What make you think that the impending social security shortfall will be different this time?

=> The short answer is demographics.

A longer answer combines the effects of adverse demographics, increased political acrimony, and a significantly larger US federal debt.

I believe it is much more likely they will adjust (increase) the Full Retirement age again, as well as dramatically raise or eliminate the top amount on income that social security tax applies to ...

=> While that's possible, it's worth asking is such a solution probable?

and thereby kick the can down the road again.

=> It's also worth asking, how far does such a solution, if implemented, kick the can?

As I've mentioned elsewhere, rocket science is simple but people are complex ... and SS is definitely a complex people problem ;-)

Demographics

From the most recent Social Security Trustees Report[1], the following:

In 1945 there were 41.9 covered workers per OASDI[2] beneficiary, by 1950 there were 16.5, and by 1960 the number had dropped to 5.1. In 2024 there were only 2.7 covered workers per beneficiary.

The trustees provide three scenarios (low-cost, intermediate, and high-cost)[3], using the more likely high-cost scenario for the number of covered workers per beneficiary (cwpb), the following:

. by 2035 there will be 2.2 cwpb

. by 2045 there will be 2.0 cwpb

. by 2055 there will be 1.9 cwpb

. by 2085 there will be 1.5 cwpb

When the cwpb ratio was 10 or higher the cost per worker was generally tolerable and the SS program remained conceptually feasible. However, the last time we experienced such a ratio was in the early 1950s -- when it was common for young folks to buy a house, marry, raise a family, and save for retirement, often, but not always, on one income.[4]

Due to latency --the time delay between cause and effect-- it took years for the effects of the declining cwpb to manifest and then more years for the folks in DC to agree enough to patch the system.[5] Unfortunately, some of the patches magnified the problem by expanding the benefits.

Returning to the trustees intermediate scenario:

To illustrate the magnitude of the 75-year actuarial deficit, consider that for the combined OASI and DI Trust Funds to remain fully solvent throughout the 75-year projection period ending in 2099:

• revenue would have to increase by an amount equivalent to an immediate and permanent payroll tax rate increase of 3.65 percentage points to 16.05 percent beginning in January 2025;

• scheduled benefits would have to either be reduced by an amount equivalent to an immediate and permanent reduction of 22.4 percent applied to all current and future beneficiaries effective in January 2025, or by 26.8 percent if the reductions were applied only to those who become initially eligible for benefits in 2025 or later; or

• some combination of these approaches would have to be adopted.

If substantial actions are deferred for several years, the changes necessary to maintain solvency for the combined OASI and DI Trust Funds would be concentrated on fewer years and fewer generations. Significantly larger changes would be necessary if action is deferred until the combined trust fund reserves become depleted in 2034. For example, maintaining 75-year solvency through 2099 with changes that begin in 2034 would require:

• an increase in revenue by an amount equivalent to a permanent 4.27 percentage point payroll tax rate increase to 16.67 percent starting in 2034,

• a reduction in scheduled benefits by an amount equivalent to a permanent 25.8 percent reduction in all benefits starting in 2034, or

• some combination of these approaches. We're obviously well past January 2025 and:

- the SS payroll tax did not increase to 8.025% (or 16.05% for the self-employed)

- there was not an immediate and permanent SS reduction of 22.4% for all current and future recipients.

- there was not a permanent 26.8% benefit reduction for those who retired in 2025.

IF we impose a 30% payroll tax increase[6] on the working to provide a continuation (or expansion) of benefits for those not working, then the following results are probable:

- increased rates of "laying flat"[7]

- decreased rates of marriage, family creation, and child birth

- fewer people able to save (to pay for an emergency or to fund/supplement their own retirement)

Increased political acrimony

Assume everyone reading this blog is aware of the myriad problems in DC -- so will cautiously tiptoe around the topic and comply with Chowder's mandate of "no politics".

While it's possible a miracle might occur in DC such that a solution to SS could be implemented before the end of this year, believe the odds of such are effectively zero.

Believe the odds of a fix during 2026 --which will be occupied by mid-term electioneering-- are also effectively zero. Doubt the odds of a fix in 2027 or during the presidential election year of 2028 will be any better.

US federal debt

The US Federal debt currently exceeds $38T[8] -- and the rate of increase of federal debt is increasing[9].

Why?

Uncle has a spending addiction, and due to financial and geopolitical factors the current interest rate on his debt is 4-5% instead of the artificial ZIRP (Zero Interest Rate Policy) of a few years ago.[10] As a consequence, Uncle's debt service is now his third largest cost[11].

Why?

'Cause:

(a) new debt is financed at today's higher interest rate and

(b) much of Uncle's existing debt is short-term and thus will be rolled over at today's higher rates.

