2 Stocks to Buy Now to Profit from the Rise of Robotics

Sushree Mohanty - Barchart - Tue Nov 4, 6:30AM CST Columnist

Image by Sorapop Udomsri via Shutterstock

Automation and robotics are transforming the global manufacturing landscape. As companies race to improve efficiency, cut costs, and address labor shortages, demand for advanced robotics systems is soaring. In this rapidly evolving space, two innovative companies stand to benefit.

Robotics Stocks #1: Rockwell Automation (ROK) With a market cap of $41.1 billion, Rockwell Automation (ROK) sits at the heart of industrial automation and digital transformation. The company offers hardware, software, and services that assist manufacturers in automating and optimizing their production lines, including robots and control systems, sensors, data analytics, and AI-driven solutions.

Rockwell's automation platforms, such as FactoryTalk, Logix, and PowerFlex, among many others, enable companies to adopt robotics, smart sensors, and AI to increase productivity and save costs.

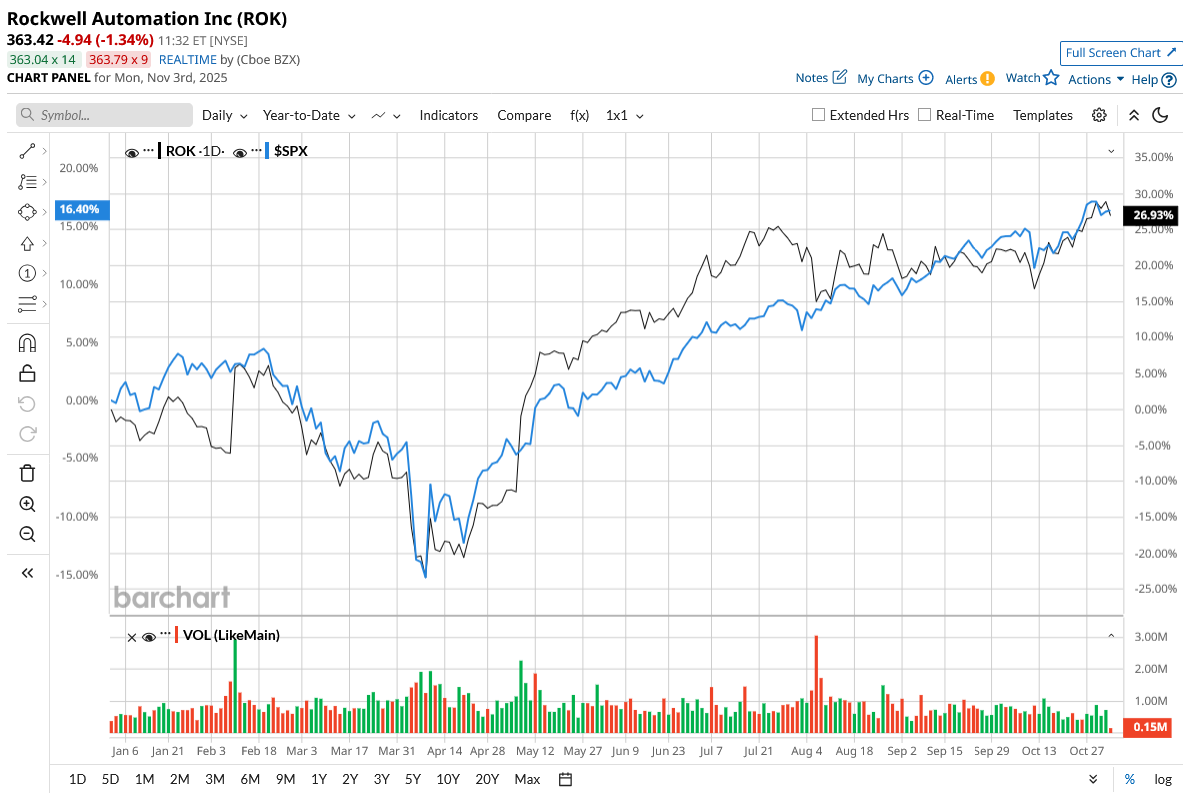

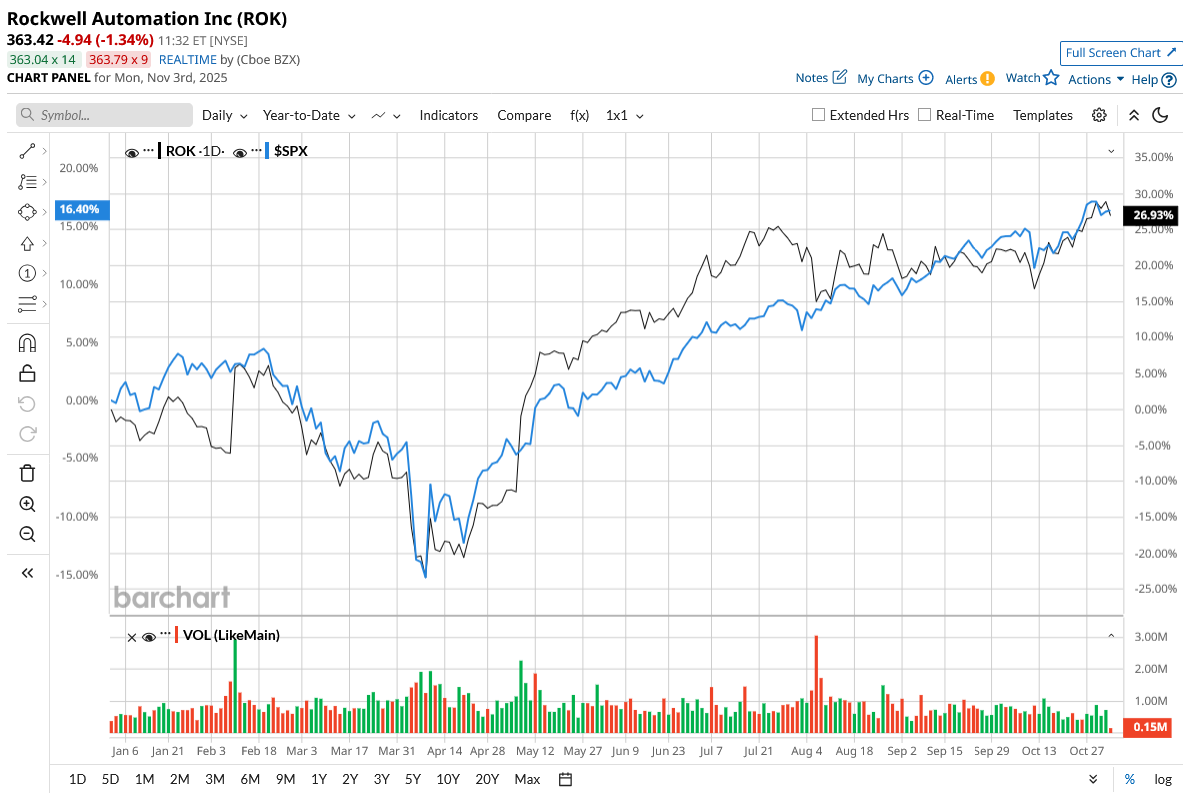

ROK stock has gained 27% year-to-date (YTD), surpassing the broader market gain.

www.barchart.com Rockwell's integrated ecosystem includes intelligent devices, control systems, SaaS-based manufacturing software, and autonomous robotics. These enable manufacturers to modernize operations more quickly and efficiently than ever before. www.barchart.com Rockwell's integrated ecosystem includes intelligent devices, control systems, SaaS-based manufacturing software, and autonomous robotics. These enable manufacturers to modernize operations more quickly and efficiently than ever before.

