ON RRPs Drop to Near-Zero $17.9 Billion, Liquidity Flow into Markets Over, while TGA Refilling Drains Liquidity from Markets

by Wolf Richter • Sep 3, 2025 • 8 Comments

Liquidity now begins to drain out of the markets for the first time since the debt ceiling.

By Wolf Richter for WOLF STREET.

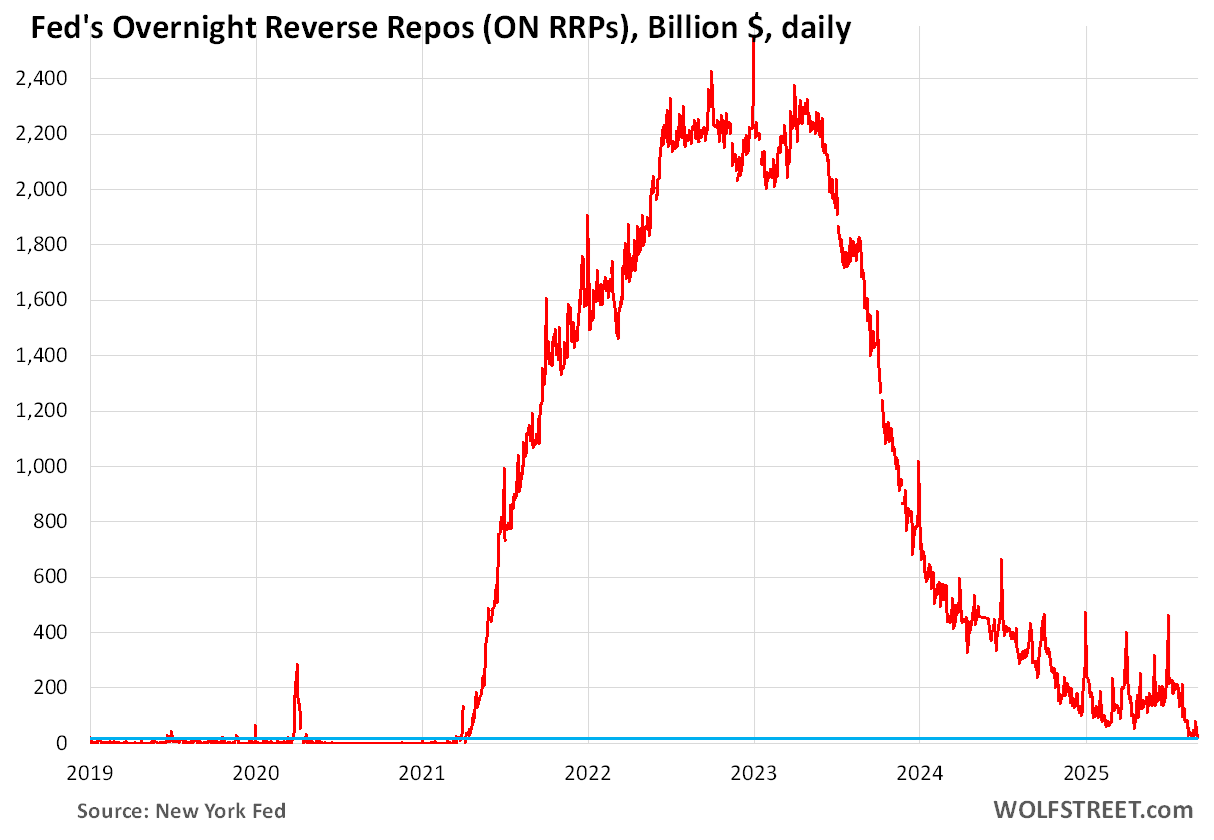

ON RRPs fell to $17.9 billion today – essentially near zero compared to the peak range of around $2.3 trillion that prevailed from May 2022 through June 2023 – and the lowest since early April 2021 when huge amounts of QE were beginning to wash into ON RRPs. In normal times, these Overnight Reverse Repurchase agreements are zero or near-zero. But QE wrecked the normal times. The blue line in the chart denotes the current near-zero level.