Though today's interest rates are much lower than the 19% rate of July 1981, Uncle's accumulated debt is now 3,800% larger.[12]

A different solution

One way to solve the long-term SS problem is to return SS to its original purpose as stated by FDR[13]:

This social security measure gives at least some protection to thirty millions of our citizens who will reap direct benefits through unemployment compensation, through old-age pensions and through increased services for the protection of children and the prevention of ill health.

We can never insure one hundred percent of the population against one hundred percent of the hazards and vicissitudes of life, but we have tried to frame a law which will give some measure of protection to the average citizen and to his family against the loss of a job and against poverty-ridden old age.

We could re-implement that purpose by limiting SS benefits to only those who would otherwise fall below the federal poverty guidelines[14] -- and then pay those folks only what is needed to bring 'em up to that level.

However, believe the odds of that solution are also effectively zero.

Due to unresolved SS problems and Uncle's ever-increasing debt service cost, believe the late 2020s and early 2030s will be very interesting.[15]

Thank you for the question.

Best wishes,

Kiisu

1. ht tps://www.ssa.gov/OACT/TR/2025/tr2025.pdf

Unless otherwise noted, all quotes and numbers are from the trustees report.

2. OASDI ::= Old Age Survivors and Disability Insurance. What most folks think of as SS is the OASI portion of the program. DI is the companion Disability Insurance portion.

3. Among the factors embedded in the three scenarios is the Total Fertility Rate (TFR)[A]. The trustees assume over the long-term a TFR of

- 2.1 for the low-cost scenario

- 1.9 for the intermediate scenario, and

- 1.6 for the high-cost scenario.

However, the current TFR barely exceeds 1.6 and continues to fall. While a substantial increase fertility is conceptually possible, given trends in the US and across the planet, such is improbable.

As a result, believe the intermediate scenario is unbelievably optimistic -- and the high-cost scenario is more reasonable.

How important is TFR?These patterns in the cost rate are largely driven by the effect of birth rates on the adult population’s age distribution. Birth rates are assumed to increase from recent very low levels to an ultimate level of 1.9 children per woman for 2050 and thereafter. In last year’s report, the same ultimate total fertility rate of 1.9 children per woman was assumed for 2040 and later. After the release of the trustees report, Senator Wyden asked the SS chief actuary for an update on the depletion date for the intermediate scenario. The reply was:

Considered alone, the reserve depletion date for the OASI Trust Fund is accelerated from the first quarter of 2033 to the fourth quarter of 2032. Though not referenced, believe the accelerated schedule (which moves the depletion date earlier) likely applies to the other scenarios.

. ht tps://www.finance.senate.gov/imo/media/doc/wyden_letter_20250805_finalpdf.pdf

4. In 1950, almost 65 percent of families included a working husband with a nonworking wife. By 1995, this fraction had dropped to only 15 percent. . ht tps://www.urban.org/urban-wire/adjusting-family-composition-increases-incomes-income-gap-remains-high (Feb 2015)

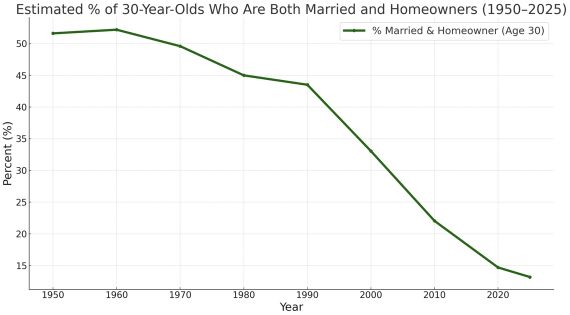

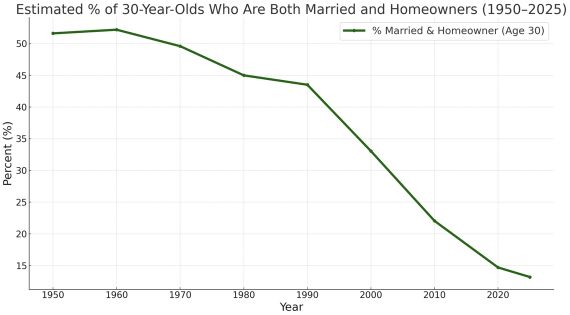

The following chart suggests a similar phenomena.

The graph tracks the share of 30-year-olds in the United States who are both married and homeowners. A majority of young people fell into that category a half-century ago, but today it’s closer to one in 10.

This graph created by Nathan Halberstadt and shared on X shows homeownership amongst married people in their 30s.

. ht tps://www.newsobserver.com/opinion/article311757952.html

5. The SS system is like a software package -- frequently patched[C] -- for many of the same reasons.

The SS was patched in 1950, 1954, 1956, 1961, 1962, 1965, 1972, 1977, 1983. Many of the patches expanded benefits while some of the patches fixed errors in earlier patches.