Notably, in the second quarter, Rockwell achieved significant project wins across various industries. Notably, Freshpet and Incobrasa Industries have chosen Rockwell to automate their new processing plant. In automotive, Hyundai Motor Group and Lucid Motors (LCID) also adopted the company’s automation systems. This resulted in a 30% increase in eCommerce and Warehouse Automation sales year-on-year (YoY) in Q2, driven by rising demand for Rockwell's OTTO autonomous mobile robot (AMR) platform, which enables intelligent, flexible material movement in modern logistics facilities.

Its Software & Control division also performed well in Q2, with organic sales increasing 22% YoY and Logix hardware sales up more than 30%. Advanced manufacturers like Beam Therapeutics (BEAM) and Hancock Iron Ore are increasingly adopting its software platforms, which include FactoryTalk PharmaSuite MES and Guardian AI.

Management remains optimistic about the prospects of robotics, software-defined automation, and AI-powered production. Rockwell is scheduled to report fourth-quarter and full-year fiscal 2025 results on Nov. 6. The company anticipates organic sales growth of +1% to -2%, with annual recurring revenue increasing by high single digits. Adjusted EPS could rise by 3% at the midpoint.

Investors should also keep an eye out for the company's upcoming Automation Fair and Investor Day in Chicago this November. Rockwell plans to showcase its latest advancements in robotics, intelligent devices, and integrated digital services. With strong tailwinds from rising automation demand and AI integration, Rockwell Automation stands out as a stock primed to benefit from the unstoppable rise of robotics in manufacturing.

