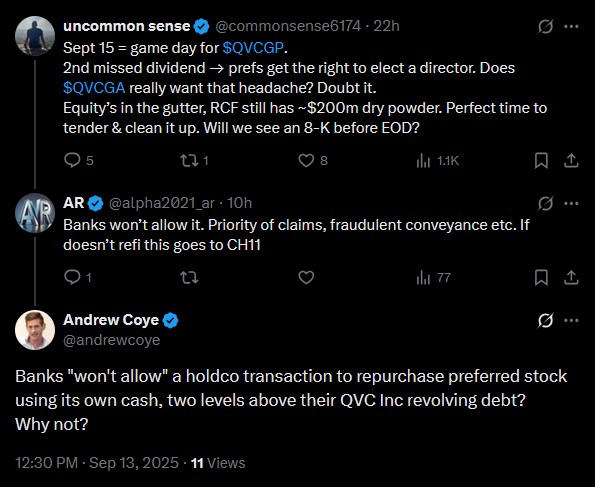

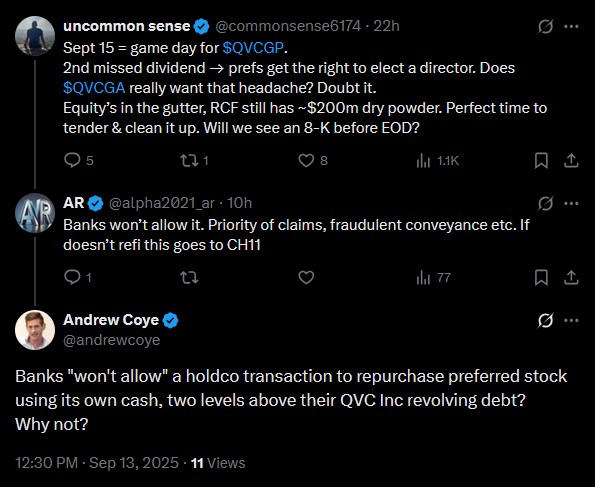

I saw this exchange on X and wanted to add my $0.02. I do not post on X and am purely a lurker but keep it because there is some great news platforms there.

For starters, most of the holders of QVCGP are likely already on the board or close enough to it given how QVCGP was issued and released.

If they're not in the above camp and QVCGP gets to vote in a new board member does it really matter? They shrunk the board when Malone and Wong left and then increased it for the two disinterested directors, Meltzer and Flaton. QVCGP adding a board member doesn't really give them ANY power either because the board still needs to manage the fiduciary duties of the entire enterprise. They can't jump on the board and start calling shorts that benefit themselves (preferred shares). This is a non-factor IMO. QVC isn't making decisions because of this.

Now in the comments one user stated the banks won't allow it and then someone I've exchanged with on Substack, Andrew Coye, is implying the banks can't really block the HoldCo from doing this. Andrew is correct. Andrew is wonderful and have appreciated his insights on many topics.

My challenge here is while banks can't stop the ParCo/HoldCo from doing anything with their capital there is some red tape as is the usual with QVC.

