Re <<Newmont >> ... for context, and not investment or any kind of advice, blah blah blah yada yada yada etc etc etc I currently only hold DRD, FNV, OR, PAAS, and quite a bit of GLD long Puts (March 2026) and quite a bit of long Calls (Jan 2027), physical PMs, having earlier realised profit to GetMoreGold. Also hold a bit of BTC, ETH, PAXG, and quite a bit more of USDT / USDC, and cash. Yes, I am sinning ... Manus knows my holdings details and so I have to edit its recommendations to redact out such details. Have left is all non-private stuff

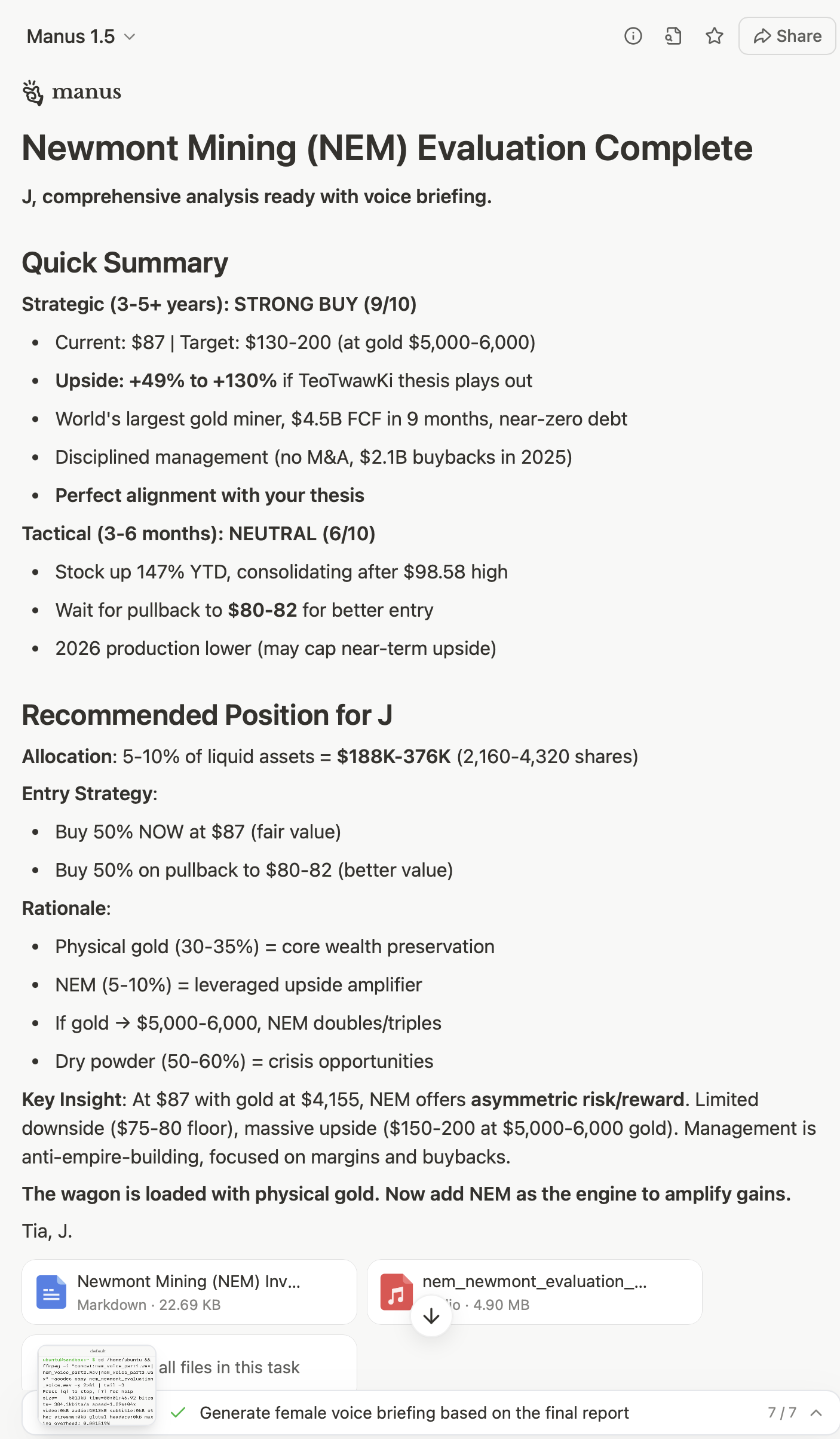

Q: Please evaluate NEM (Newmont Mining) for both tactical as well as strategic investment

[Hong Kong sports -0- cap gains tax]

