As regards silver price going forward.

I think silver prices are going far past $50 because the driving forces will be many, and include both fundamentals and speculation.

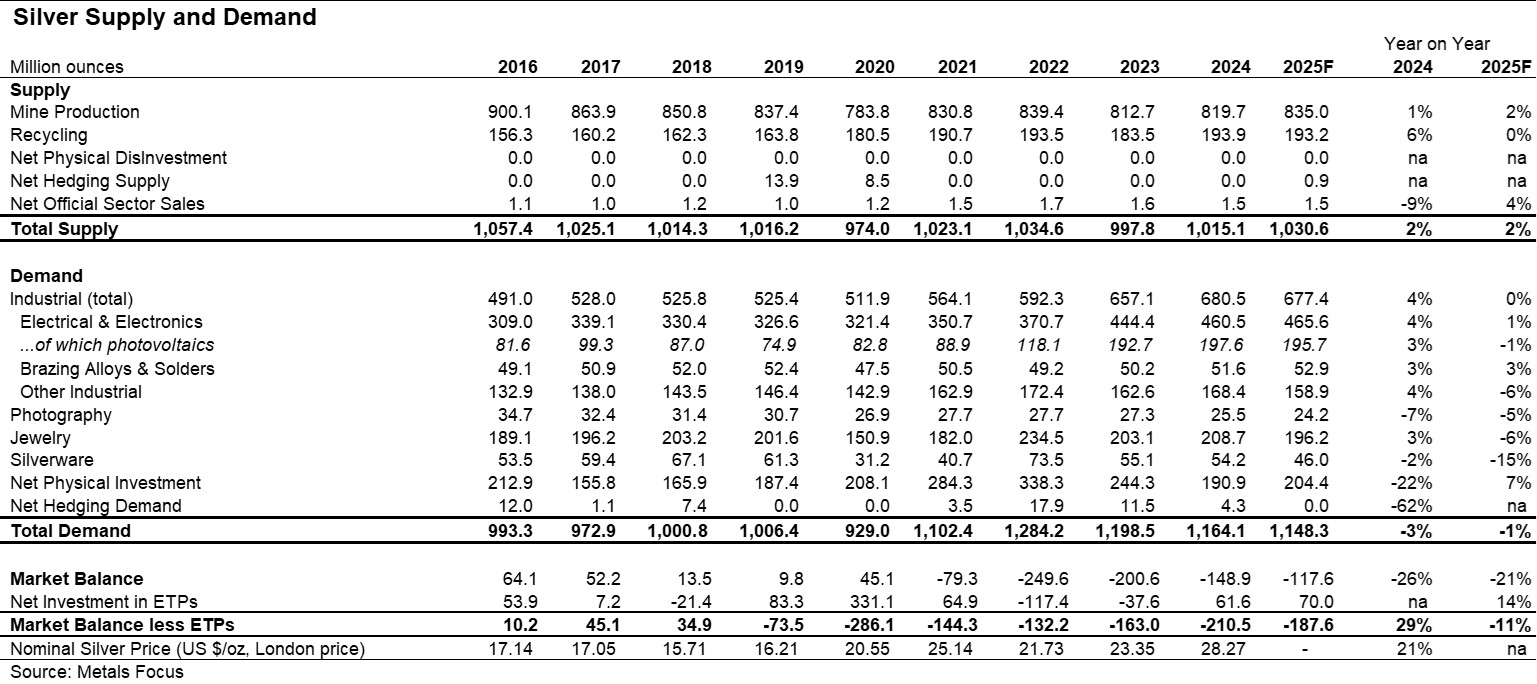

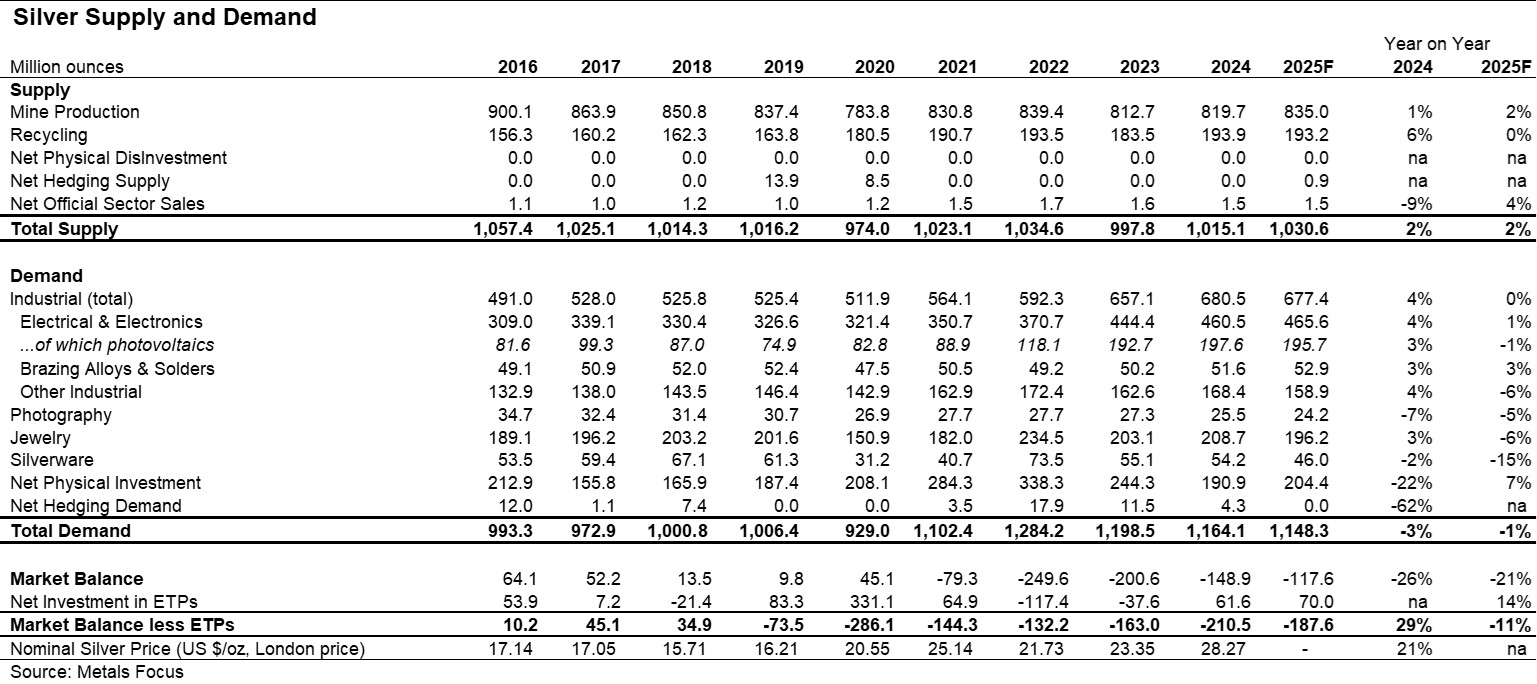

Over the last 10 years supply has been steady at about one billion oz, so even at these higher prices I don't see supply increasing more than 100 million oz at best.

But look at demand, it has been steady at about 1, 150 million. And then look at where the demand is. Mostly it is from industrial and electronics and it has been increasing, and with investment pretty constant at about 200 million oz.

Then look at the main variables, green energy is sky rocketing, in both EV and energy for AI. As well the world is going on a tear to build more military. this should increase demand a lot.

And with silver prices rising almost daily one can expect speculation to sky rocket, and I could see a doubling of investment from 200 to 400 million oz, and if industry and electrical increases by about 100 million oz, and supply by 100 million oz then we have a new deficit of 400 million oz.

And while as recently as a few months ago silver was in abundance, increasingly organizations will be fighting for new supplies. Naked short sellers are getting clobbered.

Last we must remember speculation cannot be quantified, but looking at past moves like this I think we are going to shoot right through $50, and the new prices will hold based on supply demand fundamentals.

PS and the falling dollar, based on the world losing trust in the US and very high US debt which could be very much worse if we fall into a recession, which looks likely, that is another likely variable pushing silver prices higher.

JMO, that and $10 will buy you a cup of coffee :).

Material and statistics in this section were adapted in part from the Silver Institute’s World Silver Survey 2025. |