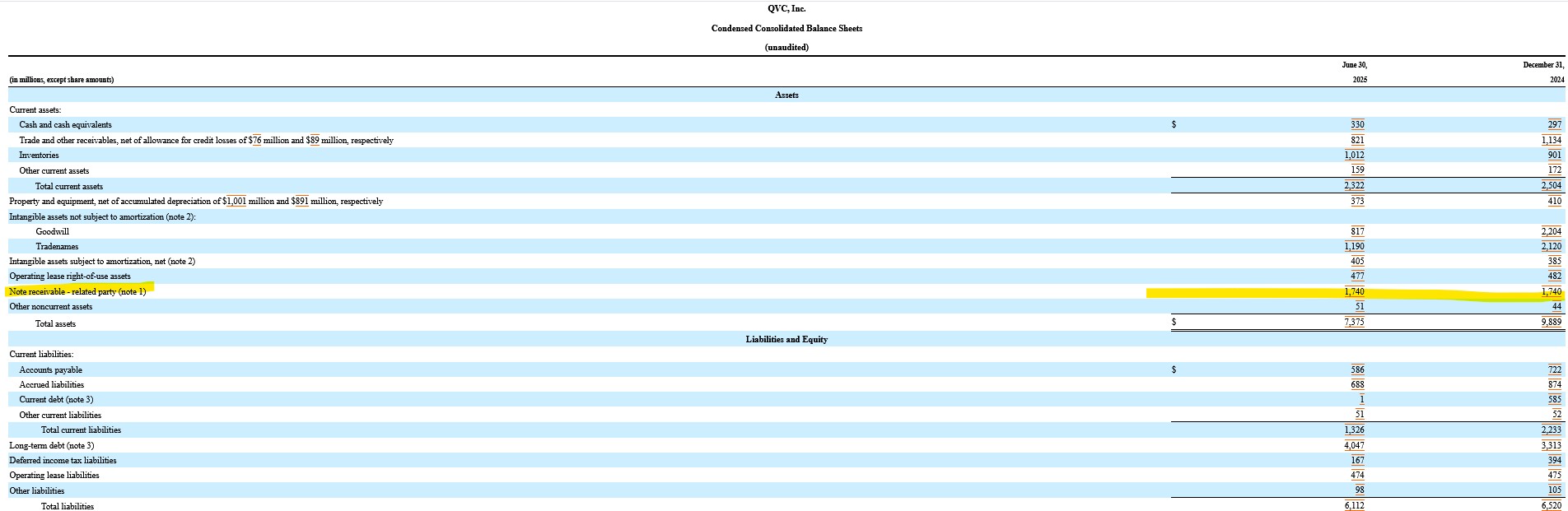

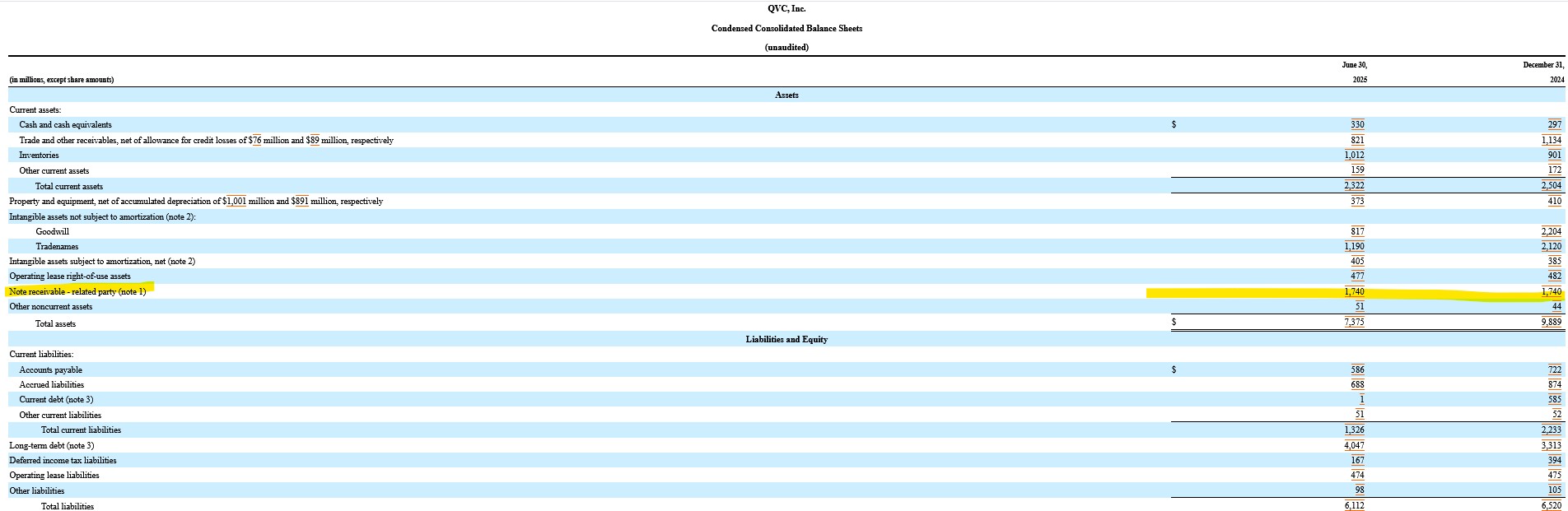

What is the red tape? Likely the $1,740M that HoldCo (Liberty Interactive, LLC) owes to a QVC, Inc subsidiary that sits as an asset on the QVC, Inc books:

These notes were issued December 30th, 2020 by Liberty Interactive, LLC because a sub of QVC, Inc, QVC Global Corporate Holdings, LLC (QVC Global), took on the obligation of LIC's 3.5% exchangeable debentures (MSI Exchangables) and in turn LIC issued a promissory note to the company for the amount of $1,740M and a stated interest of 0.48% payable annually and maturing on December 29th, 2029.

From a QVC, Inc 10-K:

"On December 30, 2020, the Company and Liberty Interactive LLC ("LIC") completed an internal realignment of the Company's global finance structure that resulted in a common control transaction with Qurate Retail. As part of this realignment and upon entering into a payment agreement, QVC Global Corporate Holdings, LLC ("QVC Global"), a subsidiary of the Company, became the primary co-obligor on LIC’s 3.5% Senior Exchangeable Debentures Due 2031 (the “MSI Exchangeables”), which allowed the MSI Exchangeables to be serviced directly by cash generated from the Company’s foreign operations (see note 8 to the accompanying consolidated financial statements). Concurrently, LIC issued a promissory note to the Company with an initial face amount of $1.8 billion, a stated interest rate of 0.48%, payable annually, and a maturity of December 29, 2029. QVC recorded $9 million of related party interest income for the year ended December 31, 2021, included in interest expense, net in the consolidated statement of operations. LIC also repaid $85 million of the note receivable to QVC during the year December 31, 2021."

QVC received $8M in 2024 from these notes.

