from behind the curtain, in alignment with my current premise, that China shares and gold shares are the same-same even if not perfectly tracking

zerohedge.com

China Stocks Hit New 10 Year HIgh, On Verge Of Historic Breakout

BY TYLER DURDEN

SATURDAY, AUG 23, 2025 - 05:20 AM

Just a few days after we discussed how China's Shanghai Composite had quietly made a fresh 10 year high when it breached the 3,700 level, overnight the SHCOMP made fresher 10 year highs now reclaiming 3800 level just days after breaching 3700. Or, as Goldman trader Fred Yin points out, "it took about 3 weeks from 3500 to 3600, another 3 weeks from 3600 to 3700" and then 3 days to go from 3700 to 3800. Clearly the move in China is accelerating.

China's CSI300 index - the rough onshore Chinese stocks equivalent of the S&P - recorded its biggest weekly rise since November. Gains in local chipmakers provided an added tailwind Friday after a report that US rival Nvidia has instructed component makers to stop production related to its H20 AI chips.

Most important, however, the chart below shows that the SHCOMP is now on the verge of a historic trendline breakout, one which could result in the next Chinese stock bubble in the coming weeks and months.

[url=] [/url] [/url]

The Goldman trader then further details a few things that boosted sentiment for Chinese equities further today:

- DeepSeek launched the latest V3.1, and the company highlighted the fact the UE8M0 FP8 was designed with the next-gen domestic chips in mind, suggesting domestic AI industry is on the cusp of a new era of software/hardware collaboration.

- Nvidia reportedly is looking to halt H20 chips production after China started cracking down on purchases.

- Liquidity remains ample: PBOC injects a net 123.2BN yuan of short-term cash via reverse repo, bringing the weekly total to 1.37t yuan - the biggest weekly injection since Jan.

- Preference for risk assets: China’s 30y govt bond auction fetched the highest yield since Dec, while the bid-to-cover ratio dropped to the lowest since Oct.

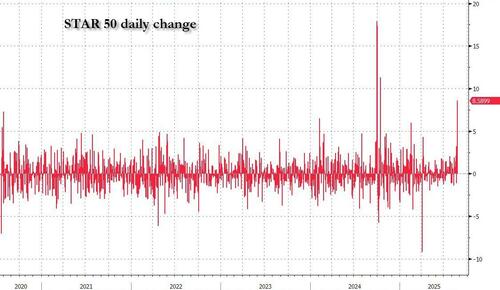

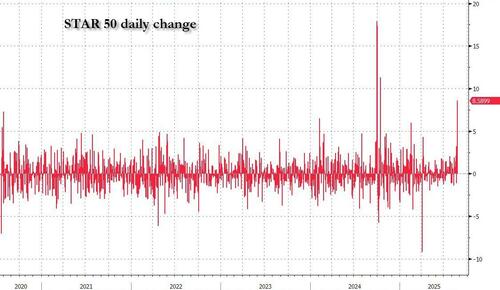

The SSE STAR50 (tech/innovation board also called the Chinese equivalent of the Nasdaq) surged 8.6% on the day, the 3rd largest daily gain since inception

[url=] [/url] [/url]

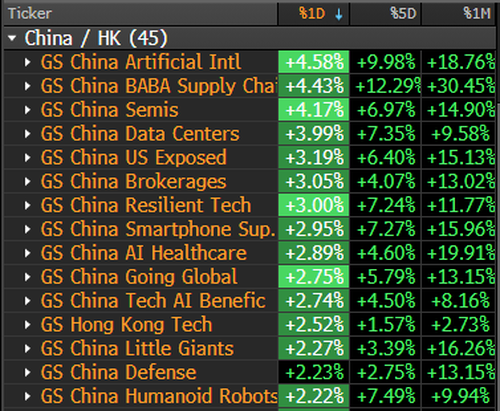

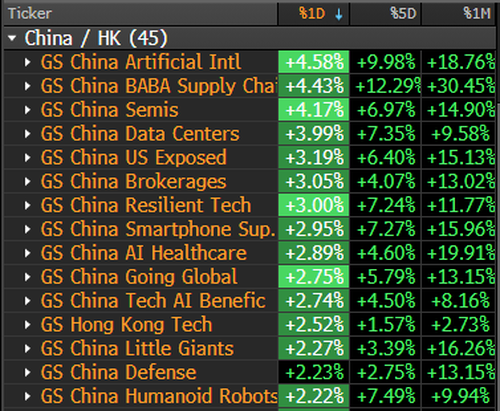

Thematically, AI/Semis/Resilient Tech (e.g. domestic focused) names got lifted ...

