Pinnacle Delineates New Vein at El Potrero as Robust Epithermal System Takes Shape

pinnaclesilverandgold.com

September 24, 2025

View PDF

VANCOUVER, BRITISH COLUMBIA, September 24, 2025 (TSXV: PINN, OTC: PSGCF, Frankfurt: P9J) – Pinnacle Silver and Gold Corp. (“Pinnacle” or the “Company“) is pleased to announce that continuing surface mapping and sampling, in conjunction with the previously announced high grade gold-silver mineralization in the historic Pinos Cuates and Dos de Mayo mines is revealing the presence of a robust low sulphidation epithermal system at the Potrero project in Durango, Mexico. Not only has the surface sampling extended the underground mineralization to surface, but a parallel vein some 200 metres to the southwest, called El Capulin, is demonstrating good continuity of gold-silver mineralization.

Highlights:

- Surface sampling above the Pinos Cuates and Dos de Mayo mines has extended high-grade gold-silver mineralization over a vertical distance of up to 80 metres

- Silver grades of 2,280 g/t and 1,444 g/t at surface imply a potential vertical zonation with silver increasing upwards in the system

- A newly defined mineralized vein called El Capulin lies parallel to, and approximately 200 metres away from, the Dos de mayo vein and has been traced and sampled for approximately 375 metres along strike with grades up to 6.27 g/t Au and 99 g/t Ag

- The identification of El Capulin and the vertical extension of gold-silver mineralization have significantly increased the potential of the project

“We are extremely pleased with how the combination of underground and surface sampling is coming together to define a strong, well-defined and high-grade vein system at El Potrero,” stated Robert Archer, Pinnacle’s President & CEO. “On the Dos de Mayo trend, the higher silver grades at surface continue to suggest there may be some vertical zonation, with silver increasing upwards. As one moves uphill to El Capulin, the continued presence of gold-silver mineralization up to 1720 masl infers that mineralization here could extend downwards to similar levels seen on the Dos de Mayo structure, or a vertical distance of approximately 200 metres. These observations are consistent with low sulphidation systems in the Topia District and elsewhere in Mexico and bode well for the potential to develop significant zones of mineralization.”

