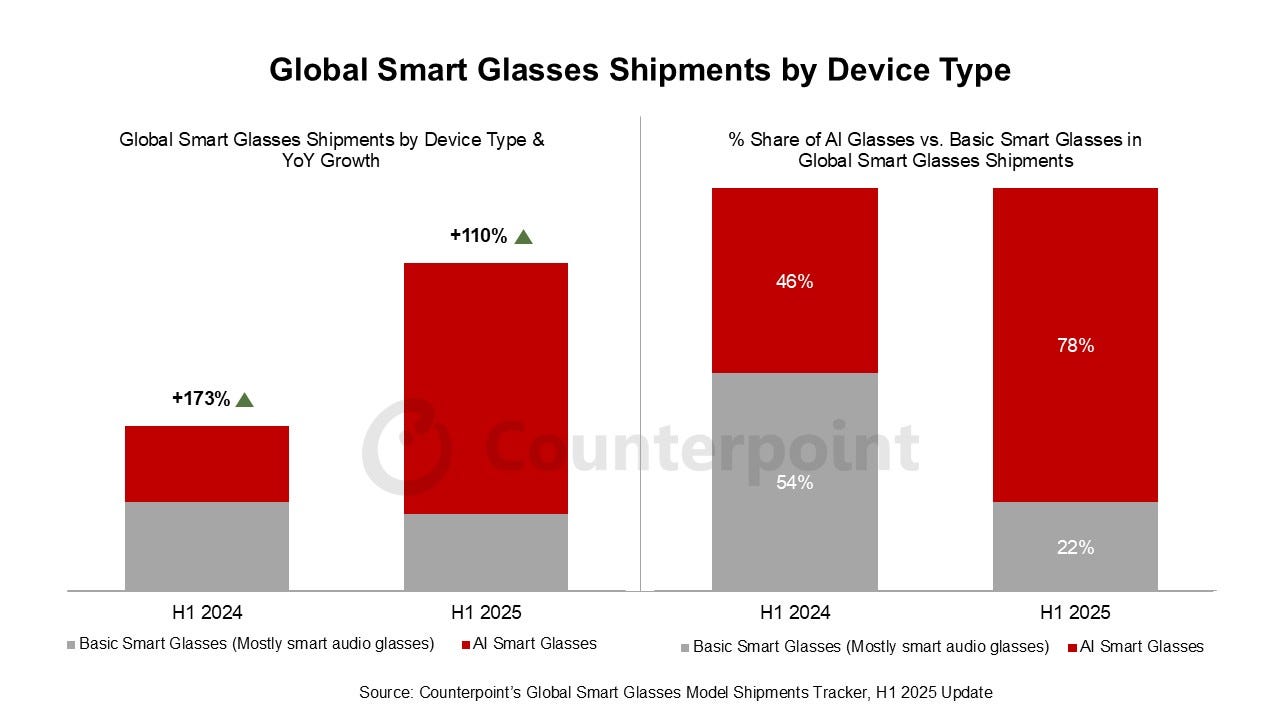

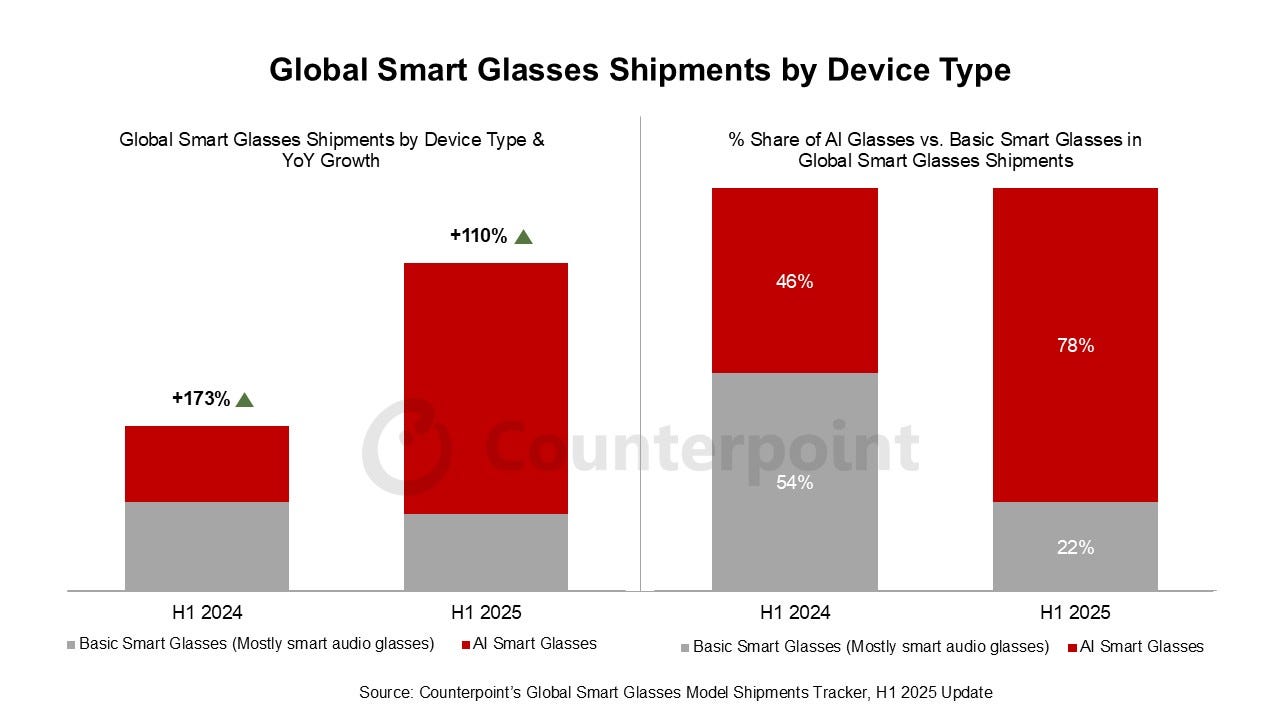

The smart glasses market is experiencing a resurgence after the first iteration of Google Glass flopped in 2015. In the first half of 2025, global smart glasses shipments increased 110% year-over-year (YoY), and demand for AI-enabled smart glasses is outpacing that of traditional smart glasses, according to Counterpoint Research.

