Liability Management Exercise (LME):

I was reading the biography of Steve Jobs on an airplane last week. Fascinating view into a very complicated man. The focus on quality he instilled on Apple is deeply impressive and one that made me ponder the concepts of quality in everything I see around me. This even led me back to thinking about QVC; quality of their products, quality of their services, quality of their leadership, and even quality of investment analysis I am seeing online. I remain fascinated by this one, simply because the investor psychology is just so interesting to view as the company has evolved. Each negative result is met with a positive hand-wave that ignores what's happening. Buffett quotes thrown around, misunderstood value, and many other things to support a turnaround that has yet to show itself.

Common equity, QVCGA, is on a tear recently (+200% in a month and up 30% today at the high) and this after another poor quarter and now many take this as a time to load up because of price movements. Life has been found! Suppose if we forget to zoom out we then forget to see QVCGA is down ~98% too. Someone has made out so all that matters I suppose, right? No thought on are current holders being used as exit liquidity for big fish who have been under water. Trades vs. investments.

I suppose I see this as more of a death rattle in the agonal period instead of new life in QVC in its current state.

If we go back to quality of analysis, I have not seen much outside of my own. I see clever strategies the company could technically explore, but nothing that explains the probabilities of them being executed or anything that leverages valuation to try and capture what could the company be worth? Now today price goes up so loose analysis is validated!

Below I will make my attempt to bring some deeper analysis into play as I believe in the value sense one should be able to apply quantitative analysis to support the qualitative. This will likely be my final analysis on this one until we get some major update.

I replied to a post on Substack and the original poster (TJ) responded to me with "you may be right that retiring all bonds with $1 billion may be a stretch. But there’s plenty of precedent for tender offers that aren’t 100%. Your math assumes 100% only. At 50% tender+consent, tons of rights are stripped with liquidity to spare. At 75%, the bonds can be subordinated".

My original LME analysis did assume 100% participation, which was intentional even if unrealistic, and I will now scale back into what could be a realistic outcome from a tender offer and an out-of-court LME. My belief though is without all senior notes taken out, an LME looks good in theory but given complexity is not as valuable as one assumes. Let's take a look.

For starters let's look at the liquidity QVC Group has to play with; in total there is now $1,872M for the QVCG with $1,305M for QVC, Inc post credit facility draw, $105M at CBI, and $462M at corporate.