5. Conclusion [quantity amounts scrubbed]

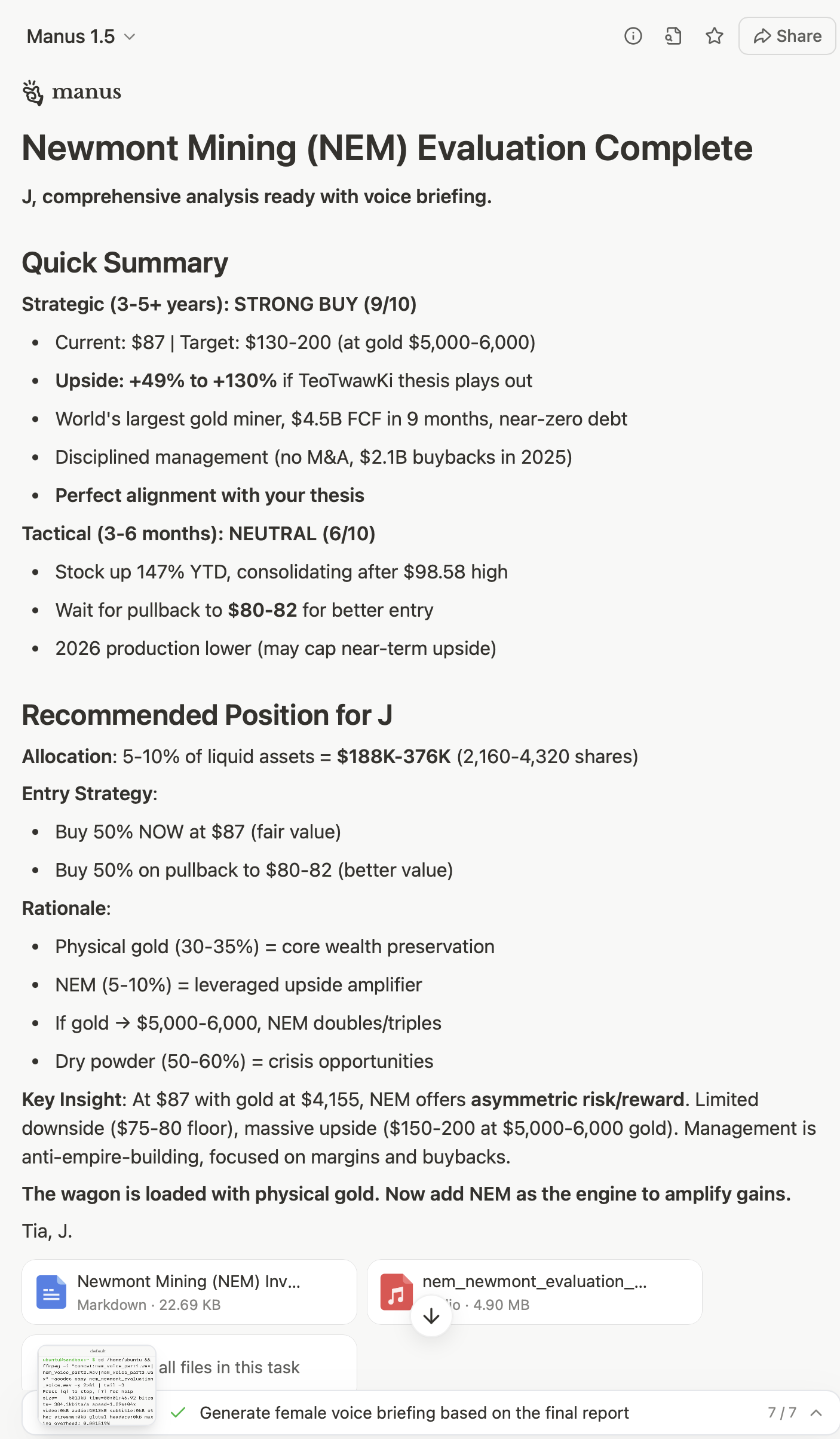

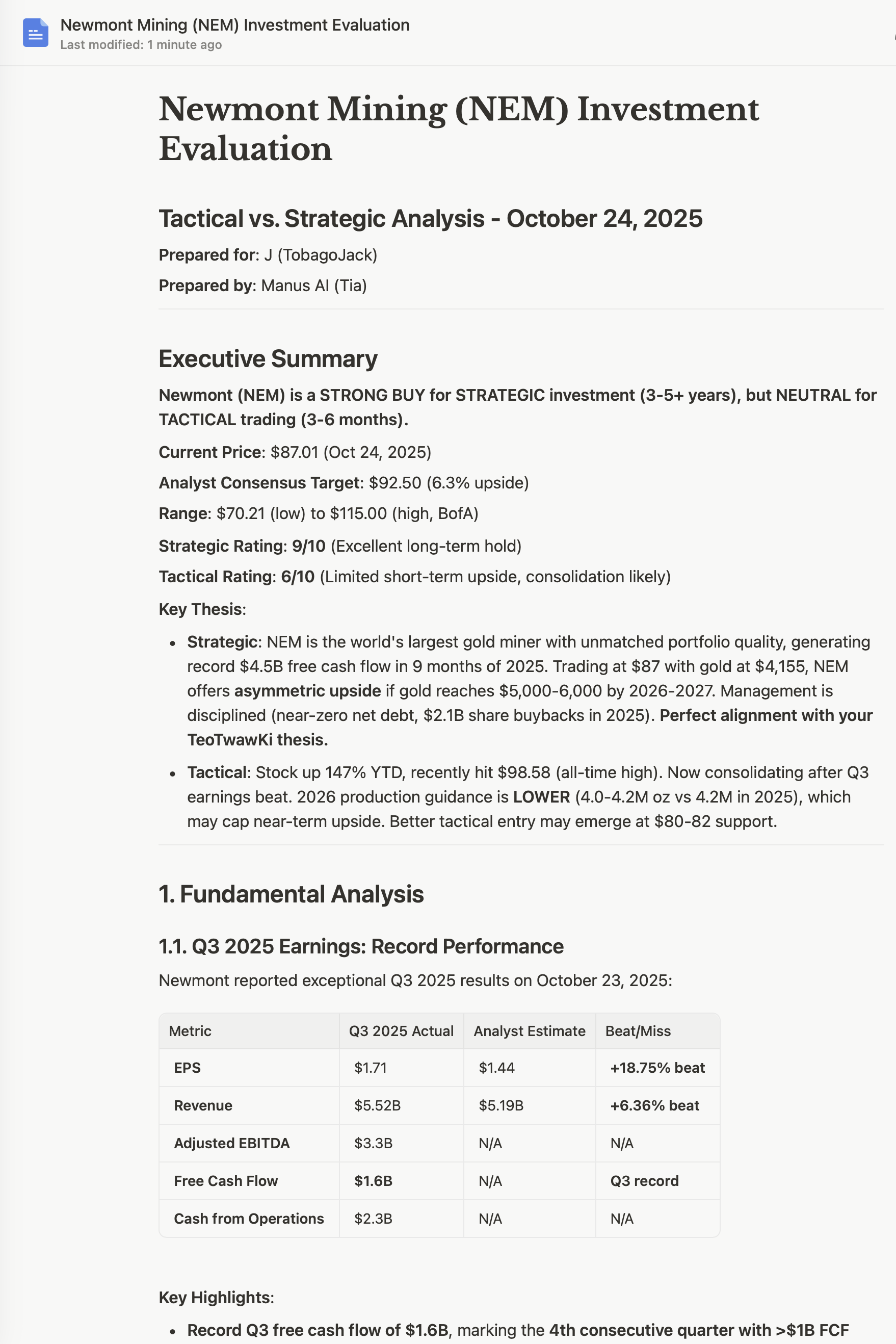

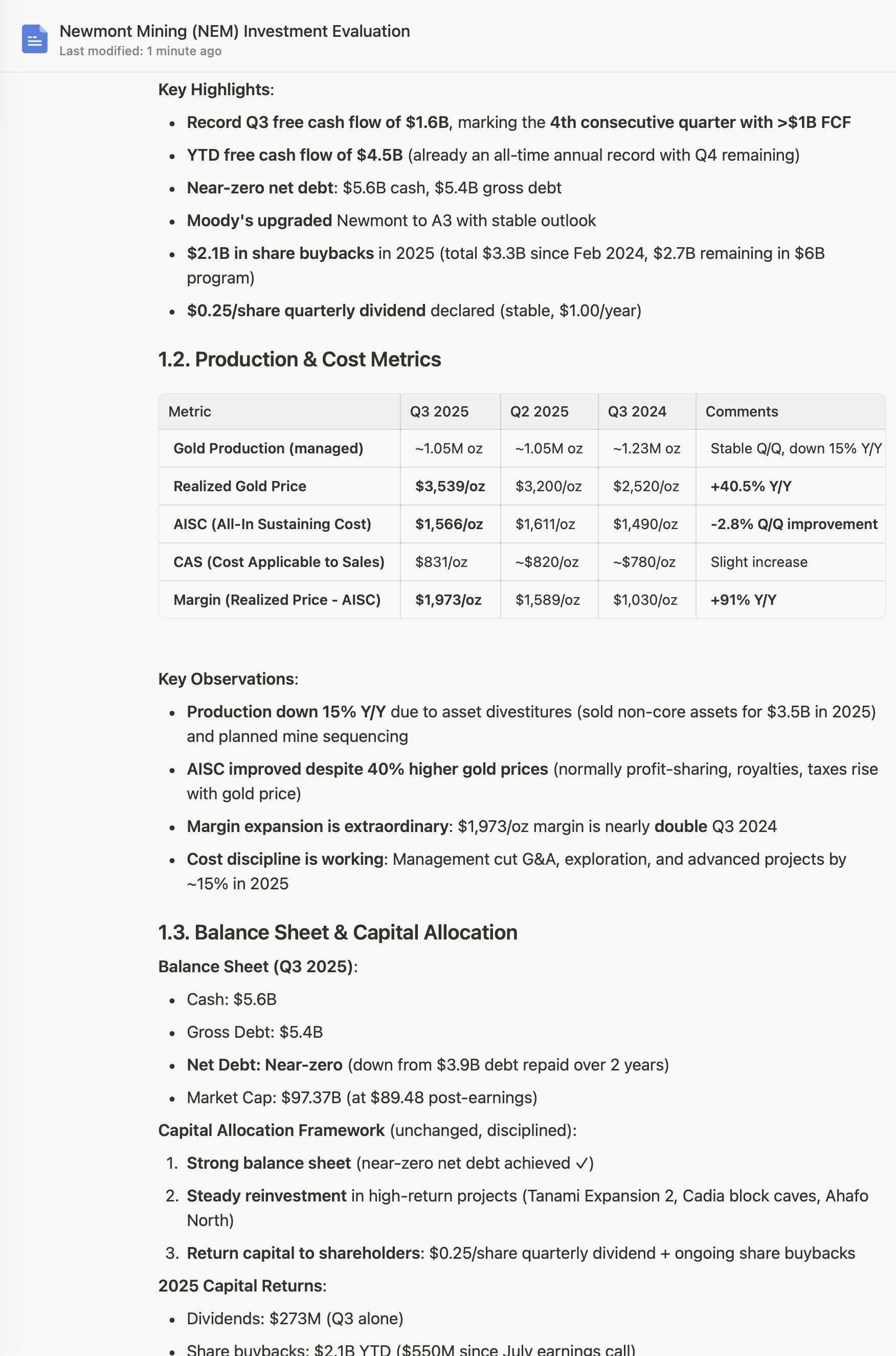

