Opinion & Analysis

Back in motion: Battery revenues surge as volatility returns

After a relatively slow couple of months, September brought back a more favorable trading environment for battery operators in Germany. Lennard Wilkening, CEO and Co-Founder of suena energy, unpacks what drove the rebound and why precision and the right strategy are set to matter even more as day-ahead trading transitions to 15-minute granularity.

By

Lennard Wilkening

Oct 30, 2025

Opinion & Analysis

Revenue streams

Image: suena

Following a summer characterised by fluctuating market conditions and modest returns, September brought the kind of market conditions that battery operators in Germany had been waiting for: high spreads, deep troughs and a resurgence of volatility in the intraday and reserve markets. For the first time since June, price signals across spot and ancillary services came together to create more trading opportunities. For flexible, responsive systems, that shift translated directly into higher earnings.

September in numbers

While June had still delivered strong battery revenues, driven by high volatility and pronounced price events, that momentum faded over the remainder of the summer: July was marked by narrow arbitrage opportunities across all timeframes, and August brought only a moderate recovery, with limited improvement in spreads and ancillary market signals. September, by contrast, marked a clear turnaround, as reflected in our updated trading benchmarks.

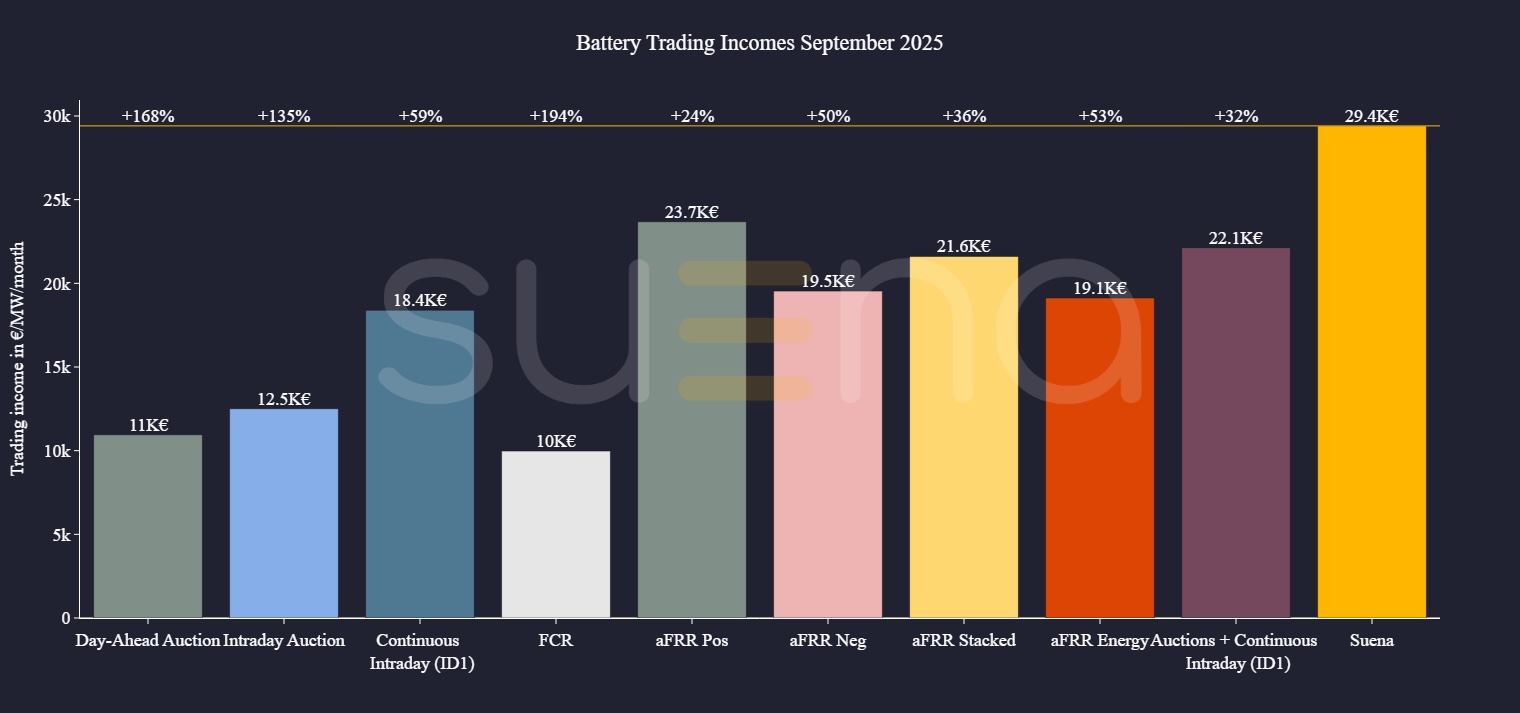

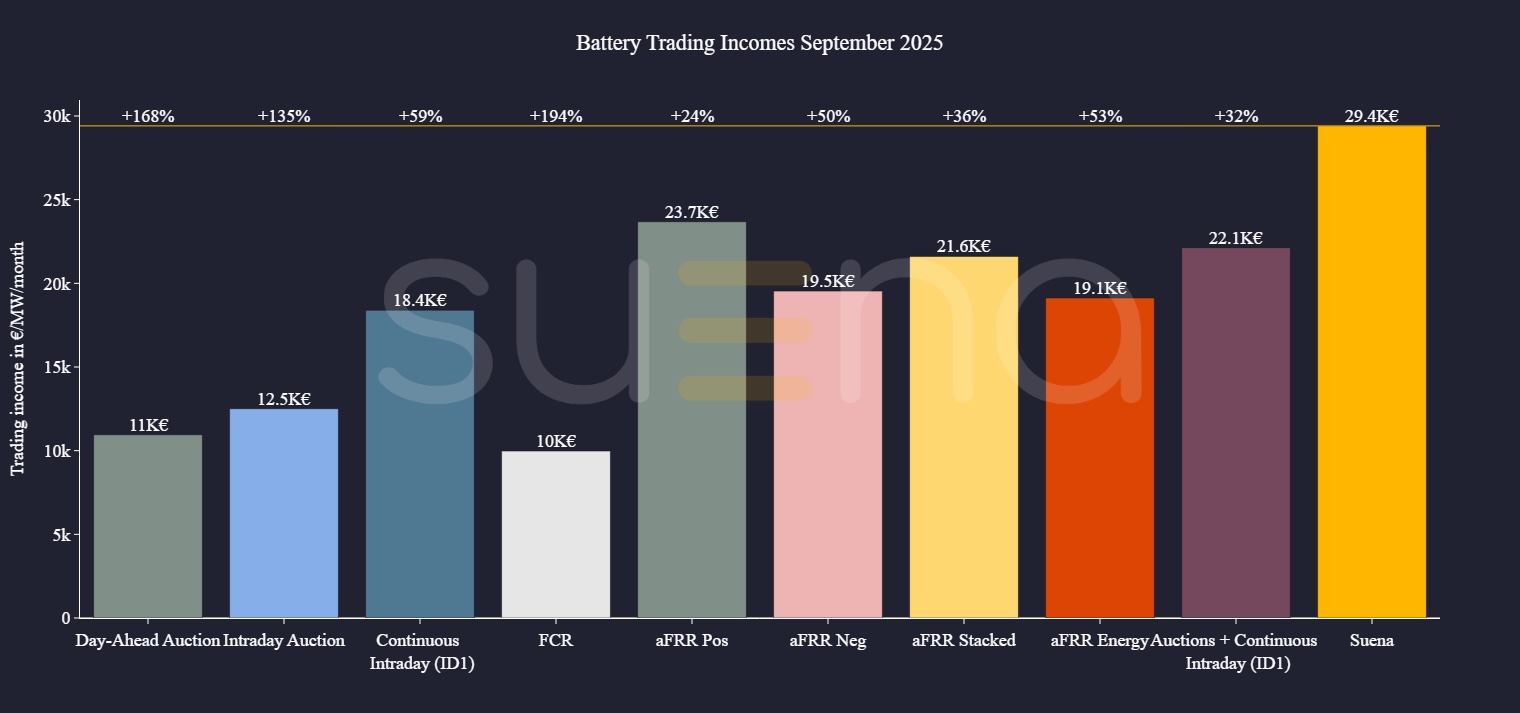

A linear optimizer coordinating across day-ahead, intraday auction, and continuous intraday markets reached a combined income of €22.1k per MW. Isolated strategies on individual spot markets ranged from €11k to €18.4k per MW, depending on volatility intensity and market segment. Ancillary service revenues added further upside. While FCR held steady at a maximum of €10k per MW, aFRR capacity revenues surged, reaching up to €23.7k per MW. aFRR energy activations also gained strength, with our Picasso benchmark returning €19.1k per MW – the highest value so far this year.

Against this backdrop, suena energy’s Energy Trading Autopilot executed a cross-market optimization strategy that generated €29,4k per MW, with an average of 1.98 cycles per day. That’s a 9% increase over August. Compared to the stacked spot benchmark, the Autopilot outperformed by 32%. Versus FCR, the gain reached 194% – an 86% increase over last month. Even against high-performing aFRR capacity setups, the margin held between 24% and 50% and in relation to single-market strategies, the Autopilot’s advantage extended as high as 168%.

What drove the surge?