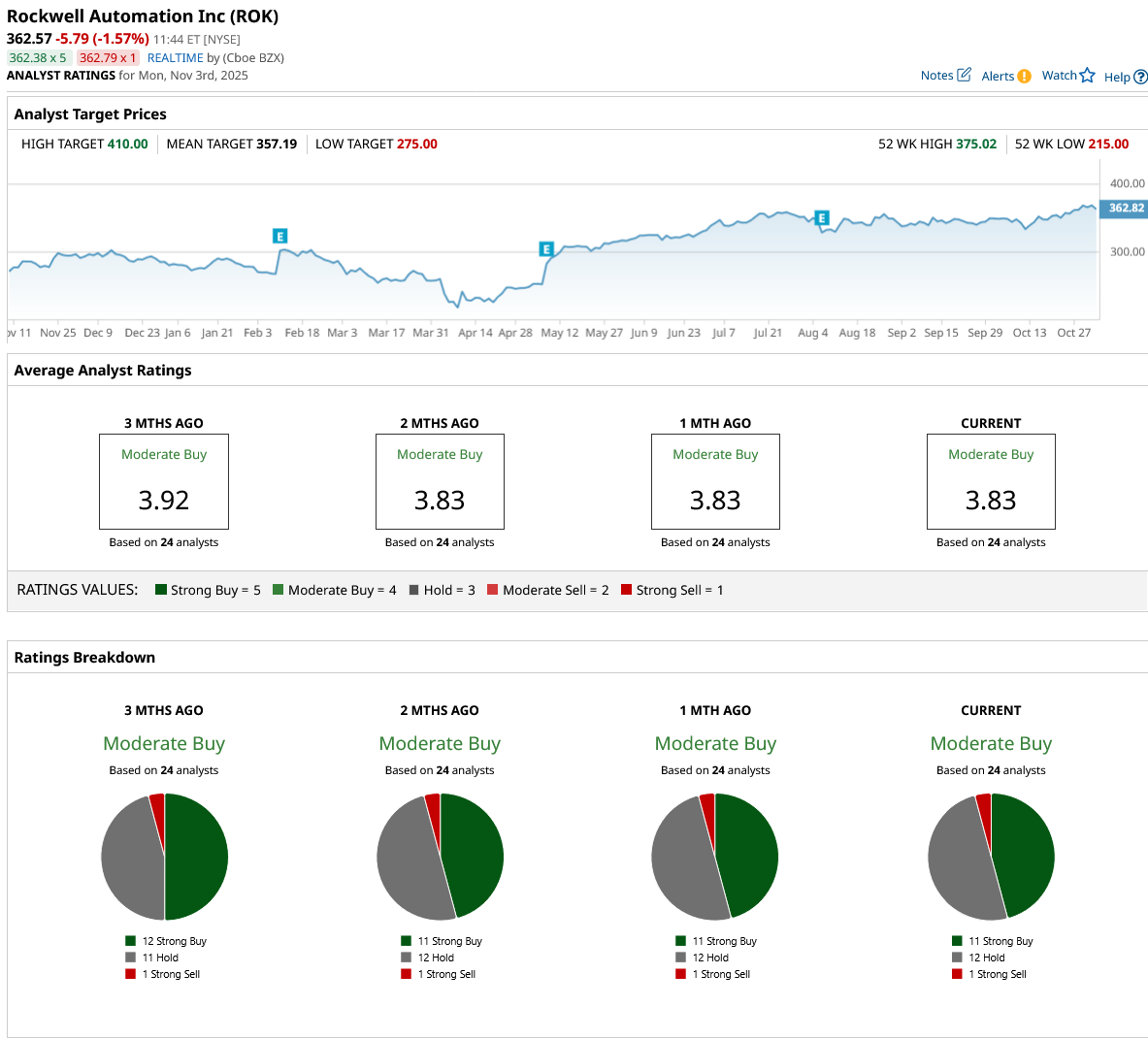

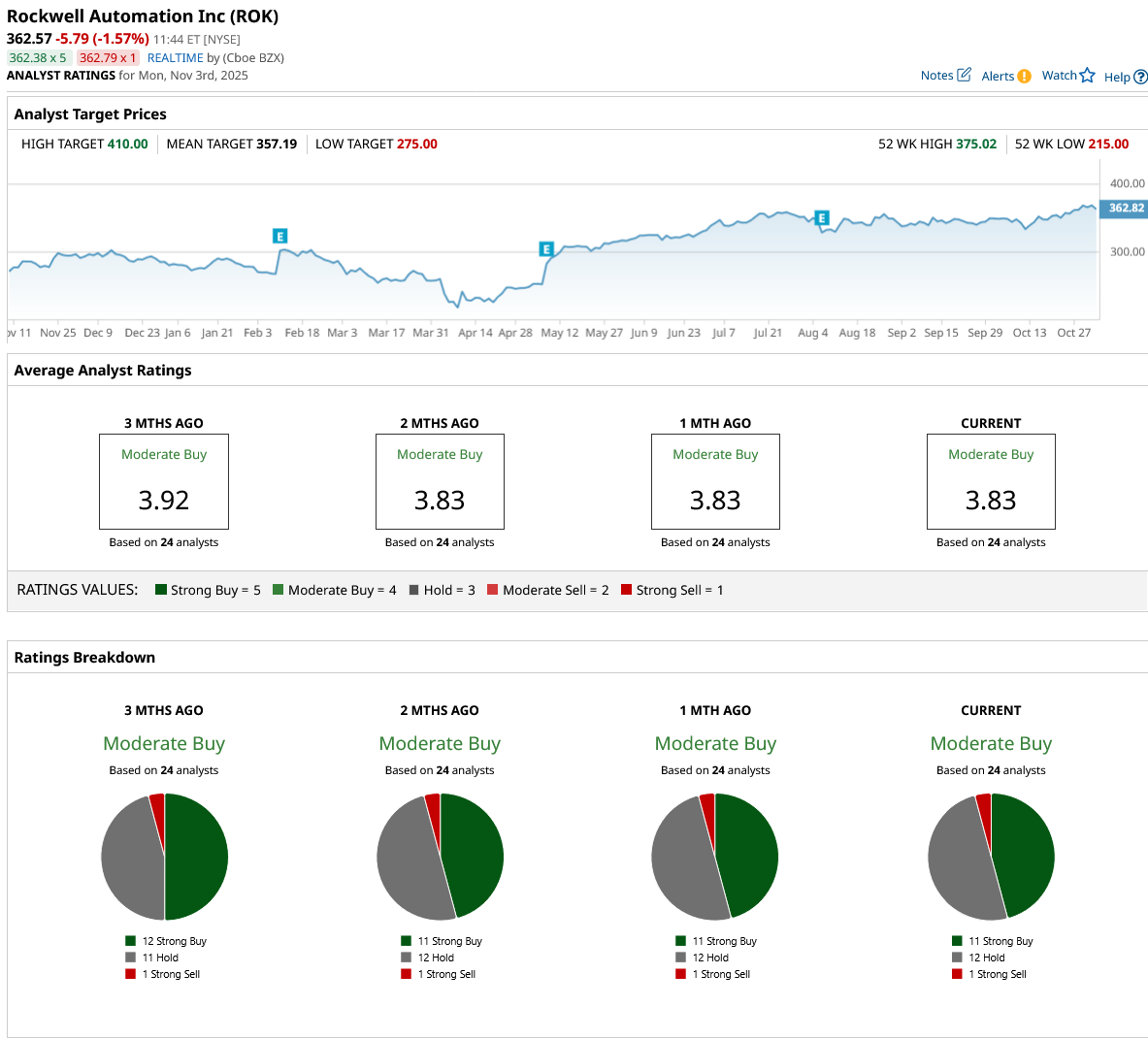

Overall, on Wall Street, ROK stock is a “ Moderate Buy.” Of the 24 analysts covering the stock, 11 rate it a “Strong Buy,” 12 rate it a “Hold,” and one rates it a “Strong Sell.” The stock has surpassed its average target price of $357.19. However, its high price target of $410 implies ROK stock can climb 13% over the next 12 months.

www.barchart.com Robotics Stocks #2: Boeing Company (BA) Valued at $151.3 billion, Boeing (BA) is one of the world’s largest aerospace and defense companies. It designs and manufactures commercial airplanes, military aircraft, and satellites. It also offers global maintenance, training, and defense services. www.barchart.com Robotics Stocks #2: Boeing Company (BA) Valued at $151.3 billion, Boeing (BA) is one of the world’s largest aerospace and defense companies. It designs and manufactures commercial airplanes, military aircraft, and satellites. It also offers global maintenance, training, and defense services.

While Boeing is not a pure-play robotics company, it does use advanced robotics and automation in its manufacturing process. It is particularly useful for building airplane components that require great precision.

