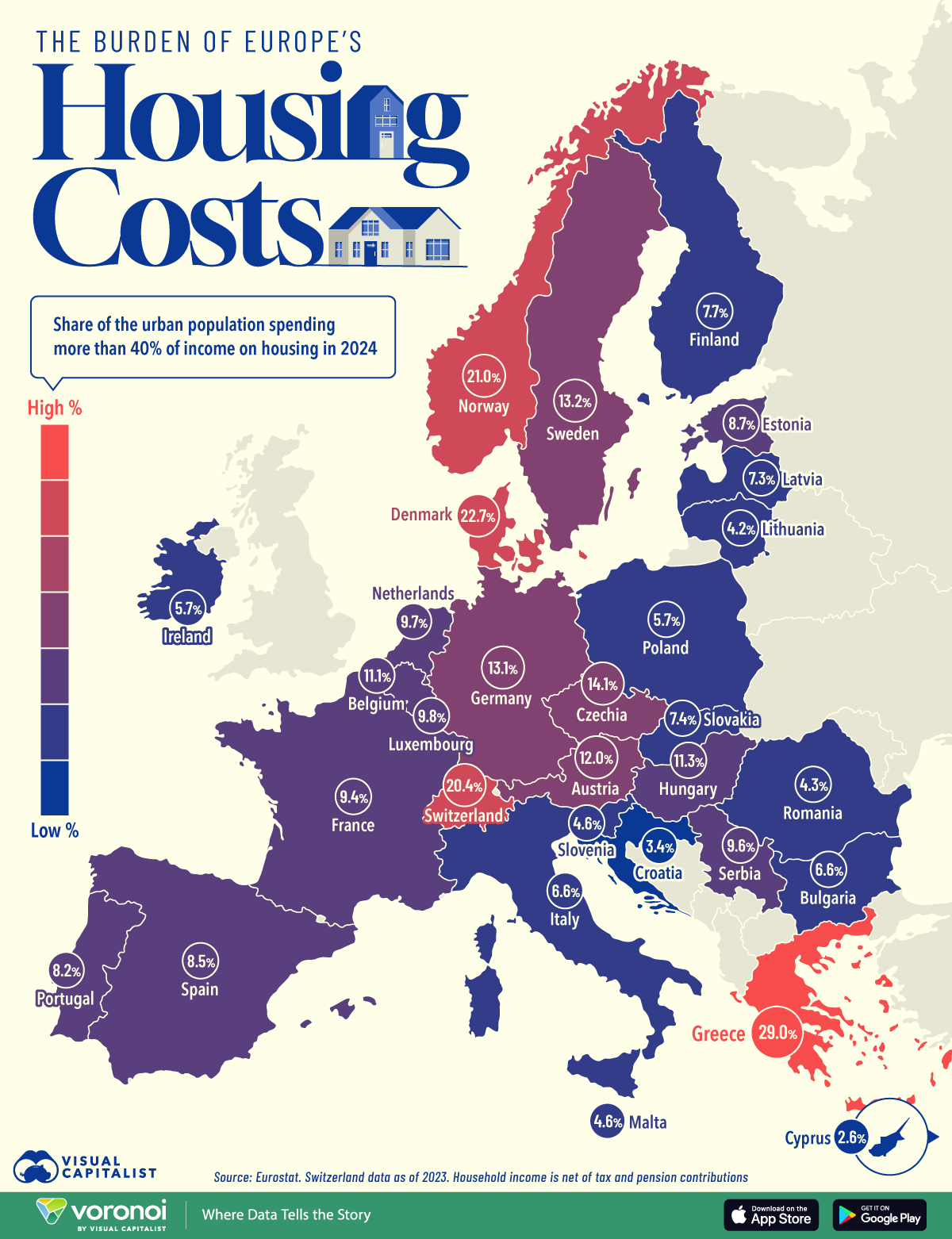

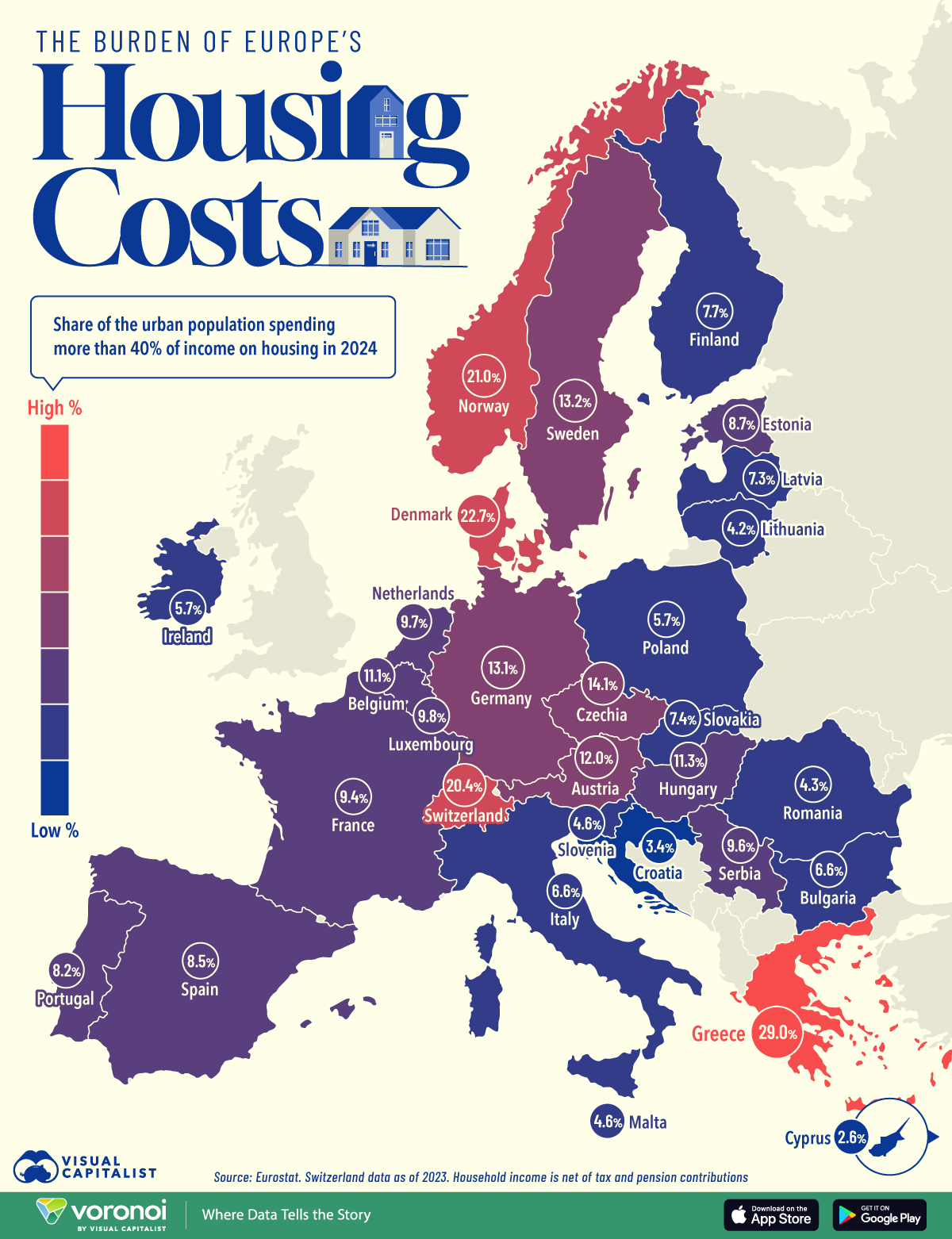

Mapped: Europe’s Housing Cost Burden by Country

Mapped: Europe’s Housing Cost Burden by CountryThis was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- Housing cost burden refers to the share of people who spend more than 40% of their income on housing.

- Among European countries, Greece faces the highest rate of urban residents under this strain, with 29% of its population affected.

- Denmark and Norway rank next in line, with 22.7% and 21.0% of the population being overburdened.

For many European countries, housing costs are eating up a larger share of workers’ paychecks.

Given rising unaffordability, protests have erupted across Spain, Lisbon, and Berlin as the gap between wages and rent widens. In Hungary, for instance, home prices have soared 234% between 2010 and 2024— far outpacing the EU average of 55.4%.

This graphic shows the housing cost burden of European countries in 2024, based on data from Eurostat.

Which Countries Have the Highest Housing Cost Burden?In the table below, we rank EU countries by the share of the population that pays more than 40% of household income, net of tax and pension contributions, on housing:

entries per page

Search:

RankCountryShare of urban population spending >40% of income on housing (2024)|

