| | | Some Monday thoughts since the 8-K last Friday is being spun bullish and how it's boxed equity in and is a positive for QVCGA holders. Like Palpatine in Star Wars Episode IX ....somehow QVCGA returns. I find this to be the opposite and of course being a contrarian will offer my contrarian thoughts to the other side of this narrative.

This starts with the LME again that is for sure taking place I read. No one with $1,000M+ of cash files for bankruptcy I read too......we can leave out that 75% of QVC, Inc cash is really debt and costs $59.085 annually to have.

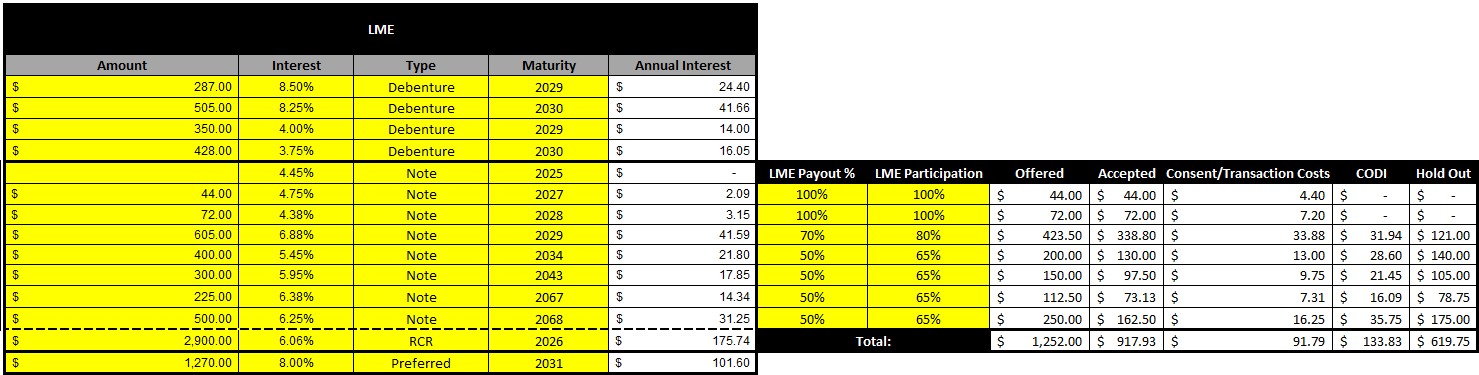

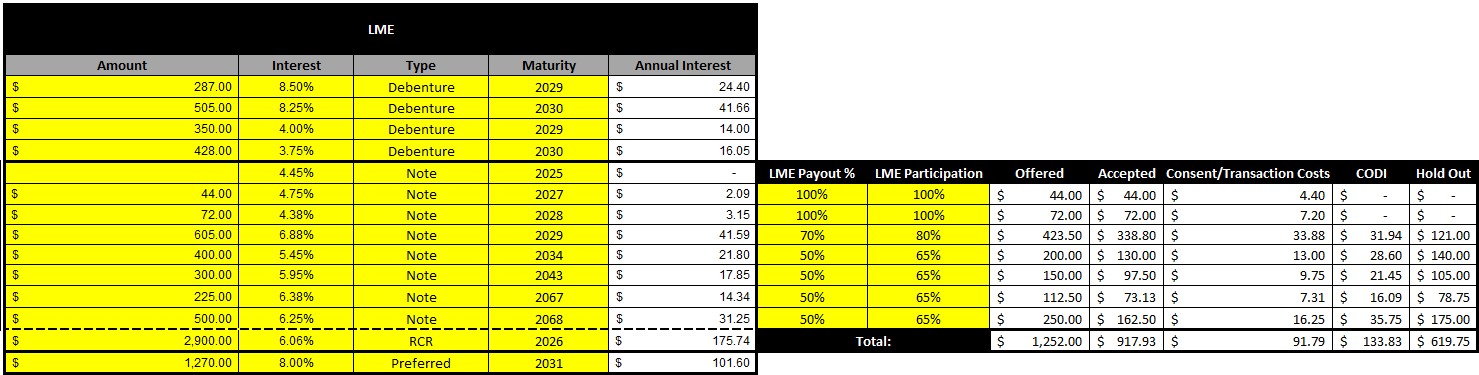

I had someone reach out and mention CODI impacts from retiring debts were missing from my LME post a few weeks back. I intentionally left the tax implications (but mentioned they were left out) out as my original thoughts were to just show high-level could an OOC LME work and I believe it does not, but if you do assume a 22% tax rate (this can swing +/- but will use flat tax rate since I can't predict and they don't have many carry forwards to offset at OpCo level) and add that in then an LME is just not economically possible at the scale many are writing it for.

Let's rerun some of the scenarios and throw CODI in at 22% to see what we have.

I adjusted some of my numbers after giving more thought. The 2027-2028 are really close to maturity and with an LME in theory they are safe to maturity so I assume if the company is going to pay they may just offer to take them out early but would need to get them an offer at PAR. 2029 are trading around $0.50 and we may see a $0.70 and 80% participation to walk leaving holdouts that may/may not be stripped of covenants and collateral. 2034-2068 I will assume $0.50 and just 65% participation for each as some may be higher, some may be lower, but it averages out here. This LME will cost $1,252M in total offering and with the acceptance will be around $917.93M but when you layer in consent costs, transaction fees, and then the CODI piece which will count as income we're looking at $1,143.55M to make this happen and we still have $619.75M left as holdouts. QVC, Inc is left with $161.45M in cash. I could go lower and use 15% for the tax and that gives a total CODI impact of $91.25M instead of the 22% which is $133.83M but you get the point either way.

