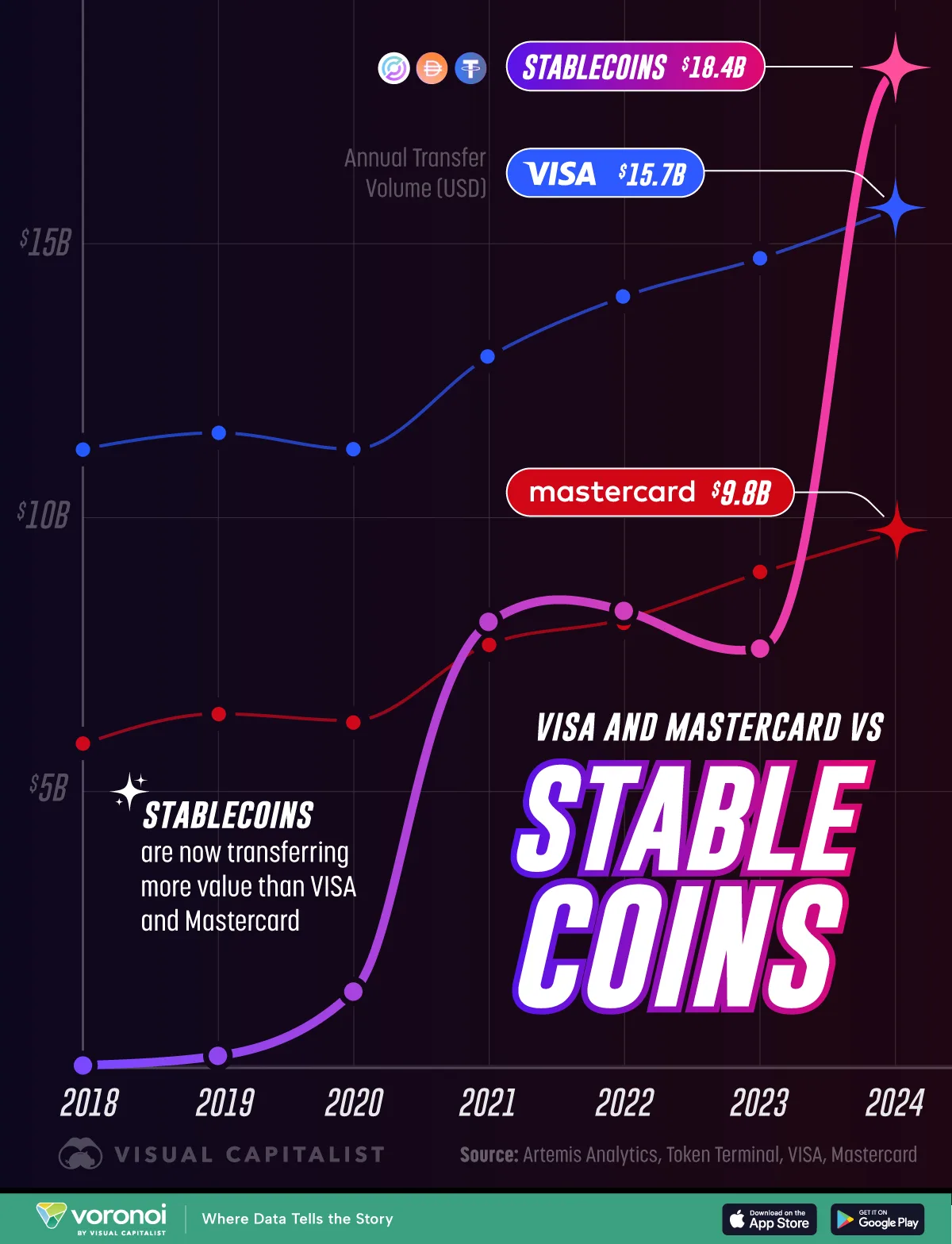

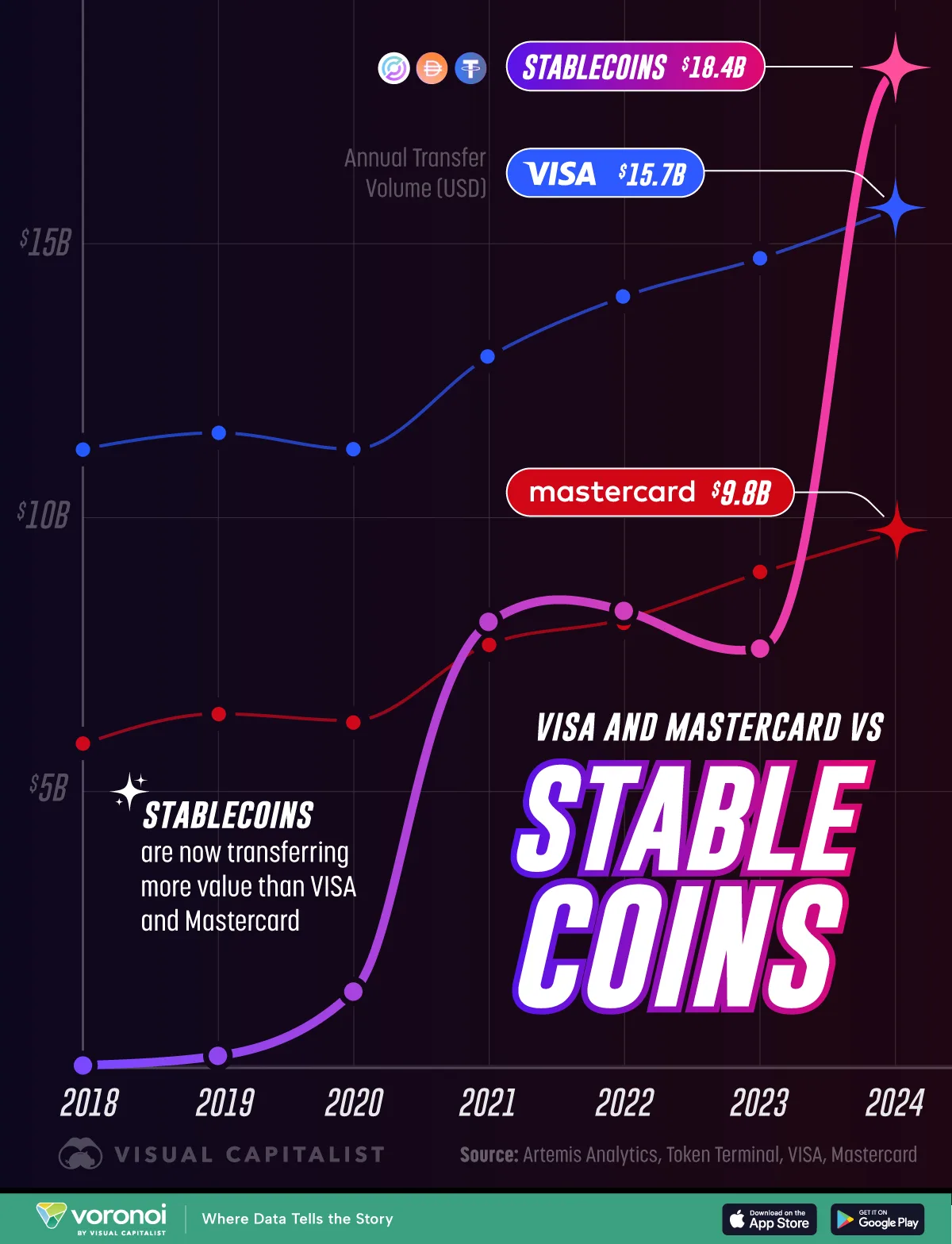

Charted: Stablecoins Are Now Bigger Than Visa or Mastercard

October 2, 2025

By Niccolo Conte

Graphics/Design:

Use This Visualization

Stablecoins Now Transfer More Value Than Visa and MastercardSee visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- Stablecoin transfer volume rose from just $3.3 billion in 2018 to $18.4 trillion in 2024, overtaking Visa at $15.7 trillion and Mastercard at $9.8 trillion.

- Visa’s annual transfer volume increased gradually from about $11.3 trillion in 2018 to $15.7 trillion in 2024, while Mastercard climbed from $5.9 trillion to $9.8 trillion over the same period.

In just a few years, stablecoins have gone from niche cryptocurrency assets to major players in the global payments landscape.

Once considered experimental, they now transfer more value annually than Visa and Mastercard, the two largest credit card and payments networks.

This chart shows the annual transfer volumes of stablecoins, Visa, and Mastercard between 2018 and 2024, using data from Artemis Analytics along with financial updates from Visa and Mastercard.

The Rise of Stablecoins’ Annual Transfer VolumeStablecoins have surged from just $3.3 billion in transfer volume in 2018 to $18.4 trillion in 2024.

This represents one of the fastest adoption curves in financial history, which you can see compared to Visa and Mastercard’s annual transfer volumes in the data table below:

YearStablecoins annual transfer volumeVISA annual transfer volumeMastercard annual transfer volume|

