Research Frontiers Inc. (REFR): The Future is so Bright, Someone Needs to Turn on the Shade!Article #10

1035 Capital Management

Sep 24, 2025

· Paid

Summary

- High-margin licensing model: REFR doesn’t manufacture, it’s a royalty model that delivers 90%+ margins, as a result, even modest sales growth will quickly flip the company to profitability.

- Automotive ramp: Multiple new vehicle programs are set to launch globally over the next 12–18 months, including the company’s largest revenue opportunity to date.

- Architectural retrofit breakthrough: A partner is rolling out a new low-cost, easy-install retrofit window solution, with the potential of tens of millions in first-year sales, more than enough to make REFR profitable on this segment alone.

- Falling manufacturing costs: Manufacturing partner, Gauzy is expanding SPD production capacity with improving order visibility, solving the long-standing cost bottleneck, opening the door to broader adoption across markets.

- Technology edge & IP moat: SPD is proven to reduce heat, UV, and energy use, and a new “Dark Particle” innovation unlocking fully black glass coming in 2026. Patents on the technology extend to 2037, protecting the runway for long-term growth.

Intro

REFR has been around for a long time, but the company has very little following, this is truly an underfollowed and unloved company. That’s not surprising, because despite having an interesting technology, REFR has struggled to gain mainstream adoption. Its success has been limited to luxury markets such as premium cars, aviation, rail, and high-end boating via licensing partners.

For context, let’s step back and look at REFR’s core product, SPD smart glass. Gauzy, a key production partner, explains the two primary smart glass technologies, PDLC and SPD, on its website.

