Barchart Experts Love This Data Center Energy Stock That’s Up 220% in 2025

Yiannis Zourmpanos - Barchart - 1 hour ago Columnist

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

A concept image of space_ Image by Canities via Shutterstock_

With artificial intelligence, as well as electric vehicles (EVs) putting a strain on the power grid in America, battery storage is now the second largest contributor to new power grid capacity, after solar. Data center power demand may increase tenfold by 2030, as stated by global risk expert firm DNV.

In this context, innovative zinc battery expert Eos Energy Enterprises (EOSE) has emerged as a major stock performer, with EOSE's stock price rising about 220% in 2025. Its battery, which will provide a safer, more durable battery life compared with existing lithium-ion batteries, has started to get attention from stock players.

About Eos Energy Enterprises Stock Eos Energy Enterprises, a Nasdaq-listed stock under the ticker “EOSE,” produces zinc-based battery solutions for storing grid-scale energy. With its headquarters in Edison, New Jersey, the firm caters to utilities as well as industrial consumers who require a long-duration, fire-safe storage solution that goes beyond that offered by lithium batteries. It has a market value of approximately $3.9 billion.

EOSE stock has surged 220% year-to-date (YTD), far outperforming the S&P 500 Index’s ($SPX) ~11% gain. Shares have traded between $2.06 and $19.05 over the past 52 weeks, recently changing hands around $15.25.

Eos Energy remains highly valued, with a price/sales (P/S) multiple of approximately 250x, thanks to its early stage and expectations of explosive expansion. The company may not yet be generating profits, but it continues putting out its production capacities while reducing costs of finance with a view to being able to produce at scale as soon as possible. EOSE does not distribute a dividend.

www.barchart.com Eos Energy Enterprises Delivers Record Results www.barchart.com Eos Energy Enterprises Delivers Record Results

Eos posted revenue of $15.2 million for Q2 2025, its highest ever, almost equal to its total sales in 2024. It reiterated its guidance for 2025 at $150-190 million for the whole year. Its Z3 customer system efficiency registered an average of 88-89.5%, corroborating its technology’s quality.

Eos also generated $336 million from concurrent equity and convertible note offerings, which enhanced its liquidity. It received $22.7 million for its second DOE loan program advance, making a cumulative contribution of $91 million from government aid since late 2024. Its management extended its 26.5% convertible notes maturity to 2034, with a significant reduction in interest costs at 7% from 2026.

The commercial pipeline increased to $18.8 billion, a jump of $3.2 billion from the previous quarter, primarily fueled by its UK Cap & Floor business and strong eight-hour+ storage sales. With its first production line now automated and a second production line on order, Eos is poised for volumetric expansion over 2026.

