Make American GWs Again - How Washington’s Westinghouse Deal Reignites the Atomic Economy

The Hoot this Week: 27th October - 31st October 2025

Ocean Wall

Oct 31, 2025

On Tuesday, news of the US government forming a major partnership with Westinghouse sent shockwaves across markets. The deal proposes at least $80 billion worth of new nuclear reactors in the United States. A nuclear rollout of this scale is designed to meet surging power demand, particularly from data centers and AI, while strengthening energy security and supporting long term economic growth.

This partnership is a stroke of strategic genius by the Trump administration. In return for the 80-billion-dollar investment, Cameco has agreed to a participation interest under which the US government will receive 20% of all future cash distributions Westinghouse makes beyond the first $17.5 billion.

If, by January 2029, Westinghouse’s value reaches US $30 billion or more, the US Government can require Westinghouse to go public through an IPO. When that happens, the Participation Interest will convert into a five-year warrant, an option to buy shares equal to 20% of Westinghouse’s IPO value, after deducting the first $17.5 billion.

The US Government’s involvement, providing financial backing, policy support, and regulatory help, is expected to speed up Westinghouse’s growth and strengthen U. leadership in nuclear energy. Importantly, it gives US taxpayers a stake in their country’s energy infrastructure.

$80 billion could feasibly build ten AP1000 reactors, providing around 11.8 GW of capacity. This would lift total US nuclear generation to more than 100 GW. It is a statement deal: the United States is fully intent on remaining the global leader in nuclear power, or at the very least, it will not surrender that position without a fight.

This is also an opportunity for the West to achieve the sequencing and standardization needed to accelerate build times and reduce costs. While much has been said about the delays and cost overruns at Vogtle Units 3 and 4, Unit 4 was ultimately completed about 40 percent cheaper than Unit 3.