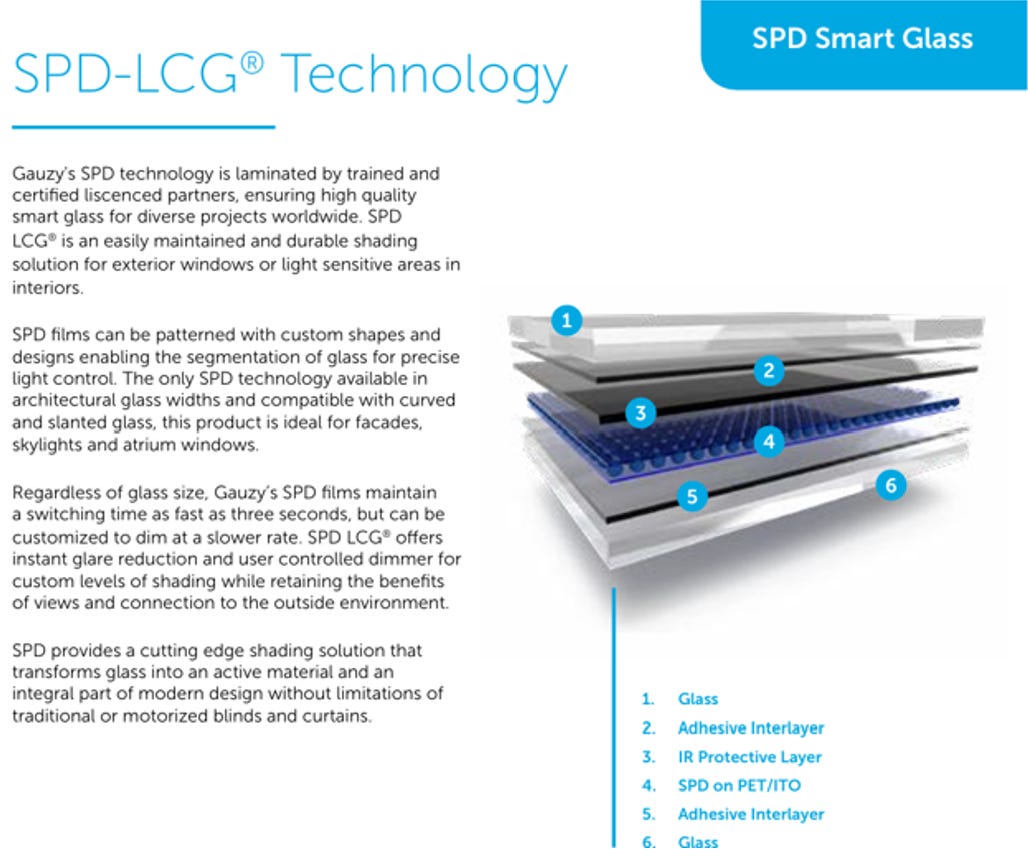

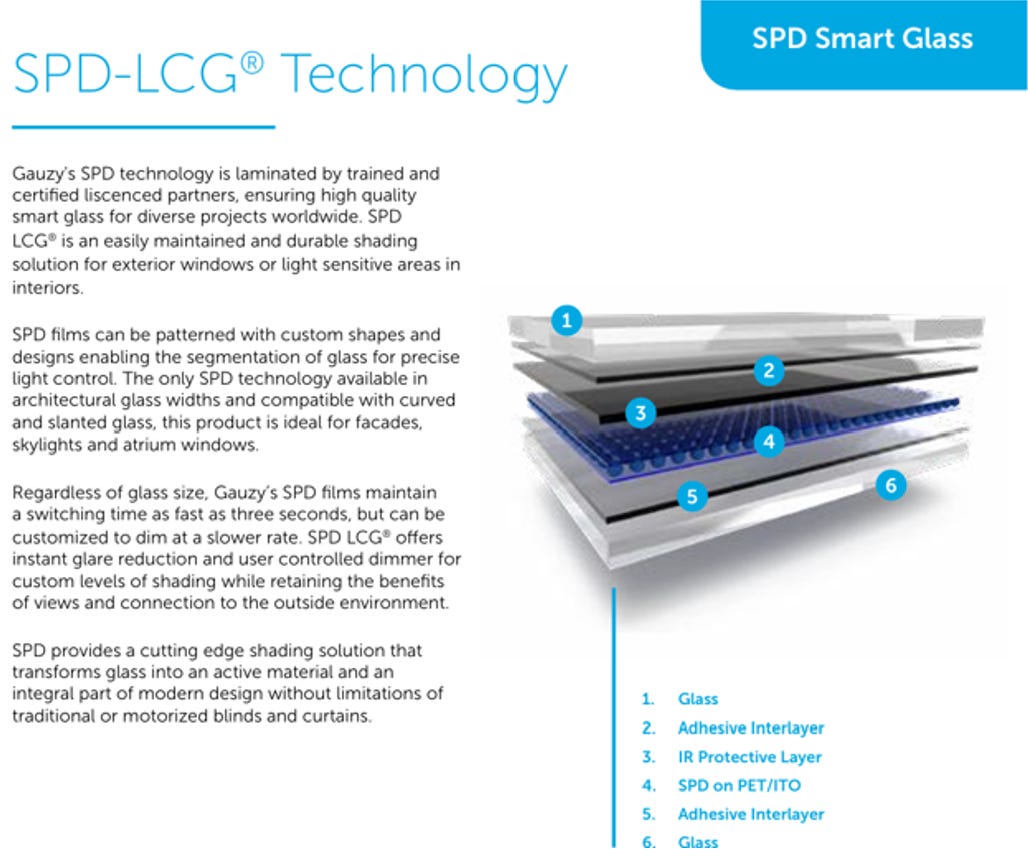

“SPD stands for ‘Suspended Particle Device,’ which are rod-like particles that are suspended in a matrix. This matrix is coated between two sheets of PET (which stands for polyethylene terephthalate, a form of polyester) that are coated with ITO (Indium Tin Oxide). As shown in the image below, this film is then laminated between two pieces of glass creating SPD Smart Glass. SPD blocks up to 99% of visible light, making it primarily used for shading and energy control, without blocking views.”

Source: Gauzy Product Catalog

PDLC (Polymer Dispersed Liquid Crystal), on the other hand, “contains liquid crystals that are dispersed into a polymer glue-like material. It is also coated between two pieces of PET-ITO to create a film, which is either laminated into glass, or applied as a sticker to existing glass, or other transparent materials. Because it has a light transmittance of 80%, it is ideal for creating a light filled privacy solution in its opaque state.”

From a layman’s perspective, if the glass can shift from clear to a dark blue or black shade in under five seconds, it is almost certainly SPD technology. If the glass instead frosts to an opaque white, that is PDLC. REFR is focused entirely on SPD, while Gauzy sells both SPD and PDLC products. An emerging trend is to combine SPD and PDLC in a single pane of glass, as Mercedes recently showcased at Auto Shanghai 2025 in its new concept van. Moving forward, we expect to see more of these hybrid solutions in future car models.