[url=] [/url] [/url]

...at the cost of “old economy” plays

[url=] [/url] [/url]

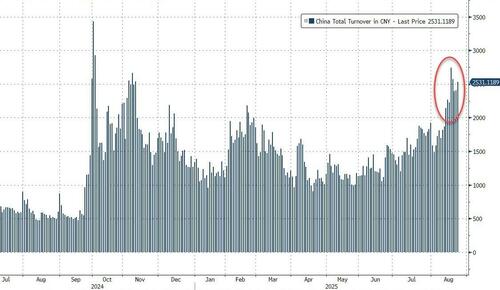

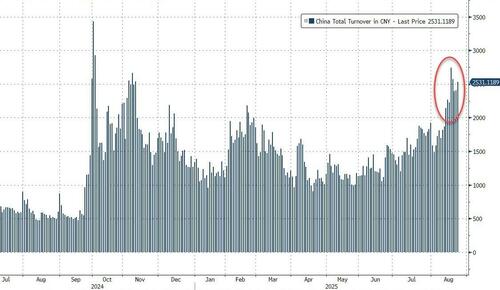

Similar to earlier this week, the momentum higher in China A was well-supported by trading activity in the market: turnover was above 2 tn yuan for the 8th day in a row, the longest such stretch on record

[url=] [/url] [/url]

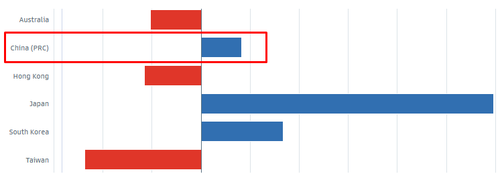

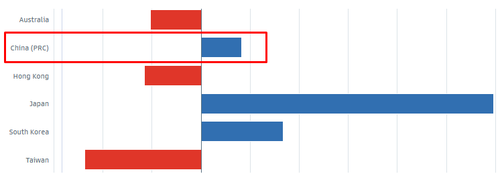

There was a rebound in momentum during Asia session so Korea/Japan inflows picked up today compared to earlier this week, but China A-shares still skewed net buyer on the Goldman cash desk.

Long Onlies again drove the buy skew of 1.5x, making up a majority of the net inflow in A-shares on the GS high touch desk, however Healthcare dominated instead while Info Tech was ranked 2nd most net bought sector. Industrials / Consumer Disc / Energy were all net sold. HF flows were light, with only small buying in Industrials.

[url=] [/url] [/url]

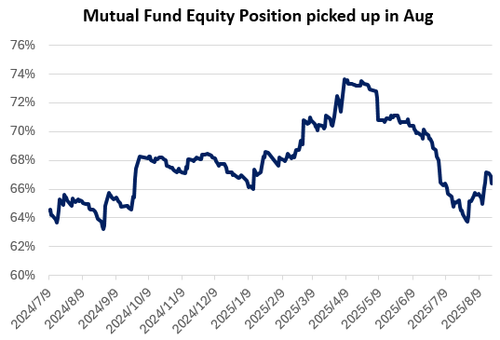

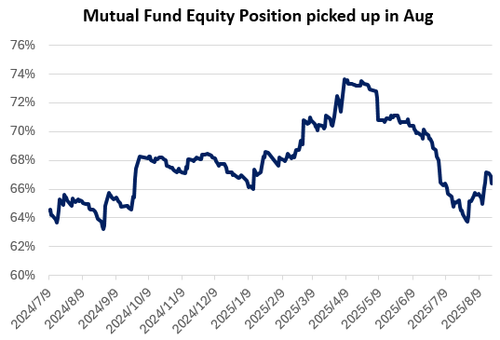

Outside of the Goldman client base, there is also increasing positioning by external institutions as well. Insurance funds have been flowing in: this week we see PingAn announced increased holding in China Pacific, China Life and Agri bank. Mutual funds equity positioning picked up in Aug too.

[url=] [/url] [/url]

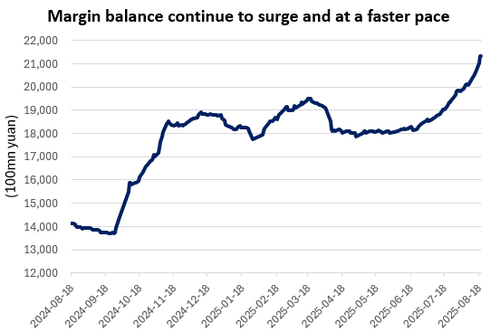

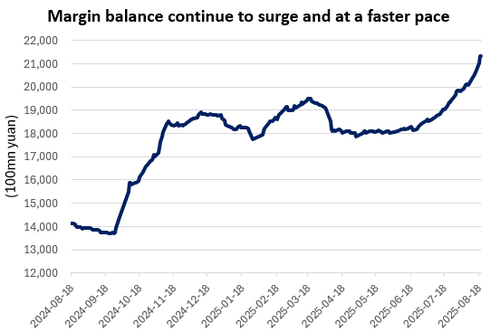

In addition to institutional flow, retail buying remains strong: Chinese brokerage firms reported dramatic new account opening surges this month, with some Shanghai brokerage branches seeing 200-300% MoM growth, though still below Sep/Oct rally peak levels. Tied to that, margin balances continue to surge and at a faster pace. Daily net margin buying reached 39bn yuan on Tuesday, 3rd highest on record.