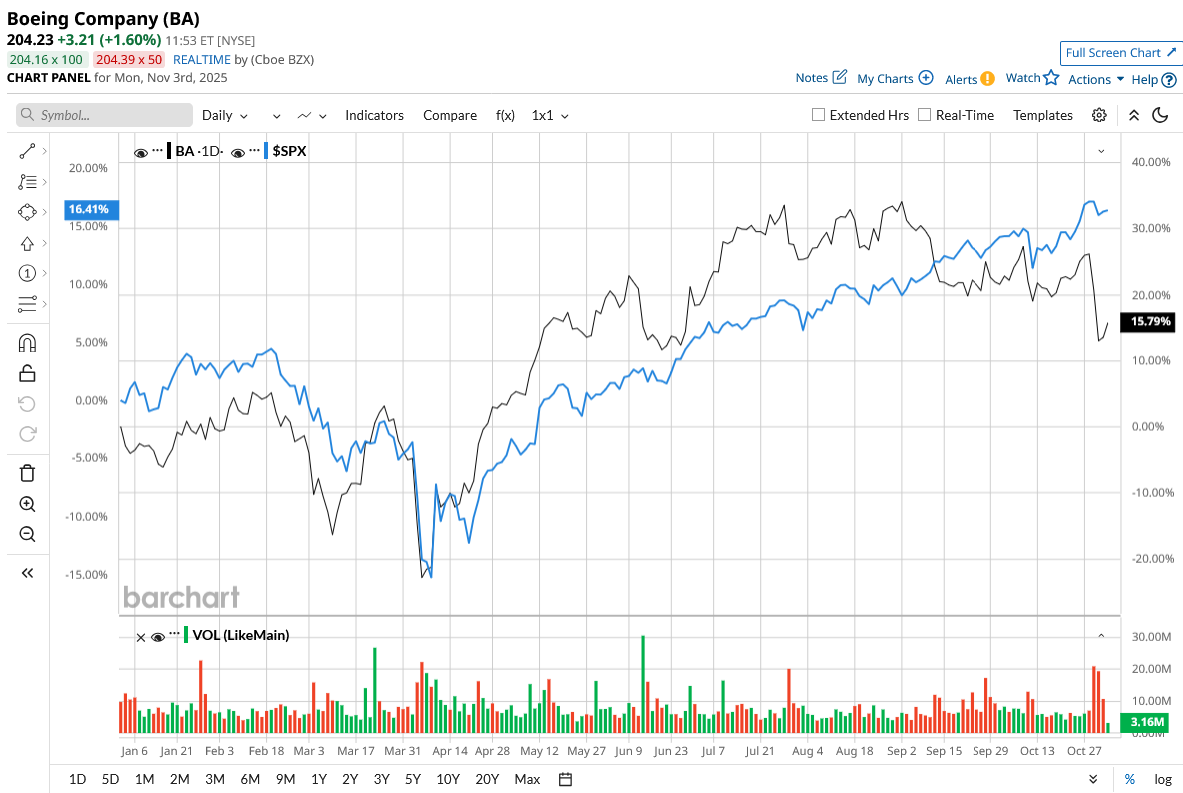

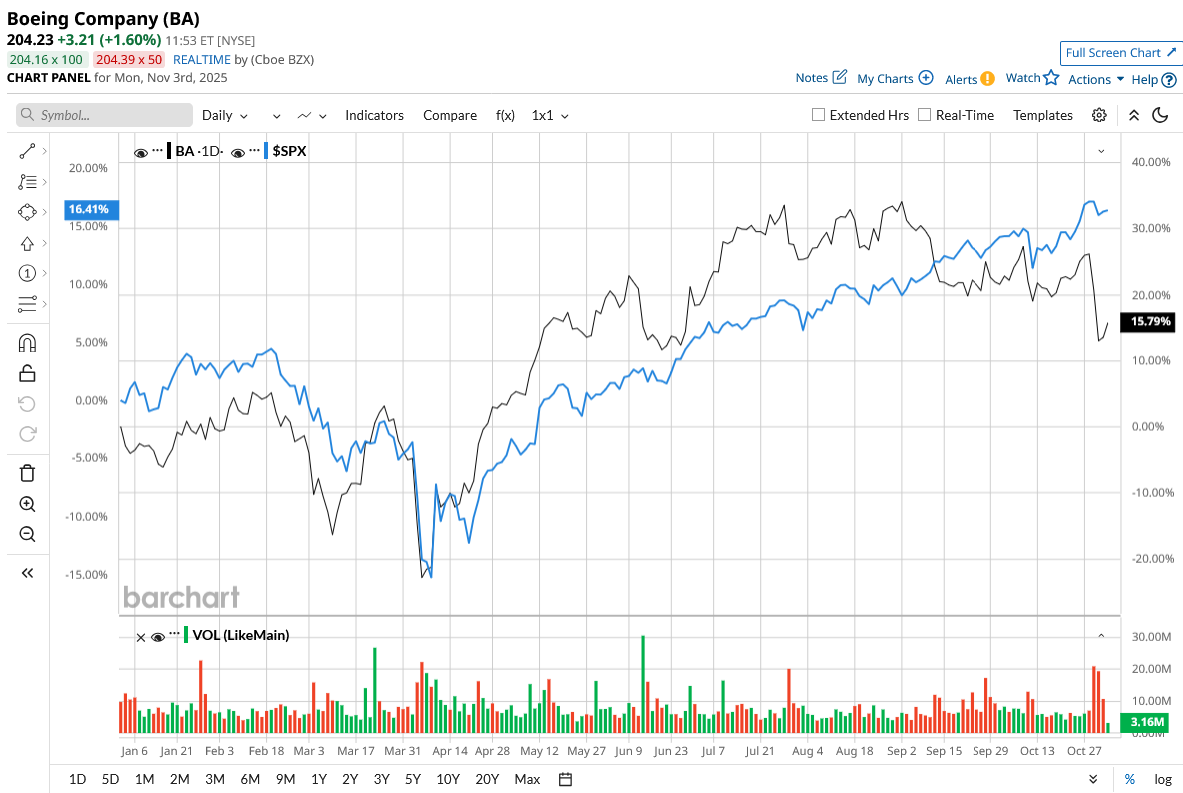

BA stock has surged 16% YTD, which is comparable to the broader market gain.