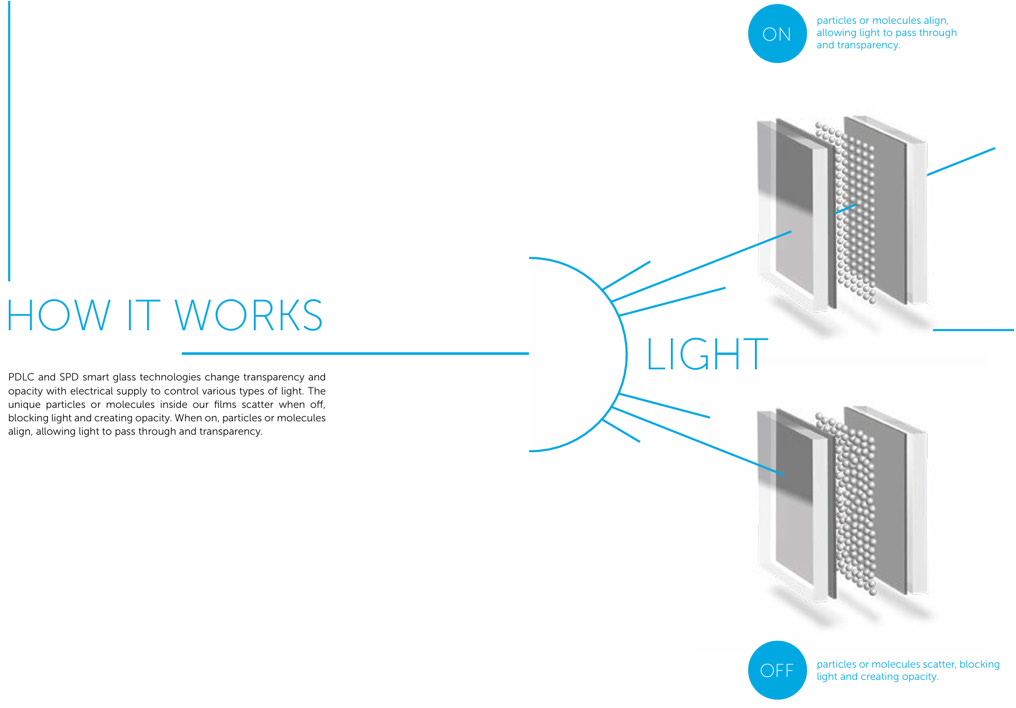

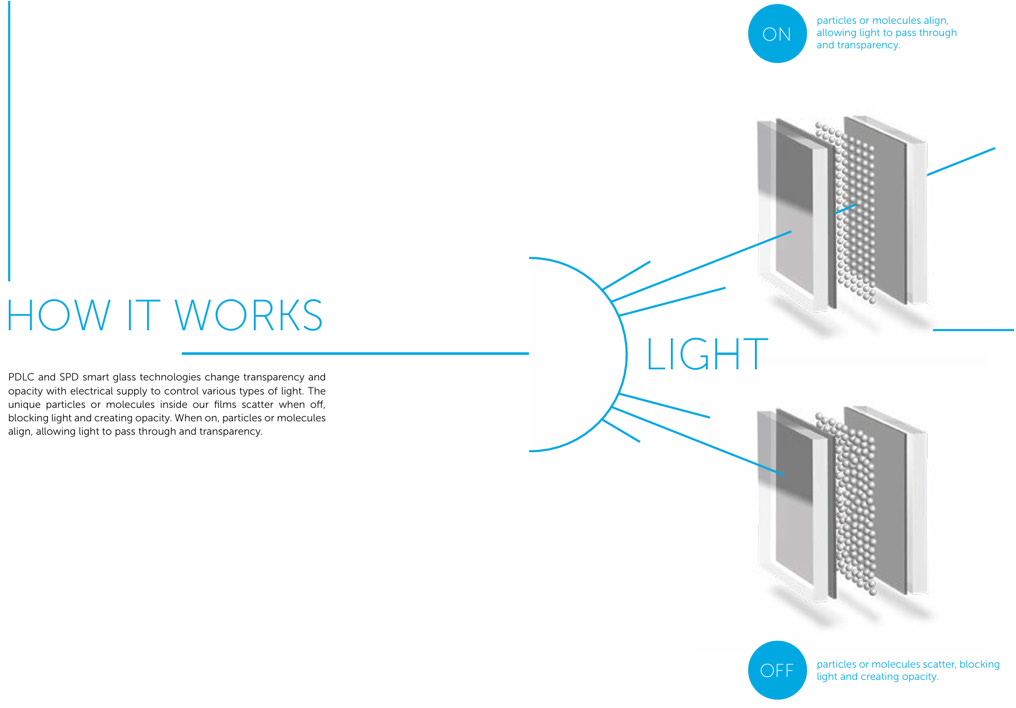

The slide below illustrates how SPD works. In its “on” state, the particles in the film align, allowing light to pass through. When electricity is turned off, the particles scatter, blocking visible light, radiation, and UV rays.

Source: Gauzy Product Catalog

REFR operates a licensing model, which keeps its burn rate low. However, because production has been limited to low-volume luxury applications, the company has not yet overcome its modest but persistent cash burn. The primary barrier has been the high manufacturing cost of SPD, which stems from small-batch production.

While REFR has found niche success, the lack of scale has capped growth. We believe that may now be changing. The company appears to be signaling the end of this “chicken and egg” problem, making this an opportune time to reassess the technology and its applications. In this article, we will focus on two near-term growth drivers, automotive and architectural glass.

Recently, Gauzy, REFR’s Israeli manufacturing partner, announced an expansion of SPD production capacity. We believe this signals the end of the bottleneck that has long limited SPD adoption. In our view, REFR is approaching an inflection point, driven by a growing backlog of automotive models and a new architectural retrofit product.

Gauzy’s decision to sell both SPD and PDLC is not ideal for REFR, but it underscores their commitment to the smart glass market. PDLC is generally used for interior uses such as bathrooms or office spaces where privacy and light transmission are valued. SPD, by contrast, is optimal where heat control, shading, and UV/infrared blocking are needed. Gauzy often cites a third-party study showing that adding SPD to a car sunroof lowered interior temperatures by 18 degrees Fahrenheit—a compelling proof point of the benefits of stopping the transmission of light and UV rays.

Source: Gauzy Product Catalog

