Markets

Global battery industry grows 83% in last five years, boosting deployment to over 300 GW

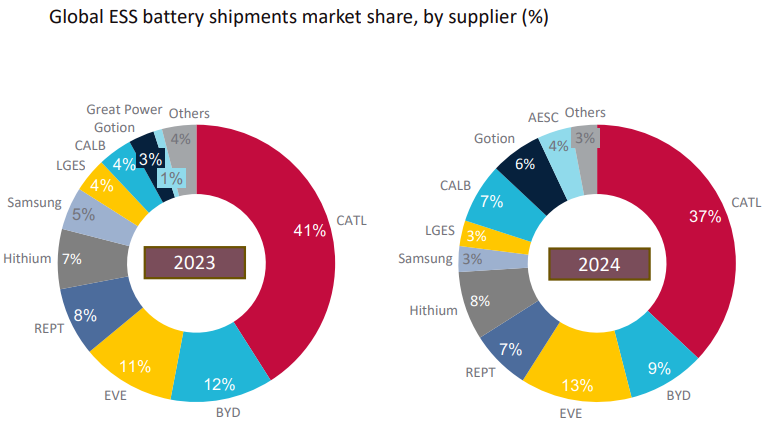

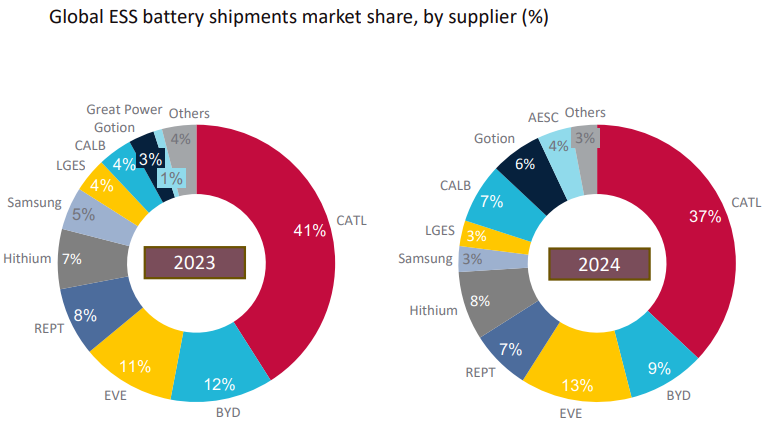

According to a new report from Intertek CEA, over 70% of the global energy storage market share is held by just five players.

By

Phoebe Skok

Oct 28, 2025

Markets

Supply chain

Image: Intertek CEA

Over 300 GWh of battery energy storage systems were shipped globally last year, according to Intertek CEA’s Q3 2025 reports on energy storage supply, technology, policy and pricing, and the industry’s compound annual growth jumped nearly 83% since 2020.

Still, it’s mostly big fish in a somewhat small pond: over 70% of that market is held by just five battery suppliers. China-based CATL alone made up 37% of the market share last year.

Impacts of domestic policies are increasingly spreading beyond national borders. China’s new anti-involution policy, which bans low-price competition by preventing companies from “dumping” modules and selling below costs, has already resulted in lithium price spikes over the last few months. From a supply chain standpoint, these policies aim to reduce oversupply and competition between domestic lithium mines.

While those spikes have peaked, prices remain elevated and the report authors expect lithium carbonate floor prices to be higher moving forward. Even so, lithium prices in August of this year were 80% cheaper than those of August 2022.

“Shifting national policies are creating some price uncertainty, be that export controls from China, export bans from Zimbabwe and the DRC or potential expansion of domestic content requirements in the EU,” said Aaron Marks, Intertek CEA’s energy storage market intelligence consultant, in a statement shared with ESS News. “While these changes won’t be as fast or uncertain as what’s going on in the US, they still have the potential to shift commodity and battery pricing materially.”

Even so, the report notes that in the near-term, US tariffs on China, India and Southeast Asian countries will have more significant ramifications on the battery market than commodity pricing.

With nearly 83% tariffs on Chinese batteries set to go into effect in 2026, American battery buyers will likely shift toward supply chains that comply with the foreign-entities-of-concern (FEOC) regulations laid out in this summer’s budget bills. This could leave Chinese battery suppliers in a bind, as they can only cut prices so much to not only stay viable in the market, but also keep their companies afloat.

If demand for FEOC modules, on the other hand, grows faster than US or other FEOC-compliant manufacturers can meet, battery prices will rise and leave some companies no choice but to buy from Chinese or Chinese-associated makers.

The bifurcation of the supply chain between FEOC-compliant and non-compliant manufacturers is slowly but surely leading to diverging cell form factors between Chinese and Korean or American manufacturers.

According to the reports, the price difference between prismatic and pouch cells is growing; pouch cells, however, have approximately a 10% cost penalty compared to prismatic ones from similar countries of origin due to differences in energy density. But though pouch cells have a higher capex, the authors note that increased manufacturing (and thus increased economies of scale) could help even the playing field in the coming years.

“Realistically,” Marks said, “Availability and FEOC status will be much more significant drivers [of the emerging cost split] than the technical differences between pouch and prismatic cells.”

ess-news.com |