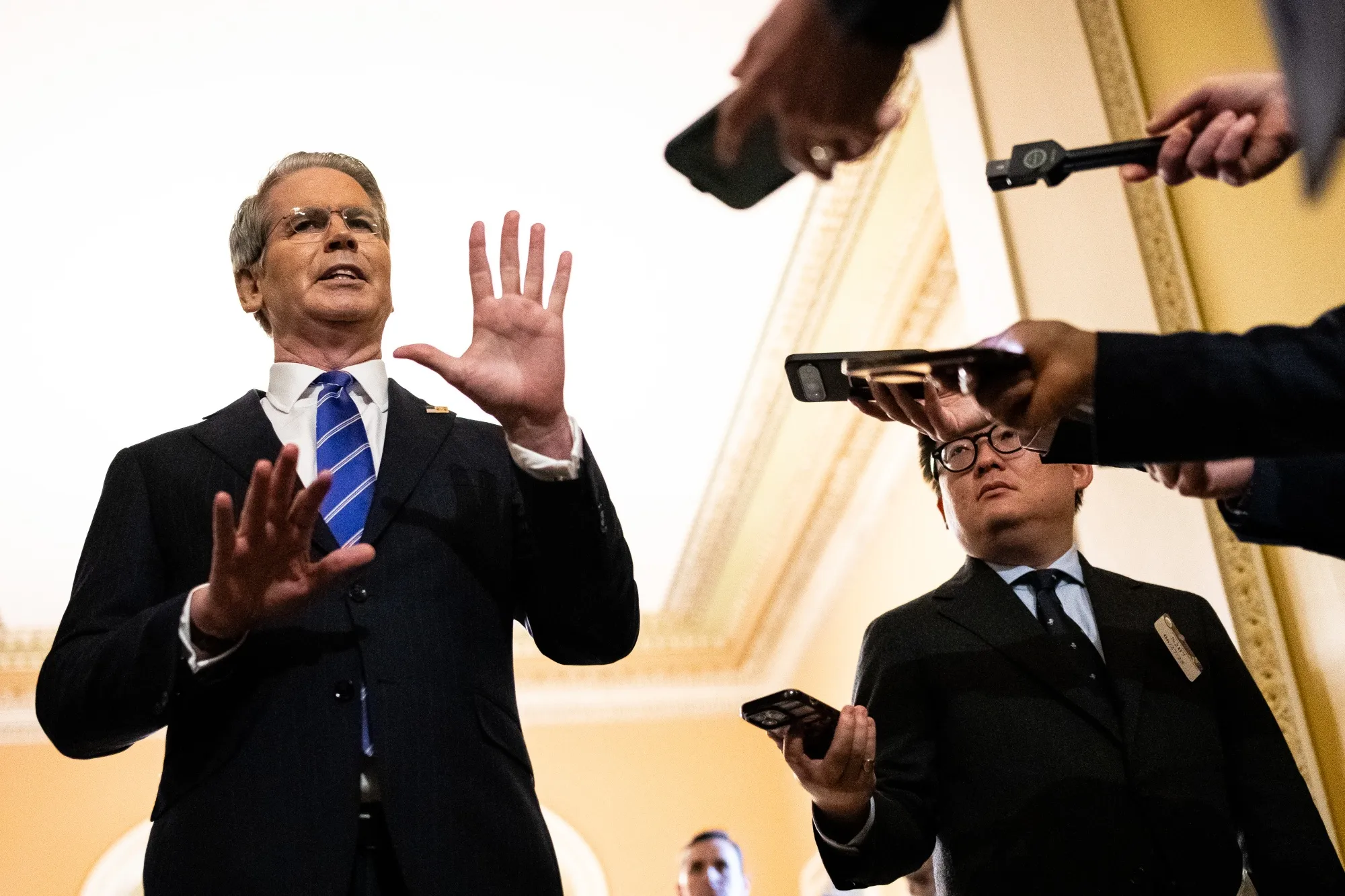

Scott BessentPhotographer: Graeme Sloan/Bloomberg

By Bloomberg News

August 13, 2025 at 9:20 AM GMT+7

Takeaways by Bloomberg AI

- Treasury Secretary Scott Bessent dismissed the possibility that Chinese investments in the US could be part of any trade pact.

- Bessent said "my sense is no" to China making pledges worth billions of dollars as part of their trade agreements, citing the need to reshore critical industries away from China.

- Bessent indicated that Washington wants to see measures from China over an extended period to stem the flow of chemicals used to make fentanyl before lowering duties.

Treasury Secretary Scott Bessent dismissed the possibility that Chinese investments in the US could be part of any trade pact, comments that narrow the options for the two sides to resolve their running dispute.

When asked if China could make pledges worth billions of dollars like Japan, South Korea and the EU have as part of their trade agreements, Bessent said “my sense is no because a lot of the buyout or the funds from the buyout are going to go to critical industries that we need to reshore and a lot of those need to be reshored away from China.”

Whether the industry was semiconductors, rare-earth magnets, pharmaceuticals or steel, “my sense is that isn’t what will happen,” Bessent said in an interview with Fox Business on Tuesday in the US.

Bessent’s comments point to the competition between the US and China over a range of issues, with tech and AI among the most high profile. President Donald Trump has extended a pause of higher tariffs on Chinese goods for another 90 days into early November, a move that stabilized trade ties between the world’s two largest economies while they try to forge an agreement.

Chinese companies in sectors such as electric vehicles have opened factories abroad to access new markets, a move that could also help them skirt US tariffs.

In the interview, Bessent said he’d be meeting again with his Chinese counterparts “within the next two or three months.”

He also indicated that Washington wanted to see measures from China over an extended period to stem the flow of chemicals used to make fentanyl before lowering duties Trump put in place over the issue.

“We will need to see months, if not quarters, if not a year, of progress on that before I could imagine those tariffs coming down,” he said. |