Now possible the company tries for §108 to skirt that CODI but I don't see it. I find §108 use to be hard to support OOC and why this is just another reason to take care of this in scale in court.

At a $800M EBITDA this gives QVC, Inc a net leverage ratio of 4.2x which is still close to risk area. 4.4x if we don't use net leverage and just take the debt/EBITDA ($3,519.75/$800). The real issue here is the debt load has declined but still above the 3.5x and above the 2.5x QVC, Inc target BUT with an A&E of the facility as I wrote prior will likely come a higher interest rate. The B-spread and C-spread are on the rise even after the 25 bps cut from the fed and the difference is about 5.17% so I am currently projecting a fair refinance rate to be around 10.98% for the credit facilty given QVC credit ratings of B/CCC and the fact that leverage is still high and banks are single largest creditor group with nearest maturity. Post LME QVC, Inc has burned precious cash and it's also now paying ~$48.61M more annually in interest even with all the reductions above. Any disruptions to the business (e.g., another Rocky or cable accelerates) and this move did nothing.

Even if I go with a lower rate instead of 10.98% and use 8.67% it only saves QVC, Inc $18.38M in annual interest - not much wiggle room given the cost to make it happen. The worse case too is the more debt that doesn't get taken out just makes the entire concept of an LME not impactful because regardless if a credit facility A&E takes place they will be getting a higher rate and the less debt they take out via LME then it's just more interest they payout annually.

I also assume preferred are offered $0.15 to be taken out as that's better than what they may be getting and this move would cost QVC Group $190.85M leaving the entire group with $537.60M in cash. This is speculation but many keep touting it even though it has minimal impact on OpCo and only benefits the ParCo and since ParCo doesn't generate cash there's only so much left they can downstream too and OpCo is still likely restricted in upstreaming.