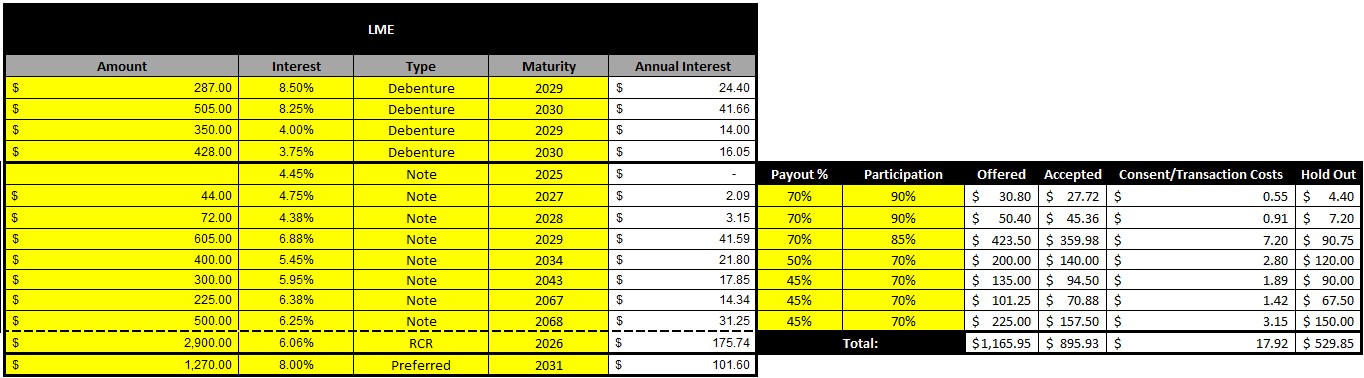

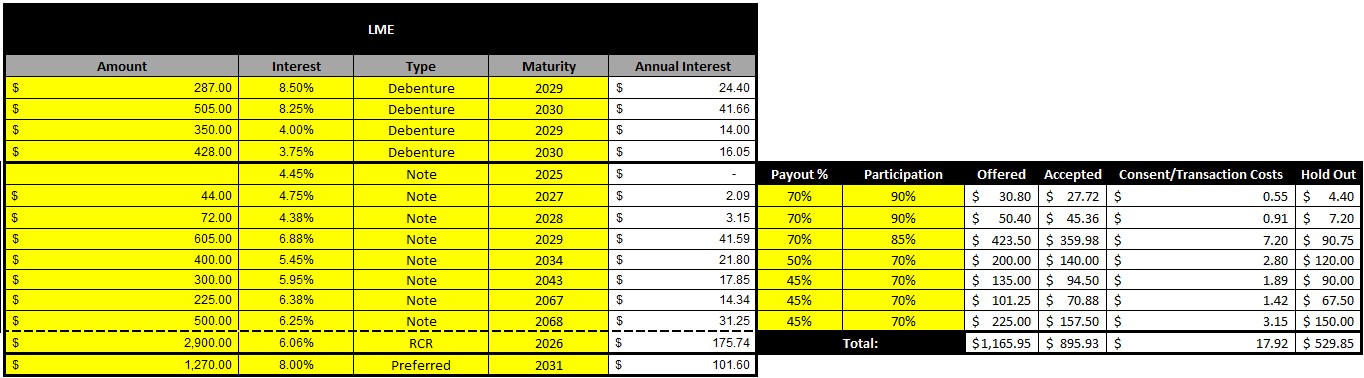

Now let's take a look at the liability profile:

- $1,270M QVCGP outstanding still (preferreds here are not "real" debt but currently functions as such until dealt with)

- $1,570M LITNA unsecured debt,

- $2,146M senior secured QVC, Inc notes

- $2,900M drawn on bank credit from QVC, Inc.

This brings the total debt picture to $7,886M. We also have $1,130M in a deferred tax liability that QVC Group would need to deal with as a result of the LITNA unsecured debentures; at maturity of these debentures interest carryforwards should offset half gross DTL so for this analysis we will use $565M instead of GAAP value of $1,313M.

Now I have seen many write elsewhere the preferred shares could be bought out for a lower price since they have weak rights and with 50.1% of the preferred vote can then cease to exist and thus taking a $10-$15/s consent offer is better than the current market price of $6.81/s. If QVC Group came in with a $15 consent offer this would cost them $190.85M to make $1,270M go away and save $100M annually in preferred dividends. If they throw in only a 20% consent ($8.17/s) over market price (instead of a flat $10-$15/s) this would only cost them $103.97M.

Now for the LITNA debentures. Because of the DTL and the overall tax shield these provide today, I really do not believe QVC Group would address these in an LME as they would reduce the $462M in cash at parent and after the $103.97-$190.85M for preferreds would only have $271.15-358.03M left anyway. The tax benefit is expected to grow to $147M by 2029 so better to keep these around and get the benefit and the company is either in a better spot by 2029 to deal with it all or it doesn't matter anyway. So there is a double edged sword in addressing these that I think the tax benefit outweighs the need to remove them.

Now for the main show - QVC, Inc.

For an LME to work the real value will need to be here. The EBITDA is mainly driven here, the cash flows are mainly driven here, and this is where the senior debt all resides and equity is tied to QVC, Inc. as collateral for all of the bank + senior notes which are pari passu.

What I have done below is taken the entire liability stack and then broke down the senior secured notes and what the possible payout % would be for an OOC LME and then what the participation rate could be.

For breakdown I assume 70% payout offers for 2027-2029 notes where we see 90%, 90%, and 85% participation. For 2034 we then have a 50% payout and maybe 70% participation. Then for 2043-2068 we have 45% payouts & 70% participation. In total the offer would be $1,165.95M from QVC, Inc and with participation would cost them actually around $895.93M and when you add in for consent/transaction costs this would be $913.85M and leaves QVC, Inc with $391.15M in cash.

There are now $529.85M left in holdouts, but despite what I read the worst that happens here is the company could adjust covenants and make life harder for senior holders, but sacred rights are not touched. So from a subordination standpoint, you are 100% not subordinating senior secured notes out of court unless 100% of each tranche voted to do so. So the collateral (QVC, Inc equity), coupon, and maturity remain for these.

