The Taper is DeadThe next wave of QE approaches.

Roberto Rios

The Federal Reserve cut rates today for the second time this year, lowering the federal funds rate by 25 basis points to a range of 3.75% to 4%, and more importantly, announced the end of quantitative tightening effective December 1st.

For those of you who have read my work over the past 4 years, this comes as no surprise.

But what makes this decision historic is not the cut itself, but the circumstances under which it was made: for the first time in modern history, the Fed is setting monetary policy completely blind, with no official jobs data due to the ongoing government shutdown.

Powell’s press conference was a masterclass in doublespeak, simultaneously claiming that the outlook for employment and inflation has not changed much since September while acknowledging that downside risks to employment appear to have risen in recent months.

The contradictions pile up faster than the Treasury debt: how can you assess employment risks without employment data?

How can you claim inflation remains contained when near-term measures of inflation expectations have moved up, on balance, over the course of this year on news about tariffs?

The answer, of course, is that you can’t. What we witnessed today was essentially political theater, with Powell desperately trying to thread the needle between an administration demanding looser policy and an economy that is already seeing signs of further inflation.

This confusion stems from the government shutdown that’s left them flying blind. Without September’s jobs report or October’s inflation data, they’re making monetary policy decisions based on anecdotal evidence and private sector data. The Labor Department’s sole economic report last week showed inflation was “slightly milder than forecasters had expected,” but without the slew of other data from the BLS, it’s like navigating a ship through fog with a broken compass.

Now Powell says that there are a “multitude” of reasons to cut today. The reality is there are only two driving factors. The first is funding stress building up in the shadow banking market. Per Colby Smith from the New York Times:

“Mr. Powell also said the Fed was thinking carefully about its balance sheet, which the central bank said it would stop shrinking in December. He said that market strains that have cropped up in the past three weeks have shown that now is the right time to make that change.”