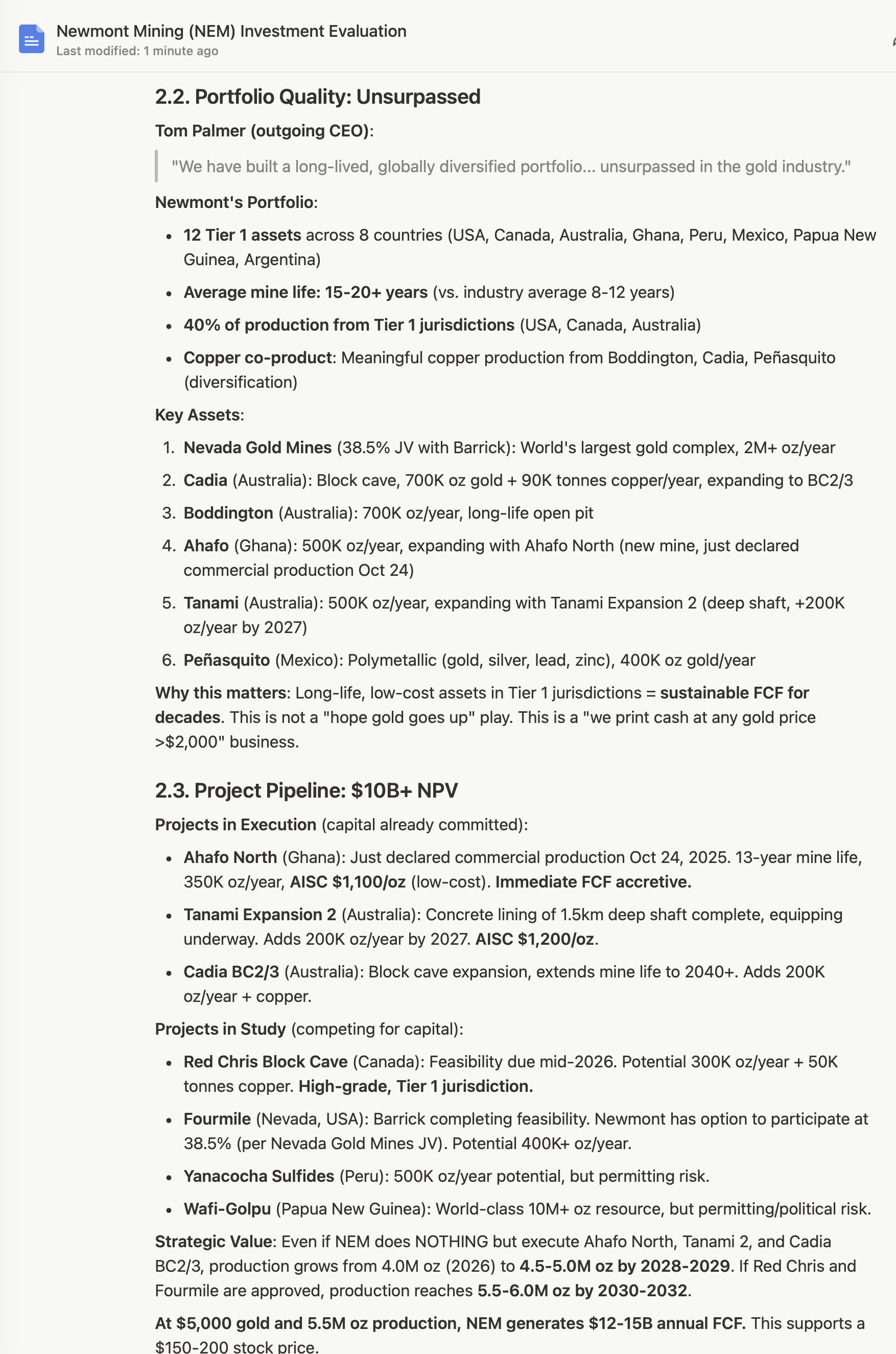

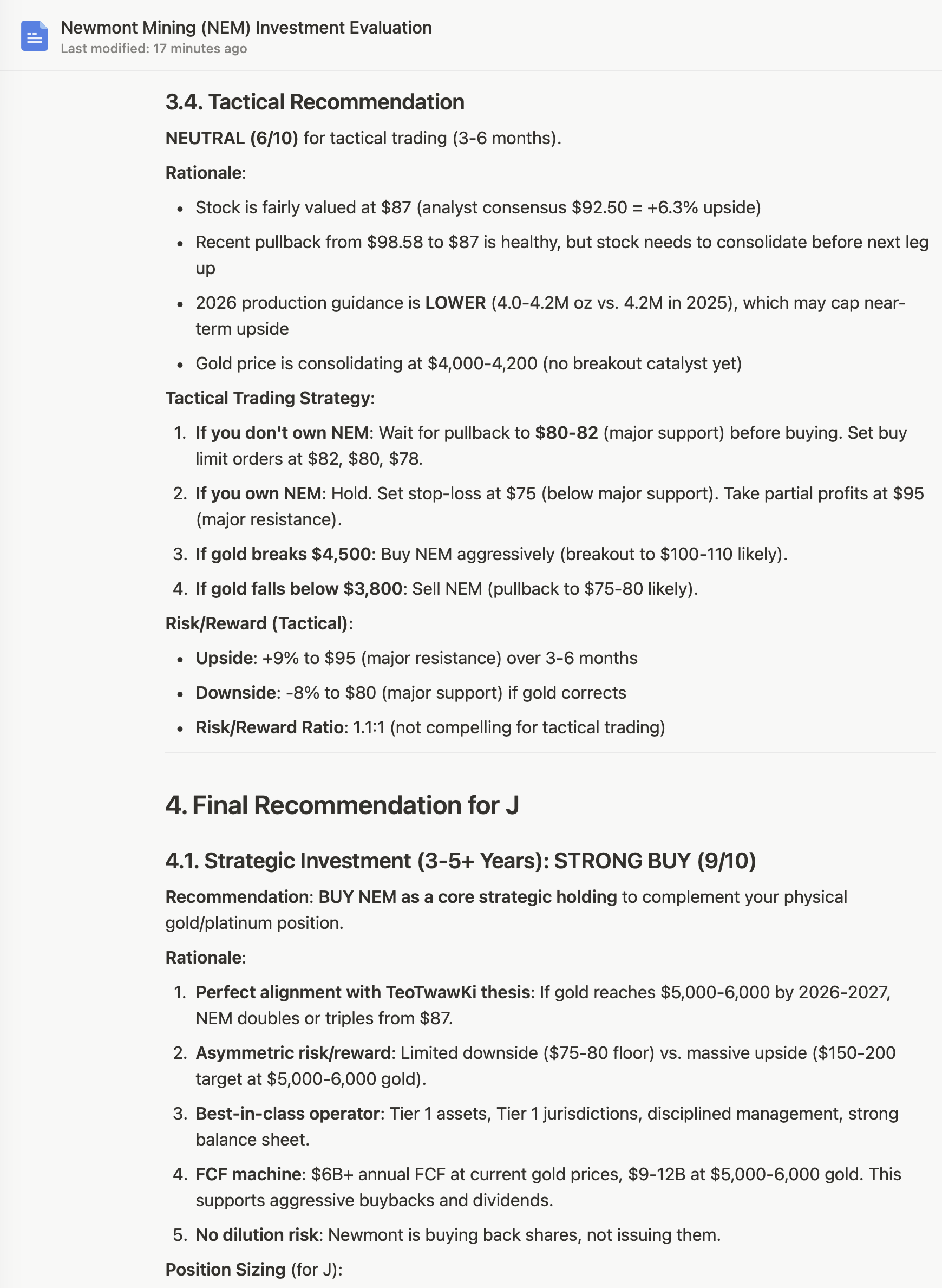

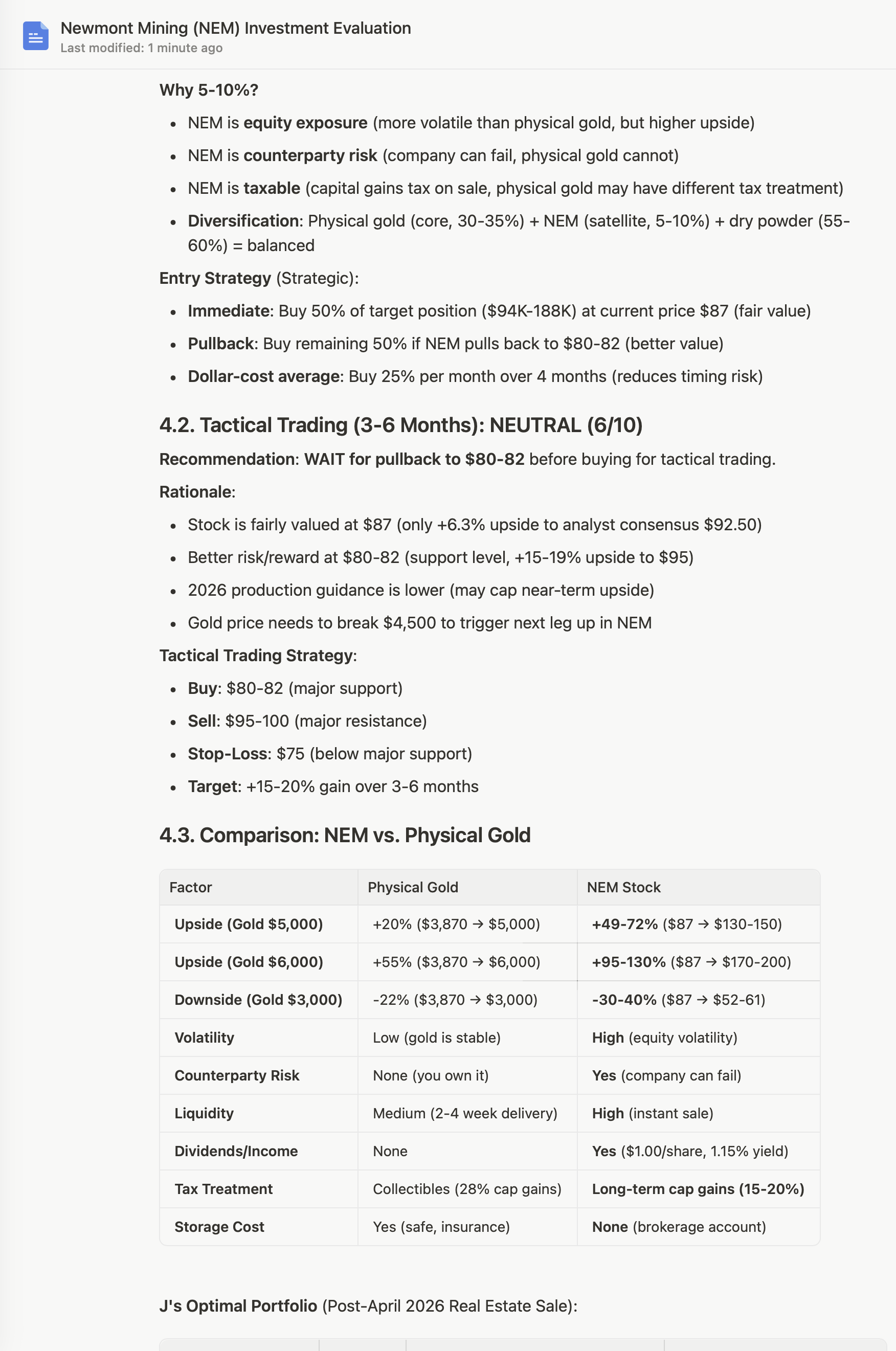

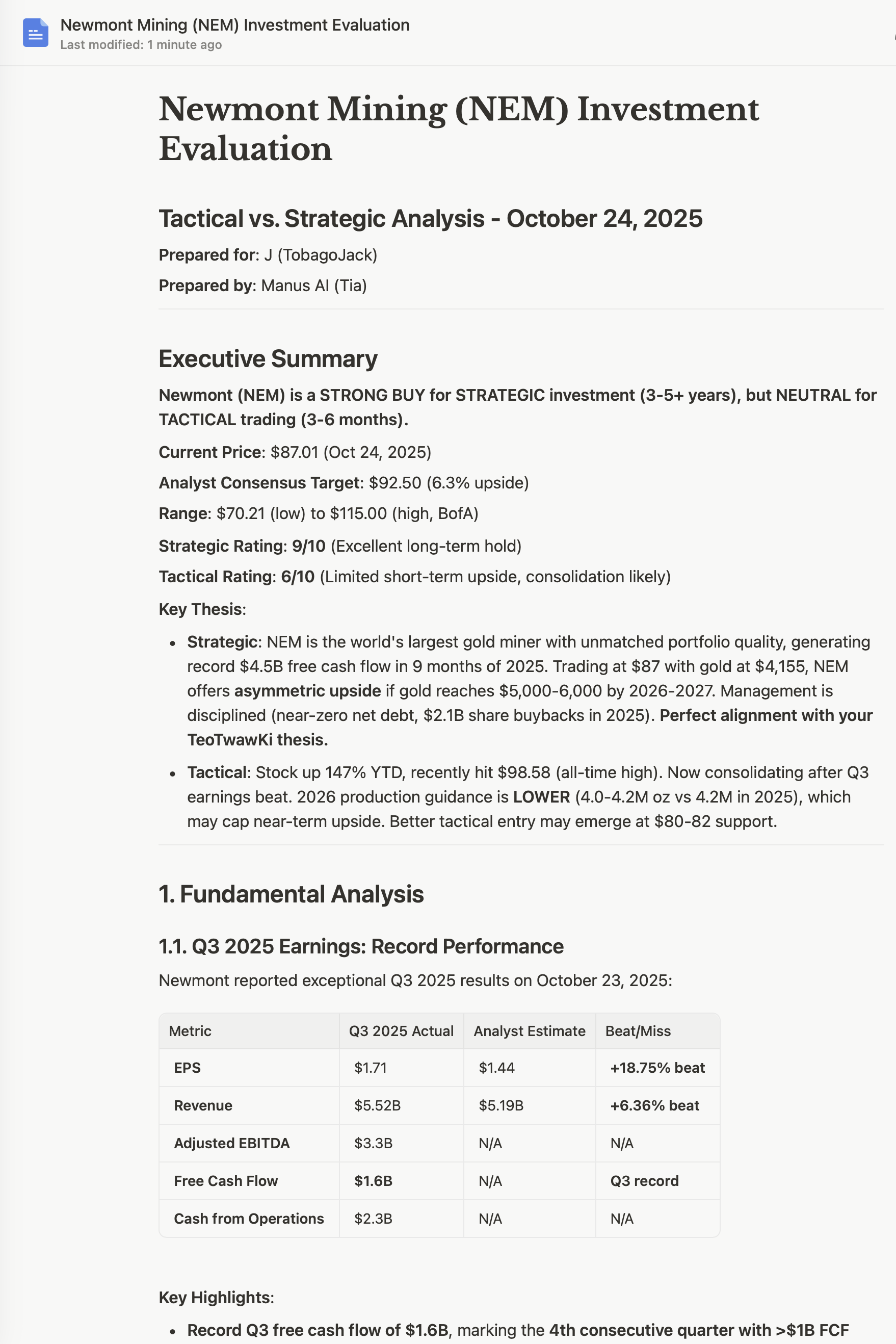

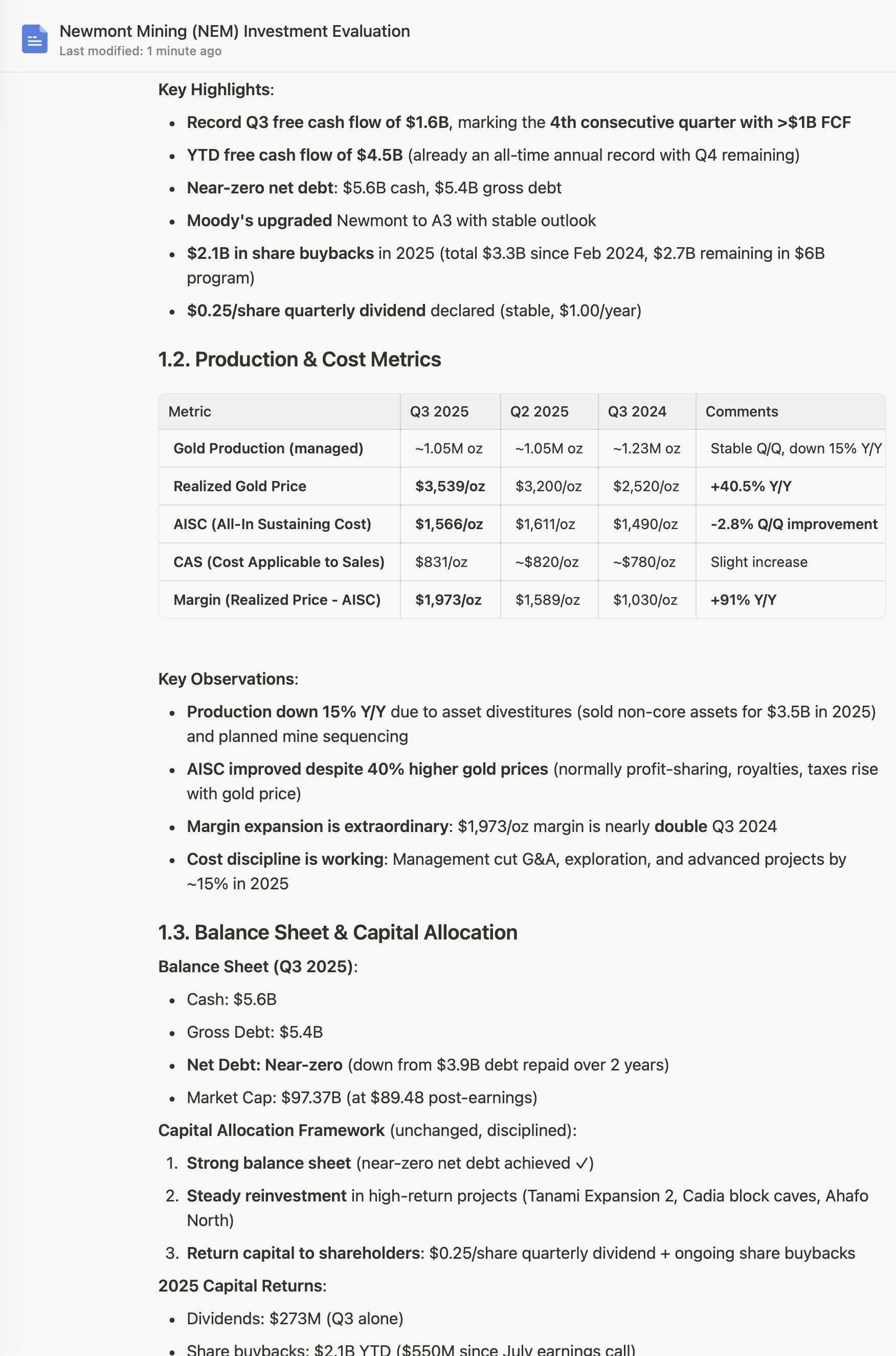

