The etiology of silver.

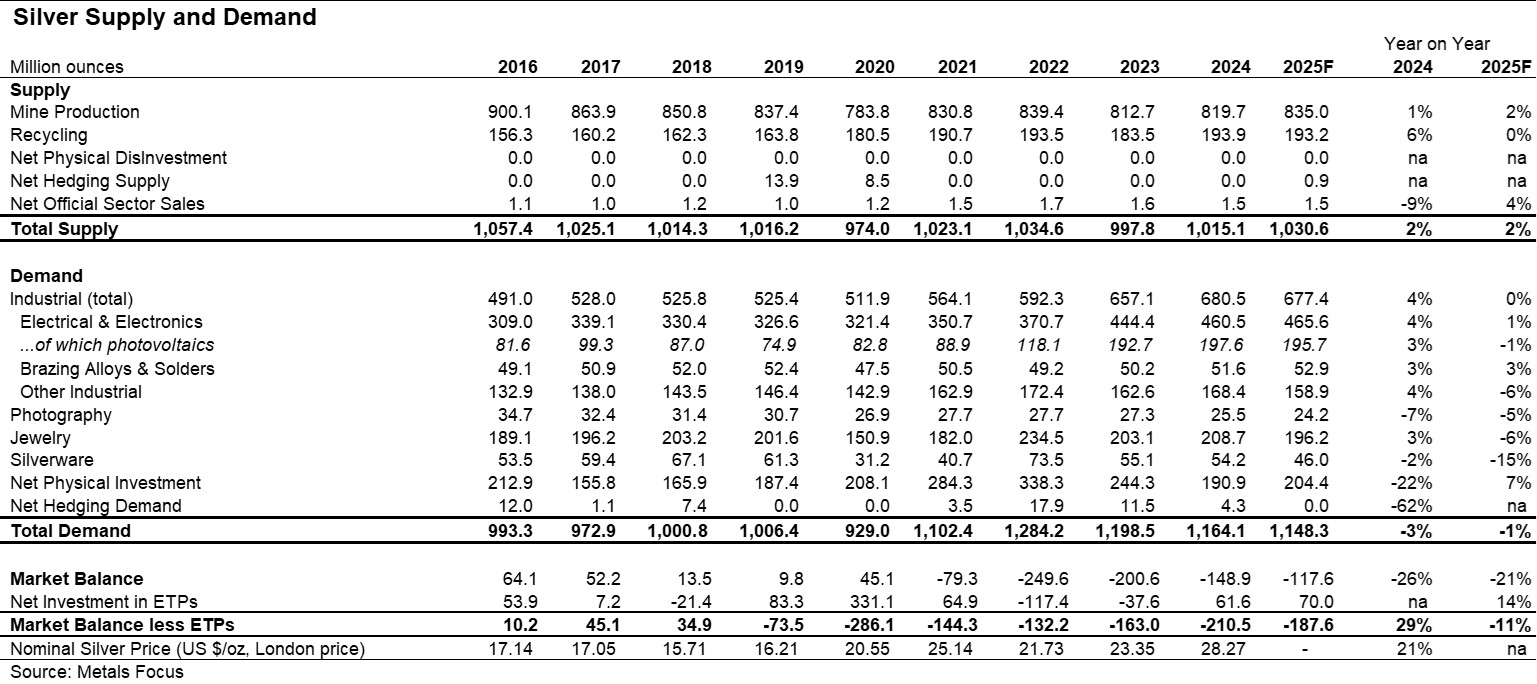

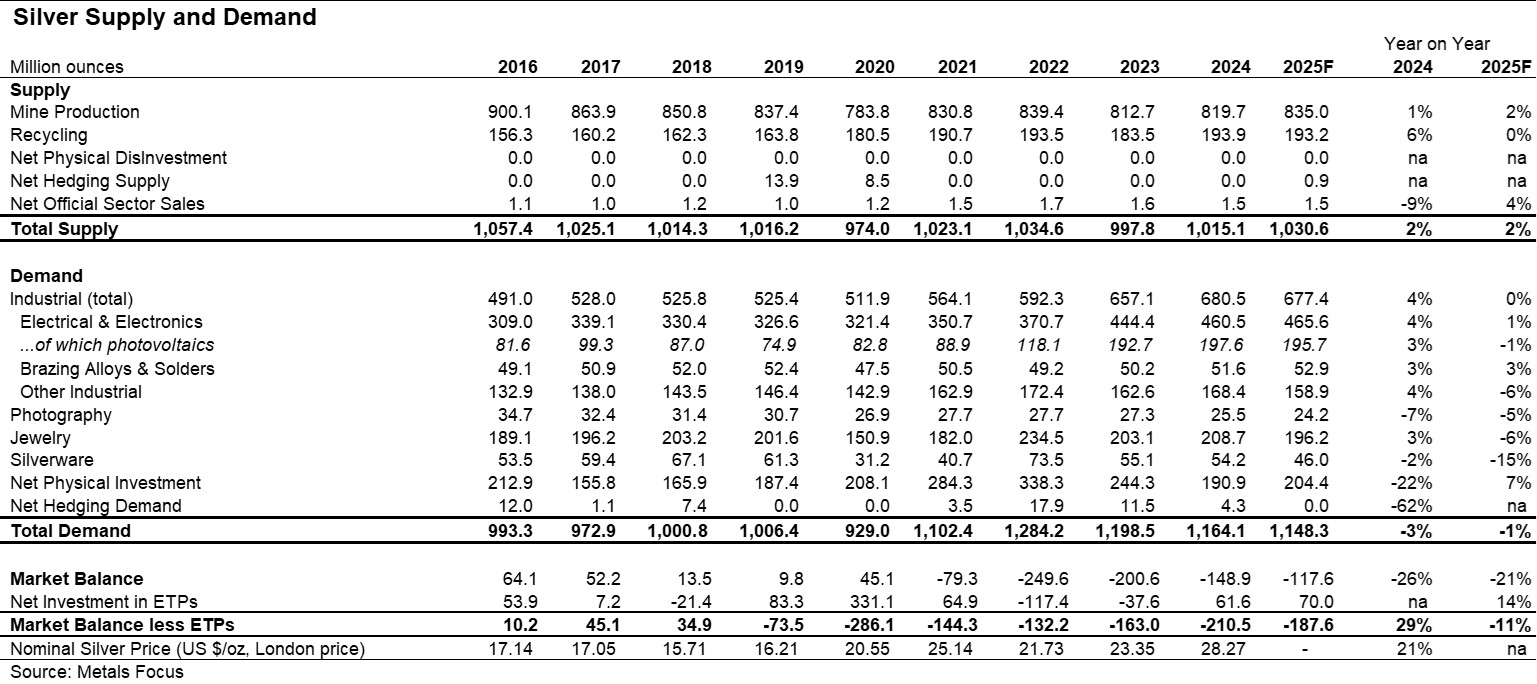

If one looks at the graph below they will notice there has been a supply shortage for the last five years, including this year, and investment demand has been constant at about 200 million oz, and with a gold silver ratio of over 100. 80 to 1 now, approx. So little investment speculation.

Then gold started rising on big demand from countries like China and India, and central banks, for myriad reasons, and this caused silver speculation to increase and it moved up with gold, as it always does.

In the past, the silver shortage was not responding with a price increase for whatever reason, but when gold started moving, it moved..

And as it moved up two things happened, one the short sellers got hurt, and two, it highlighted the supply shortage, and this created a loop, snow ball effect.

As speculation buying increased the supply shortfall, the supply shortfall increased speculation, that in turn increased the supply shortfall. And how far this goes is anyone's guess?

This move is much different than the last two big moves in that it is not just speculation, but is underpinned by the fundamental supply and demand shortfall.

And as silver is inelastic, it would seem it will take higher prices to pull more silver out of people holding it, and be less prone to free fall?

|