| 2018 | $3,279,344,039 | $11,300,000,000,000 | $5,900,000,000,000 | | 2019 | $177,385,343,798 | $11,600,000,000,000 | $6,458,000,000,000 | | 2020 | $1,355,800,297,277 | $11,300,000,000,000 | $6,334,000,000,000 | | 2021 | $8,119,984,437,078 | $13,000,000,000,000 | $7,725,000,000,000 | | 2022 | $8,335,094,236,523 | $14,100,000,000,000 | $8,185,000,000,000 | | 2023 | $7,644,470,860,158 | $14,800,000,000,000 | $9,022,000,000,000 | | 2024 | $18,356,300,240,041 | $15,700,000,000,000 | $9,757,000,000,000 |

Unlike traditional card networks, stablecoins operate on public blockchains, allowing transfers to occur nearly instantly and without intermediaries. This has fueled their popularity for both crypto-native activity and cross-border payments.

Stablecoins saw two significant surges in transfer volume since 2018. The first was between 2020 and 2021 when volumes rose nearly sixfold from $1.3 trillion to $8.1 trillion the following year

The other surge was from 2023 to 2024, when volumes more than doubled from 2023’s $7.6 trillion to reach $18.4 trillion the following year.

Visa and Mastercard: Slower Growth

Visa and Mastercard have also grown steadily, but at a much slower pace.

Visa rose from $11.3 trillion in 2018 to $15.7 trillion in 2024, while Mastercard increased from $5.9 trillion to $9.8 trillion over the same period.

Their growth reflects the continued expansion of digital payments globally, but they are now being outpaced by blockchain-based alternatives.

If trends continue, stablecoins could cement themselves as core infrastructure in global finance. Meanwhile, Visa and Mastercard are responding by exploring blockchain and stablecoin integrations to ensure they’re not left behind.

Learn More on the Voronoi App

To learn more about where stablecoins stand in the overall crypto ecosystem, check out this graphic breaking down the top 20 cryptocurrencies by market cap on Voronoi, the new app from Visual Capitalist. |