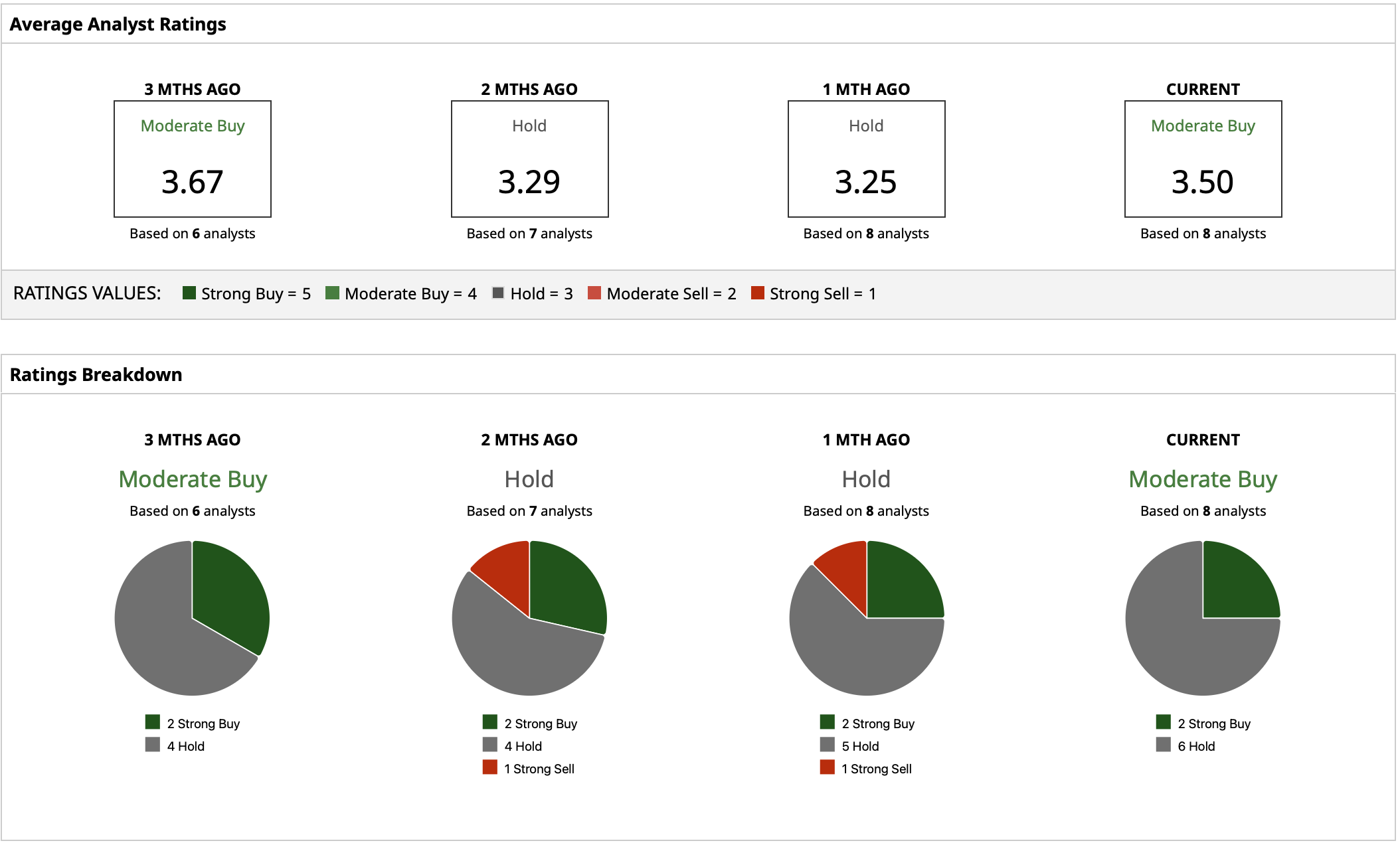

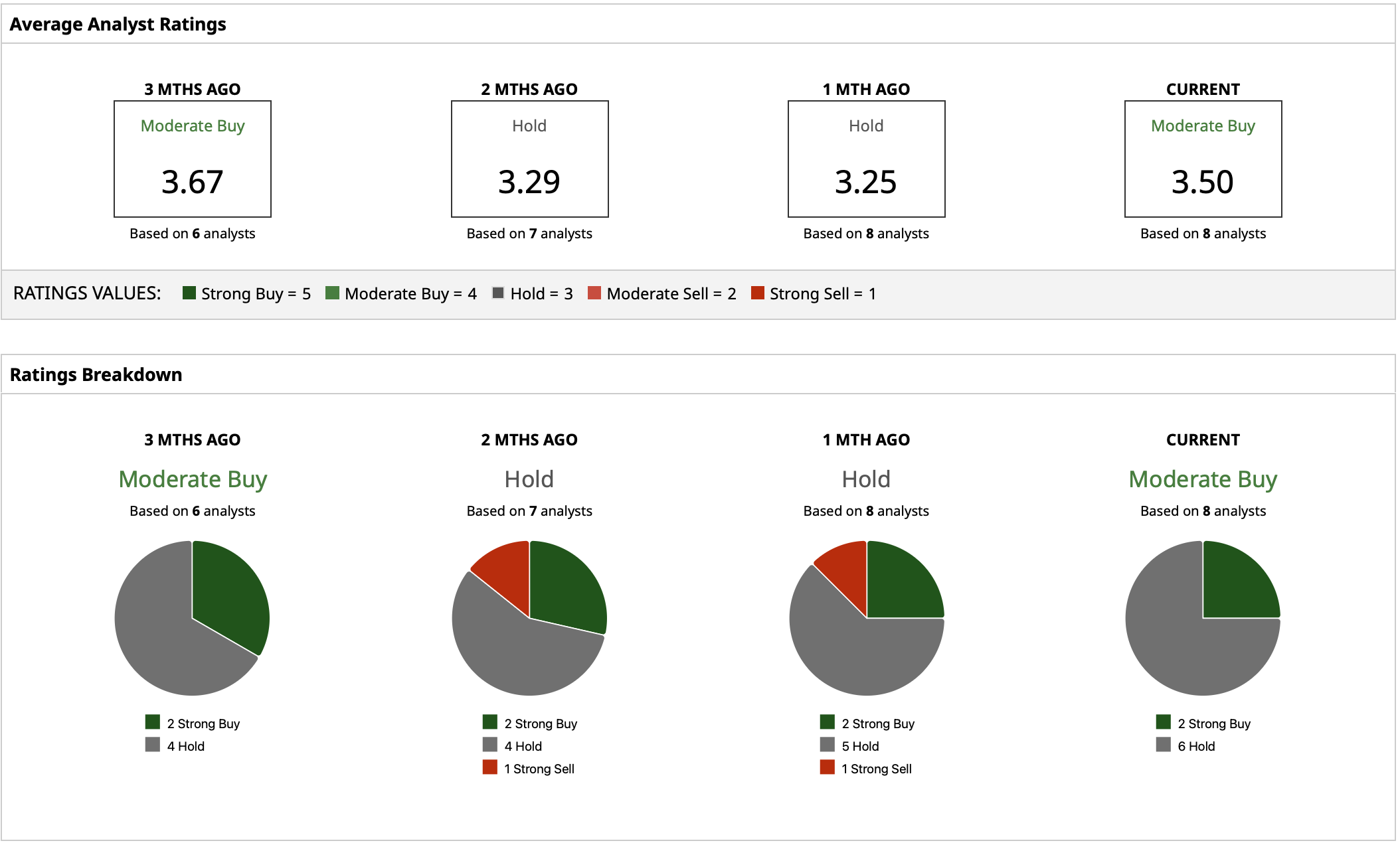

What Do Analysts Expect for EOSE Stock? Analysts remain divided. Barchart data shows a “Moderate Buy” rating consensus and a mean target of $13.08, implying downside potential of ~14% from recent levels, with estimates ranging from $6.50 to $22. Some on Wall Street view EOSE stock as overextended in the short run after its massive rally; others see a strategic leader in long-duration energy storage supported by federal loan programs and manufacturing tax credits under the “One Big Beautiful Bill Act.” Eos Energy could be, according to one Barchart writer, part of a “dark horse” zinc battery revolution.

www.barchart.com www.barchart.com

On the date of publication, Yiannis Zourmpanos had a position in: EOSE . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More News from Barchart

Related Symbols

Symbol Last Chg %Chg | $SPX | 6,791.69 | +53.25 | +0.79% | | S&P 500 Index | | EOSE | 16.60 | +0.54 | +3.36% | | Eos Energy Enterprises Inc |

Don’t Miss a Minute of Daily Action Don’t Miss a Minute of Daily Action

Our exclusive midday newsletter highlights top stories, big movers, and breakout charts.

By clicking Sign Up Now to receive this free newsletter, you will also receive free Barchart Partner emails. Opt-out any time. See Terms of Service and Privacy Policy for details.

Most Popular News

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg) 1 1

Broadcom Stock Could Soon Generate $100 Billion in AI Revenue Each Year. Should You Buy AVGO Now?

2 2

Enphase Energy (ENPH) Has Just Flashed a 119% Payout Opportunity

/AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg) 3 3

This ‘Strong Buy’ Tech Stock Is Riding the AI Server Boom to New Highs

4 4