www.barchart.com Boeing is integrating advanced robotics, automation, and digital systems in its operations, which are designed to enhance safety, quality, and efficiency. Using robotics and automation improves manufacturing efficiency, resulting in more planes being manufactured and delivered on schedule, increasing the company's revenue and margins. www.barchart.com Boeing is integrating advanced robotics, automation, and digital systems in its operations, which are designed to enhance safety, quality, and efficiency. Using robotics and automation improves manufacturing efficiency, resulting in more planes being manufactured and delivered on schedule, increasing the company's revenue and margins.

In recent years, Boeing's major objective has been to regain confidence with customers, regulators, and employees by focusing on safety and quality, while automation reduces human error, rework, and defect rates. The company is increasing production of its best-selling 737 MAX to 38 aircraft per month, with FAA approval for an increase to 42 planes per month.

Boeing reported its third-quarter earnings on Oct. 29, wherein total company revenue surged 30% YoY to $23.3 billion, driven by stronger airplane deliveries and improved operational performance across commercial, defense, and service businesses. Importantly, Boeing recorded a positive free cash flow of $238 million, marking its first cash-positive quarter since 2023 and a significant milestone in its long-term turnaround strategy. Boeing's Commercial Airplanes (BCA) division, the company's largest and most visible business, is benefiting from advanced robots more than ever. In the most recent quarter, the business supplied 160 aircraft, its highest number since 2018.

Automation is also having a disruptive impact on its Defense, Space, and Security (BDS) division. The business supplied 30 aircraft and two satellites in the quarter, increasing revenue by 25% to $6.9 billion in Q2. Demand across its commercial and defense markets remains strong, reflected in a backlog exceeding $600 billion. For investors looking to benefit from the rise of automation in high-tech production, Boeing stands out as a great choice.

