Micron announces, stock flying as a first response--up to $173

EDIT: but dropping in a hurry, now at around 170 but of course bouncing wildly around.

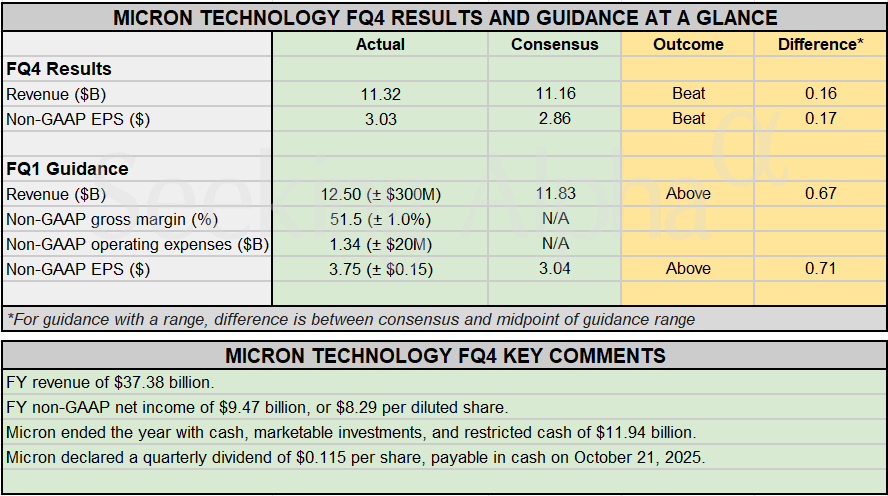

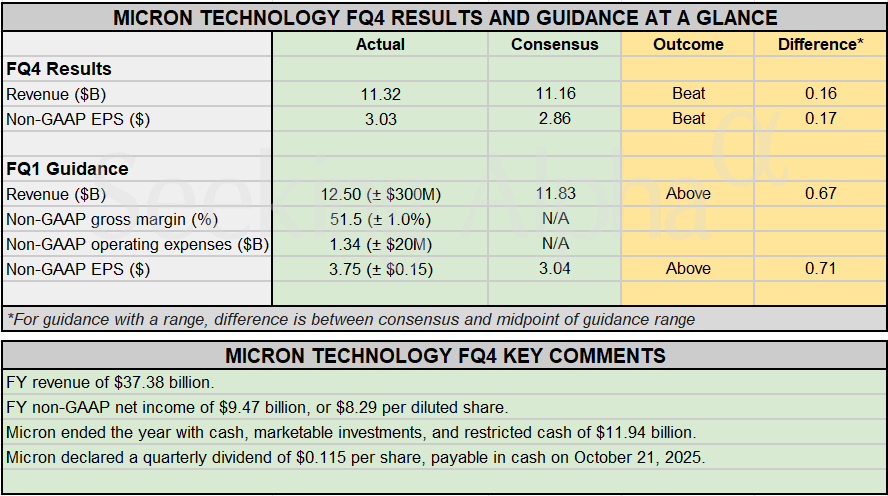

A snapshot:

Micron Technology, Inc. Reports Results for the Fourth Quarter and Full Year of Fiscal 2025

Sep. 23, 2025 4:01 PM ET Micron Technology, Inc. (MU)

Record fiscal Q4 and full-year revenue driven by AI data center growth

Forecasting $1.2 billion in sequential revenue growth with gross margins exceeding 50%

BOISE, Idaho, Sept. 23, 2025 (GLOBE NEWSWIRE) -- Micron Technology, Inc. ( MU) today announced results for its fourth quarter and full year of fiscal 2025, which ended August 28, 2025.

Fiscal Q4 2025 highlights

- Revenue of $11.32 billion versus $9.30 billion for the prior quarter and $7.75 billion for the same period last year

- GAAP net income of $3.20 billion, or $2.83 per diluted share

- Non-GAAP net income of $3.47 billion, or $3.03 per diluted share

- Operating cash flow of $5.73 billion versus $4.61 billion for the prior quarter and $3.41 billion for the same period last year

Fiscal 2025 highlights

- Revenue of $37.38 billion versus $25.11 billion for the prior year

- GAAP net income of $8.54 billion, or $7.59 per diluted share

- Non-GAAP net income of $9.47 billion, or $8.29 per diluted share

- Operating cash flow of $17.53 billion versus $8.51 billion for the prior year

“Micron closed out a record-breaking fiscal year with exceptional Q4 performance, underscoring our leadership in technology, products, and operational execution,” said Sanjay Mehrotra, Chairman, President and CEO of Micron Technology. “In fiscal 2025, we achieved all-time highs across our data center business and are entering fiscal 2026 with strong momentum and our most competitive portfolio to date. As the only U.S.-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead.”

