Some game theory thoughts on the situation outside of my prior valuation posts. I felt I needed to personally map this since I read it is only QVCGA that appears to be a logical "winner" in this race to the bottom and in my mind this is not so simple, so the below is where my mind is going. This is really a Part II to my LME valuation post from 9/2/2025.

We have a nice Mexican standoff between banks, bonds, and the company.

Now the talk of the town is the liability management exercise (LME) and how that's going to take place. Somehow QVCGA equity will thrive again and the margin of safety is already in the price so buy up. The question I ask then is does the LME solve the problem at QVC? The math I have shared prior does not support an OOC LME, which then had me ask another "why" question and below is where my mind begins to go.

Senior secured notes have an aggregate value $2,146M outstanding with 66.4% of that entire amount maturing on and after 2034 - this leaves only $721M that matures between 2027-2029. We then know the next maturity concern is not the bonds, but the banks who now have $2,900M outstanding with the credit facility maturing October 2026.The rest of the debt is not QVC, Incs problem because it resides higher at HoldCo so from a lender and cash flow concern the LITNA debt in 2029-2030 is really a HoldCo problem not an OpCo one.

Let's look at the bank syndicate:

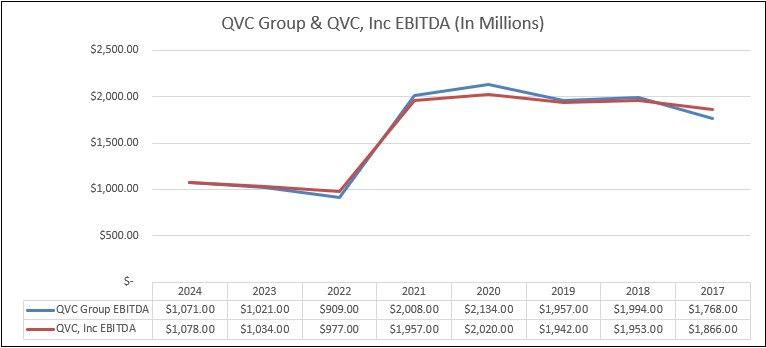

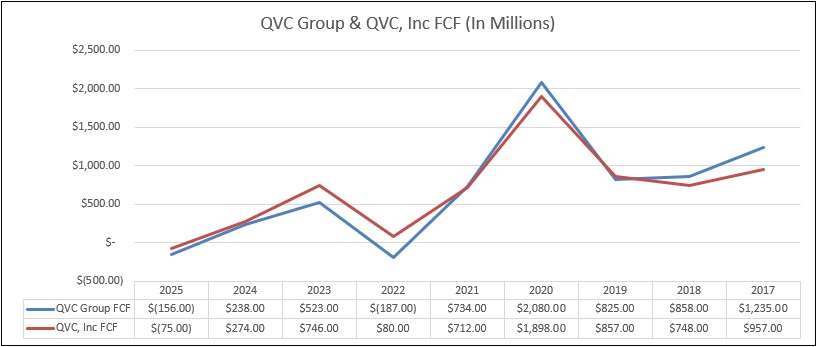

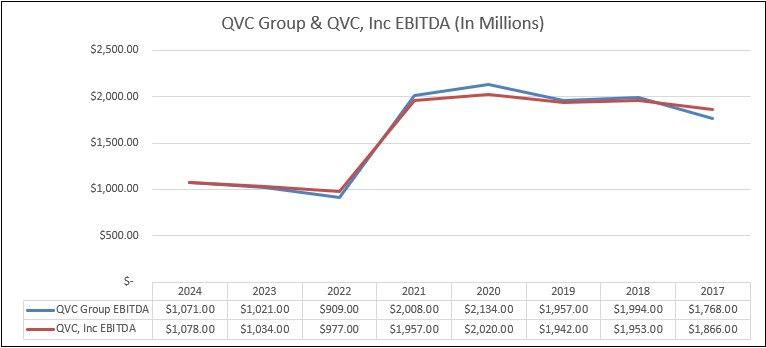

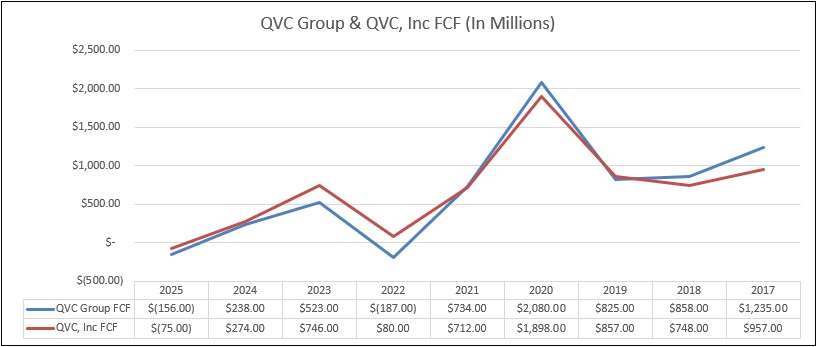

As stated, we know the banks now have $2,900M of their money lent to a customer with declining EBITDA (earnings potential) and also a contraction in real cash flow generation.

