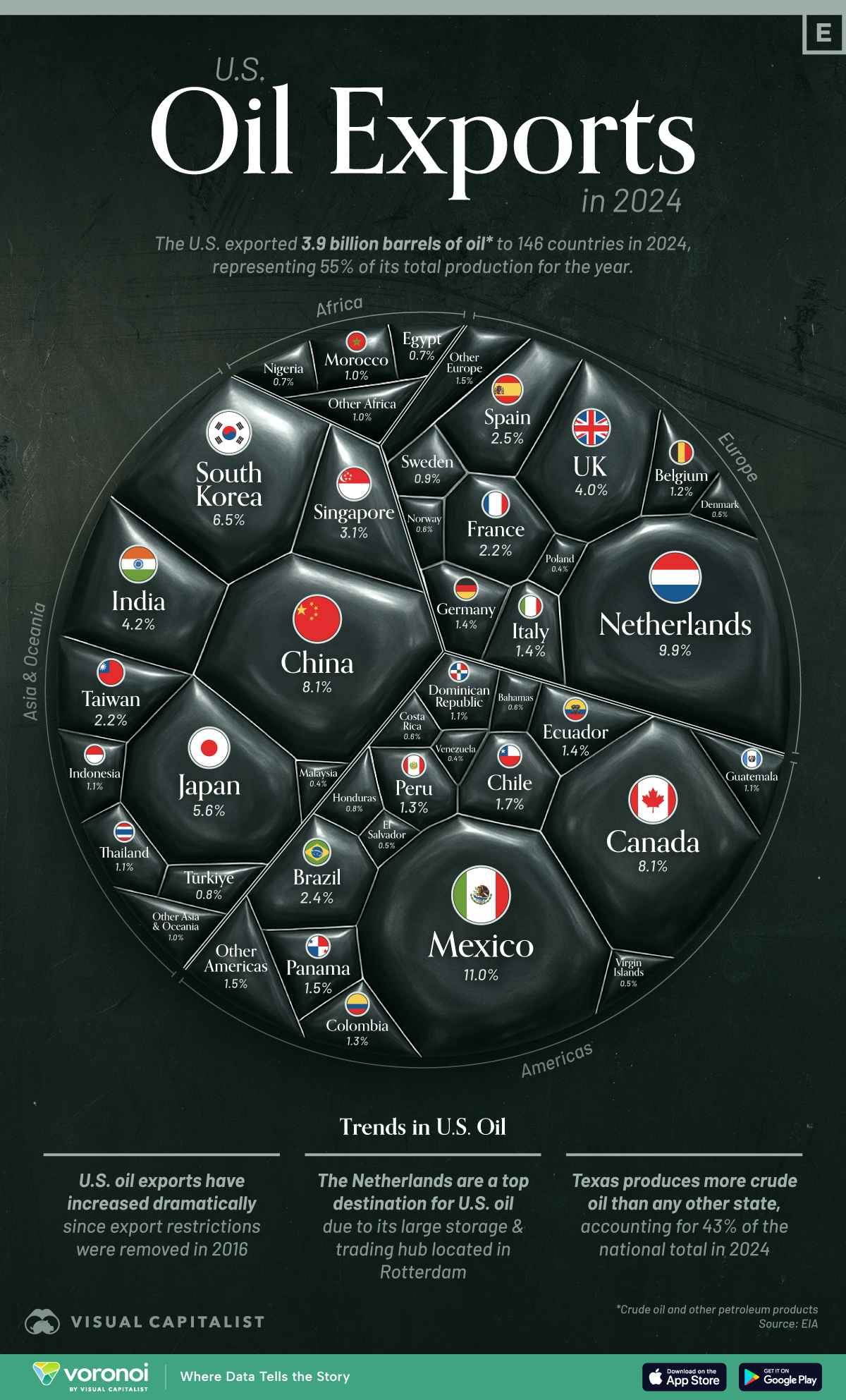

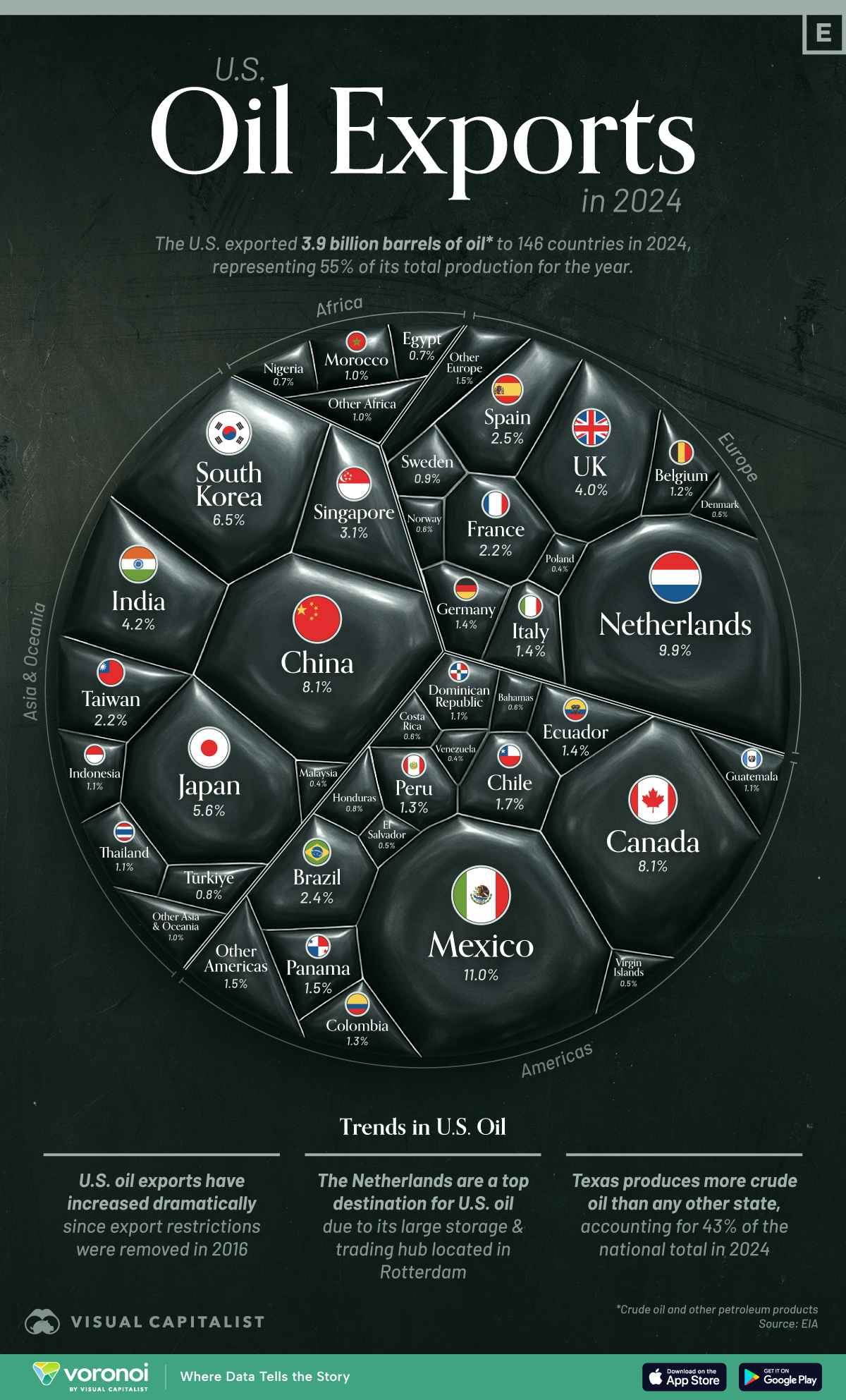

Visualized: The Top Countries Buying U.S. Oil in 2024

September 18, 2025

By Marcus Lu

Article/Editing:Graphics/Design:

See this visualization first on the Voronoi app.

Use This Visualization

Visualized: The Top Countries Buying U.S. Oil in 2024This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- The U.S. exported 3.9 billion barrels of oil to 146 countries in 2024, representing 55% of its domestic production

- The top destinations were: Mexico (11.0%), the Netherlands (9.9%), Canada (8.1%) and China (8.1%)

The U.S. is one of the world’s largest oil producers and exporters. In 2024, the country shipped nearly 4 billion barrels of oil abroad, accounting for more than half of U.S. production that year. This flow of crude, refined products, and other liquids highlights the global importance of American energy.

This visualization breaks down the top countries buying U.S. oil last year. The data for this visualization comes from the U.S. Energy Information Administration (EIA). It tracks all petroleum and liquid fuel exports, measured in barrels.

North America Leads U.S. Oil ImportsMexico topped the list of importers, receiving 429 million barrels, or 11% of all U.S. oil exports. Canada followed closely, importing over 316 million barrels (8.1%).

Rank2024 ExportsBarrels% of TotalTotal3,919,330,000100.0|

| 1 | Mexico | 429,192,000 | 11.0 | | 2 | Netherlands | 387,659,000 | 9.9 | | 3 | China | 318,166,000 | 8.1 | | 4 | Canada | 316,498,000 | 8.1 | | 5 | Korea | 255,126,000 | 6.5 | | 6 | Japan | 219,421,000 | 5.6 | | 7 | India | 164,200,000 | 4.2 | | 8 | UK | 158,044,000 | 4.0 | | 9 | Singapore | 120,041,000 | 