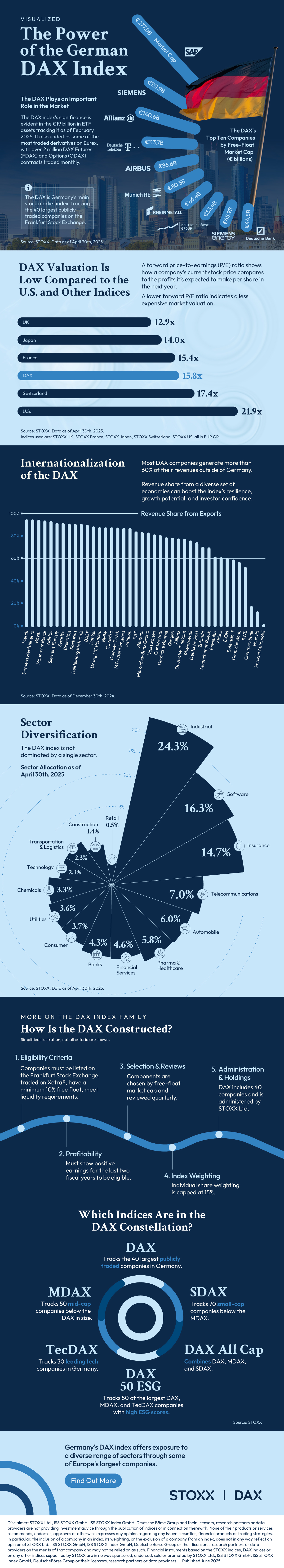

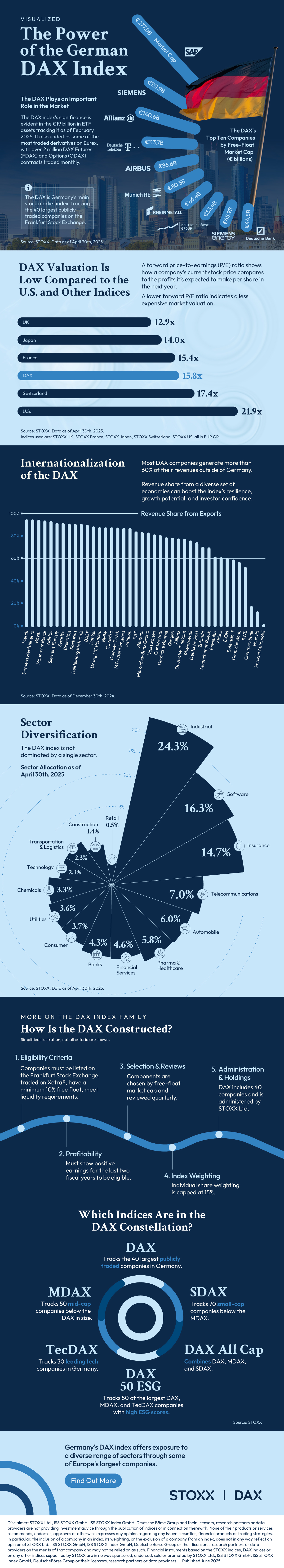

Visualized: The Power of the German DAX Index

June 26, 2025

By Julia Wendling

Graphics & Design

The following content is sponsored by STOXX

The Power of the German DAX IndexDid you know that investing in products that track the DAX offers exposure to some of Europe’s largest companies across a diverse range of sectors?

This graphic, developed in partnership with STOXX, highlights the key facts investors should know about the German DAX index.

An Important Role in the Market

The DAX is Germany’s main stock market index, tracking the 40 largest publicly traded companies on the Frankfurt Stock Exchange.

CompanyMarket Capitalization (€ billions)|

| SAP | 277.0 | | Siemens | 151.9 | | Allianz | 140.6 | | Deutsche Telekom | 113.7 | | Airbus | 86.6 | | Muenchener Rueck | 80.5 | | Rheinmetall | 66.4 | | Deutsche Boerse | 53.4 | | Siemens Energy | 45.9 | | Deutsche Bank | 44.8 |

The index’s significance is evident in the €19 billion in ETF assets tracking it (as of February 2025). It also underlies some of the most traded derivatives on Eurex, with over 2 million DAX Futures (FDAX) and Options (ODAX) contracts traded monthly.

Valuation

A forward price-to-earnings (P/E) ratio shows how a company’s current stock price compares to the profits it’s expected to make per share in the next year. A lower forward P/E ratio indicates a less expensive market valuation.

IndexForward P/E Ratio|

| UK | 12.9 | | Japan | 14.0 | | France | 15.4 | | DAX | 15.8 | | Switzerland | 17.4 | | U.S. | 21.9 |

The DAX’s valuation is less expensive compared to its American counterpart. The former was at 15.8 as of April 30th, 2025 versus 21.9 for the United States.

An International Index

Most DAX companies generate more than 60% of their revenues outside of Germany. Revenue share from a diverse set of economies can boost the index’s resilience, growth potential, and investor confidence.

Instrument Name% Revenue share from exports|

| MERCK | 95.2 | | SIEMENS HEALTHINEERS | 95.1 | | BAYER | 94.9 | | Hannover Rueck | 94.2 | | ADIDAS | 93.7 | | Siemens Energy | 91.9 | | Symrise | 91.9 | | Brenntag | 91.3 | | Sartorius | 91.0 | | Heidelberg Materials | 91.0 |

The pharmaceutical giants Merck (95.2%) and Bayer (94.9%), along with the automations company Siemens (95.1%) all derive approximately 95% of their revenues from overseas customers. The vast majority of companies (37 of 40) see over 50% of their revenues coming from international sources.

Diverse Sectors

The DAX index is diverse across sectors. The industrial sector makes up approximately one-quarter of the index (24.3%).

SectorWeight|

| Industrial | 24.3% | | Software | 16.3% | | Insurance | 14.7% | | Telecommunication | 7.0% | | Automobile | 6.0% | | Pharma & Healthcare | 5.8% | | Financial services | 4.6% | | Banks | 4.3% | | Consumer | 3.7% | | Utilities | 3.6% | | Chemicals | 3.3% | | Technology | 2.3% | Transportation &

Logistics | 2.3% | | Construction | 1.4% | | Retail | 0.5% |

Software (16.3%) and insurance (14.7%) are the second and third largest sectors, respectively. Telecommunications (7.0%) and automobiles (6.0%) round out the top five in the list.

Learn More About the German DAX IndexThe German DAX index is one of the most-followed indices in Europe, tracking many big names across a variety of sectors. And, beyond the headline index, there are several other indices in the DAX constellation investors can consider, including ones that focus on small- and mid-caps, tech companies, and top ESG performers. |