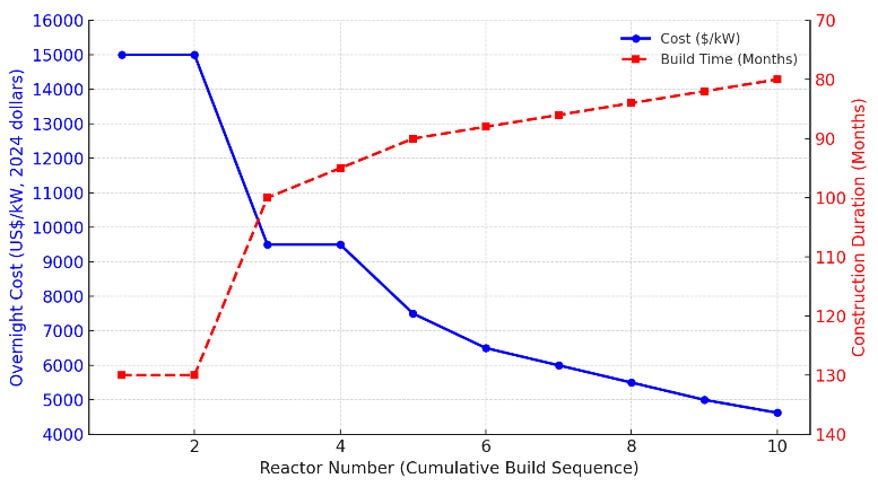

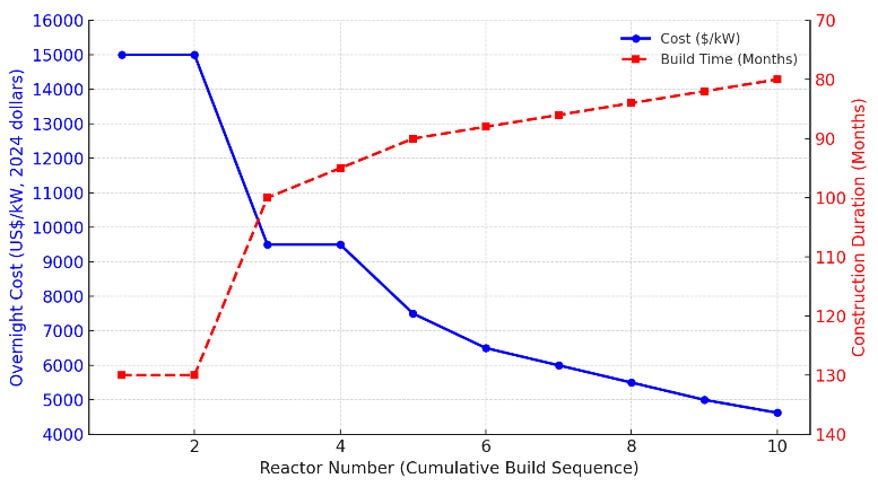

MIT’s analysis found that Vogtle 3 & 4’s first-of-a-kind AP1000 units cost about $15,000 per kW in 2024 dollars due to design changes, supply-chain issues, and long schedules. The study projects that the next pair could fall to $8,300–10,375 per kW, and an Nth-of-a-kind fleet to roughly $4,625 per kW, as standardization and experience improve efficiency. Overall, this suggests that building around ten AP1000s in sequence could halve capital costs, shorten construction to 80–96 months, and deliver electricity at $66–97 per MWh, depending on financing and policy support

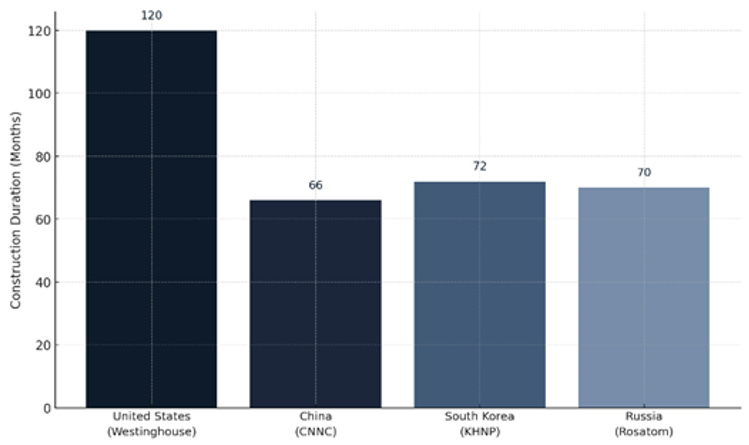

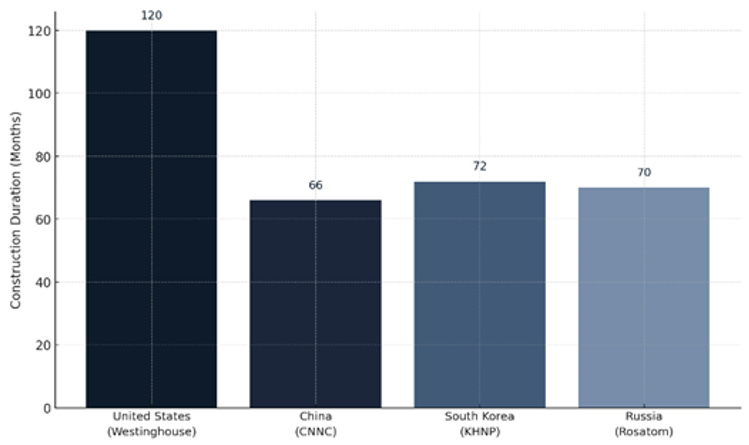

By contrast, nearly every Chinese nuclear project that has entered service since 2010 has achieved construction in 7 years or less.

The chart below compares average nuclear reactor construction durations among major reactor-exporting nations, highlighting the US (Westinghouse), China (CNNC), South Korea (KHNP), and Russia (Rosatom). It shows how the US faces longer build times, largely due to FOAK projects, regulatory complexity, and supply-chain reactivation, while China, Korea, and Russia complete similar projects in roughly 5–7 years. These faster schedules reflect standardised reactor designs, continuous domestic build programs, and mature supply chains, which make their companies globally competitive in the export market. As a result, CNNC, KHNP, and Rosatom currently dominate the international nuclear construction space, while Westinghouse is seeking to re-establish competitiveness.