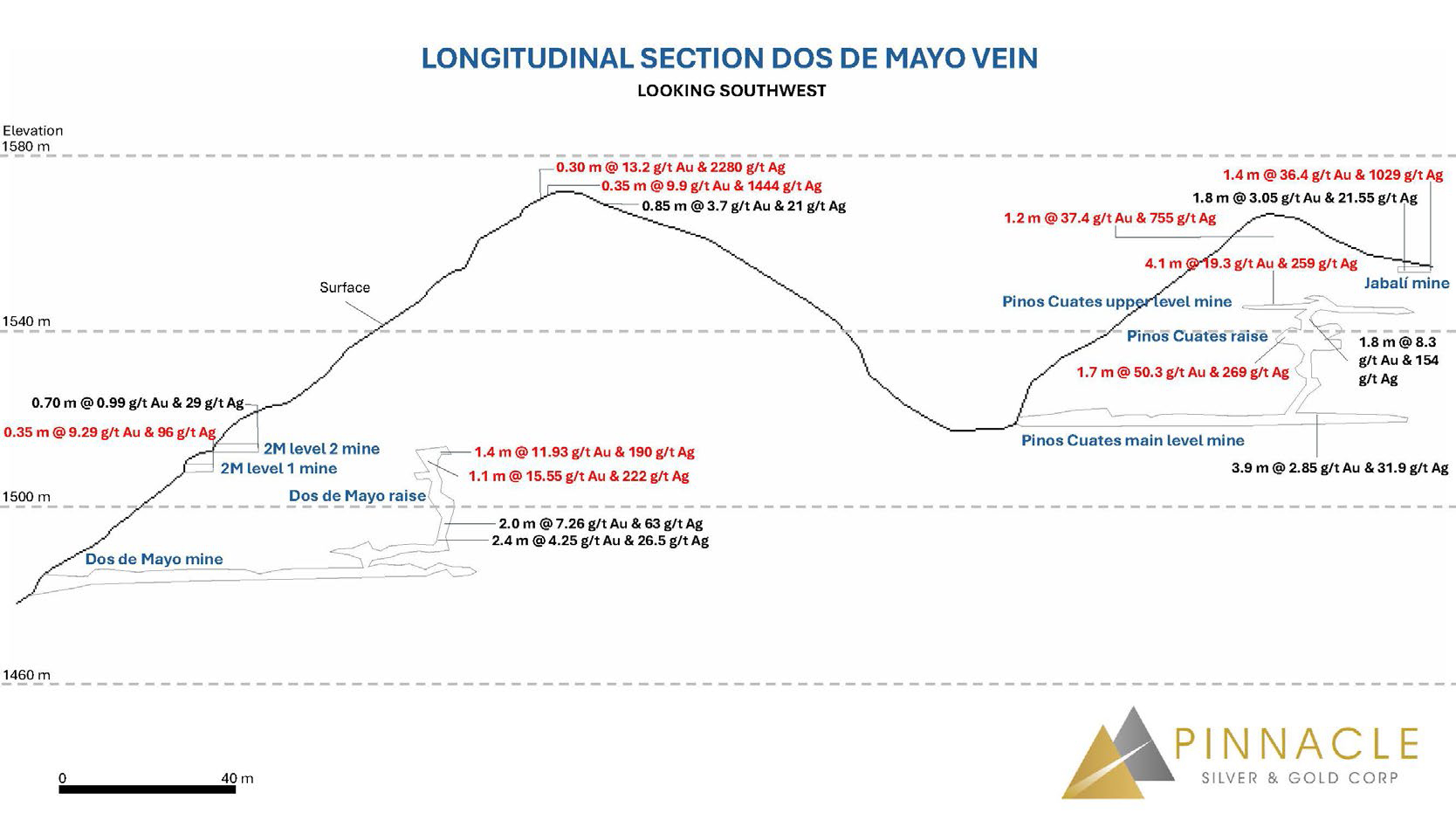

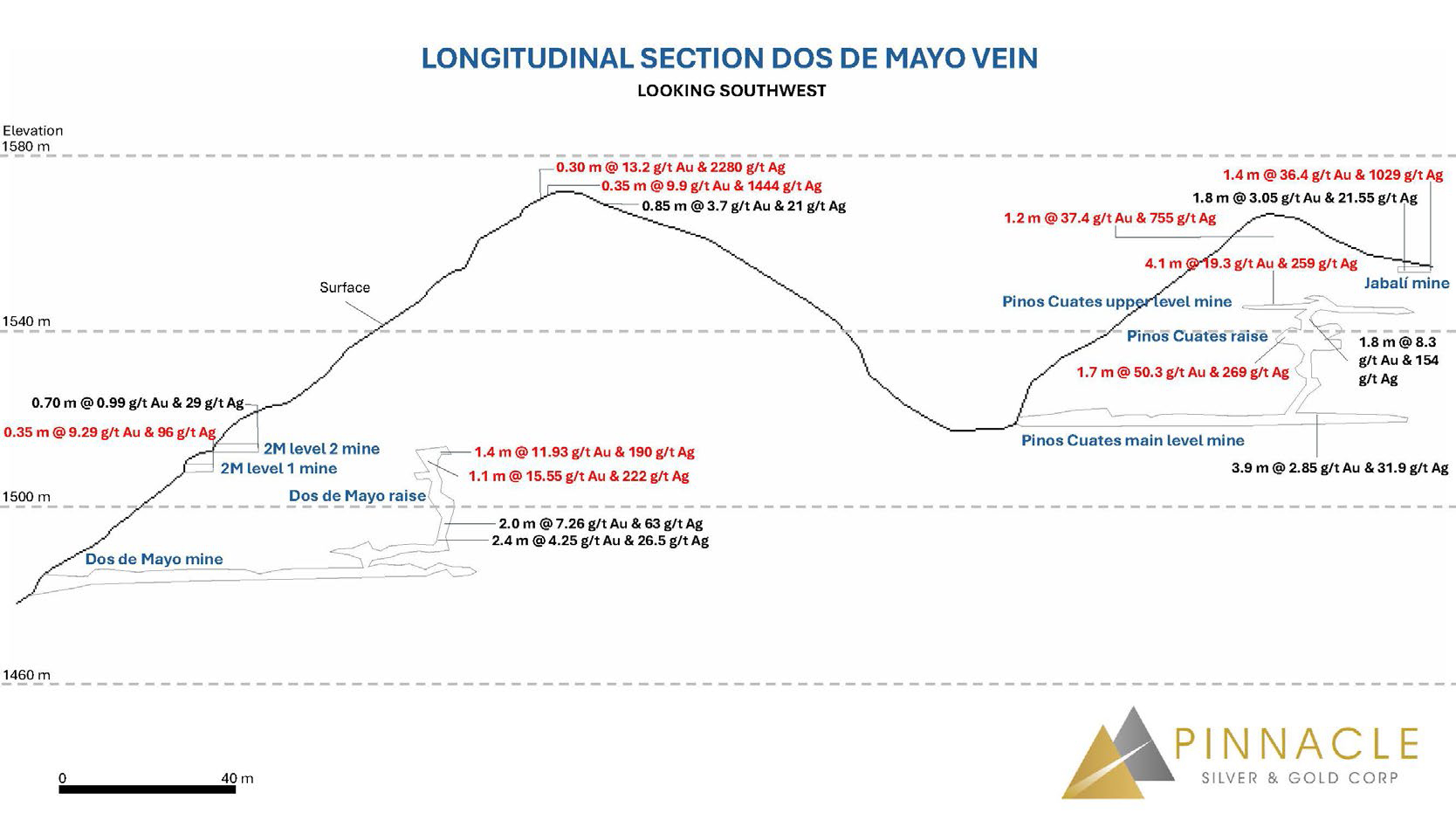

Above the Dos de Mayo mine, the previously announced ( June 2, 2025) 13.2 g/t Au and 2,280 g/t Ag over 0.30 metres is accompanied by a new grab sample assaying 9.9 g/t Au and 1,444 g/t Ag over 0.35 metres. These, and other samples, effectively extend the mineralization from an elevation of 1490 masl (metres above sea level) to 1570 masl, a vertical distance of 80 metres (see Longitudinal Section below). Above the Pinos Cuates mine, surface channel sampling returned up to 37.4 g/t Au and 755 g/t Ag over 1.2 metres, while sampling in a small underground working called El Jabali returned up to 36.4 g/t Au and 1,029 g/t Ag over 1.4 metres, together defining a vertical distance of 45 metres from 1520 masl to 1565 masl. There is an unexplored gap of approximately 120 metres between the Dos de Mayo and Pinos Cuates mines where there is no outcrop exposure or underground workings, but the two mines define a strike length of approximately 325 metres.

Fig. 1: Longitudinal Section of the Dos de Mayo – Pinos Cuates Area Fig. 1: Longitudinal Section of the Dos de Mayo – Pinos Cuates Area