In Q4 2024 earnings Ben Orin (with Liberty Media) was asked by Karru from Jefferies about the revolver extension. Ben stated "I think the way we're thinking about that is October 2026 is the maturity, October 2025 is the go current. And so we are in active dialogue with the banks and hope to have something back to you in the next one to two quarters".

Next one to two quarters later....

By Q1 2025 we then have QVC CFO/CAO Bill Wafford who was asked if cash flows would be used to repay the revolver and he stated "in terms of how we’ve managed capital structure and free cash flow, I mean no change right now. But like we said, we’re evaluating what our opportunities are going forward." and later he was asked by Karru specifically "just in terms of proactive financial option review, does this mean that the RCF renewal is off the table? " and Bill responded "So I mean, we’ve given you our kind of where we are in terms of the leverage ratio and kind of what that gives us in current liquidity right now. We haven’t said anything is off the table right now. But obviously that’s why we’re evaluating what all options are given kind of what the current headwinds are and where the business is today."

In Q2 2025 Bill Wafford then stated "additionally, to further increase our financial flexibility, we made the decision to borrow $975M of the funds available on our revolving credit facility in July 2025. These decisions reflect the Board’s focus on and commitment to taking the necessary steps to preserve cash and enhance long term value for our business, customers, partners and investors". There was no live Q&A for this earnings call so no further explanation given, but going from Ben's comments in Q4 to comments and actions we see by Q2 there is a large difference.

It would seem our roadblock is not the bonds but the banks. If an amend and extend of the credit facility was simply in play it would have been done like every other time prior. The bonds are for the most part termed out and don't present a maturity risk and the only major issues they present is leverage ratio restrictions and interest expense eating cash flows to the tune of $132.08M annually. The root cause of both those being issues is though the declining EBITDA and cash flows as if those resolved tomorrow the bonds would not be a problem.

The solution floated though is a liability management exercise (LME) to tackle the bonds to reduce leverage and interest, but if we again consider the above, the two major issues are declining EBITDA + cash flows and the banks with the nearest maturity and now $2,900M drawn - does an LME solve these? It helps cash flows only but not enough too if a higher bank rate comes into play.

If the banks extend it will likely be to 2027-2028 as they will still want to come before any maturities, including ParCo, to ensure cash is protected, so they still become nearest maturity. Company will have used precious cash for an LME which leaves the banks in the following situation:

- They now carry majority if not all of the lending risk post LME and EBITDA/cash flows are still contracting currently. Lenders don't go off speculative optimism (e.g, Tiktok) but what's really likely to get them paid, especially with $2,900M borrowed.

- They also just saw the company use their cash (which includes borrowed bank money) to benefit long-dated senior bonds who took cash today and thus reduced value for banks and in the event EBITDA does indeed keep declining and company is forced to file anyway and banks recover much less.

The banks post any LME, or even without an LME, will push for a higher interest expense. Why? The company has had four ratings downgrades in 2025 alone (2 from Fitch, 1 from Moody's, and 1 from S&P) and they have the nearest maturity risk. In fact in any amend, LME or not, the banks will likely go for a higher interest as I modeled prior, tighter cash covenants which prevent upstreaming to parents, tighter restrictions on new debt issuance, and a few other things. In the end though the higher interest expense as I modeled can almost offset any interest gains from an LME anyway making the cash savings muted and in the end banks are still nearest maturity. The LME would have really solved minimal.

Remember too, through all of this the banks are pari passu with the senior notes on the QVC, Inc equity too.

One then can assume the 75% signing the cooperation agreement is a sign the banks do not see simple LME as a likely path too. We also know in the WSJ report "the pact commits the lenders to move in lockstep as they negotiate with the company on restructuring options, the sources said. The formation of the cooperation group was a defensive move, the sources said. Revolving lenders rarely sign cooperation agreements before negotiating with a company. These lenders typically are the first to get paid back in a restructuring and often are made whole, even in bankruptcy.