If executed at scale, this partnership will define the next chapter of US nuclear power. Ten AP1000s built in sequence could reindustrialise America’s nuclear supply chain, halve construction costs, and compress build times to global standards. With federal participation and market discipline, Westinghouse is set to cement its place as the benchmark for Western nuclear engineering, positioning the United States to compete directly with CNNC, KHNP, and Rosatom in export markets.

Ten additional reactors represent approximately five million additional lb of uranium per year. That’s 300 million lb of uranium over a 60-year operating life, 2x global annual production.

In parallel…

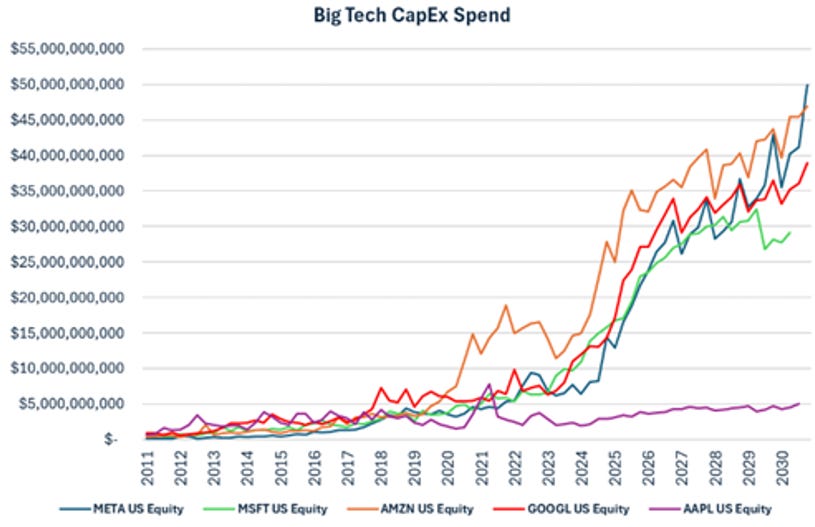

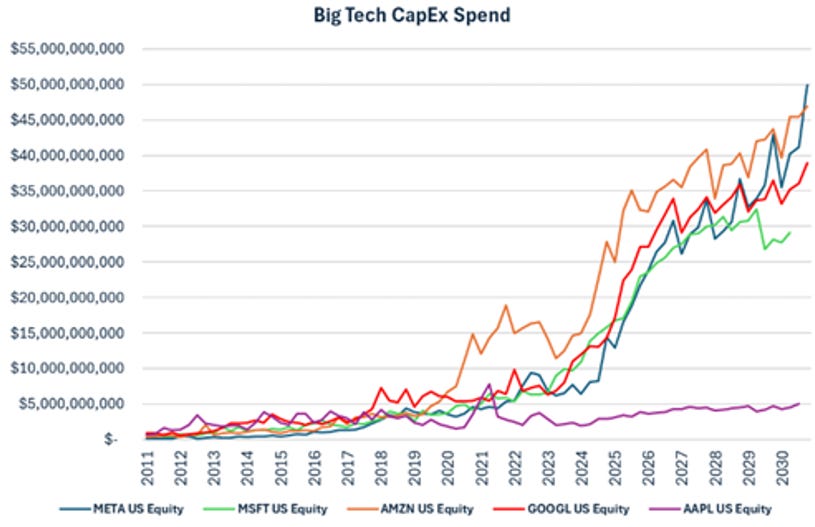

· Alphabet announced $91–93 billion in CapEx for 2025, most of it for technical infrastructure: 60% servers, 40% data centres and networking equipment, with further increases guided for 2026.

· Amazon projected $125 billion CapEx in 2025, nearly all tied to AWS expansion, and signalled another step up in 2026.

· Microsoft’s AI-driven CapEx is also surging, with $21.4 billion in Q3 FY25 including cloud leases and GPU infrastructure builds.

· Meta, for its part, noted CapEx growth across core AI, MSL, and infrastructure, with 2026 spend set to rise significantly from 2025 levels.

· Apple remains a smaller outlier, maintaining a hybrid model but acknowledging rising AI-related CapEx through its Private Cloud Compute buildout.

