(1) I think <<gold>> shall go down before going up again

(2) I do not know that in US$ terms there is an upper limit to how high gold might go, even though gold shall go down, perhaps in large steps, in a 'V' that might last anywhere from 6 weeks to 6 months

in the meantime, bad stuff happening, and the Team Trump best do coup at the FED before it is too late

bloomberg.com

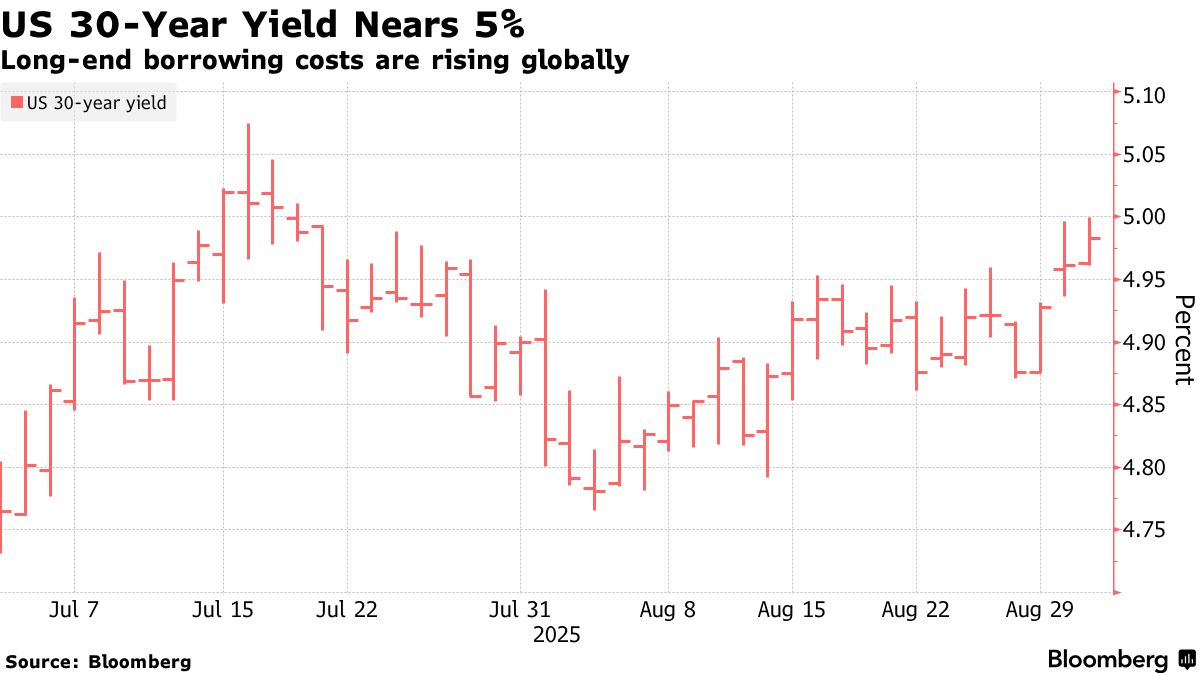

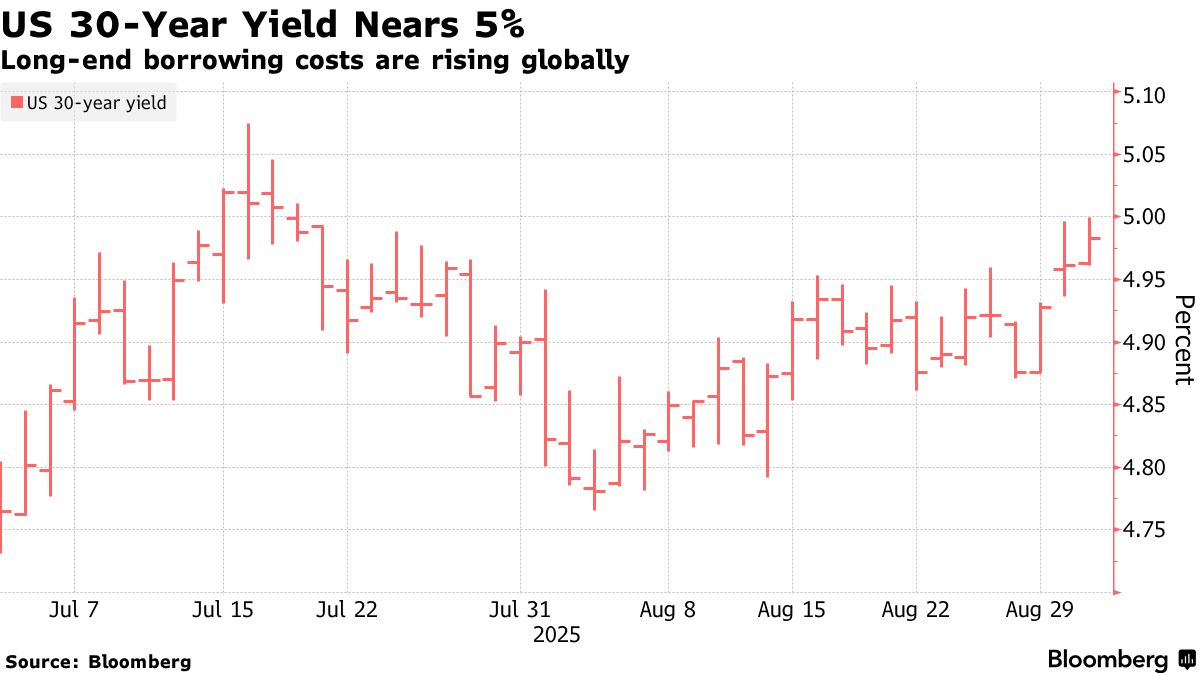

US Treasury Yields Brush With 5% as Global Borrowing Costs Mount

Global Bond Selloff Not Necessarily Contagion, HSBC’s Kettner Says

Source: Bloomberg

By James Hirai

September 3, 2025 at 5:18 PM GMT+8

Updated on

September 3, 2025 at 6:42 PM GMT+8

The US 30-year Treasury yield rose to near the psychologically key threshold of 5% for the first time since July, underscoring investors’ reluctance to fund America’s swelling federal budget gap.

The yield climbed as much as four basis points to 4.999% on Wednesday before paring its advance, mirroring similar moves in the UK and Japan, where a deepening selloff pushed borrowing costs to the highest this century.

“The signal is quite clear that there is still at these levels no appetite for the long end,” Ella Hoxha, head of fixed income at Newton Investment Management, told Bloomberg TV this week. “The risks are there’s going to be less appetite going forward.”

In the US, the moves underscore the pressure on the government from investors who want more compensation as they’re called on to finance spending plans and tax cuts by the Trump administration.