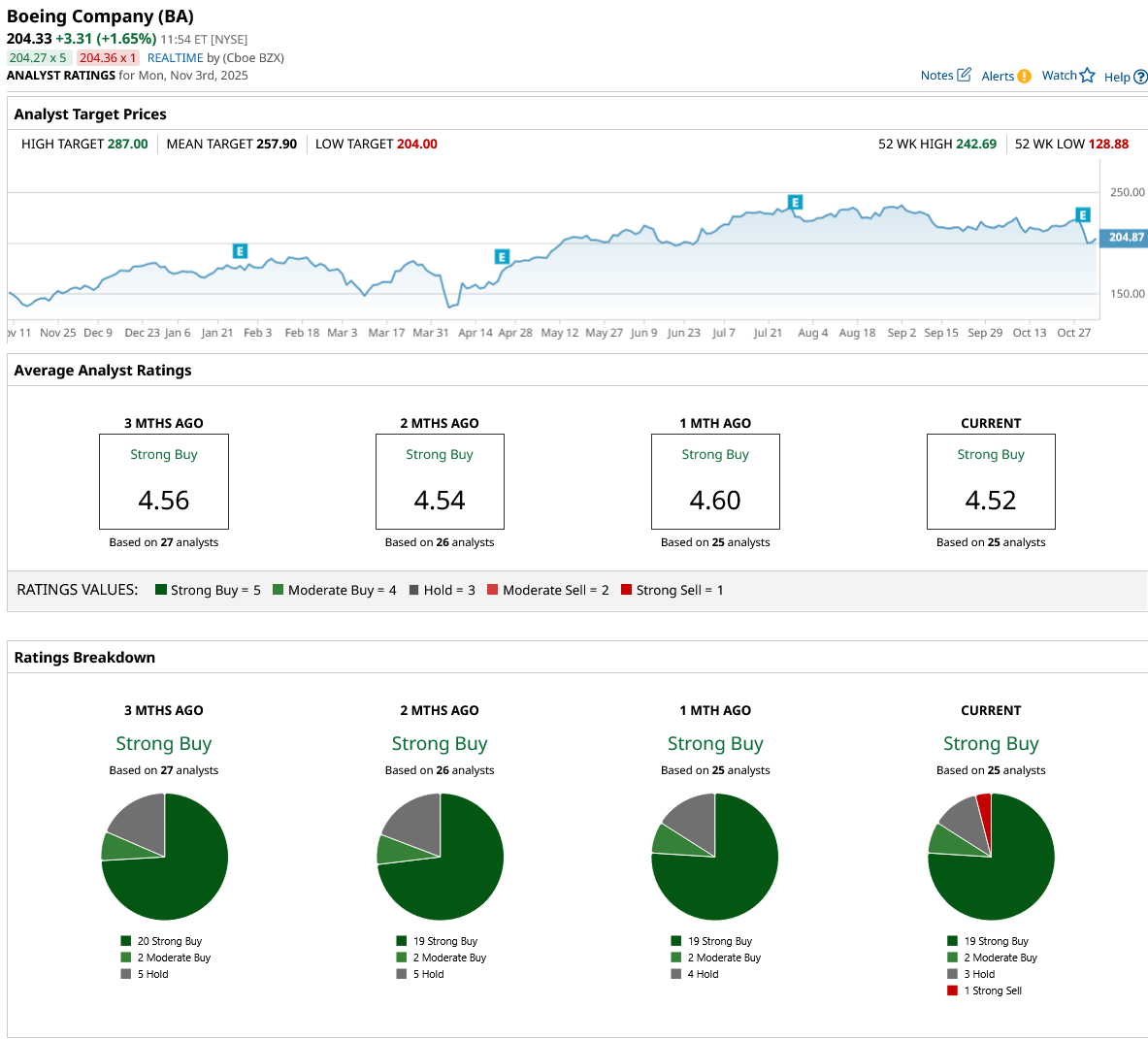

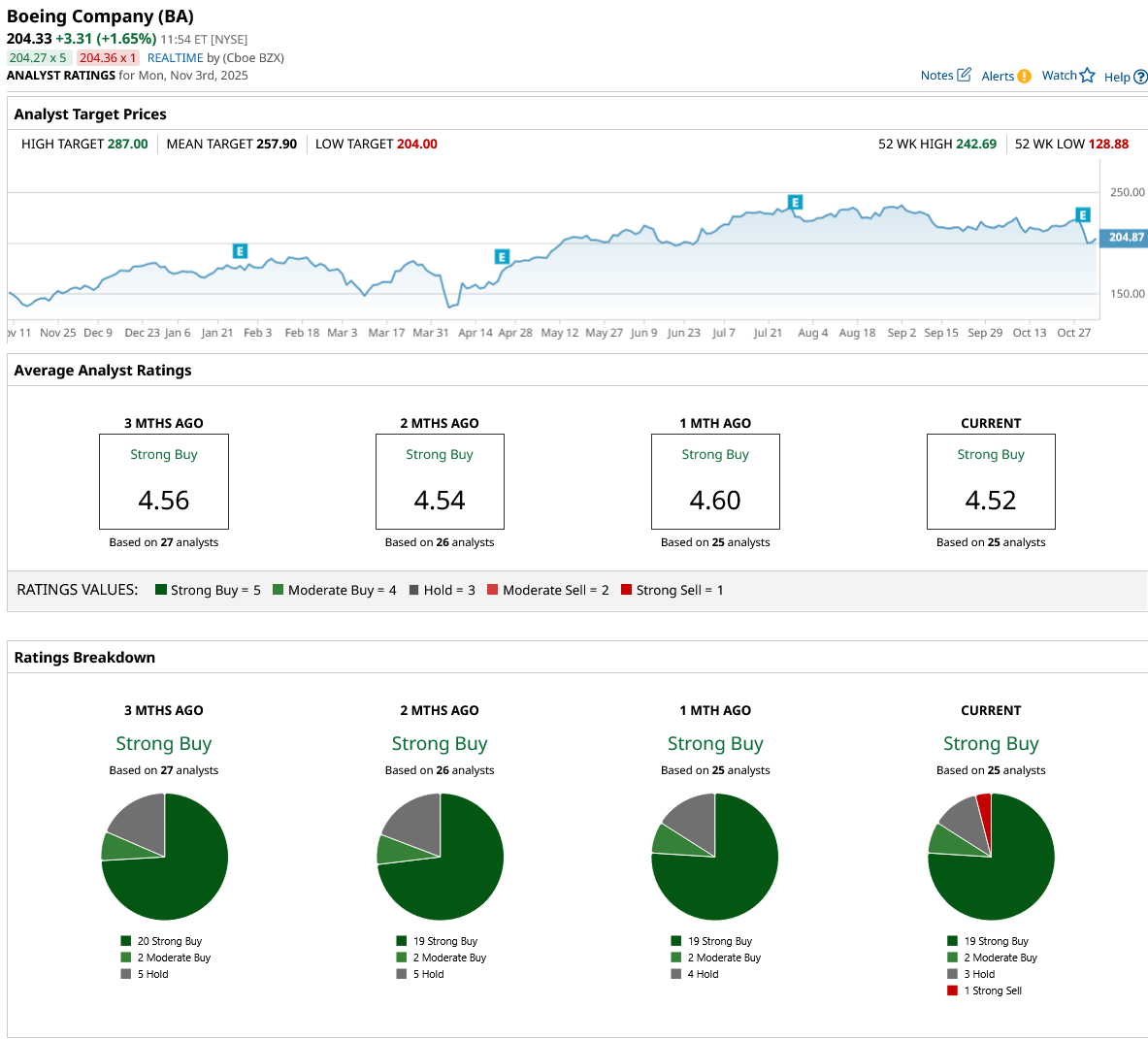

Overall, on Wall Street, BA stock is a “ Strong Buy.” Of the 25 analysts covering the stock, 19 rate it a “Strong Buy,” two say it is a “Moderate Buy,” three rate it a “Hold,” and one says “Strong Sell.” Its average target price of $257.90 suggests an upside potential of 26% over current levels. However, its high price target of $287 implies BA stock can climb 40% over the next 12 months.

www.barchart.com www.barchart.com

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More News from Barchart

Related Symbols

Symbol Last Chg %Chg | BEAM | 23.50 | -0.75 | -3.09% | | Beam Therapeutics Inc | | LCID | 16.49 | -0.15 | -0.90% | | Lucid Group Inc | | ROK | 358.78 | -5.76 | -1.58% | | Rockwell Automation Inc | | BA | 200.12 | -4.43 | -2.17% | | Boeing Company |

Don’t Miss a Minute of Daily Action Don’t Miss a Minute of Daily Action

Our exclusive midday newsletter highlights top stories, big movers, and breakout charts.

By clicking Sign Up Now to receive this free newsletter, you will also receive free Barchart Partner emails. Opt-out any time. See Terms of Service and Privacy Policy for details.

Most Popular News

/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg) 1 1

This AI Stock Is Cheaper Than AMD and Crushing It in Returns

2 2

The QQQ ETF Could Gain 30% From Here, But It’s Also Waving a Giant, Dot-Com Era Red Flag

/Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg) 3 3

What Palantir’s 400x Valuation Teaches Us About Technicals, Tech Stocks, and Trading

/A%20hand%20holding%20a%20phone%20with%20the%20Reddit%20logo_%20Mamun_Sheikh%20via%20Shutterstock_.jpg) 4 4

Reddit Stock Is Up on Q3 Earnings. Options Data Tells Us RDDT Could Be Headed Here Next.

5 5

Stocks Set to Extend Rally as Investors Await Key Earnings and Fed Speak

Log In Sign Up

Market:

HOME

