Ranked: The Top 50 Countries by Central Bank Reserves

October 7, 2025

By Marcus Lu

Graphics/Design: See visualizations like this on the Voronoi app.

Use This Visualization

The video player is currently playing an ad. You can skip the ad in 5 sec with a mouse or keyboard

Ranked: The Top 50 Countries by Central Bank ReservesSee visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways- Central bank reserves are considered critical for global economic stability, helping countries meet balance of payments obligations and buffer against economic or geopolitical shocks

- The top 10 countries collectively hold $9.4 trillion in currency and gold reserves, accounting for over 60% of the global total

Central bank reserves can be considered as a country’s financial shield, consisting of foreign currencies, gold, and other liquid assets. These reserves play an important role in stabilizing currencies and navigating financial crises.

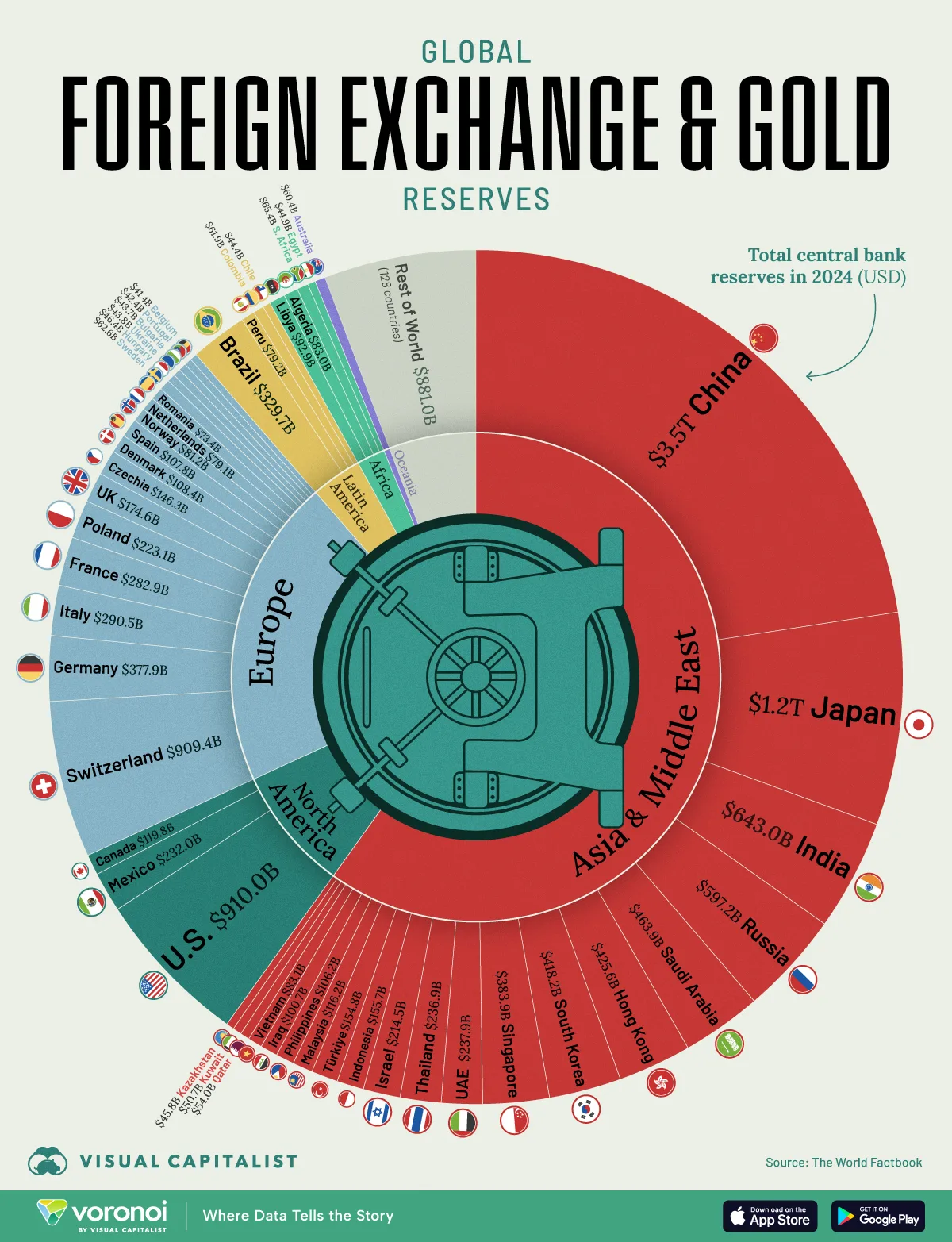

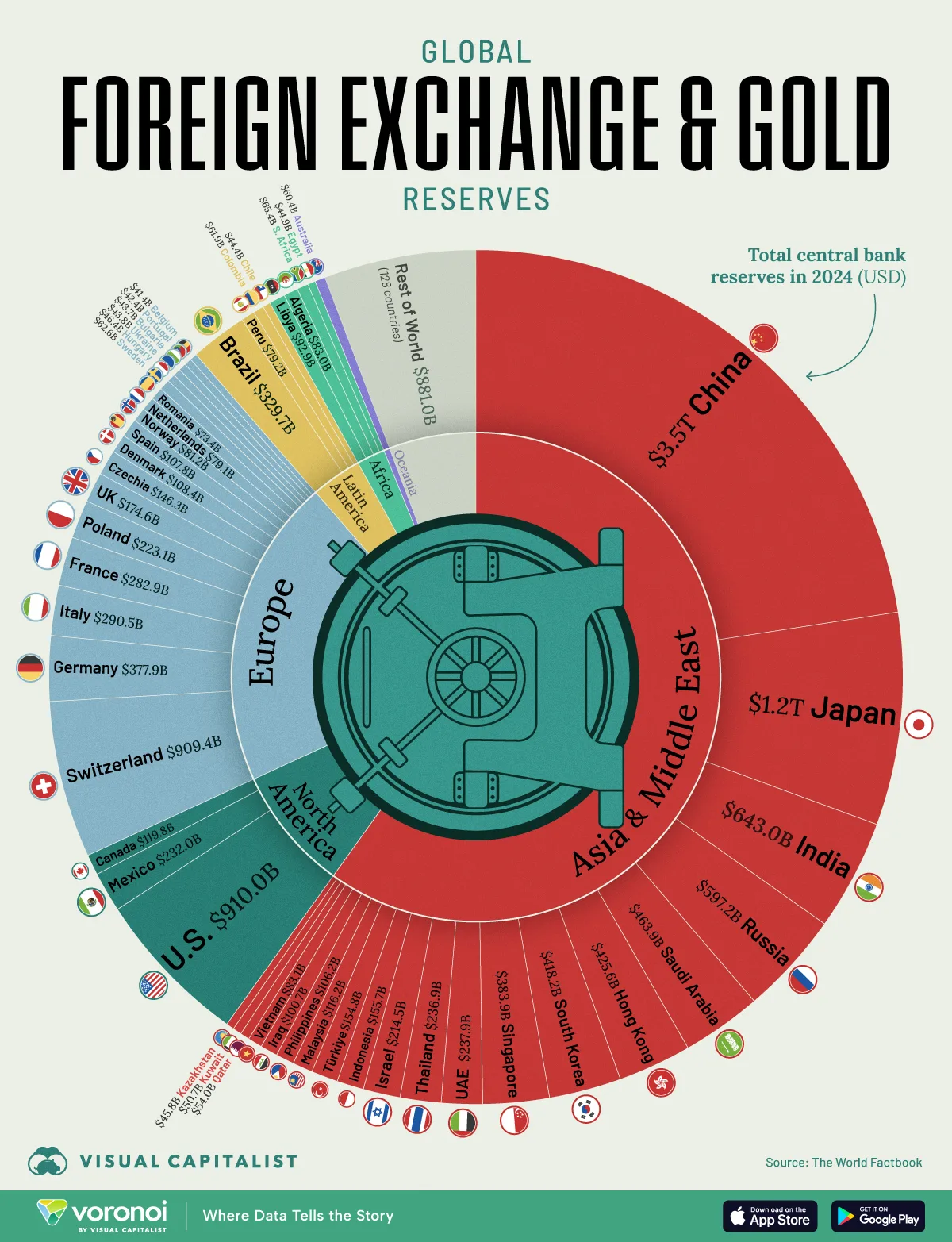

In this graphic, we visualize the 50 countries with the most central bank reserves, providing insight into the balance of global finances.

Data & Discussion

The data for this visualization comes from The World Factbook. It compares the value of reserves (foreign exchange and gold) held by the world’s central banks as of 2024.

These holdings determine how resilient economies are to shocks and how much influence they may wield in global markets.