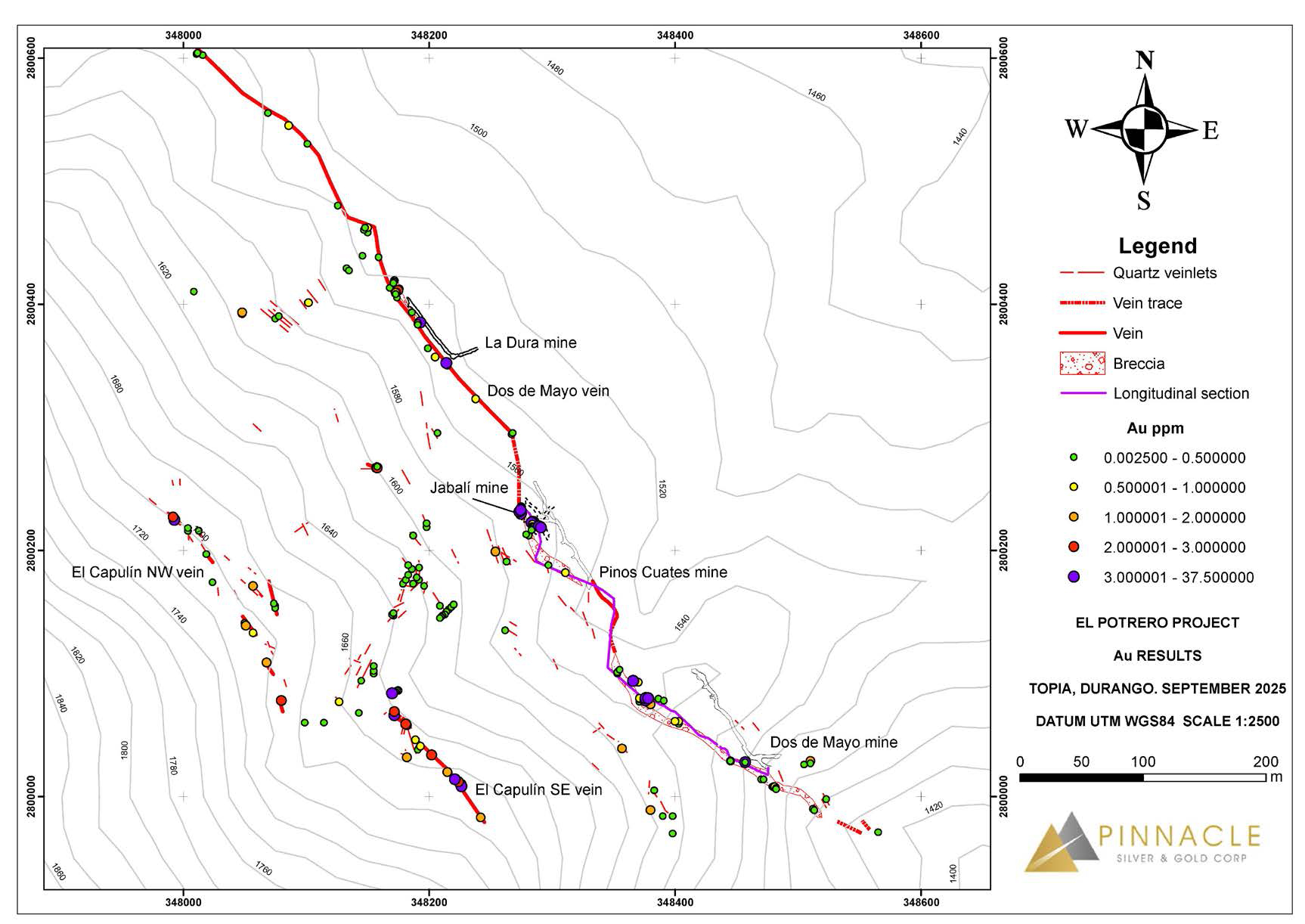

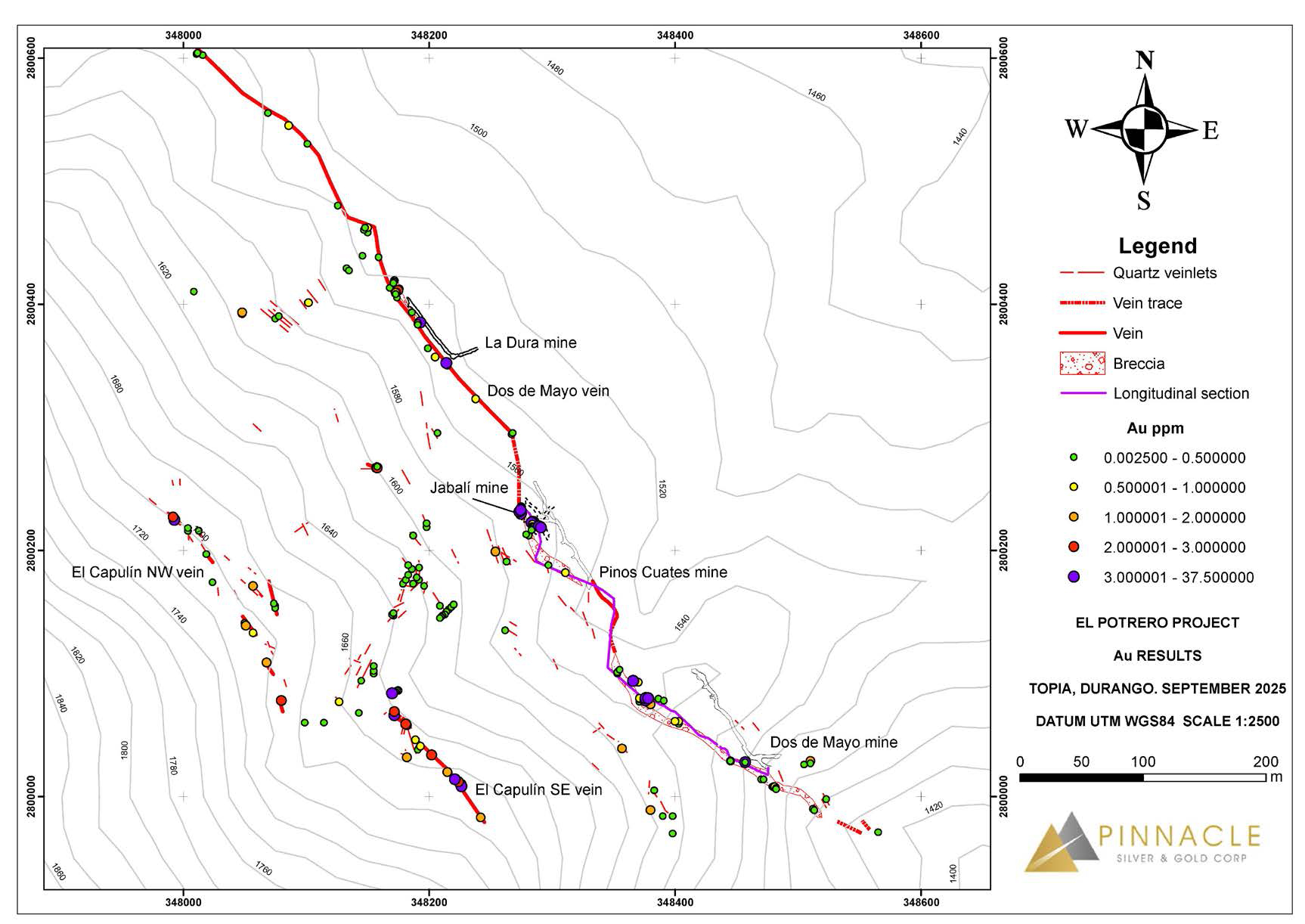

The El Capulín vein is a northwest-southeast-trending structure and has been mapped along a 375 m strike, about the same length defined by the Dos de Mayo and Pinos Cuates mineralization, interrupted and displaced by a northeast-trending fault (see plan map below). In contrast to the breccia vein on the Dos de Mayo trend, it is a crystalline quartz vein with bands of lattice bladed quartz. It has an azimuth of 325° with a dip of 65° to 85° NE and width of 45 to 60 cm, or it may appear as a zone of 1 to 5 cm-wide quartz veinlets with a lattice bladed texture, with azimuth of 320°, dip of 80°NE and width of up to 2 metres.

To date, 36 samples have been taken on El Capulin, with the highest value being 6.27 g/t Au and 99 g/t Ag and the lowest being 0.117 g/t Au. To date, the assay results are more consistent than in the Dos de Mayo vein, probably due to its crystalline rather than brecciated texture. A notable point about this structure is that it is located at an elevation of 1640 to 1680 masl (metres above sea level) in the SE segment and up to 1720 masl in the NW segment, a vertical distance of up to 80 metres. If mineralization extends downward to the 1500 masl level seen at Dos de Mayo then there is considerable potential to discover additional mineralization.

Underground mapping and sampling is continuing at the historic La Dura mine to the northwest of Pinos Cuates, and any mineralization here would effectively extend the strike length of the Dos de Mayo vein for another 150 metres, for a total strike length of approximately 500 metres. Mapping of limited outcrop has traced the vein for a strike length of 1,600 metres to date.