Figure 1: Quarterly CapEx Spend: MSFT, AMZN, GOOGL, META, APPL

Source: Company Financials, Ocean Wall Research

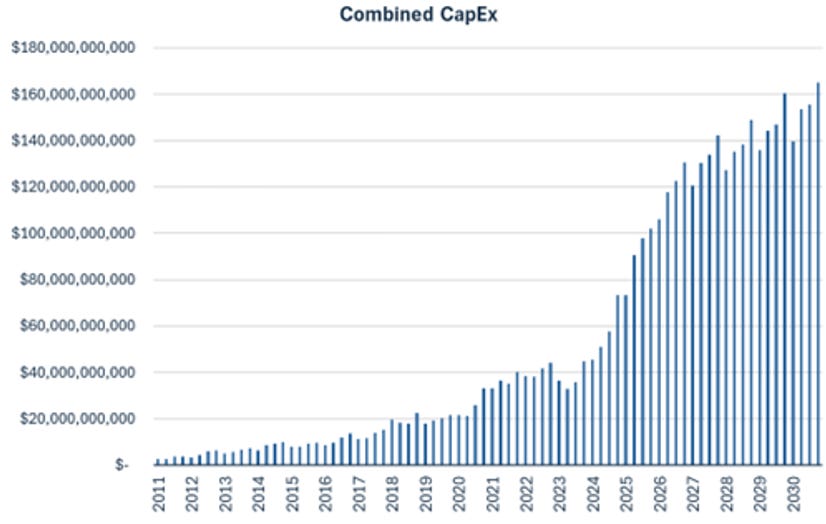

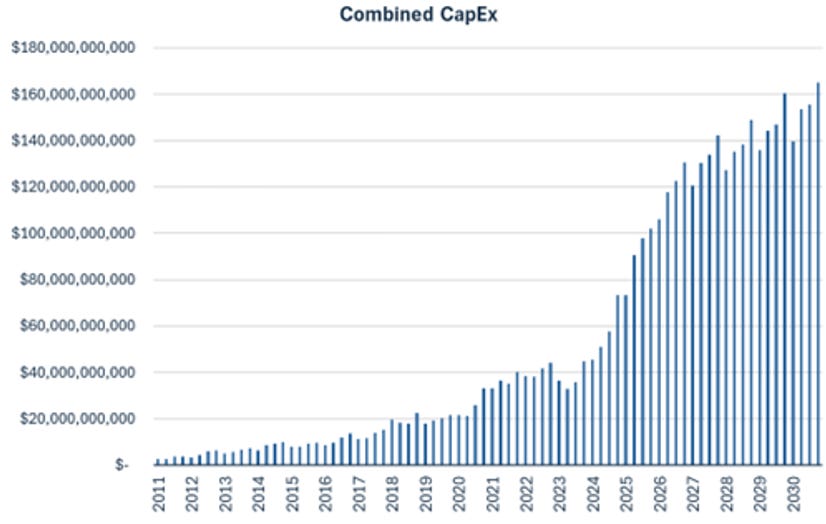

Figure 2: Combined Quarterly CapEx (2011 – 2030)

Source: Company Financials, Ocean Wall Research

The Age of the Gigawatt Data Centre

Amazon’s AWS has added 3.8 GW of data-centre power in the past 12 months, doubling capacity from 2022 and on track to double again by 2027. Another 1 GW is due online by year-end 2025. This makes AWS the largest single private power buyer globally.

Meta and Alphabet both signalled tight supply-demand conditions for energy and compute, reflecting the physical limits of grid interconnections and transmission buildouts. Microsoft, meanwhile, announced that it had opened data centres in ten countries this quarter.

Taken together, Big Tech’s combined AI infrastructure CapEx will likely exceed $400 billion in 2026, roughly equal to the total cost of building 40–50 nuclear reactors.

Amazon’s 3.8 GW gain equates to nearly four AP1000 reactors’ electrical output. Google and Microsoft also increasingly emphasise power procurement as a constraint, Google noting that energy and depreciation are the fastest-growing P&L costs in cloud operations.

The top five tech firms are effectively building a parallel grid-scale energy system, expanding at rates rivalling national utilities. The AI boom’s next bottleneck is no longer chips but power, fuelling arguments for long-duration baseload solutions like nuclear energy.