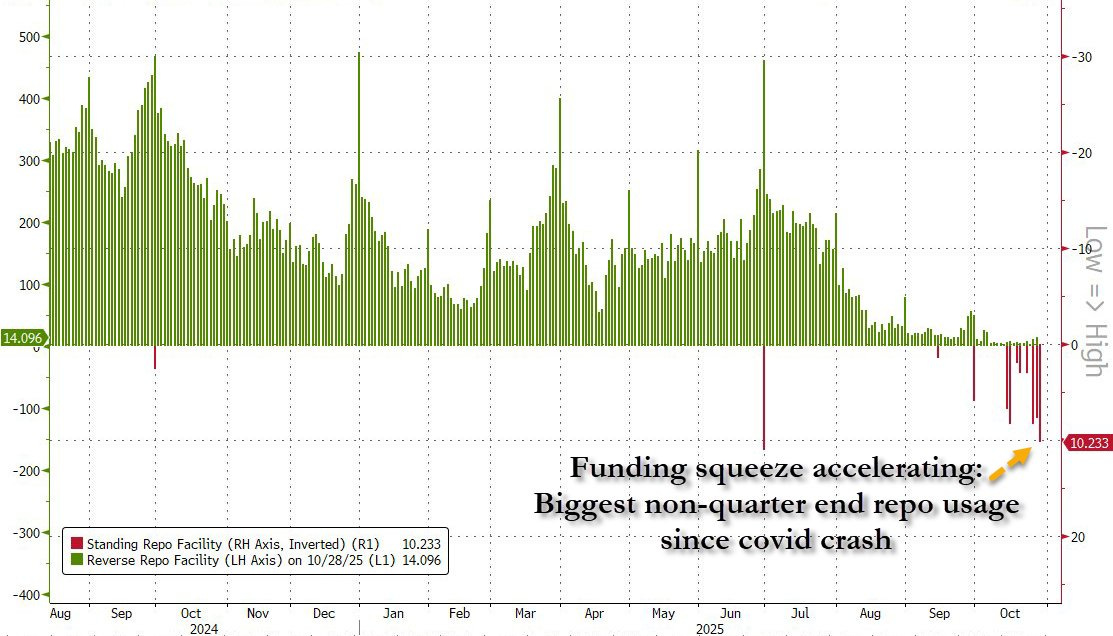

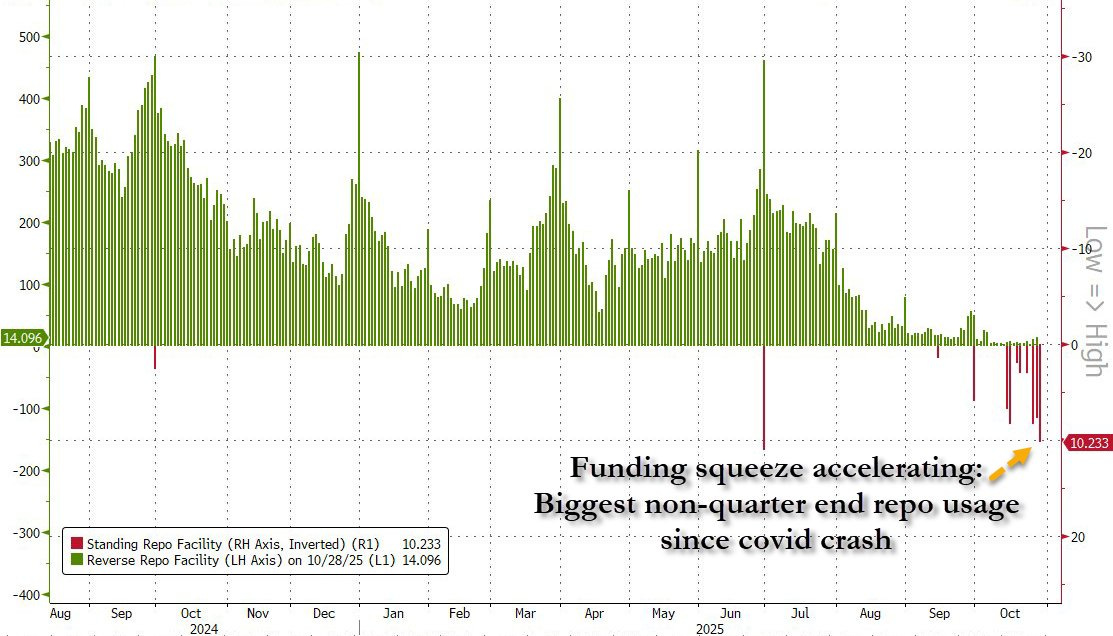

The widening SOFR:RRP spread is screaming that something is breaking in the plumbing of the financial system, and the Fed’s announcement that QT will end December 1st confirms what we’ve been warning about for months:

the Fed has lost control of its balance sheet, and QE is coming whether they admit it or not.In late June, the Federal Reserve’s Standing Repo Facility was tapped for roughly $11 billion in a single day, its largest draw since inception.

Today, October 29th, the draw on SRF was $10.2B, which again is highly unusual for a system supposedly running smoothly:

What’s particularly alarming is that the SRF suffers from significant negative market perception, as well as structural issues such as its balance sheet costs, that have prevented any real uptake from market participants outside of pressurized statement dates.

In other words, banks are so desperate for funding that they’re willing to use a facility that carries a stigma worse than the discount window, a facility that expands their balance sheets at the worst possible time, when regulatory constraints are already binding.

SOFR is also blinking red. As I covered on this substack in an earlier piece, by October, SOFR remained elevated near 4.3 percent, which indicated lingering tension in funding markets.

Even more alarming than the nominal rate, the spread between SOFR and the Fed’s Reverse Repo Rate has been steadily widening, a classic sign of funding stress that preceded the September 2019 repo crisis. See below for this chart from Infranomics on Twitter (a great follow I might add):

On October 16th, SOFR hit 4.29% while the RRP sat at 4.00%, creating a 29 basis point spread on a random Wednesday. This is highly abnormal for a date that isn’t a quarter or year end.

What’s driving this? Joseph Wang explained it perfectly:

“Demand for repo financing continues to grow rapidly from the increasing fiscal deficit, while the supply of repo financing can only keep up with the help of the Fed.“

The $2 trillion fiscal deficit is being partially financed by leveraged investors using the cash:futures basis trade, which has grown to over a trillion dollars in size.