| Quarterly Financial Results | (in millions, except per share amounts)

| GAAP(1) | | Non-GAAP(2) | | FQ4-25 | FQ3-25 | FQ4-24 | | FQ4-25 | FQ3-25 | FQ4-24 | | | | | | | | | | | Revenue | $ | 11,315 | | $ | 9,301 | | $ | 7,750 | | | $ | 11,315 | | $ | 9,301 | | $ | 7,750 | | | Gross margin | | 5,054 | | | 3,508 | | | 2,737 | | | | 5,169 | | | 3,623 | | | 2,826 | | | percent of revenue | | 44.7 | % | | 37.7 | % | | 35.3 | % | | | 45.7 | % | | 39.0 | % | | 36.5 | % | | Operating expenses | | 1,400 | | | 1,339 | | | 1,215 | | | | 1,214 | | | 1,133 | | | 1,081 | | | Operating income | | 3,654 | | | 2,169 | | | 1,522 | | | | 3,955 | | | 2,490 | | | 1,745 | | | percent of revenue | | 32.3 | % | | 23.3 | % | | 19.6 | % | | | 35.0 | % | | 26.8 | % | | 22.5 | % | | Net income | | 3,201 | | | 1,885 | | | 887 | | | | 3,469 | | | 2,181 | | | 1,342 | | | Diluted earnings per share | | 2.83 | | | 1.68 | | | 0.79 | | | | 3.03 | | | 1.91 | | | 1.18 | |

| Annual Financial Results | (in millions, except per share amounts)

| GAAP(1) | | Non-GAAP(2) | | FY-25 | FY-24 | | FY-25 | FY-24 | | | | | | | | | Revenue | $ | 37,378 | | $ | 25,111 | | | $ | 37,378 | | $ | 25,111 | | | Gross margin | | 14,873 | | | 5,613 | | | | 15,286 | | | 5,943 | | | percent of revenue | | 39.8 | % | | 22.4 | % | | | 40.9 | % | | 23.7 | % | | Operating expenses | | 5,103 | | | 4,309 | | | | 4,440 | | | 4,008 | | | Operating income | | 9,770 | | | 1,304 | | | | 10,846 | | | 1,935 | | | percent of revenue | | 26.1 | % | | 5.2 | % | | | 29.0 | % | | 7.7 | % | | Net income | | 8,539 | | | 778 | | | | 9,470 | | | 1,472 | | | Diluted earnings per share | | 7.59 | | | 0.70 | | | | 8.29 | | | 1.30 | |

Investments in capital expenditures, net(2) were $4.93 billion for the fourth quarter of 2025 and $13.80 billion for the full year of 2025. Adjusted free cash flow(2) was $803 million for the fourth quarter of 2025 and $3.72 billion for the full year of 2025. Micron ended the year with cash, marketable investments, and restricted cash of $11.94 billion. On September 23, 2025, Micron’s Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on October 21, 2025, to shareholders of record as of the close of business on October 3, 2025.

| Quarterly Business Unit Financial Results | | | FQ4-25 | FQ3-25 | FQ4-24 | | | | | | | Cloud Memory Business Unit | | | | | Revenue | $ | 4,543 | | $ | 3,386 | | $ | 1,449 | | | Gross margin | | 59 | % | | 58 | % | | 49 | % | | Operating margin | | 48 | % | | 46 | % | | 33 | % | | | | | | | Core Data Center Business Unit | | | | | Revenue | $ | 1,577 | | $ | 1,530 | | $ | 2,048 | | | Gross margin | | 41 | % | | 38 | % | | 41 | % | | Operating margin | | 25 | % | | 20 | % | | 27 | % | | | | | | | Mobile and Client Business Unit | | | | | Revenue | $ | 3,760 | | $ | 3,255 | | $ | 3,019 | | | Gross margin | | 36 | % | | 24 | % | | 32 | % | | Operating margin | | 29 | % | | 15 | % | | 20 | % | | | | | | | Automotive and Embedded Business Unit | | | | | Revenue | $ | 1,434 | | $ | 1,127 | | $ | 1,230 | | | Gross margin | | 31 | % | | 26 | % | | 24 | % | | Operating margin | | 20 | % | | 11 | % | | 11 | % |

Business Outlook

The following table presents Micron’s guidance for the first quarter of 2026:

| FQ1-26 | GAAP(1) Outlook | Non-GAAP(2) Outlook | | | | | | Revenue | $12.50 billion ± $300 million | $12.50 billion ± $300 million | | Gross margin | 50.5% ± 1.0% | 51.5% ± 1.0% | | Operating expenses | $1.49 billion ± $20 million | $1.34 billion ± $20 million | | Diluted earnings per share | $3.56 ± $0.15 | $3.75 ± $0.15 |

Further information regarding Micron’s business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

Investor Webcast

Micron will host a conference call on Tuesday, September 23, 2025 at 2:30 p.m. Mountain Time to discuss its fourth quarter financial results and provide forward-looking guidance for its first quarter. A live webcast of the call will be available online at investors.micron.com. A webcast replay will be available for one year after the call.

We encourage you to visit our website at micron.com throughout the quarter for the most current information on the company, including information on financial conferences that we may be attending. You can also follow us on LinkedIn, X (@MicronTech) and YouTube (@MicronTechnology).

continues at seekingalpha.com |