Finally, it is important to note that Gauzy’s co-founder and CEO, Eyal Peso, sits on REFR’s board and is a strategic investor, which shows strong alignment between the two companies. In June, Peso personally purchased 210,000 shares of GAUZ, backed by a personal loan. GAUZ expects strong growth across all four business segments. This, combined with REFR’s announcements on new automotive models and a high-volume retrofit application, suggests both companies are on the verge of meaningful earnings growth.

We view the commitment to expand capacity, alongside Peso’s personal investment at near-all-time lows, as a strong signal. With SPD adoption set to accelerate across multiple markets, the opportunity for REFR appears favorable.

Licensing and Partnership model

REFR operates under a licensing and partnership model. The company does not manufacture products itself. Instead, it licenses its patented technology to partners that produce the SPD film, and to licensees who develop smart glass solutions for end customers. Gauzy is REFR’s sole SPD manufacturing partner, and as such deserves close attention. Gauzy is currently expanding capacity with the dual aim of lowering cost per square foot and strategically locating production to mitigate tariff exposure.

From REFR’s perspective, Gauzy’s commitment is encouraging. It signals growing confidence in demand and willingness to invest heavily in SPD. One of the largest input costs for SPD is the conductive plastic that surrounds the SPD layer. While this material is commercially available, costs only fall with bulk orders. Gauzy’s growing order book allows larger purchases, which improves predictability and drives unit costs down.

REFR CEO Joe Harary has noted that this could dramatically reduce manufacturing costs, addressing one of the biggest barriers to higher-volume applications. A lower price point would open the door to more markets, which in turn would meaningfully increase cash flow under REFR’s licensing model.

REFR itself runs lean, with fewer than 10 employees and annual cash burn of roughly $1.25 million. The licensing structure keeps overhead low and avoids the need for heavy capital investment in manufacturing. However, it also leaves the company dependent on the pace at which its partners move. This dependence has been a long-standing frustration for investors, as the key obstacle to growth has been reducing cost per square foot to unlock broader adoption. |