New debt could be issued which would dilute the current holders, but it would still be pari passu so even the new debt is just diluted. Reality is we are right back to square one too so this isn't even a path QVC, Inc could reasonably take. New paper will be at CCC+ rating and will not be termed as far out nor with a coupon lower than +9-10% so it's more expensive paper too. There is no super senior debt coming into play without lawsuits.

With $529.85M in leftover paper + $2,900M in bank debt the senior debt here is now $3,429.85M.

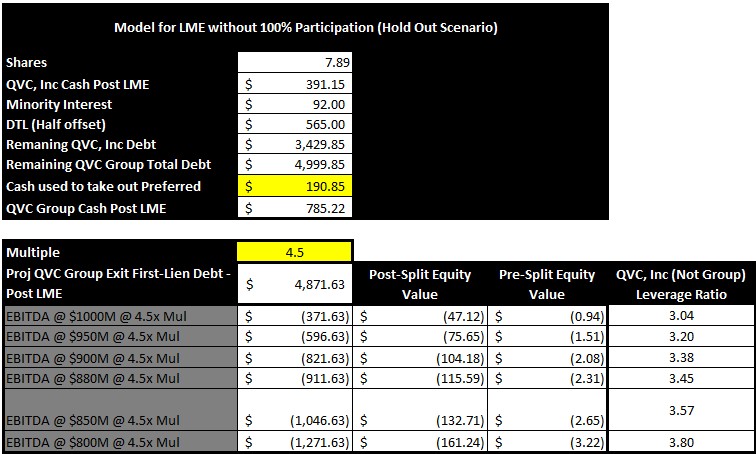

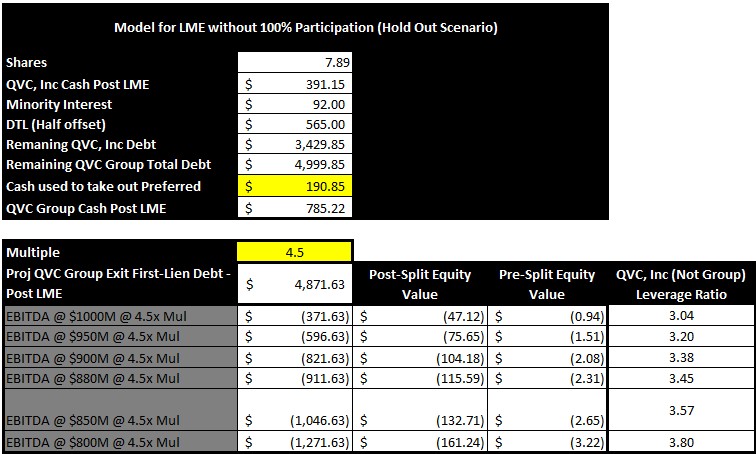

Now we move to the next step which is valuation. QVCGA equity may rocket initially on an LME because right now markets will rally on anything, but a true FMV multiple for a company still in secular decline and with $3,429.85M in debt would be 4.5x and this is likely where price begins to trend once the wow wears off.

So with $3,429.85M left in senior debt, $4,999.85M total group debt, preferrds shares gone, $565M DTL, $92M minority interest, and $785.22M left in total cash the above shows where equity value would be at 4.5x. Here we are still deeply negative.

