MUX is still coiling sideways in between the two black lines, the $13.17 and the $13.88, it is however favoring the top end of those lines. Friday's close is interesting, the pivot-point on Friday's high/low range is at $13.87.5 which is right in the middle of the upper black line.

This could coil for sometime to come, but of course at some point it will move out of those black lines and preferably upwards,... typically, within 3 to 4 week window.

The 9/04/2025 low at $13.22 (second red bar after the spike) still stands, it was tested this past Thursday at $13.28 which is the green bar with the long downwards tail.

The Weekly chart below also has a pivot point at $13.87.5. The 50-day EMA has moved yet higher and the100-day continues its approach towards the 200-day.

Food for thought:

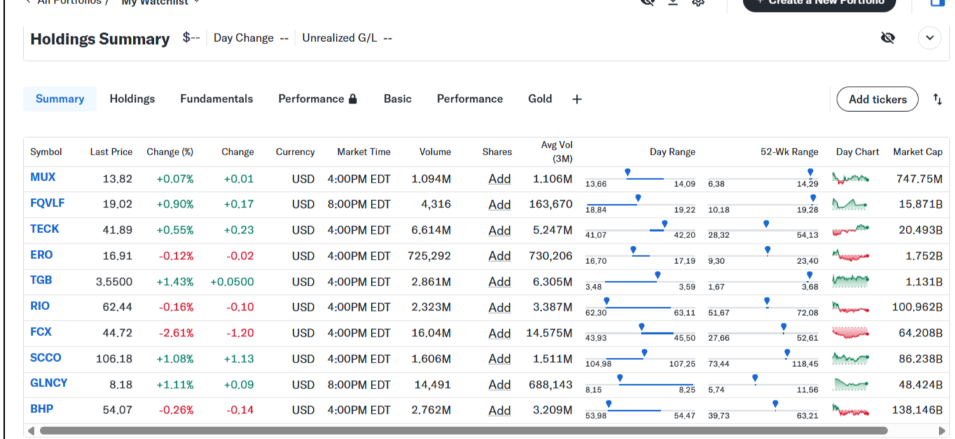

This is a watch list I put together of the top copper stocks which I view often, all of them are billion $ companies. I think MUX is preforming very very well considering they have not begun to produce any copper yet!

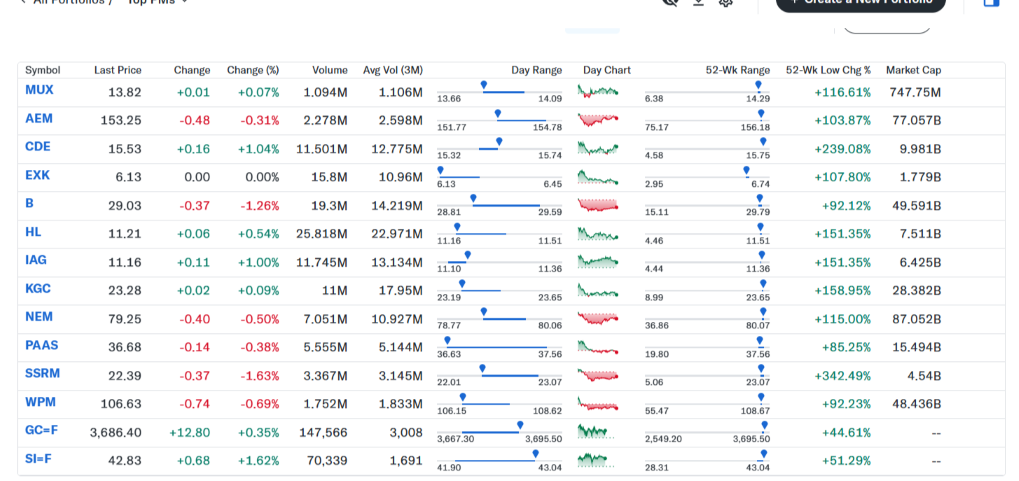

They are in the top 3 in regard to the (52-week high-range,) which is mostly due to it being in the gold sector as well.

MUX now has trading volume above 1-million shares daily on a 3-month average, and is also the lowest volume trading stock on the list. The last two tickers in the chart below are gold and sliver.

MUX's (52-week Low Chg%) category at ($116.61%) is impressive for having a Market-Cap of 3/4 million dollars, while some of the other gold silver miners are multi billion dollar companies.

SSRM has 4.45 billion market cap and is leading the pack @ a (52-week Low Chg%) of 342.49%

|