Copper Today, Uranium Tomorrow — The U.S. Expands Its Metals Mandate The Hoot this Week: 6th October - 10th October 2025

Ocean Wall Oct 10, 2025

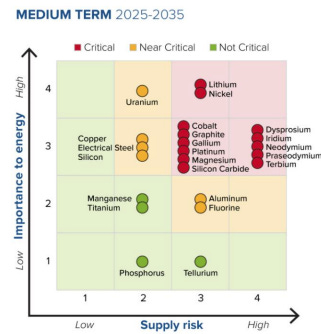

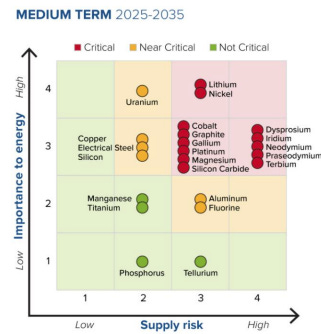

In The Hoot a few weeks back, we pointed to the US critical materials matrix. It identifies which materials are classed as “not critical,” “near critical,” and “critical.” If we consider the companies in which the US has taken an equity stake, such as MP Materials and Lithium Americas, they both produce materials that fall within the top right quadrant. The matrix therefore acts as a forward-looking indicator of where the US is likely to take strategic stakes in critical materials.

The argument made in The Hoot was that until uranium is classed as a critical material, it will not receive similar support from the government. Part of the issue is that the guidance states critical materials must be “non fuel” minerals. However, uranium is still included on the matrix, suggesting the DOE is not entirely convinced by this definition. Moreover, the Trump administration also asked the USGS to consider including uranium within the critical materials list, and a 2025 executive order exempted uranium from certain tariffs, recognising its strategic importance.

The US government’s recent equity stake in Trilogy Metals, a copper producer, is significant as it signals a willingness to invest in “near critical” minerals, a category that includes uranium. This is positive as it shows investment is not restricted to the top right quadrant, and we could soon see strategic stakes in uranium developers and producers.

Where Value Begins

The current market environment is defined by the revaluation of real assets against a structurally deteriorating fiat base. This week saw gold’s breakout above $4,000/oz and bitcoin’s acceleration past $125,000. This is the debasement trade: long exposure to non-yielding stores of value. The trade reflects investors’ response to sustained fiscal expansion, suppressed real rates, and a collapse in confidence in policy constraint. With the Fed signalling rate cuts into positive inflation and the Treasury’s net issuance exceeding $2 trillion annually, investors are being asked to absorb record issuance at negative real returns. This is all unfolding as the post-Bretton Woods order itself is stress-tested across multiple axes, from geopolitical conflict to trade fragmentation. The consequence is a rotation of the marginal dollar of global savings is rotating from sovereign duration into hard collateral. The dynamics of gold and cryptocurrencies are the balance-sheet manifestations of this shift: a repricing of assets with zero counterparty risk relative to those with infinite issuance capacity.

Gold has been the historic store of value, held by central banks as the only asset with a 5,000-year record of surviving monetary regimes. It remains highly liquid, globally recognised, and free from default or credit risk, qualities that make it a natural refuge in periods of monetary uncertainty. Its value, though, is not underwritten by any productive function but by collective consensus, a shared belief in its permanence and independence from policy. While it is finite, its price performance is shaped more by policy events and shifts in confidence than by any persistent scarcity dynamic, reflecting its role as a hedge against trust erosion rather than a claim on real-world output.

Cryptocurrencies represent programmable finiteness and an alternative to traditional monetary systems. They have introduced new frameworks for decentralised value transfer and digital ownership, though their market value remains heavily influenced by liquidity conditions and investor sentiment. Questions of transparency, regulation, and security persist, and advances in quantum computing may challenge the cryptographic assumptions that underpin their design. While the technology continues to evolve, crypto remains an emerging form of digital value rather than a fully established store of it.

Now imagine a commodity that is hedged against inflation and monetary policy, both finite and scarce, characterised by inelastic supply and demand, in growing strategic demand, non-substitutable, and accumulated by nation states, like gold. What if that commodity was not a symbol of value, but the source of it; the fuel that underwrites economic growth and innovation.