| 1 | ???? Greece | 29.0% | | 2 | ???? Denmark | 22.7% | | 3 | ???? Norway | 21.0% | | 4 | ???? Switzerland | 20.4% | | 5 | ???? Czechia | 14.1% | | 6 | ???? Sweden | 13.2% | | 7 | ???? Germany | 13.1% | | 8 | ???? Austria | 12.0% | | 9 | ???? Hungary | 11.3% | | 10 | ???? Belgium | 11.1% |

Show more

Showing 1 to 10 of 30 entries

Data for Switzerland as of 2023.

With the third-lowest wages in the EU, paired with rising home prices, the share of overburdened residents in Greece is nearly triple the EU average.

In 2024, the home price-to-income ratio reached 12.7—its highest level since 2007. Not only has sustained inflation contributed to this trend, an influx of foreign buyers has further driven up prices.

Meanwhile, Denmark ranks in second, with 22.7% of the population overburdened. Since June 2024, the central bank has cut interest rates eight times, fueling higher housing demand. In Copenhagen, the Danish capital, home prices have doubled over the past decade.

By contrast, Germany’s higher wages cushion the impact of higher living costs, with 13.1% of the population facing home costs that exceed 40% of income. Overall, wages in Germany are about 35% higher than the EU average.

On the other hand, Croatia and Lithuania rank among the most affordable, driven by high home ownership rates that help insulate residents from fluctuating housing costs. |