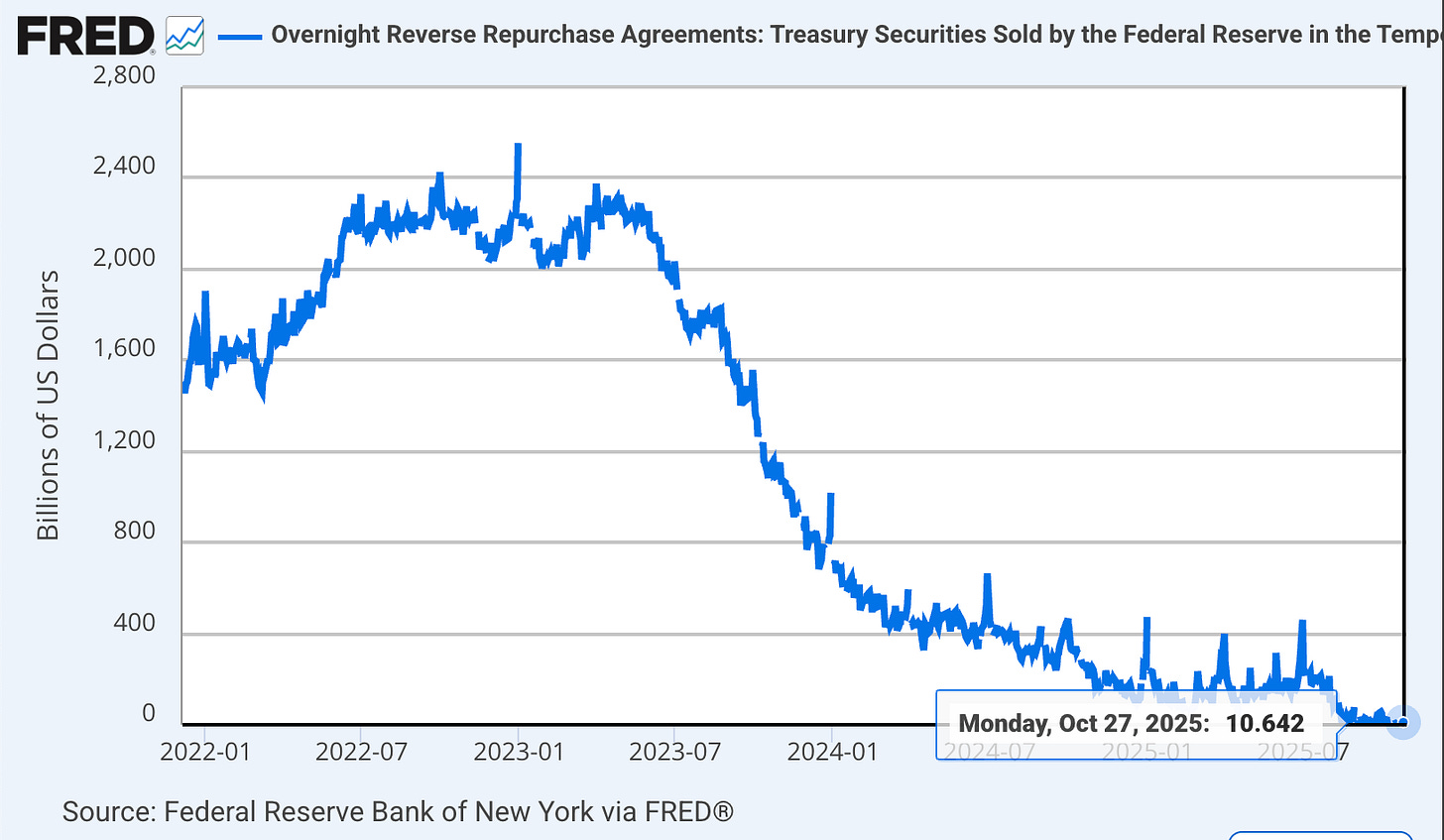

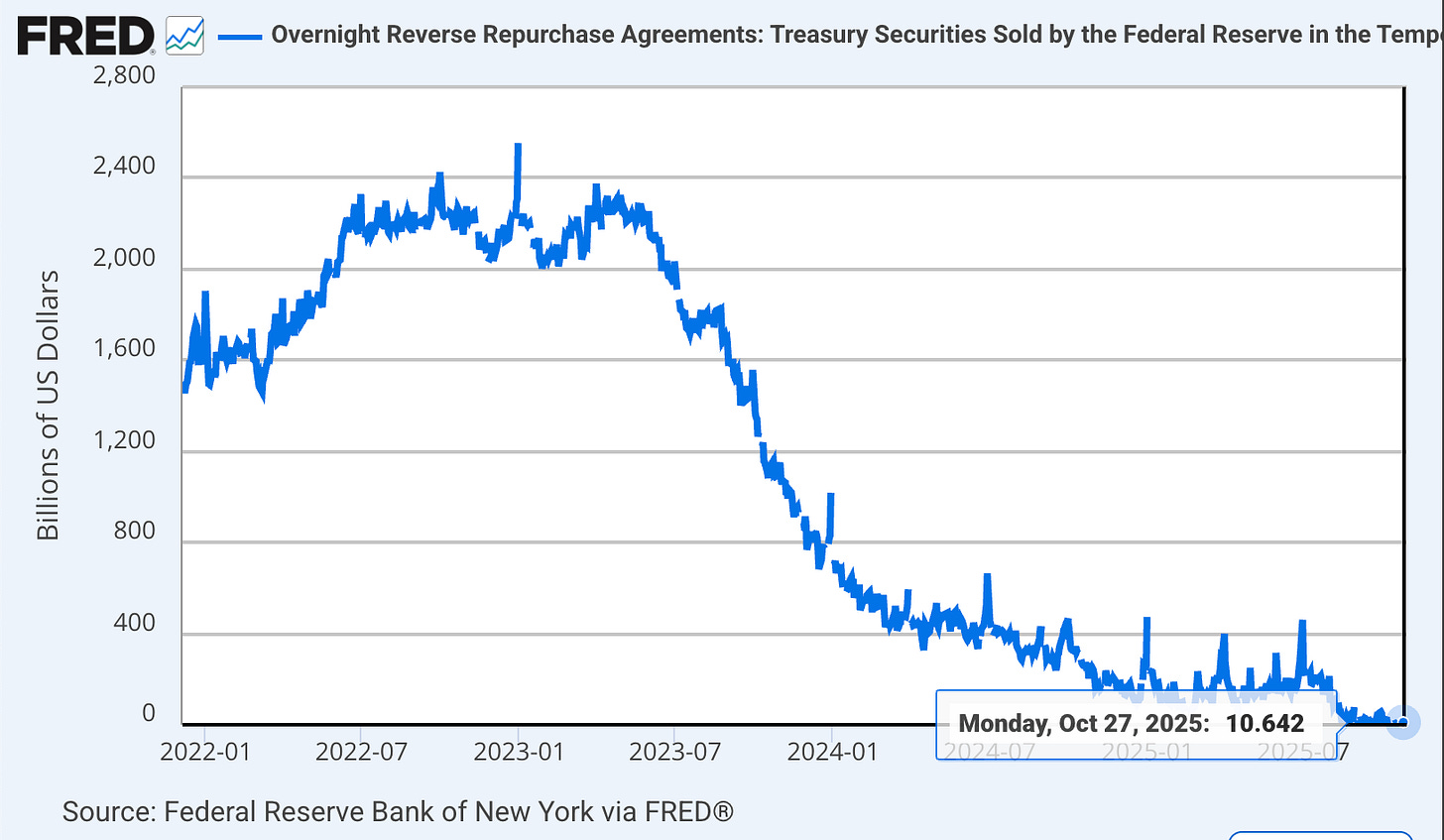

The RRP facility, which peaked at $2.6 trillion in December 2022, has now been almost completely drained. Once it hits zero, every dollar of QT directly drains reserves from the banking system, tightening financial conditions in ways the Fed can’t control.

Monday, October 27th saw a reading of $10 billion, but we’ve had multiple days already this month below that number.

The Fed’s response to these obvious signs of distress? End QT and hope for the best. As Powell stated, “Signs have clearly emerged that we have reached that standard” for ending balance sheet runoff, noting that “repo rates have moved up relative to our administered rates, and we have seen more notable pressures on selected dates along with more use of our standing repo facility”.

And there’s a larger macro reason why the tightening must end; fiscal dominance. Historically, since 2008, the Fed has not completed a rate cutting cycle without monetary accommodation. This support is needed for the Treasury to continue borrowing at current rates.

In other words, the announcement that QT will conclude on December 1st marks not just the end of normalization but the beginning of the next expansion phase.