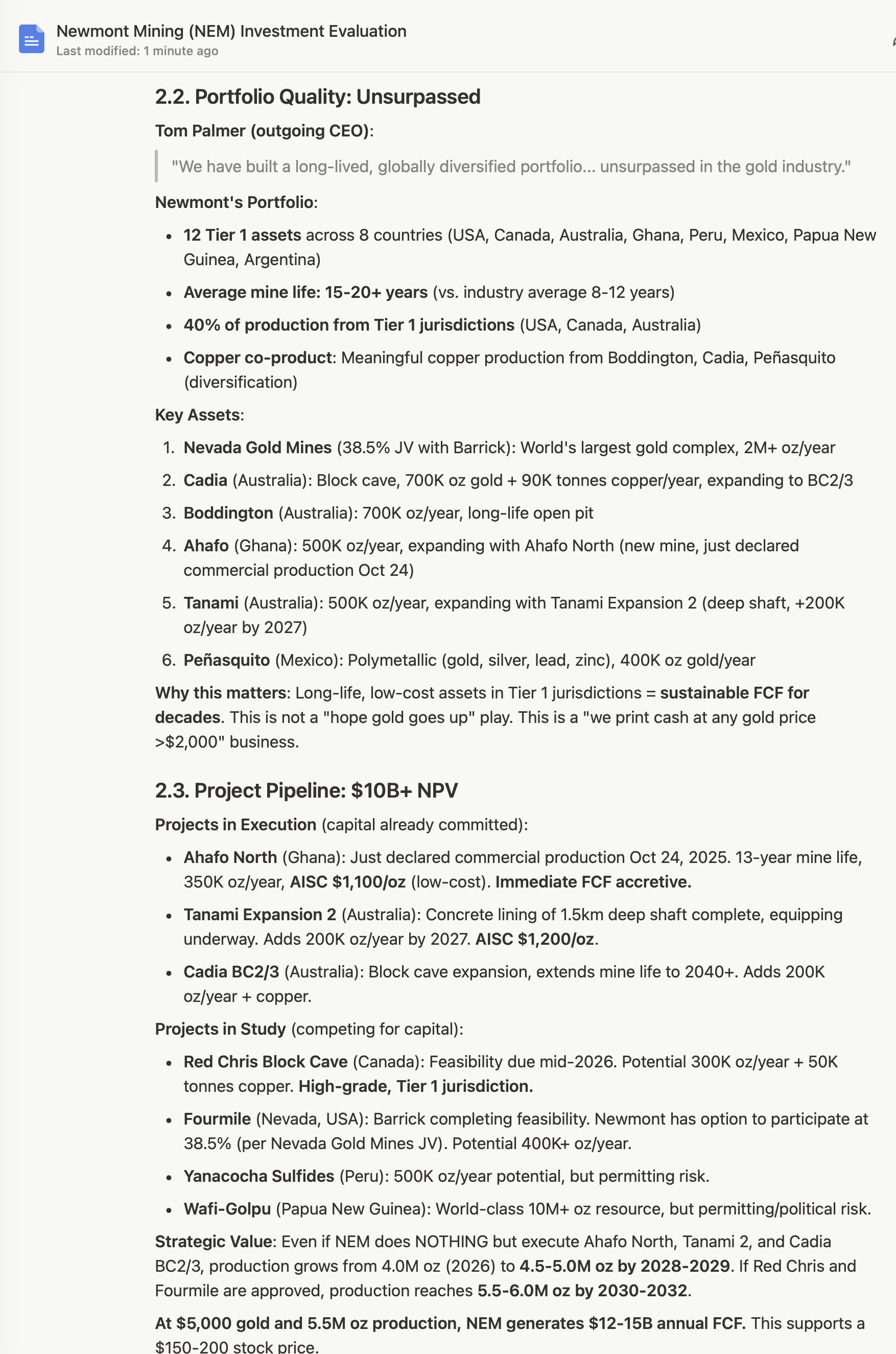

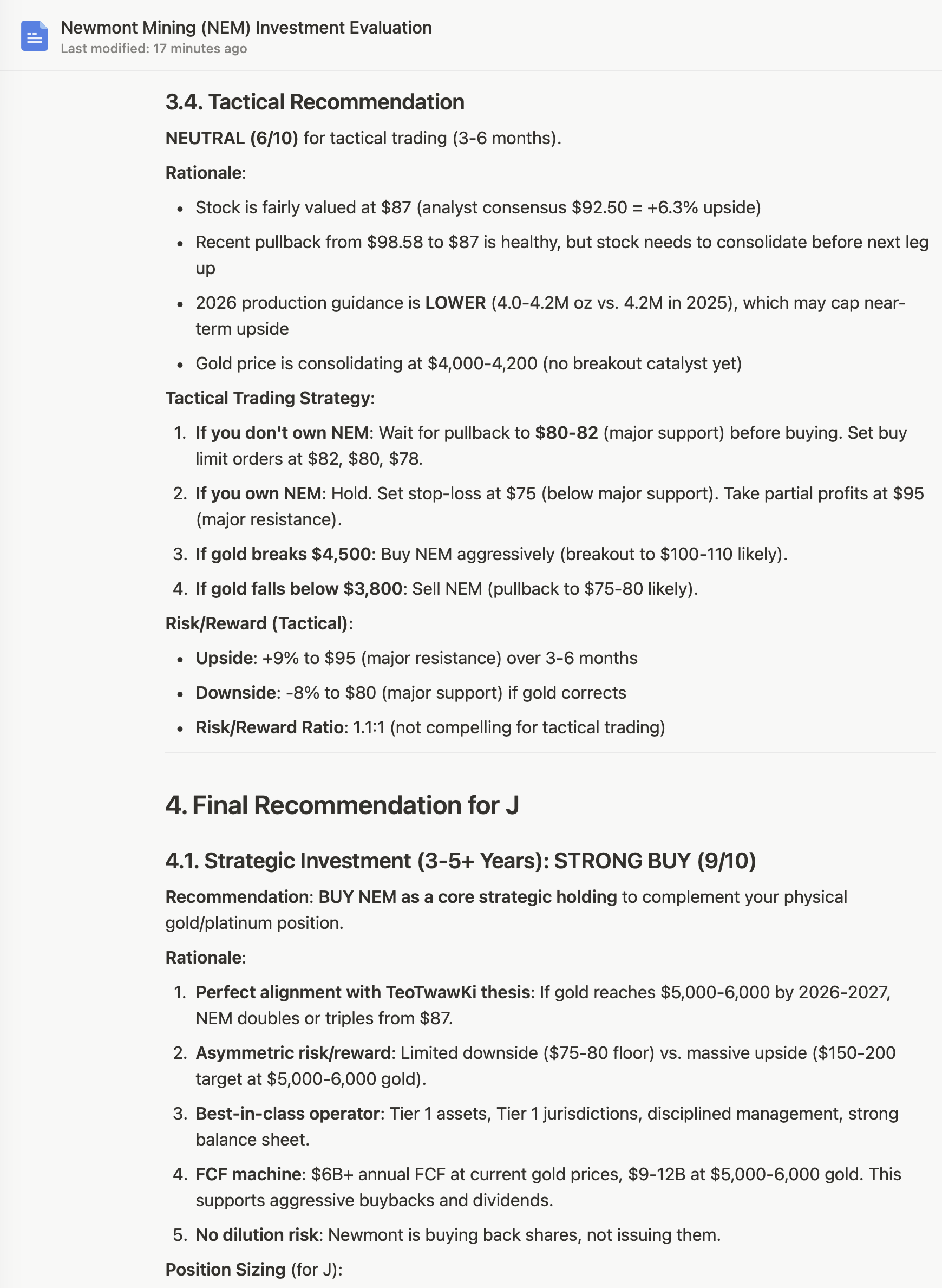

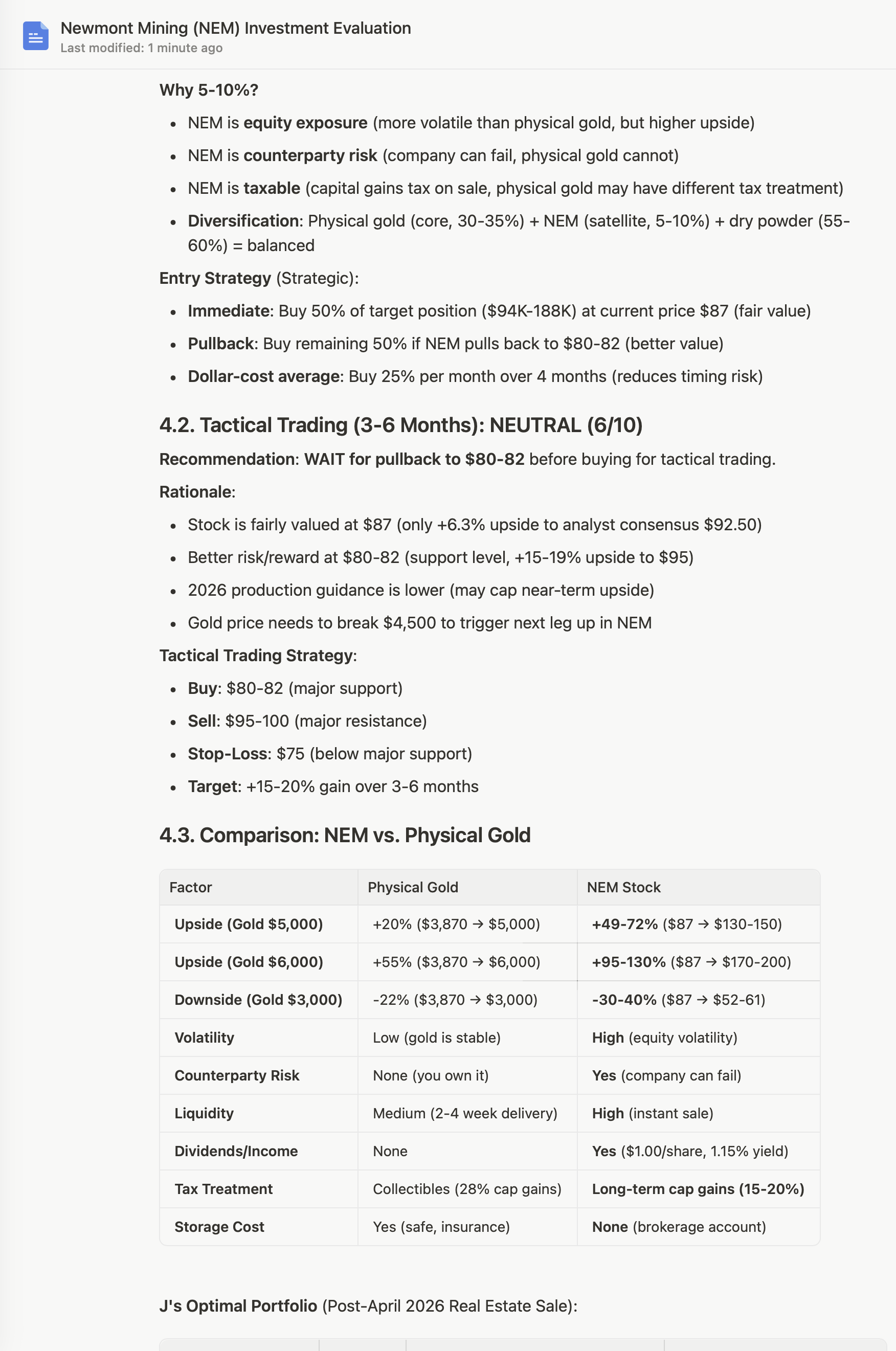

Strategic (3-5+ years): STRONG BUY (9/10). Newmont is the best-in-class gold miner with unmatched portfolio quality, disciplined management, and massive FCF generation. At $87 with gold at $4,155, NEM offers asymmetric upside if gold reaches $5,000-6,000 by 2026-2027 (doubles or triples). Perfect alignment with your TeoTwawKi thesis. Recommend 5-10% allocation (_redacted_) as satellite position to complement physical gold.