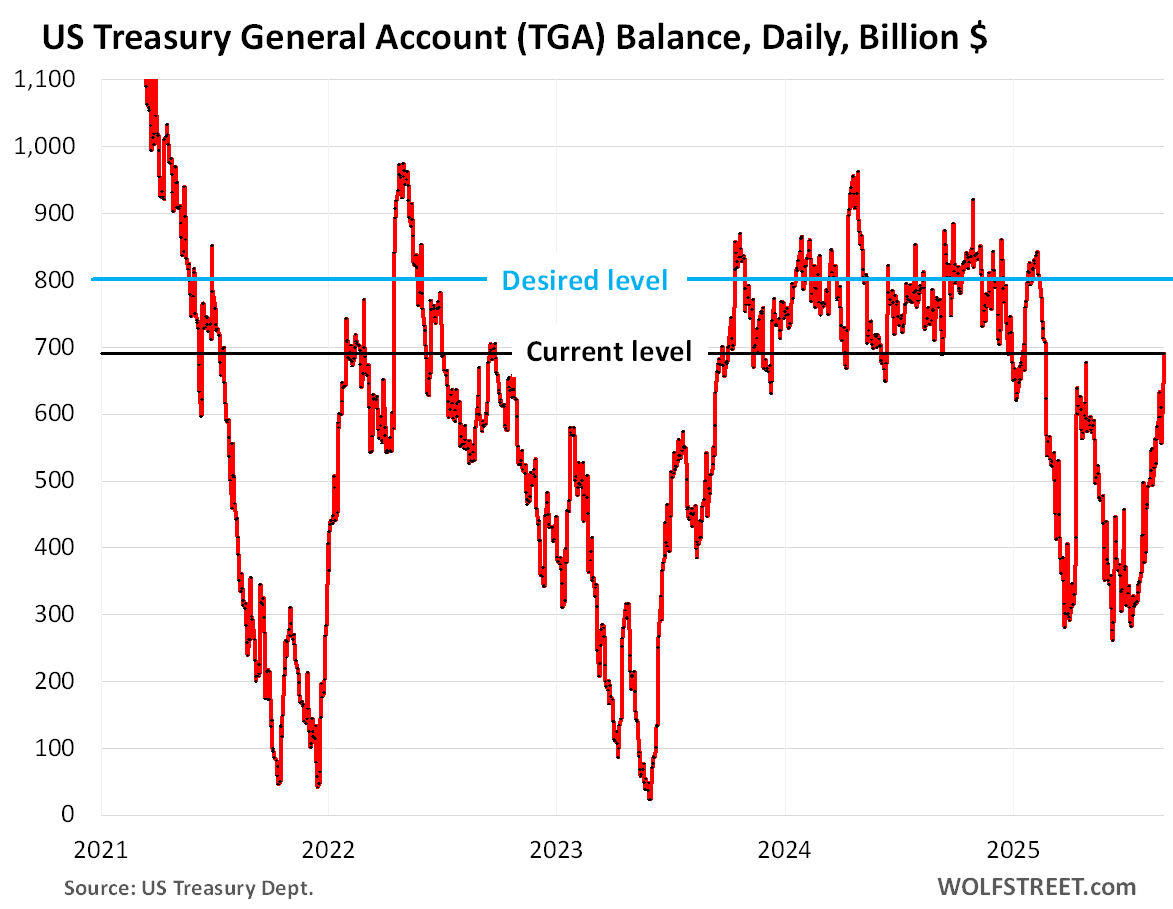

This has big implications for liquidity flows out of financial markets. ON RRPs, now being near zero, can no longer supply any noticeable amount of liquidity to the financial markets. But the government’s checking account, the Treasury General Account (TGA), is still getting refilled after the debt ceiling and is still draining liquidity out of the financial markets.

ON RRPs, refilling the TGA, and QT.ON RRPs represent excess liquidity in the financial markets. They’re used mostly by money market funds to deposit extra cash at the Fed. They’re a liability on the Fed’s balance sheet, and the Fed currently pays 4.25% interest on ON RRPs.

ON RRPs are used mostly by money market funds that have to invest in high-quality short-term instruments. Money market funds have many other options, including Treasury securities with less than one year to run, commercial paper, and lending to the repo market. They will shift funds to where they can earn a little more and still satisfy their liquidity needs.

Other approved ON RRP counterparties are banks, government-sponsored enterprises (Fannie Mae, Freddie Mac, etc.), the Federal Home Loan Banks, etc.

The spikes in the chart occurred at quarter-end and at year-end for window-dressing purposes. There are also smaller spikes at month-end.

When ON RRPs rise, being a Fed liability, they have the effect of draining liquidity from financial markets; and when they fall, the have the effect of adding liquidity to the financial markets.

ON RRPs have been falling since the end of the debt ceiling, thereby adding liquidity to the markets, just as the refilling of the TGA drained liquidity from the markets.

But ON RRPs are now near zero – where they are in normal times – and cannot fall much further, and cannot add much more liquidity to the market, so this influx of liquidity from ON RRPs into the markets has run its course. But the draining of liquidity via the refilling of the TGA continues.

The TGA is being refilled after the debt ceiling drained it down to $260 billion. Refilling the TGA back to the desired level of $800 billion requires that the Treasury Department sells even more Treasury securities at auctions than is needed to just cover the deficits and refinance maturing securities. Financial markets have to come up with this extra cash to absorb those Treasury securities needed to refill the TGA.

Refilling the TGA thereby drains liquidity from the markets. But the ON RRPs provided much of that liquidity. With ON RRPs now down to near-zero, the rest of the cash to refill the TGA back to $800 billion will come from the markets.

The TGA balance, at $690 billion at close of business on September 2, is still over $100 billion shy of the desired level, and as the TGA gets refilled to around $800 billion, those amounts get drained from the financial markets.

The massive surge of ON RRPs starting in 2021 was the result of the Fed’s QE that created so much liquidity that markets didn’t know what to do with it, and when it was even a little more profitable to deposit this liquidity at the Fed, they did, and ON RRPs ballooned to a range of $2.3 trillion back in 2022 through June 2023.

The subsequent plunge in ON RRPs is largely a result of the Fed’s QT, which has shed $2.3 trillion in assets from the balance sheet. Most of the QT has come out of ON RRPs so far – meaning that QT has so far only drained excess liquidity.

But ON RRPs are now near-zero, the additional liquidity needed to refill the TGA plus the additional QT will come out of reserves, which represent liquidity that banks have deposited at the Fed. Reserve balances were still at $3.22 trillion as of Thursday’s balance sheet. And they should now begin to decline under QT and the refilling of the TGA. |