Fig 2: Plan Map of the Main Dos de Mayo and El Capulin Areas Showing Gold Values From Surface Sampling Fig 2: Plan Map of the Main Dos de Mayo and El Capulin Areas Showing Gold Values From Surface Sampling

QA/QC

The technical results contained in this news release have been reported in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Pinnacle has implemented industry standard practices for sample preparation, security and analysis given the stage of the Project. This has included common industry QA/QC procedures to monitor the quality of the assay database, including inserting certified reference material samples and blank samples into sample batches on a predetermined frequency basis.

Systematic chip channel sampling was completed across exposed mineralized structures using a hammer and maul. The protocol for sample lengths established that they were not longer than two metres or shorter than 0.3 metres. The veins tend to be steeply dipping to vertical, and so these samples are reasonably close to representing the true widths of the structures. Samples were collected along the structural strike or oblique to the main structural trend. Grab samples, by their nature, are only considered as indicative of local mineralization and should not be considered as representative.

All samples were bagged in pre-numbered plastic bags; each bag had a numbered tag inside and were tied off with adhesive tape and then bulk bagged in rice bags in batches not to exceed 40 kg. They were then numbered, and batch bags were tied off with plastic ties and delivered directly to the SGS laboratory facility in Durango, Mexico for preparation and analysis. The lab is accredited to ISO/IEC 17025:2017. All Samples were delivered in person by the contract geologist who conducted the sampling under the supervision of the QP.

SGS sample preparation code G_PRP89 including weight determination, crushing, drying, splitting, and pulverizing was used following industry best practices where all samples were crushed to 75% less than 2 mm, riffle split off 250 g, pulverized split to >85% passing 75 microns (µm). All samples were analyzed for gold using code GA_FAA30V5 with a Fire Assay determination on 30g samples with an Atomic Absorption Spectography finish. An ICP-OES analysis package (Inductively Coupled Plasma – Optical Emission Spectrometry) including 33 elements and 4-acid digestion was performed (code GE_ICP40Q12) to determine Ag, Zn, Pb, Cu and other elements.

Qualified Person

Mr. Jorge Ortega, P. Geo, a Qualified Person, and independent from Pinnacle, as defined by National Instrument 43-101, and the author of the NI 43-101 Technical Report for the Potrero Project, has reviewed, verified and approved for disclosure the technical information contained in this news release.

About the Potrero Property

El Potrero is located in the prolific Sierra Madre Occidental of western Mexico and lies within 35 kilometres of four operating mines, including the 4,000 tonnes per day (tpd) Ciénega Mine (Fresnillo), the 1,000 tpd Tahuehueto Mine (Luca Mining) and the 250 tpd Topia Mine (Guanajuato Silver).

High-grade gold-silver mineralization occurs in a low sulphidation epithermal breccia vein system hosted within andesites of the Lower Volcanic Series and has three historic mines along a 500 metre strike length. The property has been in private hands for almost 40 years and has never been systematically explored by modern methods, leaving significant exploration potential.

A previously operational 100 tpd plant on site can be refurbished / rebuilt and historic underground mine workings rehabilitated at relatively low cost in order to achieve near-term production once permits are in place. The property is road accessible with a power line within three kilometres. Surface rights covering the plant and mine area are privately owned (no community issues).

Pinnacle will earn an initial 50% interest immediately upon commencing production. The goal would then be to generate sufficient cash flow with which to further develop the project and increase the Company’s ownership to 100% subject to a 2% NSR. If successful, this approach would be less dilutive for shareholders than relying on the equity markets to finance the growth of the Company.

About Pinnacle Silver and Gold Corp.

Pinnacle is focused on the development of precious metals projects in the Americas. The high-grade Potrero gold-silver project in Mexico’s Sierra Madre Belt hosts an underexplored low-sulphidation epithermal vein system and provides the potential for near-term production. In the prolific Red Lake District of northwestern Ontario, the Company owns a 100% interest in the past-producing, high-grade Argosy Gold Mine and the adjacent North Birch Project with an eight-kilometre-long target horizon. With a seasoned, highly successful management team and quality projects, Pinnacle Silver and Gold is committed to building long-term, sustainable value for shareholders.

Signed: “Robert A. Archer”

President & CEO

For further information contact:

Email: info@pinnaclesilverandgold.com

Tel.: +1 (877) 271-5886 ext. 110

Website: www.pinnaclesilverandgold.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

|