This is where the Westinghouse–Cameco initiative aligns: if each AP1000 reactor supplies roughly 1.1 GW, then the US government’s proposed 10-reactor, ~12 GW program could roughly offset the data-centre capacity AWS alone added this year. In other words, Big Tech’s energy hunger now equals national-scale generation projects, redefining the strategic overlap between AI infrastructure, energy security, and industrial policy.

In that emerging landscape, Fermi America sits exactly where these forces converge, between AI-driven demand, energy infrastructure, and capital formation. While the US government and Westinghouse rebuild national capacity from the top down, Fermi is advancing from the ground up, deploying multi-GW hybrid sites that combine Gas and nuclear-ready baseload power with proximity to major data-centre clusters. Its Project Matador in Amarillo, Texas, already anchors over a GW of planned generation, with expansion potential to double that by 2027. More importantly, Fermi’s early partnership with Westinghouse places it at the centre of the energy ecosystem that now underpins Big Tech’s growth. As hyperscalers begin treating energy as strategic infrastructure, Fermi represents the bridge between digital demand and physical power, a model that turns the AI energy gap into a long-duration, revenue-generating asset class.

What Else Happened This Week?

Bill Gates-backed TerraPower seeks UK approval for nuclear reactor design

TerraPower, the nuclear fission company co-founded by Bill Gates, has submitted its advanced reactor design for UK approval, marking its first international market attempt. The company’s 345 MW sodium-cooled fast reactor incorporates a molten-salt energy-storage system enabling output of 345 MWe, but it can boost of up to 500 MW for over five hours. The company plans to partner with KBR to identify potential reactor sites.

TerraPower has already secured regulatory approval in the United States, where its first Natrium reactor is under construction in Wyoming. In the UK, however, the company faces considerable headwinds, including financing challenges, political scrutiny, and public resistance, particularly over waste management and safety concerns that could complicate the licensing process. Successful approval would mark a significant milestone, potentially setting a precedent for cross-border regulatory collaboration in the deployment of next-generation nuclear technologies.

This news comes off the back of TerraPower receiving their NRC-Issued Environmental Impact Statement (EIS) last week. This enables the company to begin building the nuclear part of their Natrium reactor having already begun building the rest of the plant in Wyoming. This makes TerraPower the first advanced reactor to achieve this regulatory milestone and far exceeds the initial June 2026 target after President has sought to fast track NRC approval timelines.

Japan–US $550Bn Energy Pact Allocates $25Bn to NuScale and ENTRA1 for Landmark TVA SMR Program

In September, the United States and Japan announced a bilateral framework agreement mobilising up to $550 billion in public- and private-sector investment to expand critical energy infrastructure and strengthen supply chains.

Yesterday, ENTRA1 Energy was allocated up to $25 billion for their partnership with the Tennessee Valley Authority (TVA) under this initiative to support the deployment of NuScale SMR in the TVA service region. The program will deliver 6 GW of clean, reliable power to meet the surging energy demand from AI data centres, manufacturing, and national defence, marking the largest SMR commitment in U.S. history.

Premier American Uranium Announce Preliminary PEA for the Cebolleta Uranium Project.

Premier American Uranium (TSXV: PUR) has released a Preliminary Economic Assessment for its Cebolleta Project in New Mexico, outlining average annual production of 1.4 Mlb U3O8 over a 13-year mine life and an after-tax NPV (8%) of US$83.9 million at a US$90/lb uranium price. The project benefits from low upfront capital of US$64 million, competitive operating costs of US$41.60/lb, and strong leverage to higher uranium prices or improved recoveries.

The timing is also favourable, with the U.S. accelerating its nuclear buildout to strengthen energy independence. As uranium prices rise, global supply tightens, and utilities alongside federal agencies expand stockpiling programs, PAU is well placed to benefit from the rising premium on domestic uranium supply, particularly as Washington aims to phase out Russian uranium imports by 2028.

Illinois lifts ban on new nuclear

A new bipartisan energy bill in Illinois has been passed which includes lifting the state’s long-standing ban on building new nuclear power plants. The legislation expands on a previous measure that only allowed small modular reactors (SMRs), opening the door for large-scale nuclear projects for the first time in decades. The bill also includes a new fee for existing plant operators of $3.9 million per reactor. |