But QVC’s revolving lenders are on equal footing with creditors holding roughly $2 billion in secured bonds, diluting the value of the collateral and making repayment less certain."

So the banks are stuck between a client who has drawn $2,900M on their dime, the company itself which is in secular decline without a drastic pivot from their current distribution path, and the counter is also needing seven bond groups to agree to an LME that leaves enough company capital to service their bank debt.

Now for an LME to really be successful you would need to see a large chunk of the outstanding $2,146M to be retired - anything less does not make enough impact to cash flows and still poses risks in the event EBITDA continues to decline. Keep in mind, you need to knock out all $2,146M to get the full annual interest savings of $132.08M (without factoring higher credit facility interest rate) so anything less than the full and you create less cash savings AND still roll with a higher leverage ratio which makes an LME ineffective here. So my opinion and point before is you really need 100% here to make this economically work. Anything less does too little.

You also would need each tranche to vote >=50% to even start changing covenants and >=66 2/3-75% (depending on indenture) of each tranche to modify the security document and remove the QVC, Inc collateral pledge. Maybe a few tranches go in and you take out some debt here, but you are playing seven groups and need each of them to vote in your favor. It would require each group to really vote above 75% too so collateral can be changed otherwise the risk is you knock out some debt, burn up cash (yours + banks), and if you didn't get majority to vote above 75% then you can't even really punish because they still have claim to QVC, Inc equity and remain pari passu with the banks. Not too much a win for the banks here if QVC burned capital and didn't get a big enough win.

Now let's say some consent and post LME the leverage ratio is improved enough and perhaps super senior debt gets issued to screw the rest that holdout, but then we're back to the same problems in that no cash interest savings and tighter leverage ratios so QVC can't really can't even go this route reasonably. Issuing super senior debt while in secular decline is going to be costly so likely company is paying more annually than if they just left current bonds. New debts plus higher credit facility hurt the cash flows even more and undid any LME work.

Company bleeds more cash and banks still have the nearest maturity wall.

The banks also have some room here too because if they sense the company is heading towards a stalemate and looking to bleed value they can let the revolver go current and then QVC has a real problem as this starts to push them closer to a real default.

Perhaps we now see why the banks hired Simpson + Lazzard?

Senior secured notes:

Any LME really requires the bonds to play ball anyway, but what could the bond have in play? I am to understand that the bonds are fragmented players and hate their paper so will sell at any offer presented, but I find that not to be the most logical case for bond holders. First, are bondholders completely fragmented? Bloomberg reported on May 28th that holders hired PJT Partners and Davis Polk & Wardwell - this move is not one done from fragmentation but of some form of unity. This alone should at least reduce the probability that bonds are indeed as fragmented as one thinks and fighting from that position. We must also consider QVC has been viewed "distressed" since 2022 and bonds today are likely not being held by original holders but bought on the secondary market and often large blocks are sucked up to prevent majority votes as a strategy. The fact we see legal counsel hired indicates there are enough large block holders that can band together and are strategically aligned.

Second we must then consider, if bonds are not as fragmented as one would hope, then it may also indicate that they see an opening for a higher exit value. This would mean they may not be open to taking pennies on the dollar to walk away for an OOC LME while they potentially can get more. They have leverage in that they have QVC, Inc equity pledged as collateral AND are pari passu right now with the banks.

Most of these bondholders have modeled recoveries already so if QVC cash offering isn't great then no way they give up their equity "pearl" let alone even 50% to have covenants stripped from them for an OOC LME. If any QVCGA holder hasn't modeled recoveries then you cannot say what bondholders will or won't do. Any successful LME requires every. single. tranche. to vote >= 66 2/3-75% to change collateral and make the bonds go away otherwise you're just taking out smaller chunks of bonds leaving too many to make it work. Let's say chapter 11 bankruptcy is the scenario and the creditors (banks and bonds) take equity in the new QVC, Inc via plan confirmation and continue to run it post bankruptcy. They have the option to install new board, new management, strip the thing and either eventually file an IPO for the new lean company OR sell it to some PE company as the PE market is actually booming right now thus they recover more by taking the equity instead of LME cash.

They can holdout for more value OOC and the company can threaten to file but it's not uncommon to see this bluff called or even invited. Truth is the company is the ones at risk of losing their equity and management control if they file and banks get lumped into the same creditor class as the bonds when they do. If bonds are not as fragmented then this isn't a bad negotiating point. If they feel they can't get fair value OOC then let a judge get involved and they will get something and bring the banks in with them.

