EIA Data Underscores Depth of US Uranium Import DependenceThe Hoot this Week: 10th October - 17th October 2025

Ocean Wall Oct 17, 2025

The EIA released its 2024 Uranium marketing report. The report provides a detailed overview of US nuclear fuel market activity during 2024.

Uranium Purchases and Prices

· Owners and operators of US civilian nuclear power reactors purchased a total of 55.9m lbs of uranium deliveries from domestic and foreign suppliers, 8% higher than the 2023 total.

· Weighted-average price of uranium was $52.71/lb, 20% higher than the 2023 weighted-average price of $43.80/lb

· The largest source of uranium for the US was Canada representing 36% of total deliveries, followed closely by Kazakhstan (24%) Australia (17%) Uzbekistan (9%) Namibia and Russian-origin material accounted for 4% of total deliveries each. United States material accounted for 8% of total deliveries in 2024, up from 5% in 2023.

· 9% of the uranium delivered was purchased under spot contracts at a weighted average price of $54.09 per pound. The remaining 91% was purchased under long-term contracts at $50.97 per pound.

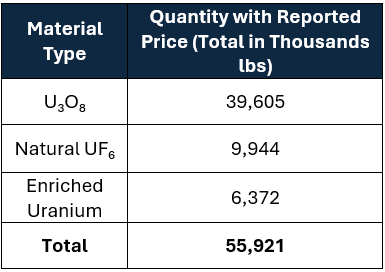

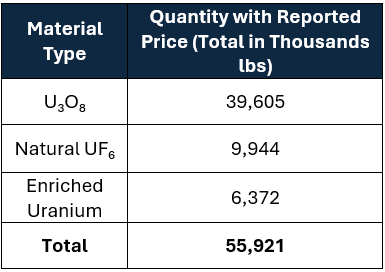

· The spot/term mix of U3O8, Natural UF6 and enriched Uranium across spot and term contracts was not disclosed, however total quantities were:

New And Future Uranium Contracts

· In 2024, COOs signed 21 new purchase contracts totalling 3m lbs U3O8e at an average price of $86.20/lb, compared to 26 contracts for 5.5m lbs at $61.93/lb in 2023.

· By the end of 2024, US nuclear plant operators (COOs) had contracts in place to receive 234m lbs of uranium for delivery between 2025 and 2034. However, they still needed to secure another 184m lbs to meet their expected fuel needs. Together, this means the industry will likely require about 418m lbs of uranium over the next decade.

Uranium Feed, Enrichment Services, And Uranium Loaded

· In 2024, US nuclear operators (COOs) delivered 42 million pounds U3O8e of natural uranium feed to enrichers.

· 28% went to US enrichment suppliers, while 72% went to foreign suppliers.

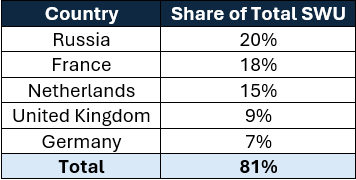

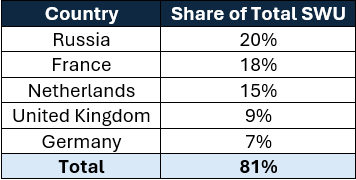

· Operators purchased 15 million separative work units (SWU) from eight sellers under enrichment contracts.

· The average SWU price was $97.66, down 9% from $106.97 in 2023.

· US-origin SWU: 19%; foreign-origin SWU: 81%.

· Fuel assemblies loaded into US reactors in 2024 contained 50.6 million pounds U3O8e, a 10% increase from 46.1 million pounds in 2023.

Uranium Foreign Purchases/Sales And Inventories

· In 2024, US suppliers (brokers, converters, enrichers, fabricators, producers, and traders) and COOs purchased 36 m lbs of uranium from foreign sources at an average price of $57.99/lb, and sold 2 m lbs abroad at an average price of $78.22/lb.

· The sales price carried roughly a 35% premium over the average purchase price.

· At the end of 2024, total US commercial uranium inventories reached 167m lbs U3O8e, up 6% from 157m lbs in 2023. Inventories held by COOs rose 11% to 126m lbs, while US supplier inventories (converters, enrichers, fabricators, producers, brokers, and traders) fell 5% to 41m lbs.

US Army Launches Janus Program

The US Army has launched Project Janus, a major initiative to deploy safe, mobile, and resilient micro nuclear reactors to power military bases and operations around the world by 2028. The program builds on Project Pele and applies advanced nuclear technologies to strengthen energy security and independence.

Each reactor will produce less than 20 megawatts, enough to support critical base operations independent from the civilian grid. The first phase includes two reactors across up to nine installations. The reactors will be commercially owned and operated, with fuel supply and regulatory oversight provided by the Army and the Department of Energy.

Project Janus follows Executive Order 14299, which requires at least one reactor to be operational on a US military base by September 2028. As threats to the power grid grow, the Army is turning to nuclear power to ensure energy resilience.

The program also creates opportunities for companies involved in microreactor design, fuel enrichment such as HALEU, and component manufacturing. It will use milestone based contracting models similar to those employed by NASA to accelerate commercial development.

What Else Happened This Week?

ASP Isotopes - The Start of Commercialisation - ASPI’s Largest Silicon 28 Order

ASP Isotopes signed its largest-ever supply contract for enriched silicon-28 with a US customer, with deliveries beginning in early 2026. Silicon-28 enables superior conductivity and transformational performance, powering the next generation of semiconductors and quantum computing. ASPI had initially planned for 10kg of capacity, it now aims for 80kg of capacity due to insatiable market demand. This is a landmark moment for ASPI, marking the start of its commercialisation in what promises to be a vast and rapidly growing market.