Every economy ultimately rests on energy and among all energy sources, uranium stands apart for its unmatched energy density, efficiency, and the degree of strategic control surrounding its supply. Uranium represents the same zero-counterparty, finite-supply characteristic, but tied to productive energy, not inert value.

The same macro forces driving the debasement trade — fiscal excess, supply constraints, and political risk — are even more acute in the global energy transition, making uranium arguably the most mispriced real asset of the decade.

Uranium is increasingly being discussed as part of the broader alternatives landscape, not just as a short-term trade idea but as an area of structural importance within the evolving energy economy. Its role reflects a form of value grounded in industrial and energy fundamentals rather than financial market sentiment.

What Else Happened This Week?

Brookfield’s $20bn Energy Transition Raises Funds and Expands into Nuclear and Clean Power

Brookfield Asset Management has raised $20 billion for its second Global Transition Fund, one of the largest private vehicles dedicated to energy transition and infrastructure investment. While most of the fund’s $5 billion deployed capital targets renewables and storage projects such as France’s Neoen and India’s Everen, Brookfield is also backing longer-duration technologies including nuclear power and carbon capture, building on its earlier investment in Westinghouse through a joint venture with Canadian uranium miner Cameco. The fund’s focus reflects surging energy demand from AI data centres and electrification, with Brookfield positioning nuclear as a key baseload solution within its broader clean-energy strategy to deliver abundant, low-carbon power for a rapidly digitalising global economy.

Google Eyes Nuclear-Powered Data Hub in Iowa

Google is planning up to six data centres near the decommissioned Duane Arnold Energy Center (DAEC) in Linn County, Iowa, signalling the company’s growing interest in pairing hyperscale compute with nuclear baseload power. The tech giant is funding a water-usage study to assess the impact of both the proposed data centre campus and the potential restart of the nuclear facility, which may return to the grid as early as 2028 under operator NextEra.

The proposal follows Google’s $7 billion Iowa investment pledge announced in June 2025, including new and expanded campuses in Cedar Rapids and Council Bluffs. Linn County officials confirmed Google is in discussions with DAEC about reviving the reactor, and are drafting new ordinances for data centres, nuclear power, and gas generation to accommodate the project.

Japan Resumes Uranium Imports as Nuclear Restarts Accelerate

Japan Nuclear Fuel Ltd. has received natural uranium at its Rokkasho enrichment plant in Aomori Prefecture for the first time in 11 years, marking a key milestone in Japan’s nuclear restart. The company restarted production in 2023 using stored uranium, but this new delivery reflects rising domestic demand for enriched uranium as more reactors come back online following the 2011 Fukushima disaster. The Rokkasho facility—Japan’s only uranium enrichment plant—uses centrifuge technology and plays a central role in rebuilding Japan’s energy security and self-sufficiency. Head of enrichment operations Masaaki Saijo said the company aims to “continue contributing to Japan’s energy security,” as nuclear once again becomes a core component of the nation’s power mix.

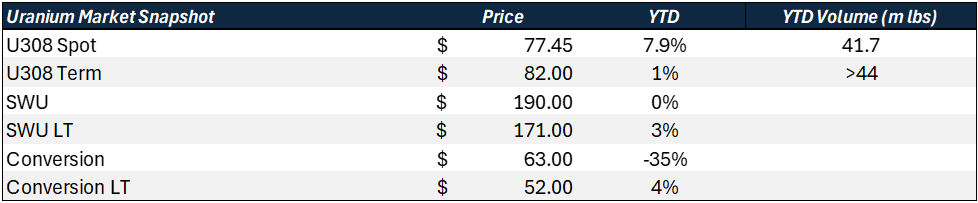

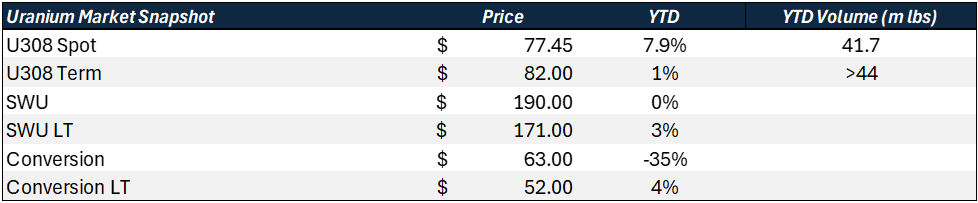

Uranium Prices

|