September’s resurgence in trading performance was not so much driven by isolated price spikes, but by a broad-based return of volatility across spot and balancing markets.

One of the most telling indicators was the rise in negative price hours, which climbed from 64 in August to 78 in September. These hours, concentrated around midday, restored consistent charging opportunities and improved conditions for intraday arbitrage.

At the same time, wind generation picked up, particularly during night and early morning hours, contributing to deeper overnight price troughs and greater variation in daily cycling patterns. Solar output, on the other hand, declined with the seasonal transition, modestly reducing charging potential around noon.

Ancillary markets also contributed to the improved revenue landscape, due to consistent activation volumes, with aFRR capacity prices reaching their highest levels in over a year.

While none of these drivers were individually extreme, they offered an alignment of favorable trading conditions, shaped by fluctuating renewable energy output, shifting load profiles, and more pronounced intraday price signals.

Farewell hourly day-ahead trading

But September was not only notable because it brought back stronger returns; it also marked the final month of hourly Day-Ahead trading before the European market transitioned to 15-minute products in October. This switch promises more accurate prices, lower balancing costs and more robust integration of renewable energies.

At the same time however, it will make trading significantly more complex – technically, operationally and contractually. Market operators and algorithm providers alike will need to adapt quickly, re-tuning models and bidding strategies to ensure responsiveness in the new cadence. The shift therefore plays to the strengths of systems already built for speed, complexity, and high-frequency decision-making.

October and the shifting landscape

October already introduces a structural change: the end of hourly day-ahead trading in Germany, with the switch to quarter-hourly products. This shift alone will create new optimization challenges – and opportunities. Arbitrage windows will shrink, forecast errors will compound faster, and bidding strategies will need to reflect a much finer market rhythm. In this new landscape, the gap between viable and suboptimal strategies is likely to widen.

At the same time, autumn volatility is likely to increase further: wind production typically rises, load ramps up, and reserve margins begin to tighten towards winter. In combination, these forces could bring another active month for flexible assets. Capitalizing on the resulting opportunities will depend on the ability to coordinate across markets and intervals in real time and with great precision

ess-news.com |