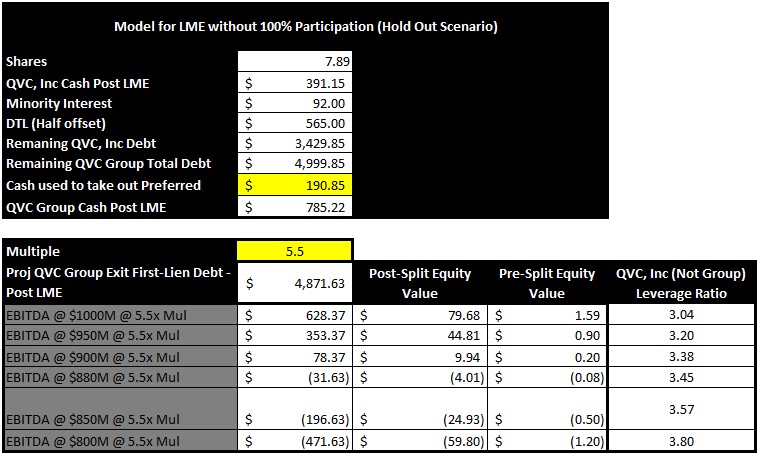

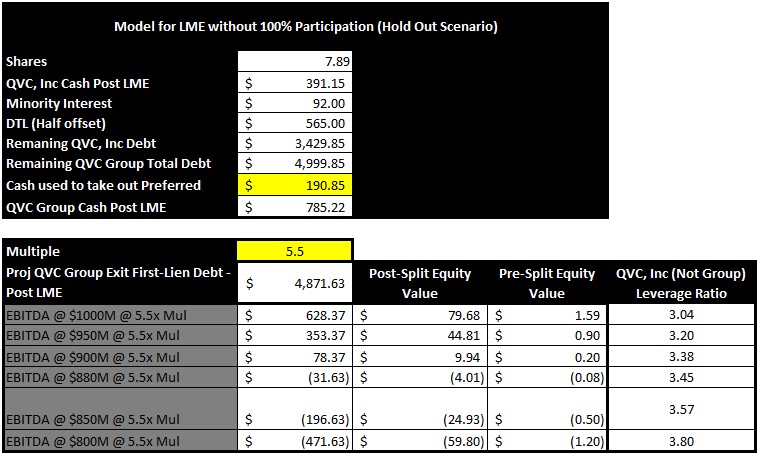

Now if we go with a 5.5x multiple instead, which excluding 2022 is where Qurate/QVC Group has historically been, then there is a higher equity value that returns but starts to quickly fade as EBITDA erodes:

Even with a 5.5x multiple, with $1,000M in EBITDA, seeing $1.59/s in pre-split value is not a great ROI from the company to shareholders IMO. Especially since the secular risk is still real and downside EBITDA is likely.

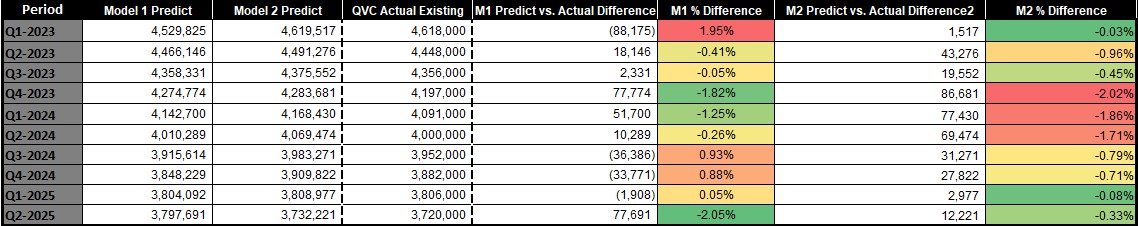

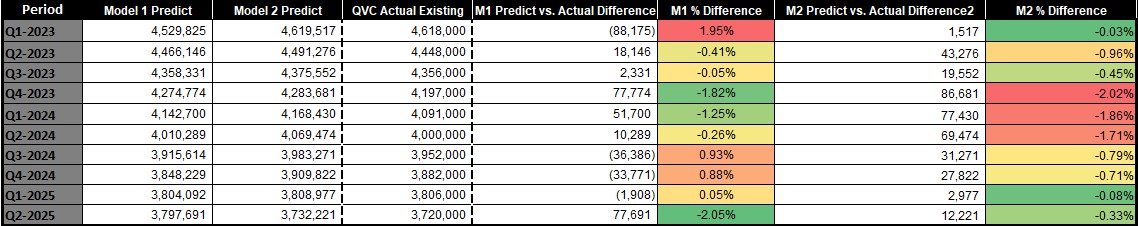

Now the crux of this entire issue is not the senior notes or preferred shares. It is the secular decline of the company's main distribution vehicle which is cable/satellite. While social streaming is seeing growth, the core engine for revenue is cable (currently 90% cable & 10% social/streaming). QVC, Inc revenue is highly correlated with existing customers and I have been able to model existing customers and back-test with accuracy since Q1 2023:

I posted my recent predictions before Q2 earnings and QVC did 2.05% worse than my first model and my second model was 0.33% inline with actual. Whatever stabilization or growth narrative anyone is presenting is irrelevant currently until trends are broken; until then I am predicting with decent accuracy QVC existing customers and then in turn revenue.

