SSD "shortfall in supply appears unlikely to be alleviated for 2+ years"

Seagate, Western Digital in focus as Wedbush ups price targets amid strong demand

Copilot:

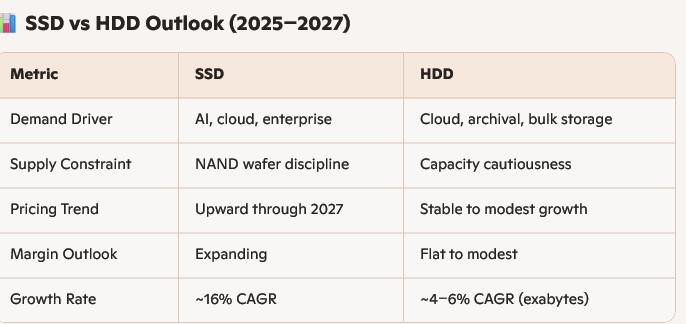

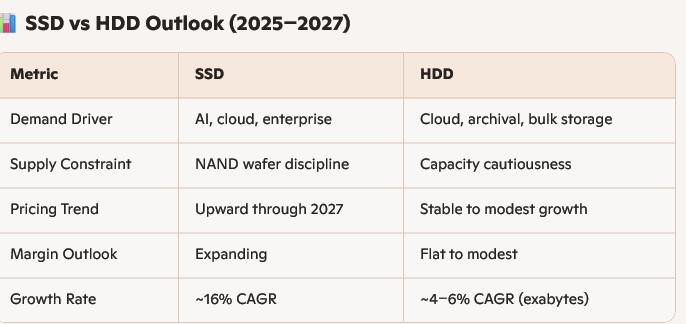

That quote refers to the SSD market, not HDD. The context is rising demand for AI-optimized enterprise storage, tight NAND supply, and strategic wafer allocation—all of which are driving SSD pricing and margins higher through 2026–2027.

Why It’s an SSD Story

- Source context: The quote aligns with analysis from Mordor Intelligence and Forbes, which highlight SSD growth driven by AI workloads, hyperscaler deployments, and NAND supply discipline.

- SSD market size: Expected to grow from $61.3B in 2025 to $129.6B by 2030, with a 16.2% CAGR, fueled by enterprise AI clusters and high-capacity QLC drives.

- NAND supply constraints: Vendors are calibrating wafer starts and layer transitions to preserve margins, creating a multi-year supply shortfall that supports pricing power.

- AI impact: SSDs are preferred for low-latency, high-throughput workloads like training and inference—especially with retrieval-augmented generation (RAG) and LLMs.

Why Not HDD?

- HDDs are also seeing demand growth, especially in exabyte shipments for cloud storage, but:

- Unit shipments remain flat (~123M units/year through 2030)

- Pricing is more volatile, and margins are thinner

- Manufacturers are cautious about expanding capacity due to past inventory crashes

If you’d like, I can break down how SSD vendors like Samsung, Micron, and Kioxia are managing NAND layer transitions (e.g. 238L ? 321L) to balance density and margin—or how QLC and PCIe Gen5 are reshaping enterprise SSD economics.

PS

Thingy, of every kind, Shrink n Stack bits ONLY soar from here.

ASML

Village |