The Fed’s balance sheet currently sits at $6.6 trillion, down from its $9 trillion pandemic peak but still massive by historical standards. That’s 22% of GDP, nearly four times the pre:2008 norm of 5:6%. Bill Dudley argues this is “about right,” but he’s missing the forest for the trees.

Consider the mechanics: Bank reserves as a % of GDP are currently at 10-11%, suggesting the Fed should have been poised to end QT sometime in 1H2025 once RRP drainage is complete. But the reverse repo facility is already essentially drained, sitting at near-zero levels after peaking above $2.5 trillion. Where does the liquidity go from here?

The answer is nowhere good. With reserves currently standing at around $3 trillion and the Fed declaring this level as the effective floor, we’re locked into a permanently enlarged balance sheet. The Fed will never return to pre-2008 normalcy, let alone pre-2020 levels. This is the new normal: a central bank balance sheet that represents over 20% of GDP, with no path back to historical norms.

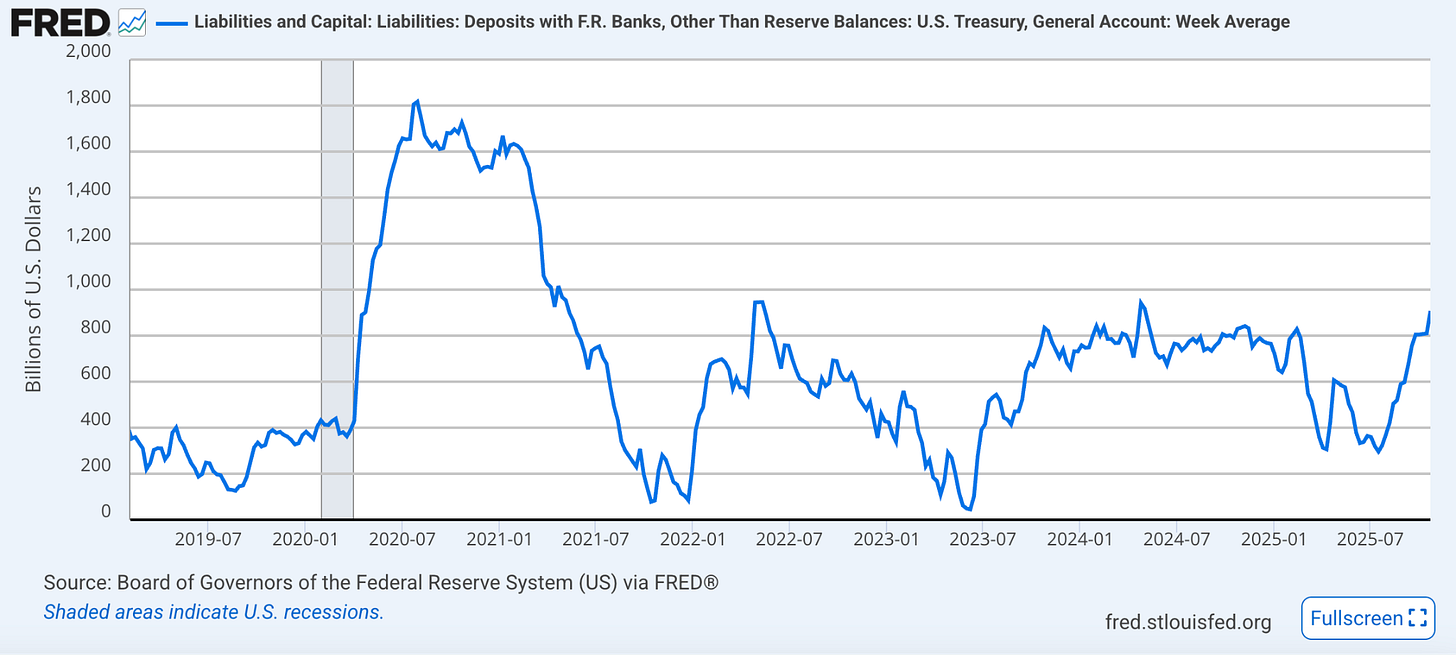

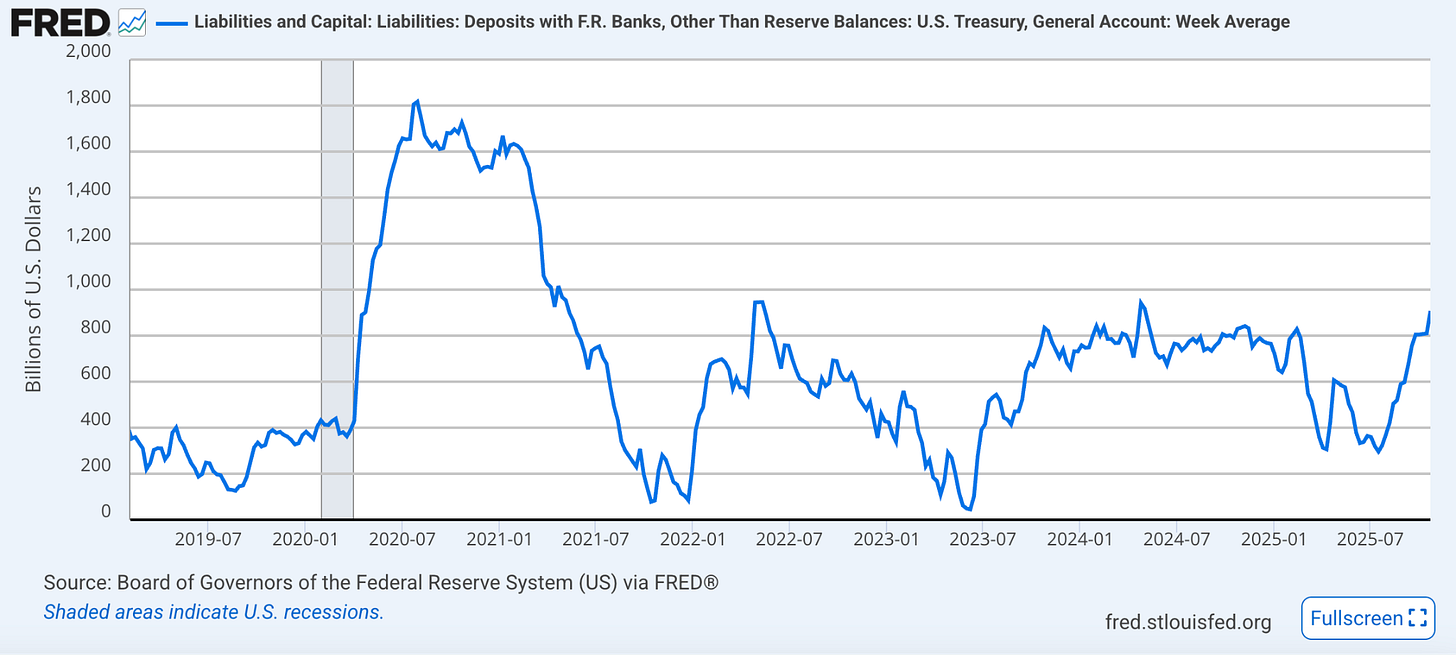

And for those who point (rightly) to the TGA being the next source of liquidity, this funding source won’t last forever. As BlackRock’s analysis shows, the Treasury General Account’s wild swings are now driving banking system liquidity more than Fed policy. The TGA drawdown in early 2025 added $800 billion to bank reserves, completely offsetting QT’s tightening effects. Now that’s reversing, and reserves are plummeting.

(Higher TGA balance means more cash stored away, and less liquidity in the system- see my Net Liquidity or Stealth QE pieces for more detail)

And since the US government is currently shutdown, a substantial portion of federal outlays are essentially paused- meaning that the Treasury will continue to build up the TGA balance without being able to spend it back into the real economy, draining liquidity.

This means QE (or more accommodation of some form) is inevitable.

Evercore ISI’s Krishna Guha predicts the Fed will actually restart asset purchases in early 2026 for “organic growth purposes.” That’s a polite way of saying QE is coming back because the system can’t function without it.

What’s more telling is what Powell didn’t say. There was no mention of when, or even if, the Fed might resume balance sheet reduction. Instead, we got vague promises about “holding the size of our balance sheet steady for a time while reserve balances continue to move gradually lower as other non-reserve liabilities such as currency keep growing”. This is central bank speak for “we’re done tightening, permanently.”

The elephant in the room that Powell desperately tried to ignore is fiscal dominance, the point at which monetary policy becomes subservient to fiscal needs. We’ve crossed that Rubicon, though nobody wants to admit it.