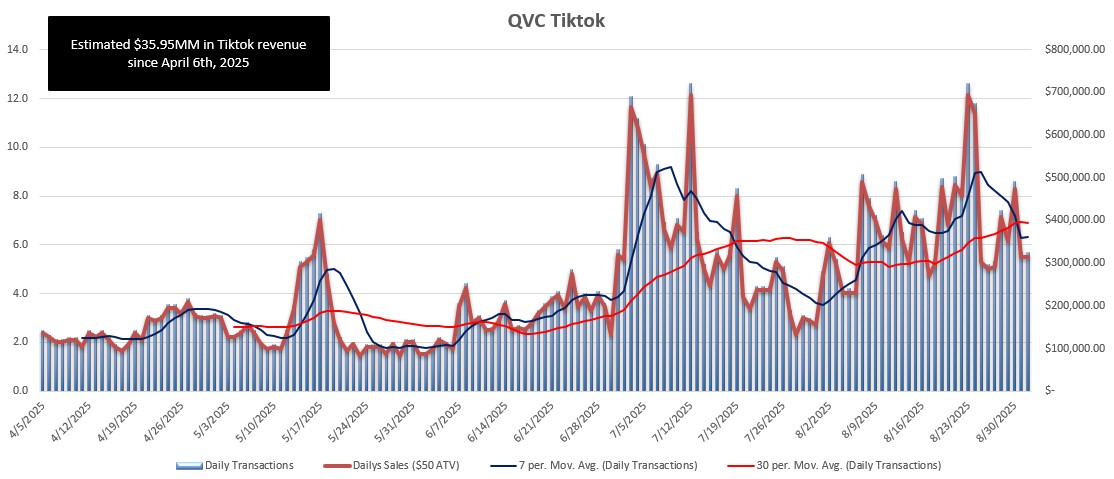

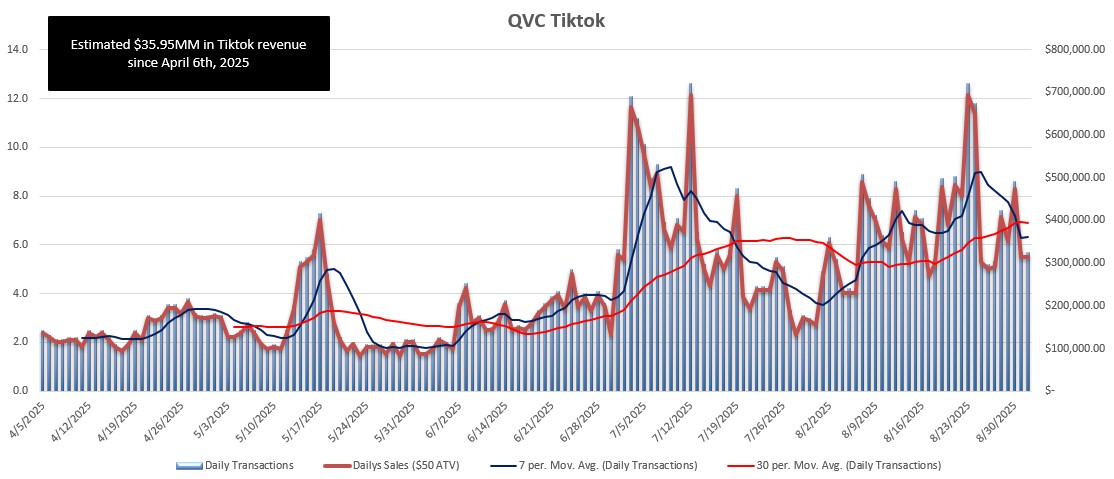

Tiktok itself may be turning into a great growth driver but it needs to be put into context. Since Alex Wellen joined their growth on the platform has started to really improve with daily transactions bumping up. Since July 3rd their daily average of transactions has been 6.5K compared to April 6th - July 2nd it was 2.9K.

Now if we assume $55 average transaction value (ATV) and look at everything they've done since April 6th, this is currently a ~$35.95M business. If the daily transactions stay in the 6.5K range then annually it would be trending towards a $130.49M business. Excellent! Though if we zoom out this is only 1.5% of QVC, Inc 2024 revenue. If they start to average 15K daily at $55 ATV then we're looking at a $301.13M business but even that is only 3.3% of QVC, Inc 2024 revenue.