While this promissory note isn't itself an issue, it becomes one once things get to where they are. I wrote before this will become a roadblock for value (equity) upstreaming if the company files chapter 11 in either a prepackaged or freefall scenario. The senior holders will use this against the HoldCo/ParCo to prevent any further value to leak out and protect the only collateral they really have which is the QVC, Inc equity. There are $1,570M principal value of the LITNA debentures and that same company also has a promissory note for $1,740M to QVC, Inc (it's OpCo) which is greater than total value of LITNA debentures - all this would likely need to be addressed before LIC was able to keep any of their equity in QVC, Inc if QVC, Inc were to file.

That aside, we go back to the preferred shares. Banks cannot block the ParCo/HoldCo from using their cash how they wish BUT that's where this gets interesting. In theory ParCo owns HoldCo and if cash was used to service preferred equity shares while HoldCo had $1,740M outstanding to OpCo it could open fraudulent conveyance claims and open them to clawback lawsuits (up to 2-4 year for look back period). OpCo in a postpetition suit could claim that money was theirs as they have a promissory note that is due before the preferred shares (2029 vs. 2031 preferred) and parent entities used limited cash to service preferred equity before them.

In a bankruptcy filing I would not expect these to matter in the sense of cash being paid to QVC, Inc (direct or to sub), not the case, but they will matter in upstreaming equity value. QVC, Inc itself does not have enough EV to cover all senior holders & banks so what will happen is a lower valuation will be used naturally anyway, but this inter-company promissory note will be leveraged to ensure further equity value isn't bleed from already hit senior holders. If ParCo/HoldCo lost all or majority equity holding in QVC, Inc they are also now losing their main cash cow so any potential cash recovery claims in a postpetition suit just does more damage to ParCo/HoldCo at a time they can't afford to bleed cash.

In my view, this makes touching these a unlikely event. Not improbable, but unlikely.

Happy investing,

Sean |