Stablecoin Week: 6 Insights Shaping the Future of Money

October 6, 2025

By Jenna Ross

Graphics/Design:

Stablecoins have gone from a niche cryptocurrency to one of the fastest-growing forces in global finance. They’re transforming payments and even influencing government debt.

For Stablecoin Week, we partnered with Plasma, a blockchain built for global stablecoin payments, to explore the shifting dynamics. From overtaking Visa in transfer volumes to bold market size forecasts, the series revealed just how big this movement has become.

Below, we’ve compiled six key takeaways.

1. Mapping Stablecoin Regulation

Clear regulations can be a catalyst for institutional adoption and cross-border expansion. However, the status of regulations differs quite a bit globally.

While some countries have outright bans on cryptocurrency, others have set out specific legislation that acts as guardrails for issuers, custodians, and/or users.

?? See the map

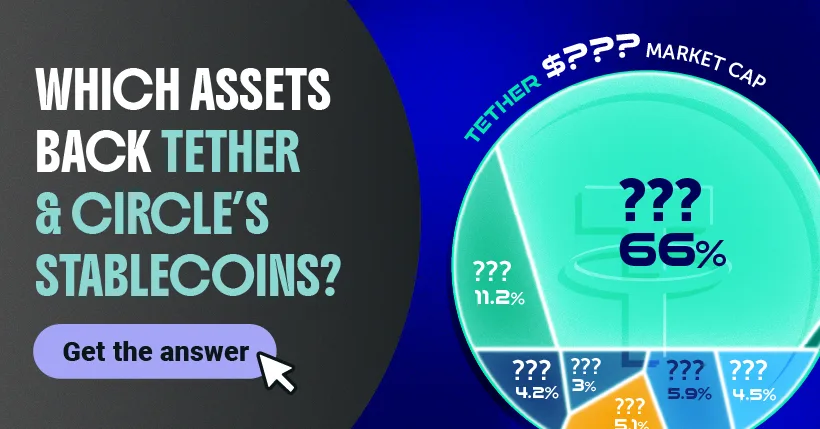

2. The Assets Backing Stablecoins

Alongside regulation, the stability of being pegged to the U.S. dollar (for 99% of stablecoins) helps boost confidence among users. But the assets held to support that stability differ depending on the issuer. Circle holds a more conservative balance sheet, while Tether has diversified into riskier assets.

?? View the full breakdown

3. Stablecoins’ Role in the U.S. Debt Market

Because Treasury securities play such a big role in the reserves of stablecoin issuers, Tether and Circle buy a lot of U.S. debt. So much, in fact, that their purchases surpass entire countries in some cases.

?? Explore the ranking

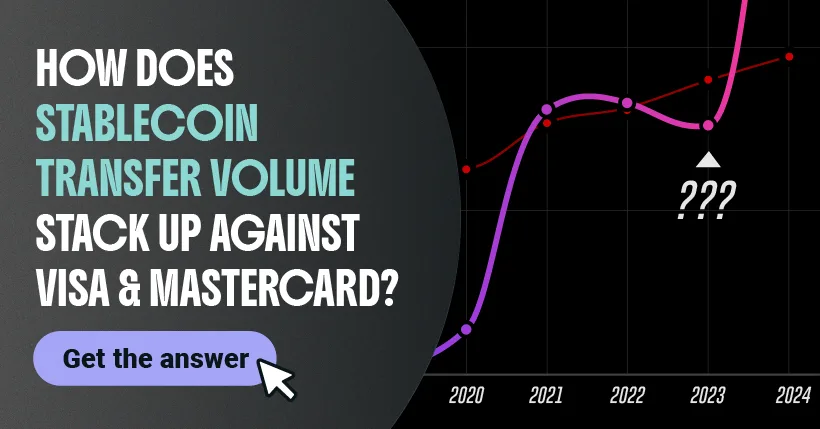

4. Stablecoins vs. Visa and Mastercard

Outside of debt markets, stablecoins are also a major player in the global payments landscape. Their near-instant, very low-cost transfers have fueled stablecoins’ popularity.

As recently as 2020, stablecoin transfer volume was far below that of Visa or Mastercard. Now, stablecoins have skyrocketed to outpace both major payment networks.

?? Explore the comparison

5. Comparing Stablecoin Value to U.S. Cash

Stablecoins are growing quickly, but it can be hard to grasp just how much they’re growing without context. We measured the stablecoin market cap relative to the value of all physical U.S. cash in circulation, which includes paper bills and coins.

In 2020, the value of stablecoins was equivalent to just 1% of U.S. cash in circulation. However, their market cap has surged over the last five years.

?? See the growth of stablecoins

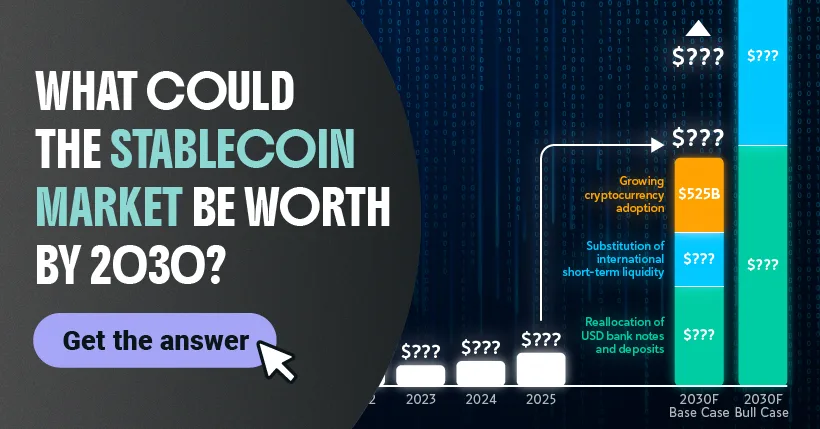

6. Stablecoin Market Size by 2030

How big could the stablecoin industry get within the next five years? According to Citi, the market could grow more than 14 times larger by 2030.

Experts expect this growth will be driven by three factors: the shift of U.S. cash and deposits into digital tokens, the replacement of international short-term liquidity tools with stablecoins, and the growing role of stablecoins as the backbone of cryptocurrency adoption.

?? View the forecast

Looking Ahead: The Digital Dollar EraStablecoins are no longer on the periphery of finance. Instead, they’re redefining how money moves. From evolving regulations to their momentum against traditional payment methods, their trajectory points toward deeper integration with global markets.

Plasma is building the infrastructure to power this next era, enabling global stablecoin transactions that move money with speed and scale. |