"Today's smart glasses offer a clear value proposition – use cases make sense and the price is right. But just as important is style. Nobody wants to look like robocop or feel like they're pointing a camera in someone's face. The tech has caught up and smart glasses today are familiar and I'd even say stylish," Flora Tang, senior analyst for Counterpoint, told Light Reading.

AI smart glasses outpace their basic counterpartsAI smart glasses accounted for 78% of global smart glasses shipments, and the AI segment of the market grew 250% YoY. On the other hand, basic smart glasses, which are mostly smart audio glasses, only accounted for 22% of the global smart glasses market. Among the smart audio glasses makers are Huawei, Amazon and Mijia (a Xiaomi ecosystem brand).

While smart glasses have been available for about a decade, AI is introducing "way cooler" applications, Marc Einstein, research director for Counterpoint Research, told Light Reading. AI glasses have more features than their basic counterparts. In addition to providing photo and video capture, AI smart glasses provide image and object recognition, encyclopedia-based Q&A, live translation and more.

Xiaomi AI Glasses and Alibaba's Quark AI Glasses (still in pre-commercial stages) are looking into device-based payment options so users could pay for merchandise with their smart glasses, instead of tap-to-pay via their smartphone.

Future applications for AI smart glasses could include networking assistance – glasses could recognize someone the user has met before and sync with their LinkedIn to provide additional information, said Einstein. While useful, these types of features could spark privacy concerns.

Counterpoint forecasts that new AI glasses models – from Meta, Alibaba and smaller OEMS – will launch in the second half of the year, including upcoming releases from Meta, Alibaba and several smaller players. Meta recently launched the Oakley Meta glasses in June, which have better battery life and video-shooting quality over the Ray-Ban Meta AI Glasses. Additional Meta AI glasses models will likely launch during Meta Connect on September 17.

Strong demand for Ray-Ban Meta Smart Glasses, whose market share rose 73% in H1, has been a major boon to the smart glasses market. Ray-Ban Meta sold 1 million smart glasses in 2024, and it expects to sell between 2 million-5 million pairs by the end of this year.

New entrants – including Xiaomi, which launched the Xiaomi AI Glasses; and TCL-RayNeo, which has the RayNeo V3 series glasses – are boosting the smart glasses market as well. Although Xiaomi's AI glasses were only on sale for about a week in H1, they were the fourth best-selling model overall and the third best-selling product in the AI glasses segment.

Kopin Solos, which has the Kopin Solos AirGo V series glasses; and Thunderobot, which produces the AURA smart glasses, are also among the top AI glasses OEMs.

Meta's production partner Luxottica has been key to Meta's success by scaling production, providing a range of product styles, and through retail sales, said Counterpoint. Luxottica's retail networks such as Ray-Ban, Sunglass Hut and LensCrafters have played a significant role in contributing to sales of the Ray-Ban Meta Smart Glasses. Shipments of Ray-Ban Meta AI Glasses increased over 200% YoY in H1.

Service provider channel for smart glassesHowever, smart glasses aren't yet widely available via the service provider channel.

"Globally telecom carriers are not yet aggressively promoting smart glasses but there are some exceptions," said Einstein. "Tier 1 operators such as NTT Docomo and Deutsche Telekom have invested heavily in R&D to design their own smart glass products, but these are more geared towards enterprise use."

Many service providers are biding their time until more cellular-enabled devices emerge in the smart glasses market, which carriers could then include in data packages, explained Einstein. There are some early examples of this type of service bundling from the South Korean operators, he added.

Most smart glasses are currently connected to smartphones via Bluetooth, and some smart glasses do have integrated 4G LTE connectivity. But, 5G-enabled smart glasses are less common "because the modems are too big and power-intensive," said Einstein.

China will be key region to watchOn a regional basis, areas where Ray-Ban Meta AI Glasses are available are in the lead for global smart glasses shipments including North America, Western Europe and Australia. Meta and Luxottica launched in India, Mexico and the UAE in Q2, which drove up shipment shares in these markets.

The US is currently leading in terms of adoption of smart glasses, due in large part to demand for the Ray-Ban Meta smart glasses, said Einstein. But, China is "really pushing the next generation" of smart glasses, he added.

"I think the country to watch in the space right now is China as all three of the country's mobile operators are launching self-developed AI glasses embedded with functionalities such as eSIM and hosting LLMs on the device," said Einstein. "It will be interesting to see what kinds of use cases and business models emerge from these efforts."

Chipset makers move inA number of chipset makers are also developing their smart glasses solutions: Qualcomm recently launched an updated version of its smart glasses system-on-a-chip (SoC) – the AR 1+ Gen 1. Chinese chipset maker Allwinner Technology is also "entering the market with budget SoC solutions aimed at powering more affordable smart glasses," said Counterpoint.

The smart glasses market is expected to continue its meteoric rise into 2026, and fortunately, tariff policies haven't had a significant impact on the smart glasses market. In addition, Counterpoint forecasts the smart glasses market to grow at a CAGR of over 60% between 2024 and 2029.

lightreading.com |