The federal debt now exceeds $38 trillion, with interest costs approaching $1.6 trillion annually if rates remain at current levels. The Treasury is hemorrhaging cash: fourth-quarter borrowing needs are approaching $1 trillion in just 90 days. This is not sustainable without Fed support.

The mechanics of fiscal dominance are already visible in the data.

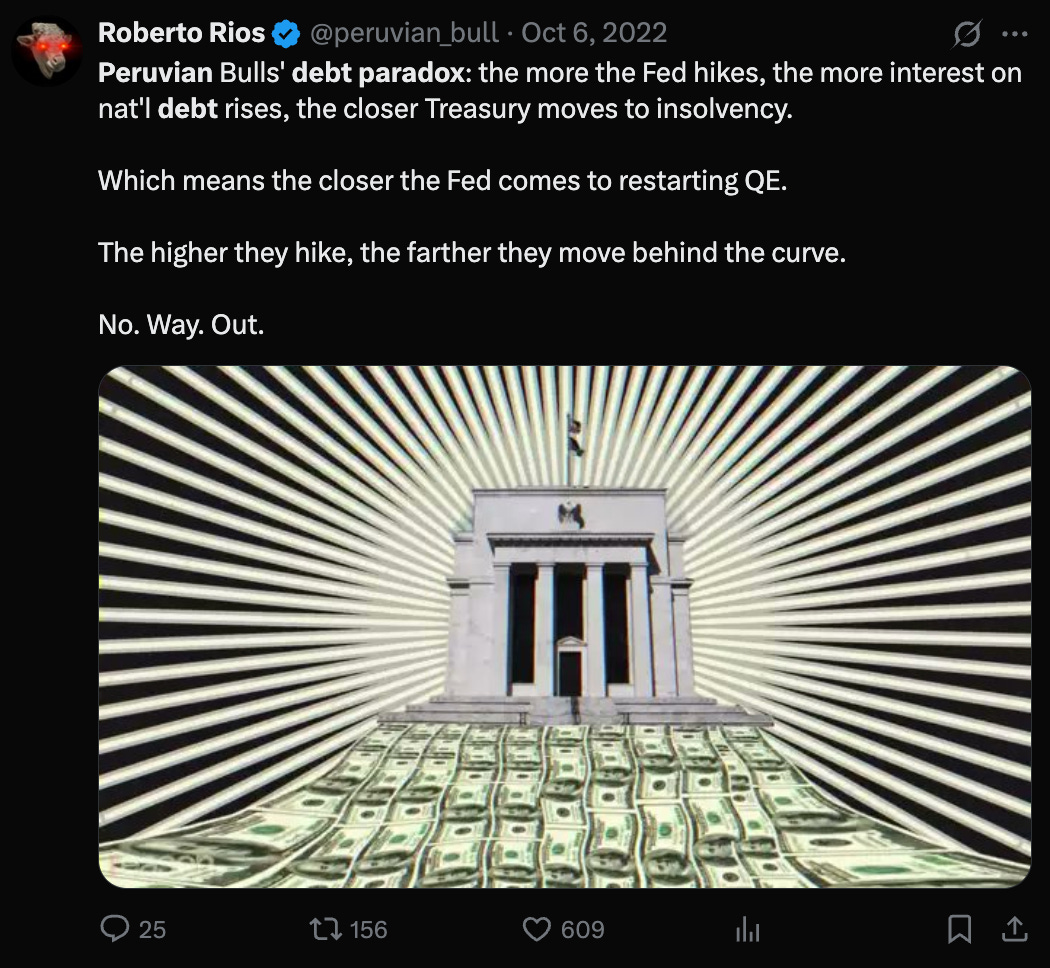

As I outlined in Dollar Endgame, higher rates are supposed to cool inflation, but when the government is the largest debtor in the system, rate hikes actually increase the deficit through higher interest payments.

Those payments flow directly into the economy as income to bondholders, creating what I’ve termed the Peruvian Bull Debt Paradox: the higher rates go, the more stimulative fiscal policy becomes, requiring even higher rates to achieve the same cooling effect, which makes fiscal policy even more stimulative.