QVC has been on many of the other major social/streaming platforms for a while so Tiktok would seem the be the biggest growth driver. The challenge is the ATV is not $55 as I track it much lower manually and if I use external sources like Kalodata they have the ATV around $39.62 for past 30 days, which would make that 15K daily average $216.92M annually which is only 2.4% of QVC, Inc 2024 revenue.

While Tiktok customer counts were not in any of the quarterly reports from QVC, the revenue was and they still declined 11%. If they add Tiktok customers into the counts in Q3 and there is no corresponding revenue jump then this is nothing but marketing fluff. The story is and has been EBITDA declines for some time.

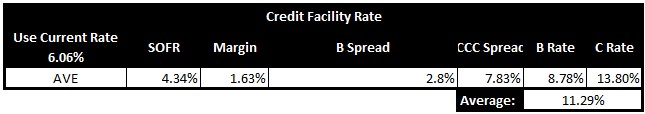

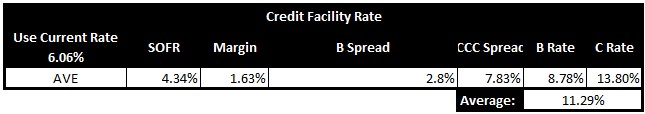

Now that we have modeled the above and the LME took place we also need to consider additional post-LME risks. There are still some senior notes left but there is $2,900M in bank debt left. The banks will be willing to work with QVC but this will be an amend and extend situation. There is a < 5% probability they will roll this facility into the future for a lower or equal to the current 6.06% rate today - future rate will be higher. The banks now lost potential value by seeing QVC, Inc. leverage cash to tackle longer term debts reducing their own recoveries and now also burden almost all the secular EBITDA risk.

Below is my model for where I could see their new floating rate be around:

The current facility has a 6.06% rate but given where SOFR is, their current draw, and credit spread I could see a new rate being at 8.78% (if B spread is used) - 13.8% (if CCC spread is used).

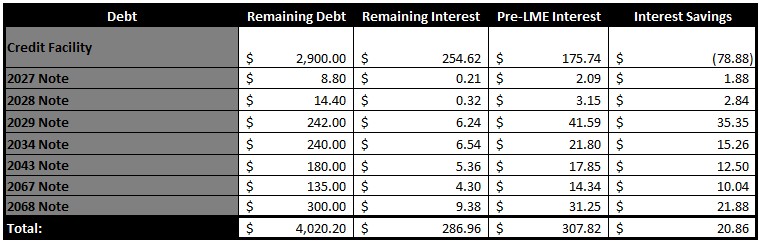

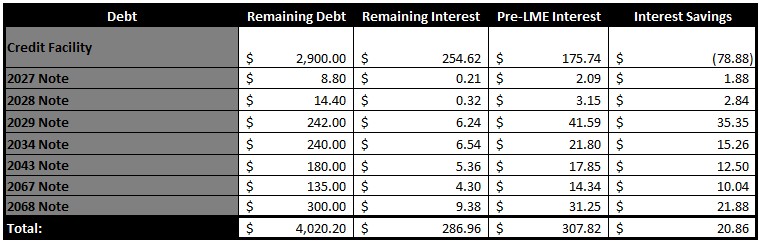

Now post-LME in the event the B-spread is used to set the new facility rate the company actually only saves $20.86M in annual interest. While debt profile improves the actual annual cash flow through is not too great:

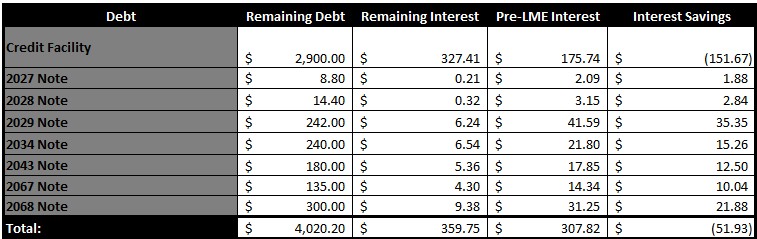

Now in a worst case if the CCC spread is used the company doesn't save anything, even after the LME, and is actually paying $124.72M more annually in interest:

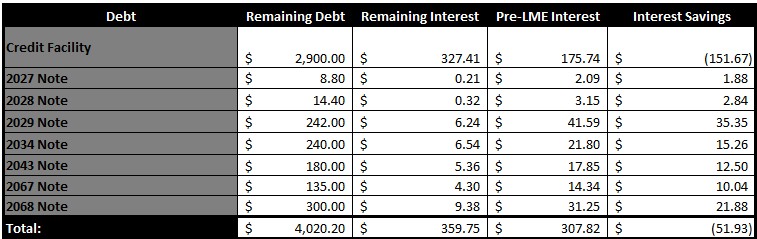

If we take the average of B & C and use 11.29% then the company is still paying $51.93M more in interest per year:

Now one can argue that new paper will be issued to term the facility out, but given what new paper is being issued for we will likely see a higher rate than what the facility even gets. Cash situation does not change.

Now the ParCo (QVCG) has $100M more annually to play with because of preferred shares going away, but the risk is as EBITDA continues to see pressure this starts to tighten the leverage ratio down at OpCo once again. The $391.15M in remaining OpCo cash is also not free since good chunk came from prior asset sales & the Q2 2025 bank draw and there is still a need to fund working capital. So leverage ratio is understated IMO even if technically correct. And with less cash being generated, even if not restricted, the cash upstreaming is less than it needs to be because QVC, Inc has less to upstream.

While an LME is the latest saving move I see presented by investors, I find most analysis to not be of quality. Too much hand waving major issues away.

- LME will not subordinate existing debt & any holdouts. If super-senior debt was introduced you would need anything remaining to agree including the banks. Regardless outside of bankruptcy, senior debt is not being subordinated without each tranche consenting. These holders understand this even if the covenant risks hurt - it doesn't strip what matters.

- While QVC has a lower leverage ratio post-LME and could issue new debt they cannot issue new super senior debt that subordinates existing senior debt and even if they could it undoes the entire effort of an LME and raises leverage ratio once again. New paper comes with a higher rate and eats into any post-LME cash flows.

- I saw one challenge the QVC, Inc subs could issue debt themselves, but issue is their subs are already co-borrowers and the collateral for the senior secured debt is tied to QVC, Inc equity so would be blocked. QVC subs likely have no collateral to offer either since assets are already pledged to the credit facility and all the senior debt has equity pledged. The current debt owns it all in some form.

- Asset drops? What assets? QVC, Inc has little P&E left compared to peak and can't push the equity down.

Perhaps I am too in the weeds and my analytical side will be proven wrong? Perhaps I am too in the weeds and will be proven right? From my view the math of an LME offers minimal wiggle room and extends the runway, but doesn't change much. Annual savings can easily be killed with bank amendments to rate when October 2026 facility extends and ultimately EBITDA trajectory is not changed either.

From the list of symptoms are patient is presenting, these are also not typical LME moves, but something more extreme:

- March 7th, 2025: Fitch downgrades QVC to B- from B

- May 23rd, 2025: QVC Group suspended paying QVCGP dividend.

- May 27th, 2025: QVC hired Evercore, Inc and Kirkland & Ellis and senior holders hired PJT Partners and David Polk & Wardell

- LITNA holders hired Centerview and Akin Gump Strauss Hauer & Feld

- May 30th, 2025: Fitch downgraded QVC again going from B- to CCC+.

- June 20th, 2025: QVC hired Roger Meltzer of DLA Piper and Carol Flaton to the board paying each $50K a month.

- August 7th, 2025: Earnings released and revenue further dissapointed. Revolver had $75M drawn in addition. It was also reported after earnings period company borrowed another $975M on the revolver bringing total borrowings to $2,900M.

- August 13th, 2025: QVC credit syndicate got 75% together and hired Simpson Thacher & Bartlett.

- August 15th, 2025: Company adjusted executive compensation which mirrors a KERP/KEIP plan.

- August 26th, 2025: S&P downgraded QVC from CCC+ to CCC.

We are not too far from action being taken. Possible company waits until after Q4, which is their monster quarter, before doing anything though - tough to say. Regardless, my analysis does not support an LME creating enough value to change the course for QVC. I am open to the discussion, but request some numbers when it happens :)

Happy investing,

Sean |