The 5 Highest-Yielding ‘Strong Buy’ Dividend Stocks To Own for Generations

5 5

Barchart Experts Weigh In: Everything You Need to Know as Cattle Collapses

Log Out

Market:

HOME

Stocks

Options

ETFs

Futures

Currencies

Investing

News

Barchart

Markets Today Barchart News Exclusives Contributors Chart of the Day News Feeds

Featured Authors

Andrew Hecht Austin Schroeder Caleb Naysmith Darin Newsom Don Dawson Elizabeth H. Volk Gavin McMaster Jim Van Meerten Josh Enomoto Mark Hake Oleksandr Pylypenko Rich Asplund Rick Orford Sarah Holzmann All Authors

Commodity News

All Commodities Energy Grains Livestock Metals Softs

Financial News

All Financials Crypto Dividends ETFs FX Interest Rates Options Stock Market

Press Releases

All Press Releases ACCESS Newswire Business Wire GlobeNewswire Newsfile PR Newswire

Tools

Learn

Site News 3

B2B SOLUTIONS

Contact Barchart

Site Map

Back to top

Change to Dark mode

Membership Barchart Premier Barchart Plus Barchart for Excel

Resources Site Map Site Education Newsletters Advertise

Barchart App Business Solutions Market Data APIs Real-Time Futures

Stocks: 15 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us with feedback and accommodation requests.

© 2025 Barchart.com, Inc. All Rights Reserved.

About Barchart | Affiliate Program | Terms of Service | Privacy Policy | Do Not Sell or Share My Personal Information | Cookie Settings

×

Terms of Content Use |

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

Don’t Miss a Minute of Daily Action

Don’t Miss a Minute of Daily Action /Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg) 1

1  2

2 /AI%20(artificial%20intelligence)/Artificial%20Intelligence%20technology%20concept%20by%20NicoEINino%20via%20Shutterstock.jpg) 3

3  4

4  5

5