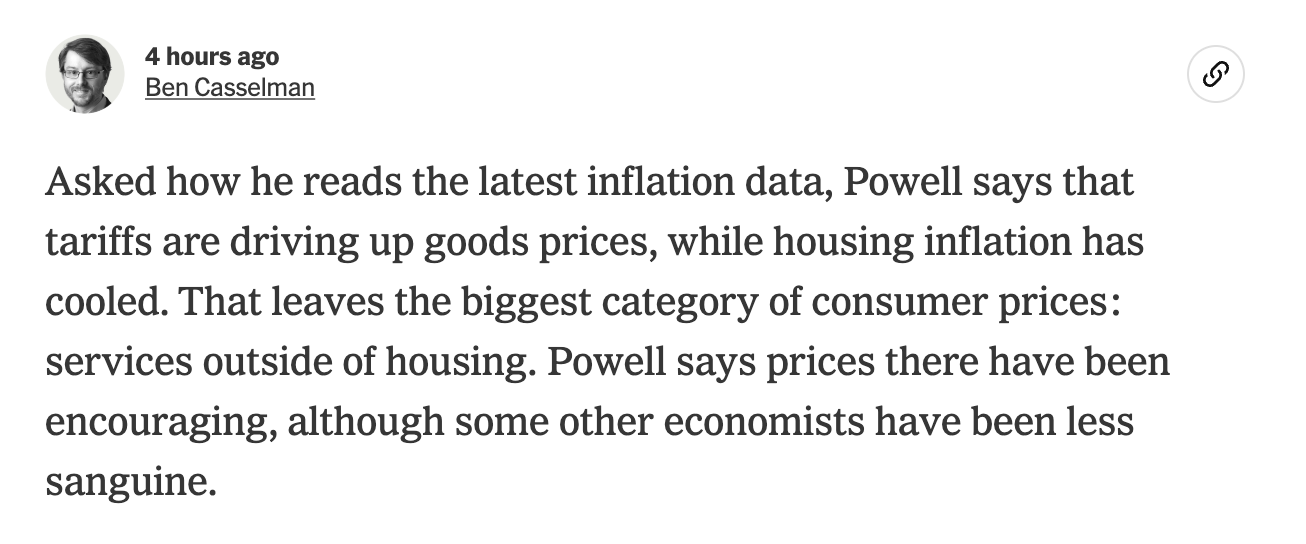

Powell acknowledged this obliquely when discussing tariffs, noting that “higher tariffs are pushing up prices in some categories of goods, resulting in higher overall inflation” and that while the base case is for “relatively short-lived” effects, “it is also possible that the inflationary effects could instead be more persistent”. What he didn’t say is that tariffs are just one piece of a broader fiscal expansion that the Fed is powerless to counteract.

Perhaps the most revealing moment came when Powell addressed the December meeting, stating emphatically that “a further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it”. He went further, noting “strongly differing views about how to proceed in December” among committee members.

The split was already evident in today’s vote: Governor Stephen Miran dissented in favor of a 50 basis point cut, while Kansas City Fed President Jeffrey Schmid dissented against any cut at all. This 10-2 vote with dissents in opposite directions reveals a committee that has lost its way, unable to agree on even the basic direction of policy.

Market reaction was swift and brutal. The CME FedWatch tool showed that the likelihood of a 25 basis point cut in December declined from 90.5% yesterday to 54.7% after Powell’s comments. Stocks, which had been rallying on the initial rate cut announcement, reversed course as investors digested the implications of a rudderless Fed.

The 10yr bond also sold off, with the yield rising by 8 basis points.

But all of this is with Powell at the helm. Trump’s current plan is to install a new Fed Chair. Treasury Secretary Scott Bessent has already announced that the list of potential candidates to replace Powell has been narrowed to five names, and President Trump is expected to name his pick by year-end. Powell’s term as Fed Chair expires in May 2026.

This lame-duck status explains much of today’s confusion. Powell is trying to maintain Fed independence while knowing his replacement will likely be someone far more amenable to aggressive easing. The result is policy paralysis, with the Fed unable to tighten due to clear signs of funding stress and unable to ease aggressively despite political pressure.

The dissent by Governor Miran, Trump’s recent appointee who wanted a 50 basis point cut, is a preview of coming attractions. The next Fed will be explicitly politically aligned, with any pretense of independence abandoned in favor of supporting fiscal expansion and market valuations.

The Fed and Treasury will be tied together in a suicide pact.And the Big Print will be upon us. |