And… ASPI Announces Purchase Order for Enriched Barium-137

ASPI saw their shares surge on Monday following news of a new purchase order from a U.S. customer for enriched barium-137, a key for ion-trap quantum computing systems. The announcement fuelled another sharp rally in the stock, which jumped more than 30% in a single day and is now up nearly 144% year-to-date.

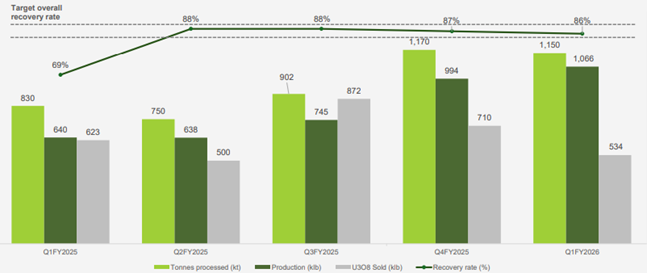

Paladin Quarterly Activities Report – September 2025

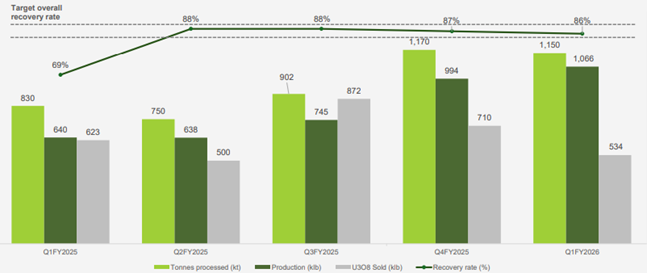

Langer Heinrich Mine (LHM) has yielded a record quarterly production of 1.066m lbs of U3O8 taking YTD production to 2.805m lbs. This output was achieved by processing ore with a feed grade of approximately 0.0477% U3O8, representative of the current operational blend, against a life-of-mine reserve average of 0.0427%. This was supported by a 63% increase in total material mined from Q1FY2025 with an 86% recovery rate, and a strengthening financial position with $269.4 million in cash. Current cost of production is US$41.6/lb, which is expected to reduce as operations reach full capacity.

Source: Paladin Energy

Paladin sold 533.8klb U3O8 during the period at an average realised price (ARP) of US$67.4/lb (+21% QoQ), marking a distinct move towards market-linked contracts and away from its legacy contracts.

The market reacted positively to the update, with shares increasing +9% on the day.LHM has a credible production history and its role in supporting uranium production in the coming years cannot be understated.

Paladin’s future is reinforced by the high-grade Patterson Lake South Project in Canada. This asset is a world-class development project with an exceptionally Probable Ore Reserve grade of 1.41% U3O8. This superior grade is the fundamental driver behind its industry-leading projected operating costs. The mine is estimated to produce ~9Mlb p.a. over a 10 year period. Not to mention plans to extend this life through further exploration and drilling in the region.

The feasibility study for PLS outlines a very competitive C1 Cash Cost of US$11.7/lb and an All-In Sustaining Cost (AISC) of US$15.2/lb over the life of the mine, positioning it firmly in the lower tier of the global cost curve. Meanwhile, preliminary economic assessments are taking place at Michelin in Canada and Advanced Exploration on the East and West coast of Australia.

Amazon and Energy Northwest Unveil the Cascade Advanced Energy Facility

Amazon and Energy Northwest officially revealed the name and concept designs for the Cascade Advanced Energy Facility, a pioneering small modular reactor (SMR) project that could host up to 12 X-energy Xe-100 units totaling nearly 1 GW of clean power. The SMR will use X-Energy’s Xe-100 reactor design, with a modular layout (three 320 MW modules totalling up to 960 MW) that occupies much less land than conventional nuclear plants. It will sit adjacent to the Columbia Generating Station in Washington State marking the first commercial SMR project in the Pacific Northwest.

Top White House Energy Official Outlines Plan to Accelerate Nuclear, Grid, and Permitting Reforms

At a policy level, the US administration’s “energy dominance” agenda could reshape nuclear’s permitting and deployment environment. National Energy Dominance Council director Jarrod Agen detailed plans to streamline licensing, grid interconnection, and federal siting; crucial bottlenecks for advanced nuclear rollout. If implemented, these reforms would significantly shorten project timelines siting crucial for developers like X-energy, NuScale, and TerraPower.

Deep Fission Expands Customer Pipeline to 12.5 GW

Deep Fission announced that it has signed letters of intent with data centers, industrial parks, co-developers, and strategic partners for a combined 12.5 GW of prospective deployment of its underground small modular reactors. The move underscores serious commercial interest in Deep Fission’s novel approach (burying SMRs deep underground) and bolsters its positioning as it seeks to convert those early-stage commitments into binding contracts.

New Uranium Find at Alta Mesa Could Be a Game Changer

Boss Energy, via its 30 % interest in the Alta Mesa project operated by enCore, has benefited from recent production ramp-ups and exploration success. The project has initiated a second ion exchange circuit (doubling flow capacity to 5,000 GPM), achieved record uranium capture rates (exceeding 3,700 lb/day), and moved up contract deliveries ahead of schedule.

Uranium Prices

|