[url=] [/url] [/url]

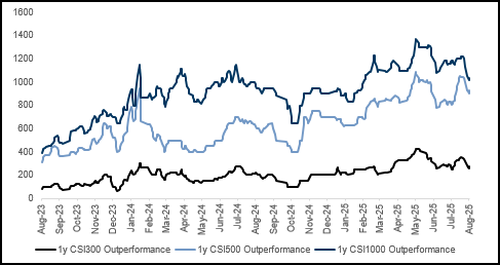

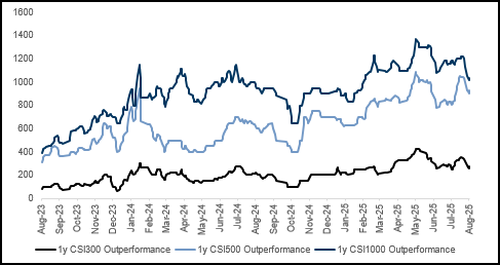

Elsewhere, after a sharp spike last week, funding levels for CSI300/500/1000 are stabilizing: for CSI1000 1y tenor that’s just above 10% annualized (e.g. the outperformance you’d collect from going long on swap).

[url=] [/url] [/url]

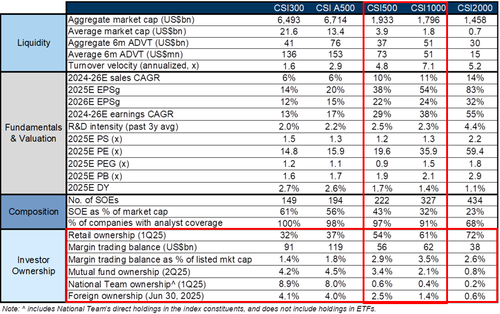

So, where do Chinese stocks go from here? According to Goldman's Yun, with the amount of dry powder still left on the sidelines, those looking to participate in the China rally should look at what retail flows have been and will likely be chasing.

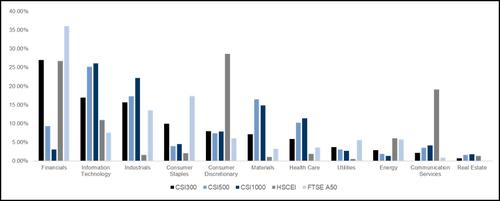

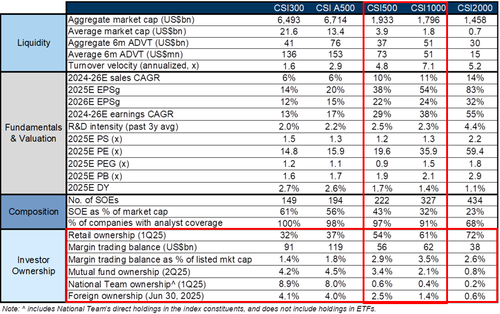

To help with that decision, the table is worth one's time if still deciding how to gain access to China:

CSI1000 and CSI500 has 61% and 51% retail ownership vs 2.5% and 1.4% foreign ownership

CSI1000 also stands out for being most exposed to margin trading at US$62b (3.5% of market cap)

The higher retail ownership, higher turnover velocity, and higher exposure to margin trading make S/MID indices more sensitive to market performance, sentiment and liquidity conditions.

[url=] [/url] [/url]

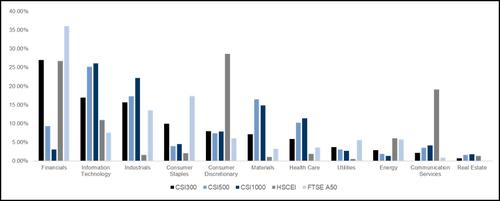

SMID cap indices also have more balanced sector weights, and higher exposure to high-tech manufacturing areas aligned with strategic policy directions (15th Five Year Plan coming out in Oct).

CSI1000 has only ~10% weights in traditional sectors such as Financials, Real Estate, Energy and Utilities, while Tech Hardware & Software and Health Care account for 25% and 12% of CSI1000.

[url=] [/url] [/url]

More in the full Goldman note available to pro subs. |

[/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url] [/url]

[/url]