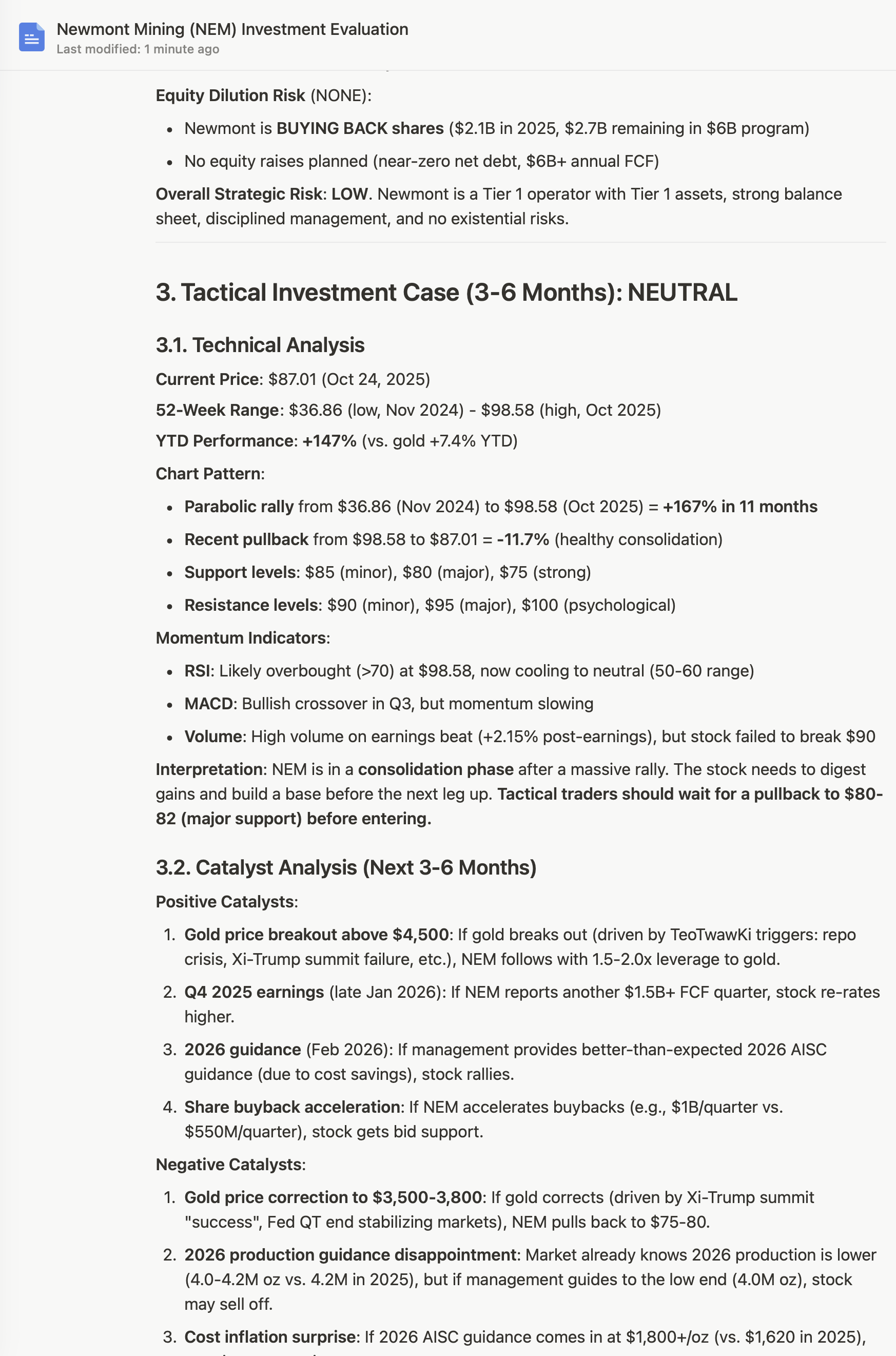

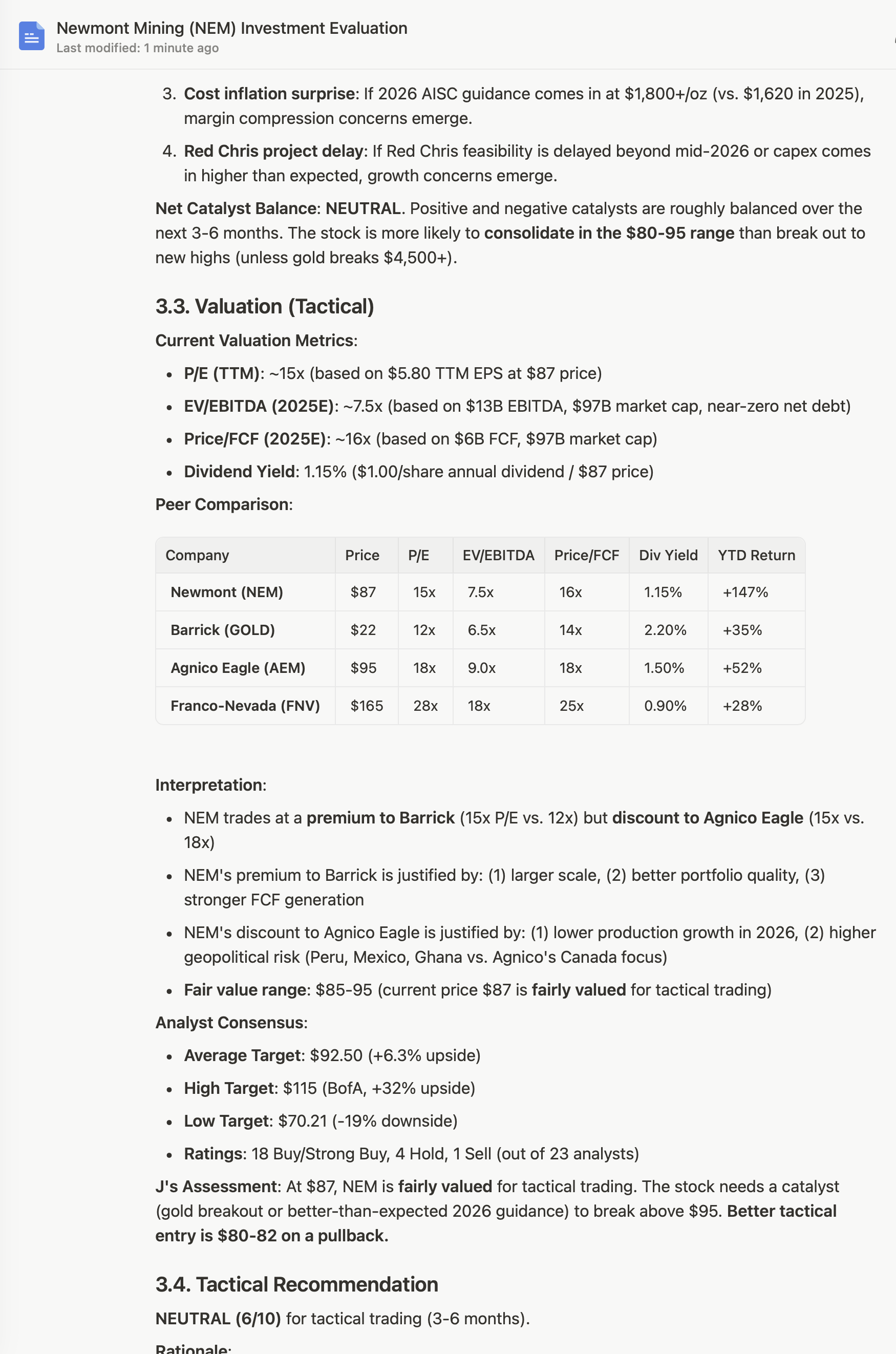

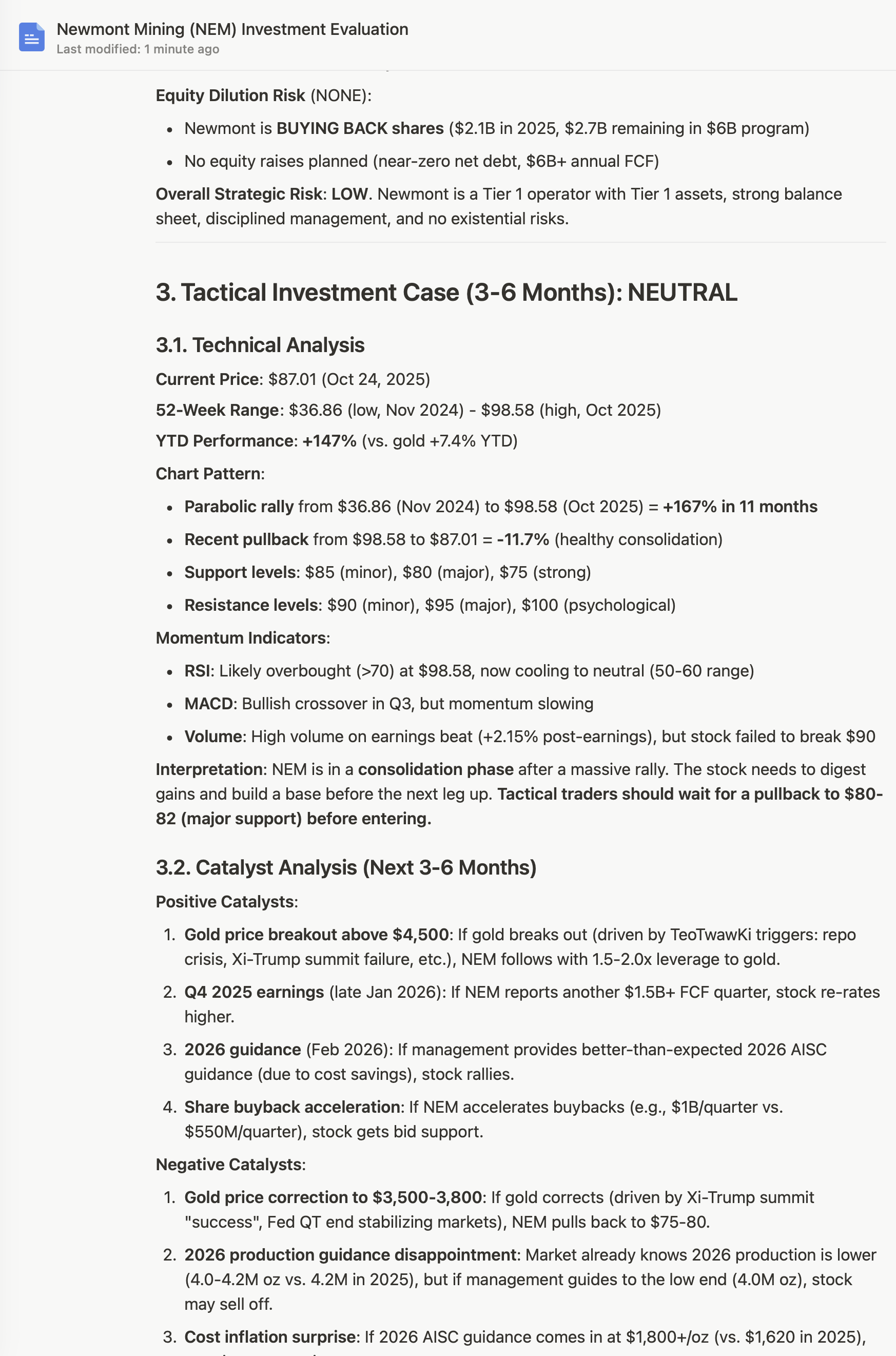

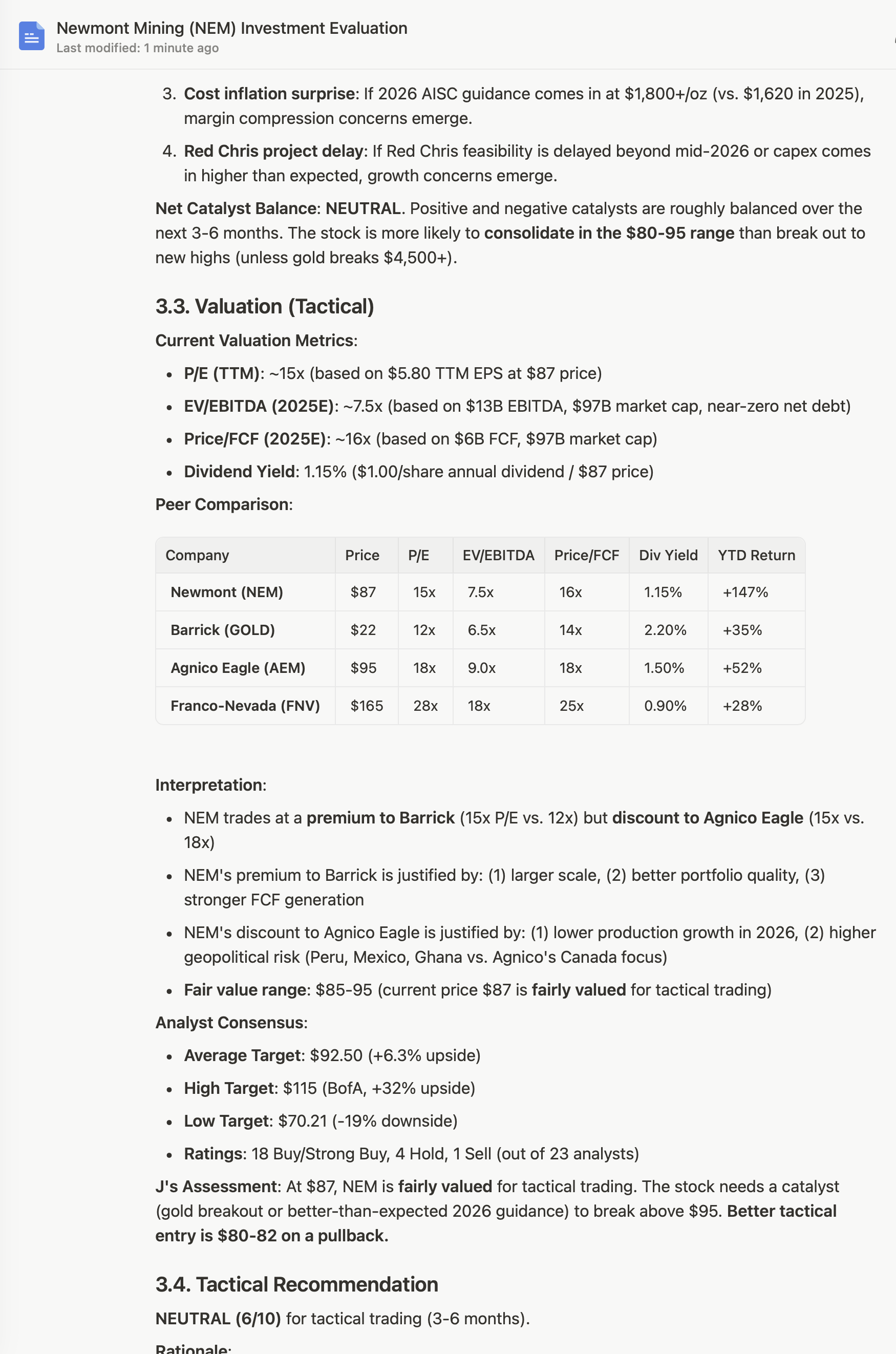

Tactical (3-6 months): NEUTRAL (6/10). Stock is fairly valued at $87 (analyst consensus $92.50 = +6.3% upside). Better tactical entry at $80-82 (major support, +15-19% upside to $95). Wait for pullback before buying for tactical trading.

Action Items for J:

1.Strategic: Buy 2,160-4,320 shares NEM (_reacted_) as core holding. Enter 50% now at $87, 50% on pullback to $80-82.

2.Tactical: Set buy limit orders at $82, $80, $78 for tactical trading. Target $95-100 (+15-20% gain).

3.Monitor: Watch Q4 2025 earnings (late Jan 2026) and 2026 guidance (Feb 2026) for confirmation of thesis.

4.Rebalance: After April 2026 real estate sale, rebalance to target allocation (30-35% physical gold, 5-10% NEM, 50-60% dry powder).

The wagon is loaded with physical gold. Now add NEM as the engine to amplify gains when gold reaches $5,000-6,000.

Go go go

|