The underperformance by 30-year Treasuries this year contrasts with more popular short-dated maturities. As 30-year yields have risen, those on 2- and 5-year notes have fallen, creating a divergence that last happened over a full year in 2001.

Rising US 30-year yields and falling two-year ones marks “an unusual situation reflecting investors’ wish for more compensation to hold long-term bonds,” BlackRock Investment Institute strategists including Wei Li wrote in a note.

As pressure builds on the Fed to lower rates, traders typically buy shorter-dated notes that are the most sensitive to changes in monetary policy.

With US job openings data due later Wednesday, the selloff may abate if a weaker number leads to widening bets on the scope for Federal Reserve interest-rate cuts, according to Evelyne Gomez-Liechti, a strategist at Mizuho International Plc. Money markets are betting on a quarter-point cut from the Fed this month. Economists polled by Bloomberg forecast openings dipped in July to 7.382 million.

“A downside surprise in openings, especially if coupled with higher layoffs and lower quits, could be a good combo to see dip-buying in Treasuries,” Gomez-Liechti said.

What Bloomberg Strategists Say...

“Treasury traders will have some excuse to move the needle in either direction given the impending JOLTS data for July as well as factory orders and the Fed’s Beige Book, but a more definitive take on the bond market may be left to the ADP employment data (to a lesser extent) and the non-farm payrolls data this Friday. With the markets already primed to expect another weak report, a surprise upside reading may mean that global bonds head into the weekend still in search of an elusive circuit-breaker.”

— Ven Ram, Macro Strategist |