And we must consider if the company files the banks will likely negotiate with the company/courts to convert $975M prepetition draw into DIP postpetition (super priority) and the rest of the $1,925M is now lumped in with the bonds; maybe some of the $1,925M gets negotiated with that DIP lending but not all of it and that matters for bonds! The $975M is really the only new "injection" as the rest was already used up but depending on legal arguments in the court negotiations the banks could try and get more facility draw into the postpetition DIP roll-up. In this situation, knowing bankruptcy can cost significant sums as it drags on, it could require the banks to funnel in more capital as DIP to protect themselves from creditor dilution. This is a position of weakness for the banks but makes QVC itself stronger and if they claim equity they benefit.

The 75% cooperation agreement from the bank syndicate is likely for when a filing occurs they are aligned and can DIP block (new capital that subordinates them), otherwise there isn't too much they can do OOC unless they and the company convince seven tranches to vote in favor of an LME and walk, but it risks excessive capital bleed, it doesn't fix company declines, and doesn't fix bank maturity wall. Bonds of course know all of this too giving them leverage if they align.

My challenge would then be perhaps the bondholders are not as weak and needing to exit as one anticipates.

The Company:

QVC itself really has no leverage outside of the current cash. They have sold off assets since 2021 and only had $330M of cash before the $975M draw. An LME doesn't give them maturity flexibility and an amended facility likely nets away any interest savings. The ParCo getting rid of the preferred shares does nothing for QVC, Inc either because they have not been upstreaming cash to cover the preferred dividend so it gives parent extra downstream cash ($275M?) ability but not much if business doesn't improve.

Not to mention the company needs their credit to fund working capital. If the bank draw is all capped and they blew a ton of cash on an LME and there is risk for cash bleeds, then the company is likely in a real tough spot even post LME. If they also can't make a move before revolver goes current this sends red flags to the market all over including their vendors.

Again, the company doesn't have the leverage of drawing this out and bleeding capital/value either because as I wrote the banks can let the facility go current and by October 2026 it forces a default. Not ideal for anyone BUT it's a strategy the banks have to prevent the company dragging this out.

From my view I am not sure the bonds are the weakest in this exchange as many may think. I think the banks are in a bad spot as they are married to a company that is clearly in decline and they have lent this company $2,900M. The bonds have no reason to play ball because if the company files the banks go in with them and a symbiotic relationship forms as the banks self-preservation directly or indirectly helps the bonds extract value. If they take QVC, Inc as a new corporate entity as part of plan confirmation they are all in that together and will instill a new board to run it on their behalf.

There of course more scenarios that exist, but these are some things to consider above. I of course can be proven wrong, and truth is, this isn't a game of ego, but about 1) not losing capital 2) making money. Chasing the common in a scenario where common looks to be Angel Eyes against Blondie and Tuco doesn't seem to be the best investment for me.

Happy & cautious investing,

Sean

P.S. I was reviewing the recent timeline and forgot the short-term Greg Maffei deal that was announced before the May 28th Evercore news. I find it interesting their chairmans deal is a short-term one given everything else. Again, in isolation nothing, but in aggregate our symptoms start to give us a firmer diagnosis.

- March 7th, 2025: Fitch downgrades QVC to B- from B

- May 23rd, 2025: QVC Group suspended paying QVCGP dividend.

- May 27th, 2025: Greg Maffei chairman agreement extended. The Employment Agreement provides for an initial term expiring December 31, 2025, which will be automatically extended through December 31, 2026 unless a notice of nonrenewal is provided by either party at least 30 days prior to December 31, 2025, or Mr. Maffei’s employment with the Company ends before such date (such period of employment, the “Term”).

- May 28th, 2025: QVC hired Evercore, Inc and Kirkland & Ellis and senior holders hired PJT Partners and David Polk & Wardell

- LITNA holders hired Centerview and Akin Gump Strauss Hauer & Feld

- May 30th, 2025: Fitch downgraded QVC again going from B- to CCC+.

- June 20th, 2025: QVC hired Roger Meltzer of DLA Piper and Carol Flaton to the board paying each $50K a month.

- August 7th, 2025: Earnings released and revenue further dissapointed. Revolver had $75M drawn in addition. It was also reported after earnings period company borrowed another $975M on the revolver bringing total borrowings to $2,900M.

- August 13th, 2025: QVC credit syndicate got 75% together and hired Simpson Thacher & Bartlett.

- August 15th, 2025: Company adjusted executive compensation which mirrors a KERP/KEIP plan.

- August 26th, 2025: S&P downgraded QVC from CCC+ to CCC.

|