Search:

RankCountryValue of Reserves (USD)|

| 1 | ???? China | $3,456,000,000,000 | | 2 | ???? Japan | $1,231,000,000,000 | | 3 | ???? U.S. | $910,037,000,000 | | 4 | ???? Switzerland | $909,366,000,000 | | 5 | ???? India | $643,043,000,000 | | 6 | ???? Russia | $597,217,000,000 | | 7 | ???? Saudi Arabia | $463,870,000,000 | | 8 | ???? Hong Kong | $425,554,000,000 | | 9 | ???? South Korea | $418,219,000,000 | | 10 | ???? Singapore | $383,946,000,000 | | 11 | ???? Germany | $377,936,000,000 | | 12 | ???? Brazil | $329,732,000,000 | | 13 | ???? Italy | $290,547,000,000 | | 14 | ???? France | $282,857,000,000 | | 15 | ???? UAE | $237,931,000,000 | | 16 | ???? Thailand | $236,934,000,000 | | 17 | ???? Mexico | $232,035,000,000 | | 18 | ???? Poland | $223,115,000,000 | | 19 | ???? Israel | $214,544,000,000 | | 20 | ???? UK | $174,598,000,000 |

China is the World’s Largest Holder of Foreign Currency Reserves

The World Factbook estimates that China has $3.5 trillion in central bank reserves, far more than any other country.

According to The Economics Review, this is due to China’s persistent trade surpluses, which result in more foreign currencies flowing into the country than flowing out.

To prevent the yuan (RMB) from rapidly appreciating, the People’s Bank of China (PBC) intervenes in foreign exchange markets by buying other currencies, pushing money into circulation (a potential inflation risk).

In order to offset this inflationary pressure, China uses a strategy known as sterilization, which involves conducting monetary policy opposite of the initial intervention to offset its effects on the monetary base.

If the PBC first intervenes in the foreign exchange market by purchasing excess foreign reserves with RMB, corresponding sterilization would be implemented using contractionary monetary policy such as open market sales or increasing reserve requirements.

This would then reduce net domestic assets in the PBC’s balance sheet and decrease liabilities, thereby curbing monetary expansion.

– The Economics Review

Why Switzerland Ranks Fourth

Following the 2008 Global Financial Crisis, demand for the Swiss franc surged as it was viewed as a safe-haven, putting upward pressure on its value.

This is problematic because as the Swiss franc quickly rises in value, imports become cheaper, pushing overall prices downwards and risking deflation.

To counter this risk, the Swiss National Bank (SNB) bought large amounts of foreign currencies, slowing the franc’s rise but expanding its reserves significantly.

In more recent years, the SNB has used its currency reserves to counter inflationary pressures. By selling foreign exchange (boosting demand for one’s domestic currency), central banks can appreciate their currency to make imports cheaper, reduce overall price growth, and bring inflation back down to target levels. |