Opinion & Analysis

China consolidates dominance in Europe’s residential storage market, pushing out European competitors

As Europe’s residential battery sector bounces back, Chinese manufacturers are ready to cash in on their leading market position.

By

Anna Darmani, Isabel Nieto Tous

Oct 28, 2025

Image: Fox ESS

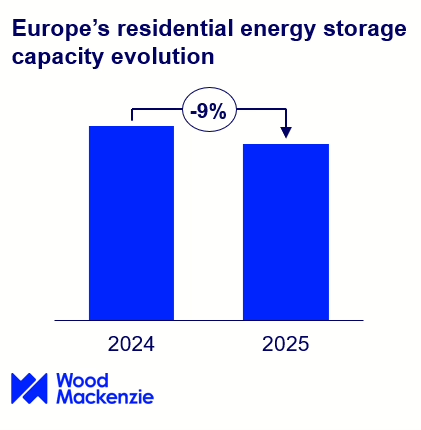

Europe continues to lead the global residential energy storage segment, accounting for seven of the top 10 global residential storage markets in 2025. However, this year, the European residential storage market is experiencing a 9% decline in installations for the second consecutive year. There are two main reasons for this contraction. On one hand, the fall in energy prices following their peak during the energy crisis, which has reduced the sense of urgency among consumers to install storage to cut their energy bills. And, on the other hand, the expiration of major government subsidies in key markets, which has eliminated a crucial incentive for the adoption of storage.

The downturn, however, is now nearing its end, with installations plateauing in 2026 and growth picking back up in 2027 and beyond. This recovery stems from the convergence of a series of favourable factors that are boosting residential storage demand. These are the expansion of the residential PV markets, the massive process of electrification of European homes, falling battery prices, and widening electricity import-export gaps. Additionally, in the long term, the wide adoption of dynamic time-of-use tariffs and the increase in retail prices will further expand the market.

So, given these prospects of expansion, which companies are best positioned to benefit from these tailwinds?

An Unstoppable Tide: The Chinese Takeover of the European Market

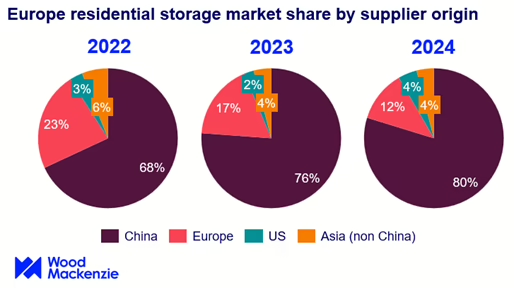

At Wood Mackenzie, we have been monitoring residential storage supply chain dynamics for years. In our latest residential storage report, we found that, in 2024, all of the top five residential battery supplier brands, according to market installation shares, had Chinese origins, with no European company having a market share larger than 3%.

While the market share of European suppliers fell from 23% in 2022 to 12% in 2024, that of their Chinese competitors increased from 68% in 2022 to a whopping 80% in 2024.

The takeover of Chinese products has fundamentally altered the market dynamics, as the growing dominance of Chinese manufacturers has forced once well-established European brands to compete over increasingly small market segments.

The Perfect Storm: Why Chinese Storage Flooded Europe

Several converging factors created perfect conditions for Chinese manufacturers to dominate the European residential storage market.

Firstly, a massive overproduction in China’s energy storage sector. This was caused by an overestimation of the capacity needed to serve a domestic market that was maturing at a slower rate than expected. And it pushed Chinese manufacturers to seek new markets to dump their excess supply.

At the same time, while Chinese internal demand was underperforming, Europe experienced an unprecedented surge in demand for residential storage systems following the 2022 energy crisis. The rapid uptake in installations surpassed the market’s capacity, creating a supply/demand imbalance that Chinese manufacturers were perfectly positioned to fill.

Secondly, a lack of protectionist measures across the European regulatory environment – with the only exception of Austria – further facilitated Chinese market penetration. While this was happening, strong measures were implemented in the United States, which aimed, first and foremost, to hinder imports of Chinese products. This event caused Chinese production capacity, aimed at covering US demand, to be redirected into European homes instead, helping intensify competitive pressure on European markets.

Thirdly, Chinese products have become very competitive from a technical and supply security perspective. This is due to years of strong investment in green tech and to the dominance of the lithium-ion supply chain, of which China controls approximately 90%. This combination of quality improvements and vertical integration gives Chinese brands competitive advantages that European manufacturers struggle to replicate.

Finally, Chinese products are highly price-competitive, which is especially advantageous given the recent downward spiral in European storage prices. With prices decreasing by 31% year-on-year in 2024 and by 8% in 2025, Chinese products are best positioned to survive the pricing race to the bottom.

About authors: Anna Darmani is lead analyst on Wood Mackenzie Power & Renewables’ global energy storage team and focuses on storage in Europe, the Middle East and Africa. She previously worked at EiT InnoEnergy, developing innovation and technology roadmaps and contributing to EU research and advisory projects. She was a founding member of the European Battery Alliance.

Isabel Nieto Tous is a Research Analyst covering the energy storage sector in EMEA

ess-news.com

My comments:

China is just killing it in storage, pv's, wind turbines and everything else in RE.

And if that was not enough, BEV's.

Their dominance is just simply stunning.

In just a few decades they will not be importing any fossil fuels.

Where is America?

Going backwards....

Still putting straws in the ground.

LOL!

Eric |