Important to really remember or understand what an LME is - it's to buy time. These large reductions in debt are not the major purpose and when you have eight different senior creditor groups (seven bonds + banks) it makes this statistically low probability. Folks like Bill Derrough from Moelis who live these situations have confirmed the LME purpose. So if the goal of an OOC LME is to buy time one could argue QVC has had time since 2022 - does more time solve 90% of their revenue coming from cable? Given the banks are the nearest maturity group taking out 2067 debts really are not their concern, it's protecting their capital and does the LME do that? No. In fact it does the opposite. I go back to my prior writing, if the A&E was so easy and the banks wanted this to work it would have. Ben Oren was in negotiations in Q4 2024 and then by Q2 2025 Bill Wafford is now authorizing the $975M draw, exploring strategic alternatives, and no live Q&A for earnings. I challenge the banks could have made this easy but perhaps they are more concerned than many are anticipating. This delay itself should adjust the game theory that some are using in my opinion.

From there I continue to not see a large scale LME as likely and any A&E from the credit facility seems to be at risk too. Given all the legal teams hired on all sides this does not scream A&E to me. Again, if banks wanted this to work they could have done it back in Q4 2024 but each piece of news keeps getting worse.

Let's talk bank incentives. And let's assume there is no roll-up of the prepetition $975M draw into postpetition DIP, which is possible and more common post 2008 (especially for a facility that has historically provided WC funding).

Now the thing I read is the banks don't want to file as they're pari with the bonds so their goals will be to A&E and run the clock. This is not how banks work. Their goal is to protect the capital and right now they have $2,900M being borrowed by a company that is not stable. If they A&E the risk becomes do they see EBITDA drop below $700M by the new maturity date? We are trending towards $800M this year at a period where the company just was pulling over $1,000M - this is beyond high risk for the banks. Throw in a higher interest killing any cash savings and likely slowing any concept of a turnaround which is needed to even rationalize this move. The banks allowing an A&E don't really put them closer to protecting their capital if they don't see a solid revenue plan for the company. Instead the company would have burned their cash and lowered economic recovery in the event they file closer to the new maturity date. And an LME is very high risk for the banks too. Why? Because you have seven senior note groups each that have to vote > 50% to strip their covenants and punish any holdouts and you need >= 66 2/3 - 75% to start stripping the equity collateral. If the company can't execute here then all they did was reduce some debt, use up value, and it's very possible the remaining holdouts are still pari with the banks.

But if the company files the banks are pari and they don't want that! True. It's also true the banks don't want to be in this situation at all, but here we are. The company likely submitted proposals for an LME along with bankruptcy threats from the start and just because they proposed an LME does not mean everyone is game - including the banks who lose value (includes their own lent cash as mentioned above) while others get to walk away today.

Now if the company files chapter 11 the assets are moved into an estate and any major moves will need court approval so there is some protection from the company burning value (e.g., selling assets, new debts, few other things) outside of normal business which does not exist OOC. The company also has about 120 days (18 months if given extensions by the court) to create and submit a plan to be voted on and here's where the banks, even in bankruptcy, have some power.

In bankruptcy all that debt will likely be grouped into one class as senior unsecured. There is possibility for the banks to be put into their own class and senior bonds into another, but since all of them have QVC, Inc equity as collateral it's likely banks and bonds are classed together as one senior unsecured class. Just what many state the banks don't want and what was even reported in the WSJ with "the formation of the cooperation group was a defensive move, the sources said.Revolving lenders rarely sign cooperation agreements before negotiating with a company. These lenders typically are the first to get paid back in a restructuring and often are made whole, even in bankruptcy.

But QVC’s revolving lenders are on equal footing with creditors holding roughly $2 billion in secured bonds, diluting the value of the collateral and making repayment less certain."

The once fragmented bonds now are no longer fragmented because of the class grouping and are possibly joined together with the banks. Now in bankruptcy for a plan to be approved we would need to see 66 2/3% in dollar amount and > 50% in number of claims in the class. As it stands the banks alone control 57% of the combined senior unsecured group ($2,900M/$5,046M) by dollar amount. They really only need to get ~$480M of the other senior unsecured notes to drive the dollar amount over the 2/3 threshold - basically nothing as it's possible an affiliate of the banks even hold some of the bonds too! For the 50% of the number of voters it's likely they get this too as 75% of the syndicate are already aligned and they can likely get a few bonds holders in with them; in these situations it's often common many don't even show up to vote so the actual 50% is only of those who are voting....