3.1 | | 10 | Spain | 99,384,000 | 2.5 | | 11 | Brazil | 94,411,000 | 2.4 | | 12 | Taiwan | 86,381,000 | 2.2 | | 13 | France | 84,471,000 | 2.2 | | 14 | Chile | 65,211,000 | 1.7 | | 15 | Panama | 58,725,000 | 1.5 | | 16 | Italy | 56,514,000 | 1.4 | | 17 | Ecuador | 54,976,000 | 1.4 | | 18 | Germany | 53,155,000 | 1.4 | | 19 | Colombia | 50,531,000 | 1.3 | | 20 | Peru | 49,678,000 | 1.3 | |

‹12345…8›

Europe and Asia Are Key Markets

The Netherlands was the second-largest buyer, taking in 387 million barrels (9.9%), while other major European buyers included the UK, Spain, and France. These exports often serve as inputs for refining hubs or redistribution across the continent.

Meanwhile, Asian countries such as China, South Korea, Japan, and India also ranked highly—each importing over 150 million barrels.

Broad Global Reach

While the top 10 countries accounted for a majority of exports, U.S. oil reached almost 150 countries. Even smaller nations like Togo, Belize, and Latvia made the list.

Why Does the U.S. Export Oil While Still Importing It?

At first glance, it may seem contradictory for the U.S. to export over half of its oil production while continuing to import oil, especially from Canada. But this is a result of differences in crude oil types, refinery configurations, and global market dynamics.

Most U.S. oil production is light, sweet crude, while many American refineries were built to handle heavier, sour grades. Additionally, some U.S. refineries are located closer to foreign markets than to domestic demand centers. As a result, oil flows both in and out of the country to optimize refining efficiency, logistics, and economic returns.

In total, 55% of U.S. oil production was exported. |