. ht tps://en.wikipedia.org/wiki/History_of_Social_Security_in_the_United_States

6. (16.05 - 12.4) / 12.4 -> 29.43% ~ 30%

7. Across the world, "laying flat" or *doing as little as possible* goes by different names, some of which include: - Freeter (Japanese) ht tps://en.wikipedia.org/wiki/Freeter

- Hikikomori (Japanese) ht tps://en.wikipedia.org/wiki/Hikikomori

- Tang ping (Chinese) ht tps://en.wikipedia.org/wiki/Tang_ping

- Quiet quitting (Occidental) ht tps://en.wikipedia.org/wiki/Work-to-rule#Quiet_quitting

- NEET (Occidental) ht tps://en.wikipedia.org/wiki/NEET

- johatsu (Japanese) "evaporated" to escape abuse and/or responsibilities.

. ht tps://en.wikipedia.org/wiki/J%C5%8Dhatsu

. ht tps://www.tokyoweekender.com/entertainment/movies-tv/johatsu-a-haunting-documentary-about-japans-evaporated-people/

8. $38,008,137,064,951.61

. ht tps://fiscaldata.treasury.gov/datasets/debt-to-the-penny/debt-to-the-penny

9. ht tps://fred.stlouisfed.org/series/GFDEBTN

10. ht tps://fred.stlouisfed.org/series/FEDFUNDS

11. During fiscal 2025 Uncle paid:

- $1,884,277M ($1.88B) for Department of Health and Human Services

- $1,646,515M ($1.65B) for Social Security Administration

- $1,215,614M ($1.22B) for Interest on Treasury Debt Securities (Gross)

. ht tps://www.fiscal.treasury.gov/files/reports-statements/mts/mts0925.pdf

Compared to the previous year (fiscal 2024) each of those line items increased:

- 9.51% for Department of Health and Human Services

- 8.34% for Social Security Administration

- 7.29% for Interest on Treasury Debt Securities (Gross)

However, the increase in the US GDP is somewhat less -- and that's a continuing problem.

From Q1 2025 to Q2 2025: - Real GDP increased by 3.84 percent annualized.

- Current-dollar nominal GDP increased by 6.04 percent annualized, or $443.616 billion, to a level of $30.486 trillion, the current size of the U.S. economy.

. ht tps://www.jec.senate.gov/public/index.cfm/republicans/gdp-update

12. ( 38,008,137M - 971,174M ) / 971,174M -> 38.1363 ~ 3,813.63%

1981Q2 total federal debt was $971,174M -- less than $1T. For today's total federal debt see #8.

. ht tps://fred.stlouisfed.org/series/GFDEBTN

The July 1981 fed funds rate was 19.04%. The June rate 19.10%.

. ht tps://fred.stlouisfed.org/series/FEDFUNDS

13. ht tps://www.presidency.ucsb.edu/documents/statement-signing-the-social-security-act-0

14. ht tps://www.healthcare.gov/glossary/federal-poverty-level-fpl/

Apply the same standard to the other classes of SS recipients.

15. "May you live in interesting times" is an English expression that is claimed to be a translation of a traditional Chinese curse. The expression is ironic: "interesting" times are usually times of trouble.

Despite being so common in English as to be known as the "Chinese curse", the saying is apocryphal, and no actual Chinese source has ever been produced. The most likely connection to Chinese culture may be deduced from analysis of the late-19th-century speeches of Joseph Chamberlain, probably erroneously transmitted and revised through his son Austen Chamberlain. . ht tps://en.wikipedia.org/wiki/May_you_live_in_interesting_times

---

A. The total fertility rate (TFR) of a population is the average number of children that are born to a woman over her lifetime if they were to experience the exact current age-specific fertility rates (ASFRs) through their lifetime and they were to live from birth until the end of their reproductive life.

As of 2023, the total fertility rate varied widely across the world, from 0.72 in South Korea to 6.73 in Niger.

. . .

... The replacement fertility rate is 2.1 births per female for most developed countries (2.1 in the UK, for example), but can be as high as 3.5 in undeveloped countries because of higher mortality rates, especially child mortality. The global average for the replacement total fertility rate (eventually leading to a stable global population) for the contemporary period (2010–2015) is 2.3 children per female. . ht tps://en.wikipedia.org/wiki/Total_fertility_rate

B. NVSS: Births: Provisional Data for 2024

The total fertility rate was 1,626.5 births per 1,000 women in 2024, an increase of less than 1% from 2023. Birth rates declined for females in 5-year age groups 15–24, rose for women in age groups 25–44, and were unchanged for females ages 10–14 and for women ages 45–49 in 2024. . ht tps://www.cdc.gov/nchs/data/vsrr/vsrr038.pdf

C. A software patch or fix is a quick-repair job for a piece of programming designed to resolve functionality issues, improve security or add new features. . ht tps://www.techtarget.com/searchenterprisedesktop/definition/patch |