Stocks

Options

ETFs

Futures

Currencies

Investing

News

Barchart

Markets Today Barchart News Exclusives Contributors Chart of the Day News Feeds

Featured Authors

Andrew Hecht Austin Schroeder Caleb Naysmith Darin Newsom Don Dawson Elizabeth H. Volk Gavin McMaster Jim Van Meerten Josh Enomoto Mark Hake Oleksandr Pylypenko Rich Asplund Rick Orford Sarah Holzmann All Authors

Commodity News

All Commodities Energy Grains Livestock Metals Softs

Financial News

All Financials Crypto Dividends ETFs FX Interest Rates Options Stock Market

Press Releases

All Press Releases ACCESS Newswire Business Wire GlobeNewswire Newsfile PR Newswire

Tools

Learn

Site News 2

B2B SOLUTIONS

Contact Barchart

Site Map

Back to top

Change to Dark mode

Membership Barchart Premier Barchart Plus Barchart for Excel Create Free Account

Resources Site Map Site Education Newsletters Advertise

Barchart App Business Solutions Market Data APIs Real-Time Futures

Stocks: 15 minute delay (Cboe BZX is real-time), ET. Volume reflects consolidated markets. Futures and Forex: 10 or 15 minute delay, CT. Market Data powered by Barchart Solutions. Fundamental data provided by Zacks and Morningstar.

Barchart is committed to ensuring digital accessibility for individuals with disabilities. We encourage users to Contact Us with feedback and accommodation requests.

© 2025 Barchart.com, Inc. All Rights Reserved.

About Barchart | Affiliate Program | Terms of Service | Privacy Policy | Do Not Sell or Share My Personal Information | Cookie Settings

×

Terms of Content Use |

Don’t Miss a Minute of Daily Action

Don’t Miss a Minute of Daily Action /AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg) 1

1  2

2 /Palantir%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock.jpg) 3

3 /A%20hand%20holding%20a%20phone%20with%20the%20Reddit%20logo_%20Mamun_Sheikh%20via%20Shutterstock_.jpg) 4

4  5

5