This is where the banks, even in court, have some sway because they can basically vote to veto any plan they don't like. If they feel the company's valuation is too high and recoveries are not in their favor they can block it. As I wrote above the company usually has 120 days to submit their first plan and after that the judge may grant an extension which after 2005 is usually capped to ~18 months. If it's 120 or the full ~18 months, once the company exclusivity period is over the courts will allow anyone with economic interest to submit their own plan for the judge to review. Banks could submit their own plan and if it aligns and is fair to all other holders then they can submit it and then drive the vote.

This of course is an ugly situation, and value destructive, but I highlight it as many think Maffei has some master ace in his sleeve and banks are helpless because of the pari situation in a filing, but I find this not to be the whole picture. Banks can essentially form a solid plan and with 75% of them already aligned just need a small group of the notes to help support it.

The By-Laws 8-K filed on Friday is a common layout you would see before a filing too. It's the company getting their affairs in order so when they enter the courts things are cleaner. This isn't a move you would see for an LME.

Let's take a look at the symptoms of our patient now:

- March 7th, 2025: Fitch downgrades QVC to B- from B

- May 23rd, 2025: QVC Group suspended paying QVCGP dividend.

- May 27th, 2025: Greg Maffei chairman agreement extended. The Employment Agreement provides for an initial term expiring December 31, 2025, which will be automatically extended through December 31, 2026 unless a notice of nonrenewal is provided by either party at least 30 days prior to December 31, 2025, or Mr. Maffei’s employment with the Company ends before such date (such period of employment, the “Term”).

- May 28th, 2025: QVC hired Evercore, Inc and Kirkland & Ellis and senior holders hired PJT Partners and David Polk & Wardell

- LITNA holders hired Centerview and Akin Gump Strauss Hauer & Feld

- May 30th, 2025: Fitch downgraded QVC again going from B- to CCC+.

- June 20th, 2025: QVC hired Roger Meltzer of DLA Piper and Carol Flaton to the board paying each $50K a month.

- August 7th, 2025: Earnings released and revenue further dissapointed. Revolver had $75M drawn in addition. It was also reported after earnings period company borrowed another $975M on the revolver bringing total borrowings to $2,900M.

- August 13th, 2025: QVC credit syndicate got 75% together and hired Simpson Thacher & Bartlett.

- August 15th, 2025: Company adjusted executive compensation which mirrors a KERP/KEIP plan.

- August 26th, 2025: S&P downgraded QVC from CCC+ to CCC.

- September 26th, 2025: QVC amended and restated certificate of incorporation for QVC, Inc and amended and restated By-Laws of QVC, Inc. Paul Keglevic (part of Rite Aid and Envision bankruptcy) and Jill Frizzley (president of Wildrose Partners and oversaw governance prior to bankruptcy filings).

If you take any of these symptoms in isolation they're not much but in aggregate they start to give an indicator this isn't an OOC treatment plan.

I continue to remain so focused on QVC because the narrative around it is so interesting. The amount of people sucked into this in hopes the equity rockets and they become rich is interesting to me. Perhaps they will be! My unofficial investing mentor would view this different and as such I have. Besides, the rest of what I am looking at is boring right now and QVC just keeps offering so much fun even as an observer. Learning is a gain too although I am hoping I can crash back into the bonds if I get my price :)

FWIW $WOLF just exited bankruptcy and rocketed +1,000% ($1.17/s -> $22.10/s). Former equity kept only 5% (before warrants diluted) but perhaps there's hope for $QVCGA. Given the capital structure I find it to be unlikely, but I seem to be one of the few writing with my view so perhaps it is me who is wrong. But protecting capital comes before anything and there seem to be too many "ifs" to make $QVCGA sound like a winner.

Happy investing,

Sean |

|