Race To The Financial Dung Heap

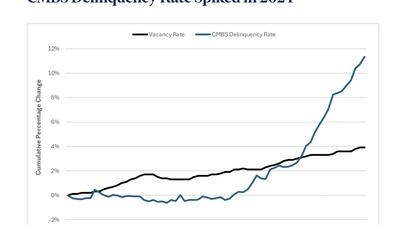

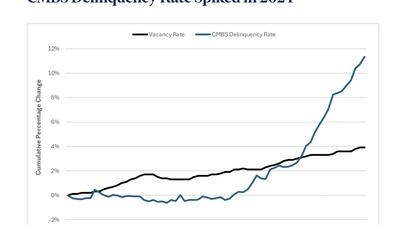

...rising defaults, strained borrowers, and lenders tightening terms—the classic setup for a credit crunch.

snip:

“What happens when people go to hit the bid when everyone’s marks are all inflated,” I asked the guy closest to me. “We’re going to need a bailout,” he said.

And it’s not just drunk 28 year old junior bankers saying this. Look at this hot-shit PIMCO executive on CNBC a couple days ago, essentially admitting that both public and private credit markets are flashing warning signs: public bonds are seeing high-profile defaults where companies can’t restructure effectively, while in private credit many borrowers are already unable to service cash interest and are resorting to “payment in kind” just to stay afloat.

He says borrowers are being forced to choose between costly but flexible private loans or cheaper public debt that becomes unworkable in distress, highlighting growing fragility across the system. At the same time, asset managers are under fee pressure and leaning on efficiency tools like AI just to manage risk.

Taken together, it points to rising defaults, strained borrowers, and lenders tightening terms—the classic setup for a credit crunch.

There have been clues along the way that this was happening. In 2024, corporate bankruptcies reached their highest level since 2010, and private-credit managers—from Blackstone to midsize players—expanded workout teams aggressively. Compensation packages for senior restructuring professionals ran as high as $1.5 million.¹° |